E-Notary Software Market Outlook:

E-Notary Software Market size was valued at USD 261.99 million in 2025 and is likely to cross USD 655.22 million by 2035, registering more than 9.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of e-notary software is estimated at USD 284.63 million.

The reason behind the growth is due to the growing adoption of e-signature across the globe. Businesses all over the world have greatly accelerated the use of e-signatures as they offer a wide range of features and benefits that improve business processes in terms of convenience, and effectiveness, and help to improve performance by streamlining business procedures. Moreover, eSignatures have contributed to over 87% increase in employee communication and around 89% reduction in project length.

For instance, in just five years, the number of electronic signature transactions worldwide has increased from around 88 million to more than 750 million.

The growing advancements in e-signature technology are believed to fuel the E-Notary software market growth. For instance, the use of artificial intelligence, or AI, has increased across electronic signatures which helps in fixing any mistakes in a signature that can give rise to a forgery claim, lowers the possibility of fraud, assists in the process of signature verification, and can assist in verifying the signatories' identities by utilizing facial recognition software to increase the signing process's effectiveness safely.

Key E-Notary Software Market Insights Summary:

Regional Highlights:

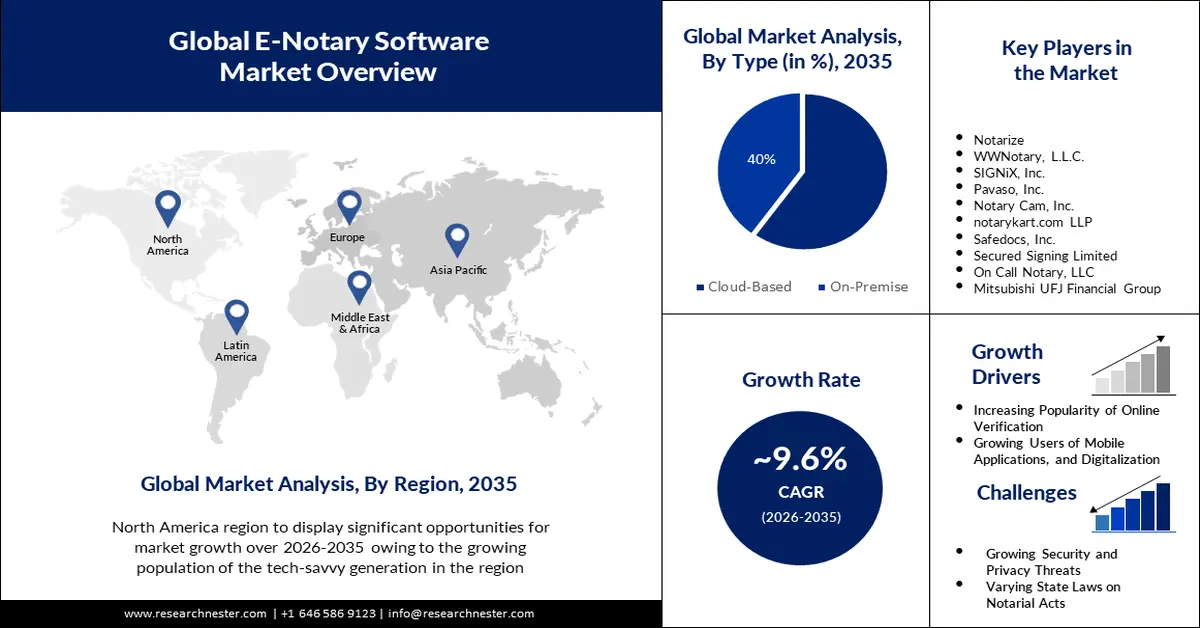

- North America is projected to command a 40% share by 2035 in the E-Notary Software Market, driven by rising online document submissions and the expanding tech-savvy population.

- Asia Pacific is anticipated to secure the second-largest share during 2026–2035, supported by rapid digitization and growing internet adoption across developing economies.

Segment Insights:

- The cloud-based segment is expected to attain a 60% share in the coming years in the E-Notary Software Market, propelled by expanding enterprise reliance on cloud computing for scalable and secure digital notarization.

- The large enterprises segment is poised to capture a notable share over the forecast period, underpinned by the need for multi-user access and advanced fraud-prevention capabilities in high-volume notarization workflows.

Key Growth Trends:

- Increasing Popularity of Online Verification

- Growing Users of Mobile Applications, and Digitalization

Major Challenges:

- Growing Security and Privacy Threats

- Varying State Laws on Notarial Acts

Key Players: Notarize, WWNotary, L.L.C., SIGNiX, Inc., Pavaso, Inc., Notary Cam, Inc., notarykart.com LLP, Safedocs, Inc., Secured Signing Limited, On Call Notary, LLC, Mitsubishi UFJ Financial Group.

Global E-Notary Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 261.99 million

- 2026 Market Size: USD 284.63 million

- Projected Market Size: USD 655.22 million by 2035

- Growth Forecasts: 9.6%

Key Regional Dynamics:

- Largest Region: North America (46% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Vietnam, Mexico, Brazil, Poland

Last updated on : 19 November, 2025

E-Notary Software Market - Growth Drivers and Challenges

Growth Drivers

- Increasing Popularity of Online Verification- Various government and non-governmental offices are now functioning online, which has surged the demand for online verification of documents. Companies and people alike are choosing digital verification techniques more often to guarantee enhanced security and effectiveness, which has turned into a need as a result of the increase in fraud worldwide. For instance, more than 60% of organizations still utilize digital document verification as their primary technique for digital identity verification.

- Growing Users of Mobile Applications, and Digitalization - Both individuals and companies commonly utilize contract management applications to electronically sign documents as it reduces errors, and makes keeping track of all the necessary signature activities simpler.

- Use of Blockchain in Notarization- A distributed online proof-of-existence for every document can be securely stored and computed by a blockchain notary, which is an open-source tool that expedites the document flow of intricate operations.

Challenges

- Growing Security and Privacy Threats - Electronic notarization, or e-notarization, involves documents that are notarized in electronic form and are more prone to security risks than paper documents. When someone has access to both the private key and digital certificate, they can perpetrate fraud therefore, it is important to notify the reputable company that provided the certificate and the local law enforcement agencies about the loss.

- Additionally, the prevalence of fraud with digital signatures is rising which is the practice of hackers or cybercriminals manipulating, forging, or using digital signatures for fraudulent purposes to trick people or organizations.

- Varying State Laws on Notarial Acts- The term notarial act, refers to actions that this state's laws and regulations permit notaries public to carry out and are crucial legal instruments that support ensuring the legitimacy and authenticity of documents, and they are accepted worldwide under particular legal restrictions that differ depending on the jurisdiction that has an impact on numerous topics and facets.

- Complexity Associated with Standardizing E-Notary Solutions

E-Notary Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.6% |

|

Base Year Market Size (2025) |

USD 261.99 million |

|

Forecast Year Market Size (2035) |

USD 655.22 million |

|

Regional Scope |

|

E-Notary Software Market Segmentation:

Type Segment Analysis

The cloud-based segment in the E-Notary software market is estimated to gain a robust revenue share of 60% in the coming years owing to the growing adoption of cloud computing technology, along with the increasing adoption of cloud-based software in general. Companies all over the world are becoming more and more interested in cloud computing, which is a massive industry that is expanding many times every year as a means for improving the scalability of Internet-based database capabilities owing to the various advantages of cloud technology, such as high mobility, easy access, unlimited storage and backup facility, low maintenance, and pay-per-use settings. Numerous technologies are employed in electronic notarization, such as cloud-based digital tools that notarize documents electronically, provide an intuitive user interface, and enable automated administration of legal document storage. Cloud-based e-notary software is attractive to businesses as it records every session and stores it in an electronic journal while offering data security, scalability, and user-friendliness.

For instance, DocuSign operates a cloud-based electronic signature platform, that enables customers to sign a variety of documents, including agreements, permission slips from schools, contracts, and approvals from corporations in many languages and sent via email by users.

End-User Segment Analysis

E-Notary software market from the large enterprises segment is set to garner a notable share shortly. Notarize is a strong tool for businesses, including strong security measures that assist in battling fraud and identity theft and is mostly ideal for larger firms that frequently require multi-user access to notary services, and frequently need to notarize substantial amounts of documents to save time and cost. For instance, businesses can use Notarize document preparation tools to cut down on signature errors and time by more than 45%.

Large businesses use e-notary software to digitize and expedite the notarization process since it provides several advantages, including improved customer service, higher efficiency, and lower a company's operating costs several times over.

In addition, notarization is sometimes necessary for small firms for a variety of documents, such as agreements, contracts, and other legal paperwork to guarantee that the parties have signed the documents willingly. Small companies are among the many that require notarizations for contracts and other agreements.

One of the simplest methods for small and medium-sized businesses (SMBs) to reduce waste, increase income, and minimize labor costs is by implementing electronic signatures which is an increasingly valuable tool for assisting small firms in growing and helping them operate more efficiently. Electronic signatures can be used for many different purposes by small enterprises such as to sign agreements, contracts, and commercial transactions since these are essential to any business's survival, to cut expenses by doing away with shipping, fax, and office supply charges.

Our in-depth analysis of the global E-Notary software market includes the following segments:

|

Type |

|

|

Application |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

E-Notary Software Market - Regional Analysis

North American Market Forecast

North America industry is likely to dominate majority revenue share of 40% by 2035, impelled by the growing population of the tech-savvy generation, surge in online submission, and verification of documents. Moreover, increasing penetration of the internet is estimated to further impact the market growth in the region. Moreover, adult Americans now make up over 70% of those who use the internet. Particularly, at the beginning of 2023, more than 90% of Americans were using the internet.

APAC Market Statistics

The Asia Pacific E-Notary software market is estimated to be the second largest, during the forecast timeframe on the back of technological development, and digitization in developing countries, rapidly growing adoption of the internet in remote areas, and evolving dynamics of government services. Countries, such as India, Singapore, and Japan, are experiencing swift transformation in the working of government, as well as, private sectors, which is estimated to boost the E-Notary software market growth.

E-Notary Software Market Players:

- Black Knight, Inc. (Doc Verify)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Notarize

- WWNotary, L.L.C.

- SIGNiX, Inc.

- Pavaso, Inc.

- Notary Cam, Inc.

- notarykart.com LLP

- Safedocs, Inc.

- Secured Signing Limited

- On Call Notary, LLC

Recent Developments

- Secured Signing Limited has received ISO 27001 certification, which enables the company to support digital signature and notarization of documents and strengthen its information security management system.

- Pavaso Inc. announced the approval of remote online notarization (RON) compliance certification from the Mortgage Industry Standard Maintenance Organization (MISMO) for e-signature and notarization.

- Report ID: 3627

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

E-Notary Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.