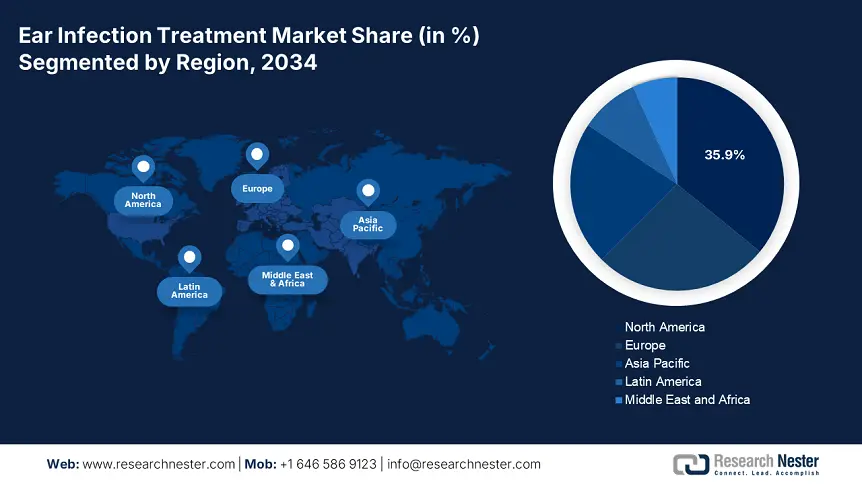

Ear Infection Treatment Market - Regional Analysis

North America Market Insights

North America is the leading region in the ear infection treatment market, with 35.9% of the market share at a CAGR of 5.7% by the year 2034. The market is fueled by strong pediatric healthcare systems, reimbursement coverage, and high rates of early diagnosis. In the U.S., robust federal funding via the CDC, NIH, and CMS ensures the accessibility of treatment for both children and elderly people in the region. Canada, via Health Canada and provincial governments, has introduced region-based budgets to increase pediatric ENT services. Increased investments in antimicrobial resistance solutions and innovation in drug delivery systems also contribute to long-term market stability in region.

The U.S. market is supported by wide-ranging public funding, insurance reimbursement, and robust outpatient facilities. In 2023, federal agencies such as the CDC, AHRQ, and NIH collectively spent USD 5.4 billion, which is 9.5% of the healthcare cost, on ear infection treatment and research activities. These values indicate a national focus on antimicrobial resistance and gaps in pediatric care. Medicaid programs increased coverage, with USD 1.7 billion in 2024 for ENT-related procedures and drugs, expanding treatment to 10.3% more beneficiaries. Medicare, in contrast, spent USD 800.5 million in 2024, representing a 15.2% increase over the past five years, with an increasing population of elderly peoples with chronic otitis media and hearing loss susceptibility. Medicaid/Medicare pricing pressures still hinder new product entry, compelling firms to pursue bundled reimbursement schemes and pediatric-focused drug design.

North America Government Investment & Policy Table (2021–2025)

|

Country |

Initiative / Program |

Launch Year |

Investment / Budget Allocation |

|

U.S. |

Pediatric ENT Workforce Expansion Grant (HRSA) |

2022 |

USD 150.5 million allocated to expand ENT services in rural clinics |

|

NIH Pediatric Infection Drug Innovation Fund |

2023 |

USD 320.4 million in multiyear research funding |

|

|

CMS ENT Access Equity Program (focus on low-income families) |

2024 |

USD 280.3 million to expand ENT treatment access across 20 states |

|

|

Canada |

National Strategy on Antimicrobial Stewardship (Public Health Agency of Canada) |

2021 |

USD 200.6 million over 4 years targeting ENT-related resistance |

|

Indigenous Child Health ENT Support Initiative (Health Canada) |

2025 |

USD 95.7 million for ENT outreach in remote provinces |

|

|

CADTH Rapid ENT Drug Assessment Framework |

2023 |

Operational rollout to expedite HTA reviews (budget undisclosed) |

Asia Pacific Market Insights

The Asia-Pacific is the fastest-growing region in the ear infection treatment market and is anticipated to hold 21.8% of the overall market share with a 6.6% CAGR by 2034. The market is driven by the growing prevalence of infections, improving access to ENT specialists, and favorable government funding in major markets, such as Japan, China, India, Malaysia, and South Korea. Further, China and India are leading the market due to the high levels of urbanization-driven outpatient volumes. The middle-income groups have increased awareness of expanded vaccine-associated otitis media and prevention programs, that has fueled momentum for treatment product adoption. Trends like R&D investment, policy focus, and digitized END diagnostics are driving innovation in formulations, affordability strategies, and pediatric coverage initiatives.

China has the highest market share in the ear infection treatment market and is likely to have an 8.2% market share in 2034. As per the NMPA data, China's government expenditures for ear infection treatment grew by 15.4% during the last five years due to health reform policies. Further, 1.8 million patients were diagnosed in 2023 with otitis-related infections, treated mostly in tertiary hospitals in urban areas. Both geriatric and pediatric populations now have better access to treatment because of the expansion of Basic Medical Insurance coverage to 190 additional cities. The updates in the reimbursement have also enhanced the use of antibiotic ear drops and ENT consultations among public health facilities.

APAC Government Investment and Funding Initiatives (2021–2025)

|

Country |

Program / Initiative |

Launch Year |

Investment / Budget Allocation |

|

Australia |

National ENT Telehealth Access Program (Department of Health) |

2022 |

AUD 85.3 million to expand remote ENT services |

|

Japan |

Otitis Media Early Intervention and Drug Innovation Grant (via AMED) |

2023 |

¥45.6 billion (~USD 330.3 million) in pediatric R&D |

|

India |

Ayushman Bharat – ENT Surgical & Pediatric Drug Package Expansion |

2024 |

INR 1,200.5 crore (~USD 145.2 million) allocated |

|

South Korea |

HIRA Pediatric Otitis Media Diagnostic Support Scheme |

2021 |

₩220.6 billion (~USD 190.5 million) over 3 years |

|

Malaysia |

National Otitis Prevention & Access Enhancement Strategy (MOH Malaysia) |

2025 |

MYR 400.2 million (~USD 85.7 million) focused on public hospital upgrades |

Europe Market Insights

The Europe ear infection treatment market is forecast to hold the market share of 26.6% and CAGR of 4.9% on a global level. The market is fueled by a blend of government-driven healthcare reforms, growing patient awareness, and the extensive use of cost-friendly antibiotic treatments and ENT procedures. The aging population in Germany, France, and Italy continues to have increased incidence rates of otitis media and chronic ear infection, whereas the UK and Spain's pediatric-oriented policies continue to increase access to early-stage treatments. Advancements in local drug delivery systems and corticosteroid treatments are also a reason for market demand. Further, the transformation to value-based reimbursement models, particularly in the Netherlands and France, facilitates the inclusion of ENT protocols in national formularies, avoiding delays in treatment and enabling long-term patient outcomes.

Germany dominates the ear infection treatment market in Europe and is likely to hold 7.2% market share in 2034. Germany's market reached €4.3 billion in 2024, and it is the largest market in Europe. Government statistics from the Federal Ministry of Health (BMG) show a 12.5% rise in demand for ENT treatment since 2021, due to the rise in antibiotic-resistant infections and an aging population. The statutory health insurance system in Germany covers almost 90.3% of the population, providing wide access to diagnostic services, ENT drugs, and hospital-based treatments.