E-commerce Apparel Market Segmentation:

End user Segment Analysis

The individual consumer sub-segment is dominating and is expected to hold the share value of 95.4% by 2035 in market. The segment is driven by the direct-to-consumer shift, the convenience of online shopping, and personalized marketing. The key trend is the rise of the individual consumer as both a buyer and a reseller, fueled by the platforms that blend the traditional B2C and C2C models. The data from the FRED in January 2026 highlights this penetration, reporting that in September 2025, the retail sales of clothing and clothing accessories stores reached USD 23,889 million. This is driven by individual purchases, demonstrating the segment’s massive and sustained scale. This growth is further accelerated by the integration of social commerce features, turning everyday social media browsing into direct purchasing opportunities.

Business Model Segment Analysis

The business-to-consumer model is leading the business model segment in the e-commerce apparel market and is poised to hold the largest share value. This includes transactions from the established brands, pure play e-tailers, and traditional retailers selling directly online. The model’s strength lies in brand control, data collection, and the ability to create seamless omnichannel experiences. Its growth is fueled by the brands bypassing wholesale intermediaries to build direct relationships, as seen with Nike’s DTC focus. The report from the International Trade Commission shows that the digital B2C transactions in consumer goods have seen compound annual growth, with the value of B2C e-commerce imports consistently rising YoY, reflecting the model’s central role in global trade and consumer access.

Consumer Gender Segment Analysis

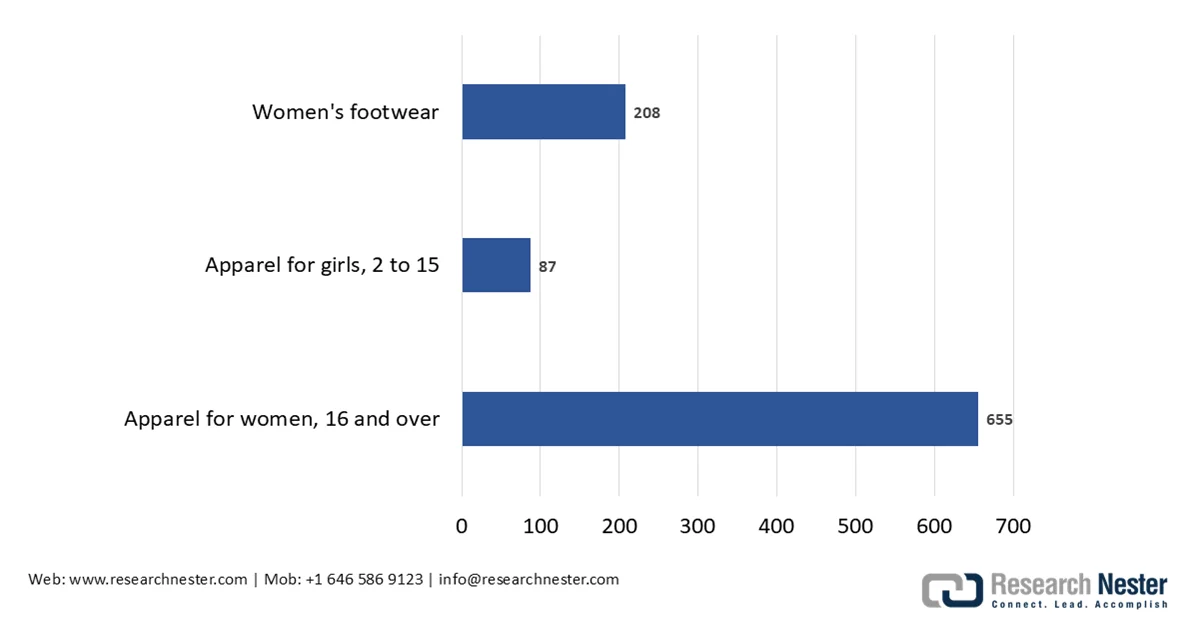

The women's apparel sub-segment is the largest by consumer gender, consistently holding the largest share value in the market. This leadership is driven by the higher purchase frequency, greater engagement with the fashion trends, and a broader product variety encompassing formal, casual, and activewear. The segment is also at the forefront of sustainability and social commerce trends. Supporting this, the report from the U.S. Bureau of Labor Statistics Consumer Expenditure Surveys shows that average annual expenditures on apparel and other services by women have consistently exceeded those for men and children. For instance, the data from the U.S. Bureau of Labor Statistics in February indicates that the spending on women's apparel averaged USD 655, while that on men was USD 406. This underscores the segment’s commercial primacy.

Average Annual Expenditures for Apparel, 2025 (USD)

Source: BLS February 2025

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Consumer Gender |

|

|

Price Point |

|

|

Business Model |

|

|

Platform |

|

|

End user |

|