E-cigarette and Vape Market Outlook:

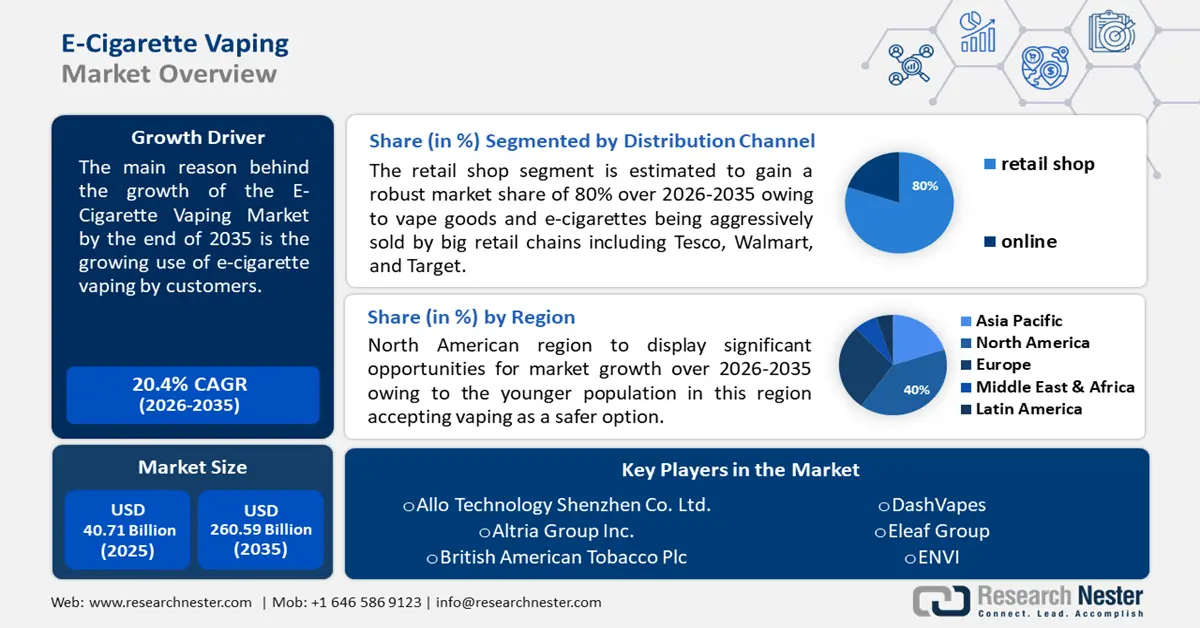

E-cigarette and Vape Market size was valued at USD 40.71 billion in 2025 and is set to exceed USD 260.59 billion by 2035, expanding at over 20.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of e-cigarette and vape is estimated at USD 48.18 billion.

The reason behind the growth is the surging use of e-cigarette and vape by customers. According to the National Library of Medicine released in the year 2023, the global lifetime and current prevalence of e-cigarette and vape in women were 16% and 8%, respectively. Also, the lifetime and current prevalence of e-cigarette and vape in men were 22% and 12%, respectively.

Key E-cigarette and Vape Market Insights Summary:

Regional Highlights:

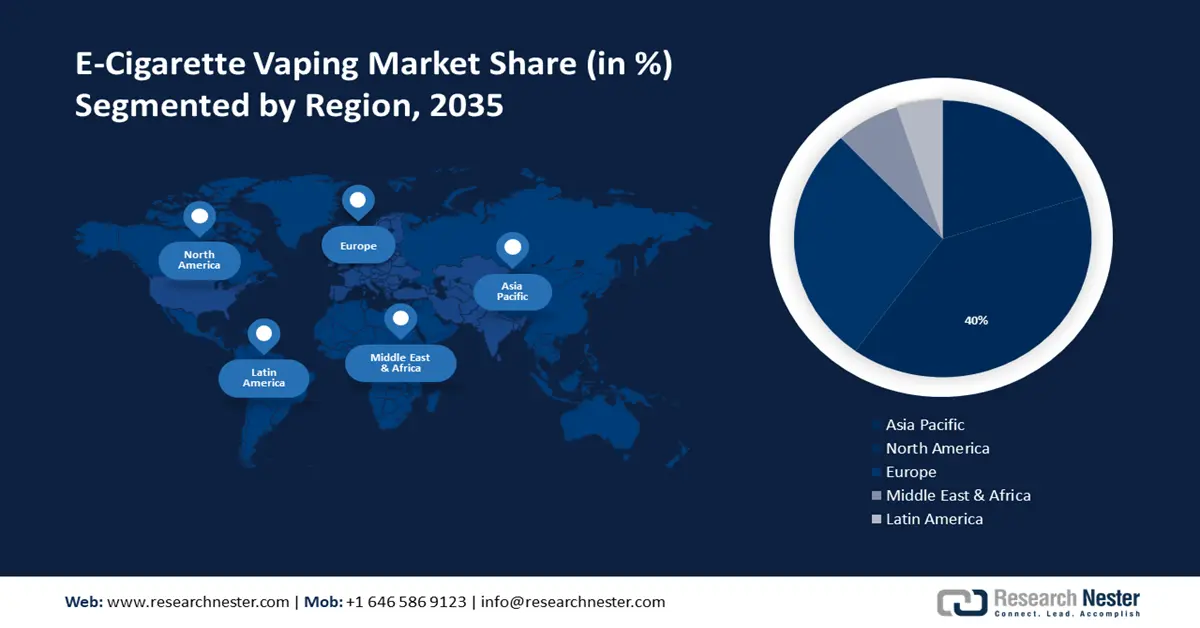

- North America e-cigarette and vape market achieves a 40% share by 2035, driven by the younger population accepting vaping as a safer alternative.

Segment Insights:

- The retail shop segment in the e-cigarette and vape market is projected to hold an 80% share by 2035, fueled by aggressive sales and advertising of vape products in big retail chains like Tesco and Walmart.

- The rechargeable segment in the e-cigarette and vape market is projected to attain a 45% share by 2035, fueled by the increasing use of rechargeable vaping as a non-toxic alternative to traditional cigarettes.

Key Growth Trends:

- Safer options than tobacco products

- Introduction of a wide range of taste options

Major Challenges:

- Health problems related to e-cigarette and vape

- Government ban on consuming e-cigarette and vape

Key Players: Allo Technology Shenzhen C0. Ltd., Altria Group Inc., British American Tobacco Plc., DashVapes, Eleaf Group, ENVI, Flavour Beast, Geekvape, Imperial Brands Plc., Innokin Technology Ltd., Japan Tobacco Inc., JUUL Labs, Inc., Philip Morris International Inc., Reynolds Vapor Company, Shenzhen Kanger Tech Technology Co., Ltd.

Global E-cigarette and Vape Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 40.71 billion

- 2026 Market Size: USD 48.18 billion

- Projected Market Size: USD 260.59 billion by 2035

- Growth Forecasts: 20.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

E-cigarette and Vape Market Growth Drivers and Challenges:

Growth Drivers

- Safer options than tobacco products - Growth in the industry is being driven by goods that are safer than other tobacco products. Smoking tobacco products may lead to a number of health issues, such as heart difficulties, cancer, precision oncology, and respiratory ailments. Actually, smoking causes six million deaths worldwide each year. Experts are increasingly advising passive smokers to switch to vaping goods.

According to the World Health Organization, the tobacco pandemic kills approximately 8 million people every year worldwide, it is one of the worst risks to public health that the world has ever faced. Of those fatalities, almost 7 million are directly related to tobacco use, and over 1.3 million are caused by secondhand smoke exposure for nonsmokers.

- Technical growth in e-cigarette and vape - The perception of e-cigarettes being limited-risk products is one explanation for this. According to a research nester’s survey, it is found that the Millennials and Generation Y people in North America use 25% of e-cigarette and vape rather than the usual one. The usual ones are used by only 20% of people.

In a similar poll in Japan, it was noticed that almost 17% of Millennials and Generation Y people most of the time take e-cigarettes and 14% take usual ones. Additionally, when they are asked why they take e-cigarettes they exert that it is cheaper than regular tobacco products and they come in a large number of flavors.

- Introduction of a wide range of taste options - Numerous tastes, including fruits, pastries, candies, and drinks, appeal to a wider spectrum of customers. The experience of using an e-cigarette is made more engaging and delightful by flavors that replicate well-known and pleasant tastes. In addition, tastes draw nonsmokers, especially young people, who are drawn to their novelty.

Furthermore, tastes contribute to the success of quitting smoking. Flavored e-cigarettes are more tempting and rewarding to smokers trying to give up traditional cigarettes, which eases the transition and quickens the pace of product acceptance.

Challenges

-

Health problems related to e-cigarette and vape - Health problems brought on by e-cigarettes are impeding industry expansion. The long-term negative consequences of smoking and vaping are still being researched, and the effects of cigarettes on health have not yet been fully determined.

According to some research, e-cigarettes and traditional cigarettes, both cause immunological reactions. They also raise other problems, such the possibility of burns from failing batteries on the hands or face. - Government ban on consuming e-cigarette and vape- Legislation pertaining to e-cigarettes is being discussed in several nations due to the possible connection between tobacco regulations and rules for medicinal drugs.

The e-cigarette manufacturers have been advocating for legislation that advances their goals. The use of electronic cigarettes aboard commercial aircraft is prohibited by the US Department of Transportation. All aircraft traveling to and from the US must abide by this rule.

E-cigarette and Vape Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

20.4% |

|

Base Year Market Size (2025) |

USD 40.71 billion |

|

Forecast Year Market Size (2035) |

USD 260.59 billion |

|

Regional Scope |

|

E-cigarette and Vape Market Segmentation:

Product Segment Analysis

Rechargeable segment is expected to dominate over 45% e-cigarette and vape market share by 2035. The increasing use of rechargeable vaping is because of its non-toxic components than regular tobacco cigarettes.

According to current research of the National Institute on Drug Abuse in 2023, switching from traditional cigarettes to rechargeable vaping as a full replacement appears to be less dangerous for smokers.

Distribution Channel Segment Analysis

By 2035, retail shop segment is set to capture over 80% e-cigarette and vape market share. The retail shop market will grow till 2035, reaching a valuation of USD 8.26 billion. This expansion will be noticed because vape goods and e-cigarettes are aggressively sold by big retail chains including Tesco, Walmart, and Target.

According to a study done by the National Library of Medicine, 68.6% of young adults reported having seen media or advertising for e-cigarettes in the previous 30 days in the year 2023. These ads were mostly found on social media (43.4%) and in retail (31.7%), and exposure to these ads was linked to e-cigarette usage.

Our in-depth analysis of the global e-cigarette and vape market includes the following segments:

|

Product |

|

|

Category |

|

|

Distribution Channel |

|

|

Flavor |

|

|

Mode of Operation |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

E-cigarette and Vape Market Regional Analysis:

North American Market Insights

North America industry is predicted to hold largest revenue share of 40% by 2035. The region’s e-cigarette and vape sector is thriving, because the younger population in this region is accepting vaping as a safer option. According to the National Library of Medicine published in 2023, eighty-three percent of North American teenagers who were using at the time reported using flavored e-cigarettes, and 38.9% said they used them at least twenty days a month.

The market for dry cleaning and laundry services has expanded in the U.S. as a result of the rising use of e-cigarette and vape in nicotine people. In the United States, high school students' current use rates peaked in 2019 at 27.5% and then dropped to 19.6% in 2020.

The Canadian e-cigarette and vape development mainly lies in the increasing craze in adolescents. In Canada, the rates of lifetime and current use of EC among teenagers reached 37% and 14.6%, respectively, in 2023.

European Market Insights

The Europe region will encounter massive revenue that will massively and will acquire the second position in the e-cigarette and vape market, owing to the rising number of users in the European region. According to the National Library of Medicine, teenagers in seven locations in Western Europe reported lifetime EC usage at 35.5% (from 23% in Germany to over 50% in Italy and Belgium), while 17.2% reported current CC use. Of these adolescents, 6.6% reported EC current use (i.e., monthly or more regularly).

e-cigarette and vape is especially in actual demand in the U.K., driven by the rising sales of online e-cigarette and vape. In the three years after the company's founding, the number of workers has expanded from five to 28, according to one online shop, whose turnover climbed by 500% between their first and second year of business.

In France, e-cigarette and vape will encounter massive growth because of the increasing sales of e-liquids and vaporizers in this country. According to Research Nester’s report, it is found that almost half of nicotine addicted people between 45% and 50% make their e-liquid mixes.

Germany will also notice a huge growth in e-cigarette and vape because of the increasing use of disposable e-cigarette and vape. In Germany, the proportion of people between the ages of 16 and 29 who say they have ever used e-cigarettes rose from 11% in 2023 to 18%

E-cigarette and Vape Market Players:

- Allo Technology Shenzhen Co. Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Allo Technology Shenzhen Co. Ltd.

- Altria Group Inc.

- British American Tobacco Plc

- DashVapes

- Eleaf Group

- ENVI

- Flavour Beast

- Geekvape

- Imperial Brands Plc

- Innokin Technology Ltd.

Leading companies are concentrating on enhancing the features and specifications of e-cigarette and vape in addition to forming alliances, mergers, and acquisitions to broaden their product offerings. A few of the key players in the e-cigarette and vape market are:

Recent Developments

- British American Tobacco Plc. and McLaren Racing have decided to extend their cooperation for a number of years. After announcing the worldwide alliance in 2019, the arrangement ensures that BAT will remain an Official Principal Partner of the McLaren Formula 1 Team through the 2024 season and beyond. Additionally, BAT branding will be shown on NEOM McLaren Formula E vehicles for the first time this year.

- Philip Morris International Inc. announced the launch of IQOS ILUMA in the Japanese market in August 2021. This most recent model in the IQOS range was the company's first tobacco-heating device using state-of-the-art induction-heating technology. Notably, this cutting-edge technology improves the product's ease and user experience by doing away with the need for a blade and cleaning.

- Report ID: 6132

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

E-cigarette and Vape Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.