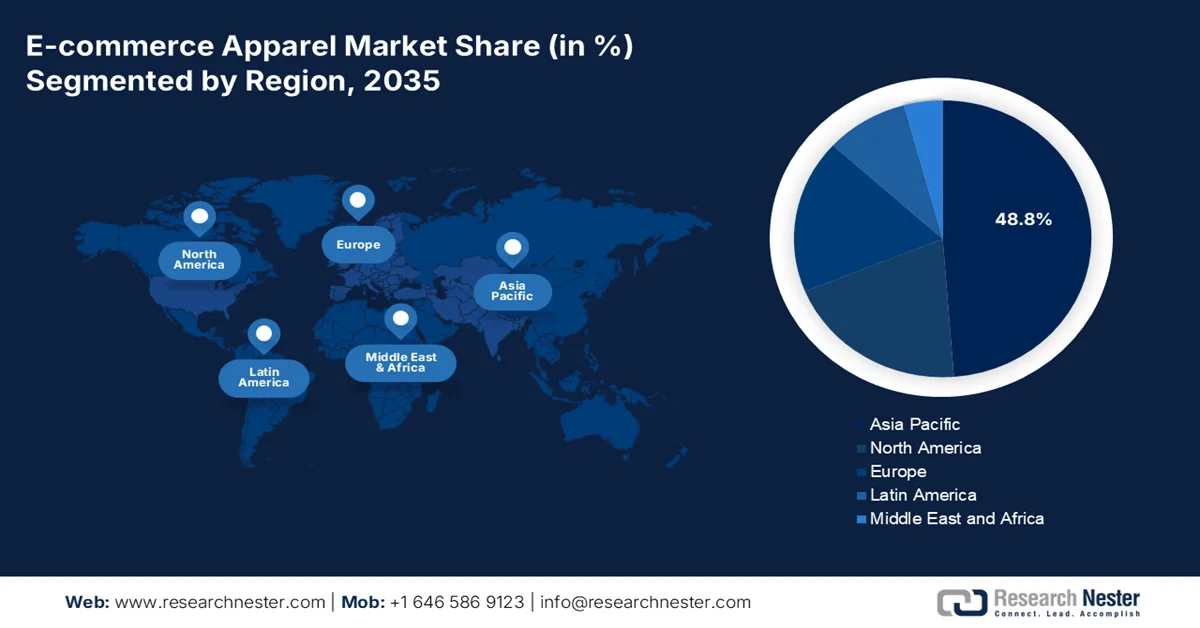

E-commerce Apparel Market - Regional Analysis

APAC Market Insights

The Asia Pacific e-commerce apparel market is the largest and dominating, expected to hold the regional revenue share of 48.8% by 2035. The leadership is due to the massive mobile-first populations, rising disposable incomes, and continuous digital infrastructure investment. The key growth drivers include the proliferation of super app ecosystems that integrate social media, payments, and shopping, and government-led digitalization initiatives. Further, the major trends are the intense competition between the vertical specialists and horizontal marketplaces, the rapid adoption of live stream commerce, and a growing, nascent consumer focus on sustainability. The region also features stark contrasts between hyper-mature markets such as Japan and South Korea, and the high-growth emerging economies such as India and Indonesia, requiring highly localized strategies for product mix logistics and pricing.

India e-commerce apparel market is expanding rapidly and is supported by rising digital adoption, government-backed payment infrastructure, and improving connectivity. According to the IBEF February 2024 data, India had over 800 million internet users in 2023, creating a large online consumer base for apparel purchases. The digital payments are the critical enabler, the report from the PIB January 2025 data shows that the UPI processed more than 16.73 billion transactions in December 2024, reinforcing the consumer confidence in online retail. On the supply side, the PIB April 2025 data reports that India’s Textile and apparel sector contributed around 2.3% of GDP and employed over 45 million people, supporting both the domestic and online channels. Government initiatives and logistics-focused infrastructure spending continue to improve the last-mile delivery positioning India as a high-growth market for e-commerce apparel.

UPI Transactions in 2024

|

Month |

Transaction in Millions |

|

May |

14,036 |

|

June |

13,885 |

|

July |

14,436 |

|

August |

14,963 |

|

September |

15,042 |

|

October |

16,585 |

|

November |

15,482 |

|

December |

16,730 |

Source: PIB January 2025

The high interest penetration, reliable digital payments, and a strong domestic retail base are driving a steady growth in the Japan e-commerce apparel market. According to the August 2023 data, Japan’s B2C e-commerce market reached nearly JPY 227,449 in 2022, with apparel and fashion among the leading product categories. Moreover, the report from the World Bank Group 2023 shows that nearly 87% of people in 2023 had internet access, enabling a broad participation in online shopping. Despite inflationary pressures, consumer spending on online retail has remained stable, supported by efficient logistics and trusted payment systems. besides the METI also highlights continued policy support for digital commerce and cross-border e-commerce under Japan’s digital transformation initiatives, reinforcing the position as a mature and resilient market in Japan.

North America Market Insights

The North America e-commerce apparel market is the fastest-growing and is expected to grow at a CAGR of 6.5% during the forecast period 2026 to 2035. The market in this region is defined by the high digital maturity and consumer spending power. The growth is driven by mobile-first shopping, advanced last-mile logistics, and the dominance of integrated omnichannel retail. The key trends include the rapid expansion of social commerce platforms as direct sales channels and a strong consumer shift towards sustainable and circular fashion models, such as resale and rental. The market consolidation is ongoing with major players acquiring the DTC brands to capture niche segments. The region faces headwinds from inflation impacting discretionary spending and heightened regulatory scrutiny on data privacy and environmental claims, which increase compliance costs for all market participants.

The e-commerce apparel market in the U.S. continues to expand and is supported by measurable growth in the online retail penetration, consumer spending, and public investment. Further, the usage of e-commerce has strengthened the demand for apparel sold via online channels. Moreover, the NLM study in August 2022 indicates the U.S. e-commerce sales grew by 25%, rising from USD 516 billion to USD 644 billion, increasing the retail sales from 11.1% 5o 14.2%, with continued growth estimated at USD 875 billion by 2022. Besides, the apparel remains a key beneficiary of this shift due to high online purchase frequency. On the supply side, the U.S. textile and apparel industry provides critical manufacturing support employing over 500,000 workers and generating USD 64.8 billion in shipments in 2023, while exporting over USD 29 billion in textile-related products, according to the International Trade Administration in July 2022. Strategic reshoring process automation and niche manufacturing are aligning domestic production with growing e-commerce apparel demand.

The market continues to grow steadily in Canada, supported by rising online retail penetration, digital connectivity, and cross-border trade integration. According to the Government of Canada in February 2024, the online retail sales account for USD 63.7 billion out of USD 815.5 billion in total spending in 2022. Despite the inflation reaching 6.8% in 2022, the online retail activity remained resilient, supported by the consumer preference for convenience and price comparison. Moreover, the International Trade Administration July 2025 data, e-commerce represented a 6.1% of the total retail sales in Canada, with online totaling to USD 2.14 billion for the month, and fashion emerged as the leading category accounting for 23.3% of online sales. Additionally, the e-commerce infrastructure continues to create favorable conditions for sustained apparel e-commerce expansion and cross-border sales growth in Canada e-commerce apparel.

Europe Market Insights

The e-commerce apparel market in Europe is a mature and growing defined by the stringent consumer protection regulations and a high demand for sustainable and circular fashion. The market growth is driven by the advanced digital payment adoption, omnichannel retail integration, and increasing cross-border online shopping within the EU’s single market. Besides, the key trends include the rapid expansion of resale and rental platforms, compliance with new EU-wide regulations such as the Digital Services Act and the Ecodesign for sustainable products regulations, and a consumer shift towards quality and durability over fast fashion. Despite economic pressures on discretionary spending, the convenience of online channels and the embedded nature of digital shopping continue to expand the market steadily.

The Germany e-commerce apparel market continues to expand on the back of strong digital adoption, stable consumer spending, and supportive regulatory frameworks. According to the NLM study in August 2022, the online retail sales increased by 29% from USD 127 billion to USD 141 billion, with clothing and footwear ranking among the top online purchase categories. Moreover, the data from the Garbe Industrial in December 2023 indicates that more than 83% of the people have purchased online, reflecting high digital maturity and trust in online transactions. Despite inflationary pressures across Europe Germanys online retail demand remained resilient, supported by widespread broadband access and secure digital payment systems. Additionally, EU-backed initiatives under the Digital Single Market continue to facilitate cross-border e-commerce, reinforcing Germany’s role as a key growth market for e-commerce apparel in Europe.

High online shopping penetration and mature digital infrastructure are driving the growth for UK market. According to the Office of National Statistics data in January 2026, the online retail sales in December 2025 accounted for 29.3%, remaining structurally higher than the pre-pandemic levels despite normalization in store-based shopping. Moreover, apparel is a key online category, with ONS data showing that clothing retailers consistently record one of the highest proportions of internet sales within the non-food retail sector. Besides, the Office for National Statistics report in April 2021 indicates that in 2021, nearly 92% of the adults in the UK had used the internet, enabling a sustained demand for online apparel purchases. Continued investment in logistics, widespread digital payment adoption, and strong consumer familiarity with e-commerce platforms support steady growth in the UK market.

Internet Sales Percentage Month wise (2025)

|

Month |

Percentage |

|

January |

26.9 |

|

February |

25.9 |

|

March |

26.6 |

|

April |

26.1 |

|

May |

26.1 |

|

June |

26.4 |

|

July |

26.5 |

|

August |

26 |

|

September |

27.2 |

|

October |

27.9 |

|

November |

32.3 |

|

December |

29.3 |

Source: ONS January 2026