E-Commerce Automotive Aftermarket Outlook:

E-Commerce Automotive AfterMarket size was over USD 256.31 billion in 2025 and is projected to reach USD 975.5 billion by 2035, growing at around 14.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of e-commerce automotive aftermarket is evaluated at USD 289.3 billion.

The aftermarket is witnessing an exceptional rise in demand due to increasing vehicle ownership across the world. With the growing number of automobiles on the road, the need for parts, maintenance services, and accessories is rising. According to the report published by IEA, in May 2020, the number of global car sales reached a total of around 73 million, including H1 and H2 regions. The inflating sales of vehicles are subsequently enlarging the investments in the aftermarket landscape. This is further heightening the demand for convenient online purchasing options, enlarging the e-commerce industry.

The rise of DIY maintenance and customization trends has further influenced car owners to purchase automotive parts for personal repair and modification projects. In addition, the presence and popularity of online tutorials and forums have encouraged drivers to explore available options. Moreover, the rapid IoT integration is bolstering the e-commerce automotive aftermarket.

Key E-Commerce Automotive Aftermarket Market Insights Summary:

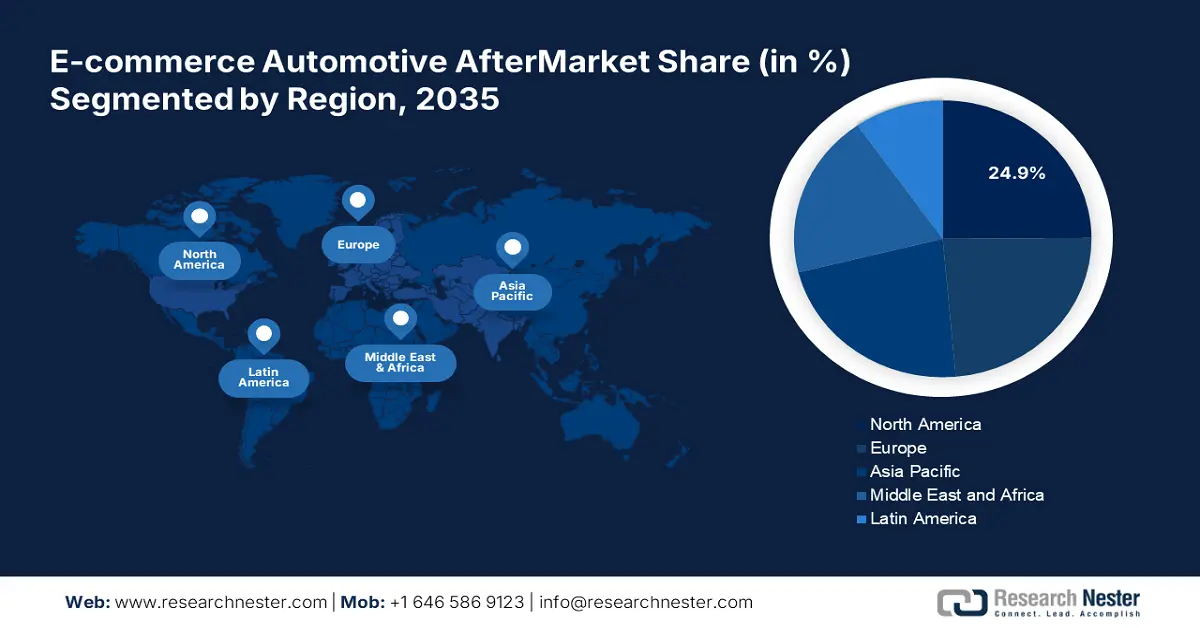

Regional Highlights:

- North America dominates the E-Commerce Automotive AfterMarket with a 24.9% share, driven by the presence of leading tech firms and automakers streamlining aftermarket product sales, bolstering growth through 2026–2035.

Segment Insights:

- Auto Parts & Accessories segment are expected to capture a 38.50% share by 2035, driven by rising demand for vehicle components and localization in the automotive industry.

Key Growth Trends:

- Rising popularity of e-commerce platforms

- Technologically advanced delivery system

Major Challenges:

- Complexity in logistics and supply chain

- Limited product availability and consumer knowledge

Key Players: NAPA Auto Parts, O'Reilly Auto Parts, Advance Auto Parts, Pep Boys, Summit Racing Equipment, Amazon, AutoAnything.

Global E-Commerce Automotive Aftermarket Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 256.31 billion

- 2026 Market Size: USD 289.3 billion

- Projected Market Size: USD 975.5 billion by 2035

- Growth Forecasts: 14.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (24.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

E-Commerce Automotive Aftermarket Market Growth Drivers and Challenges:

Growth Drivers

-

Rising popularity of e-commerce platforms: The rising online shopping trends have impelled a boom in the e-commerce automotive aftermarket. As consumers, particularly from developing countries, increasingly prefer online shopping due to convenience, competitive pricing, and easy access, companies are being intrigued to avail a wide range of products. According to the International Trade Administration report, published in January 2024, India is experiencing the fastest growth in e-commerce and is expected to reach USD 136.47 billion by 2026. This further makes this industry lucrative for developers and automakers to secure great profit margins through.

-

Technologically advanced delivery system: The improved technology and extensive efforts have helped the e-commerce automotive aftermarket to deliver better performance. Companies are making initiatives to improve the online buying experience by offering faster shipping and establishing better logistics networks, attracting consumers for auto aftermarket purchases. In addition, they are implementing digital tools such as AR and virtual fitment, providing customers with a visual idea to boost their purchasing confidence. Such innovative solutions have even drawn the attention of EV makers to participate in this field.

Challenges

- Complexity in logistics and supply chain: Growth in the e-commerce automotive aftermarket is highly dependent on efficient and precise supply management. The mishaps in items due to the variation in products and pressure for timely delivery can hamper consumer trust. Poor logistics or delays further lead to customer dissatisfaction, particularly in the case of emergency repair jobs. Moreover, the delivered inferior products can affect vehicle performance and safety, discouraging buyers or investors and damaging brand's reputation.

- Limited product availability and consumer knowledge: Seasonal demand fluctuations require sufficient feedstocks to retain customers in the e-commerce automotive aftermarket. In addition, timely delivery is subject to product availability, which may dissolve buyer’s interest in purchasing from these platforms. This forces companies to adjust their inventory levels accordingly, resulting in additional expenses and challenges. The difficulty in maintaining uninterrupted supply may become a hurdle for the participants in this sector to survive.

E-Commerce Automotive Aftermarket Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.3% |

|

Base Year Market Size (2025) |

USD 256.31 billion |

|

Forecast Year Market Size (2035) |

USD 975.5 billion |

|

Regional Scope |

|

E-Commerce Automotive Aftermarket Market Segmentation:

Product Category (Auto Parts & Accessories, Tires, Batteries, Lubricants Chemicals)

By 2035, auto parts & accessories segment is estimated to capture over 38.5% e-commerce automotive aftermarket share. The growth in this segment is driven by the enlarged demand for vehicle components. Developing countries such as Japan, China, and India are enforcing advancements in their production to supply the surge in the automotive industry for these aftermarket tools. According to an IBEF report published in October 2024, the auto components industry in India is poised to account for USD 200 billion by the end of 2026. It also mentioned the industry’s USD 7 billion funding to boost localization of advanced components such as electric motors and automatic transmissions.

Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles)

In terms of vehicle type, the e-commerce automotive aftermarket is projected to witness significant growth in the passenger cars segment by the end of 2035. The increasing need for reliable transportation due to the growing number of workers has inflated the demand for these vehicles. This further creates a surge in automotive parts, accessories, and tires, creating opportunities for retailers. According to the IEA report, published in February 2023, the number of global passenger car sales during 2010-2022 accounted for around 74.8 million. The data concluded sales of conventional cars, SUVs, electric cars, and electric SUVs in both advanced and emerging economies.

Our in-depth analysis of the global e-commerce automotive aftermarket includes the following segments

|

Product Category |

|

|

Vehicle Type |

|

|

Distribution Channel |

|

|

Application |

|

|

Products |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

E-Commerce Automotive Aftermarket Market Regional Analysis:

North America Market Analysis

In e-commerce automotive aftermarket, North America region is poised to capture substantial revenue share by the end of 2035. The region is a hub of leading tech firms and automakers, who are the major driving factors in this field. The efforts made by these leaders to streamline the purchase and sale of aftermarket products in the automotive industry have led to significant growth in this region. For instance, in October 2023, the American Tire Distributors launched a new digital hub, Radius to avail tires, parts, services, and solutions into one connected platform for the aftermarket. The comprised suite is designed to address the need for increasing efficiency and optimizing both sales and service with a scalable and customizable experience.

The U.S. is home to many automotive leaders, which inflates the demand in the e-commerce automotive aftermarket. The growing sales of vehicle components are creating scope for leaders to solidify their positions by offering a well-managed platform with a wide range of products, bringing convenience for both consumers and sellers. This further encourages leaders to make moves to leverage their businesses. For instance, in November 2024, MidOcean Partners acquired Arnott Industries to expand its portfolio in the online aftermarket industry.

Canada is experiencing significant growth in the e-commerce automotive aftermarket due to the increasing adoption of online shopping, and consumer demand for advancements in digital marketing and technology. The aftermarket of this country is propelled by the growing trends of DIY and DIFM projects. Many auto repair shops are choosing these online platforms to purchase readily available parts for their customization orders. Such involvement of local and personal car enthusiasts is further expanding the market reach.

Europe Market Statistics

Europe is expected to become one of the fastest-growing regions in the global e-commerce automotive aftermarket. The increasing interest of domestic automakers in serving their customers with a convenient solution to maintain vehicle health is propelling growth in this region. Many automakers are now even expanding their footprint towards other developing economies to gain traction in this field. For instance, in February 2022, Bosch acquired a share of 26% in Autozilla Solutions Private Limited to participate in the digital B2B marketplace for the independent aftermarket (IAM) in India. The investment aimed at strengthening the company’s position in the growing e-commerce marketplace.

The UK e-commerce automotive aftermarket is presenting great business opportunities for leaders due to the rising numbers of aging vehicles on the road. Drivers in this country have shown interest in investing in this field to make customization or upgradation more convenient and cost-effective, attracting leaders to invest in this landscape. For instance, in February 2024, NYK Group acquired Noel Topco Limited to fasten their progress in compiling delivery platform business for e-commerce operators across the country.

Germany is marking its significance in elevating the pace of global e-commerce automotive aftermarket through its contribution to maintaining quality in auto products. The leaders of this country are also following the path of expansion of the UK by outstretching its service and product network across the globe, particularly in developing countries. For instance, in August 2023, Schaeffler acquired Koovers to participate in the B2B e-commerce aftersale landscape of India. Such investments further inspire other automakers to participate in this field.

Key E-Commerce Automotive Aftermarket Market Players:

- NAPA Auto Parts

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- O'Reilly Auto Parts

- Advance Auto Parts

- Pep Boys

- Summit Racing Equipment

- Amazon

- AutoAnything

- ECS Tuning

- McGard

- AutoZone

- RockAuto

- Jegs

- Bosch GmbH

- CARiD.com

- Denso Corporation

- eBay

- Flipkart

- J.C Whitney

Besides targeting older cars, which need more repair and maintenance services to retain their mobility, the e-commerce aftermarket is now focusing on creating a marketplace for EVs. The shifting consumer preference towards sustainable mobility options is creating a new scope of business for global leaders. This is further encouraging automakers to invest in this sector to solidify their position in the automotive industry. For instance, in May 2020, KYB Corp partnered with REE Automotive to develop next-generation modular EV platforms for drivers. The partnership aimed at utilizing BYD’s unparalleled semi-active and active suspension systems to boost the REE platform’s engagement. Such key players include:

Recent Developments

- In May 2024, Genuine Parts Company acquired the Largest NAPA independent store owner in the U.S. to operate across 181 locations including Illinois, Indiana, Iowa, Michigan, Minnesota, and Wisconsin. The company further aims to deliver solutions and value to our customers by acquiring more NAPA stores.

- In December 2023, Garrett Motion launched an e-commerce platform, Garrett Marketplace for direct access to its engineering prowess. The online marketplace is specially designed for racing enthusiasts by delivering industry-leading turbochargers and accessories.

- Report ID: 6852

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.