E-Bike Charging Station Market Outlook:

E-Bike Charging Station Market size was over USD 3.26 billion in 2025 and is projected to reach USD 5.06 billion by 2035, witnessing around 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of e-bike charging station is evaluated at USD 3.39 billion.

The growth of the market can primarily be ascribed to the rising use of electric vehicles (EVs) across the world. Multiple companies are now marching toward the manufacturing of electric vehicles (EVs) mainly owing to reduce the higher utilization of fossil fuels and the emission of harmful vehicles from vehicles. As of 2021, it was estimated that approximately 650,000 electric cars were sold out solely in the USA and that number was projected to rise exponentially over the forecast period.

Global e-bike charging station market trends such as, increasing government initiatives and funding to manufacture charging station is expected to influence the market growth positively during the forecast period. These elements are anticipated to cause the global market for electric bike charging stations to expand. For instance, in the United States, The Bipartisan Infrastructure Act is going to allocate USD 7.5 billion to the construction of a nationwide network of 500,000 EV chargers, ensuring that charging EVs is predictable, dependable, and accessible. Moreover, electric bike come in a variety of sizes and power levels around the world, from those with modest motors that help the rider's pedaling to more potent models that can generate power to drive the bike using the throttle. They are a chic, functional, flexible, and eco-friendly form of transportation. These bikes are more compact, can travel at higher speeds with less effort, and contribute to reducing traffic congestion.

Key E-Bike Charging Station Market Insights Summary:

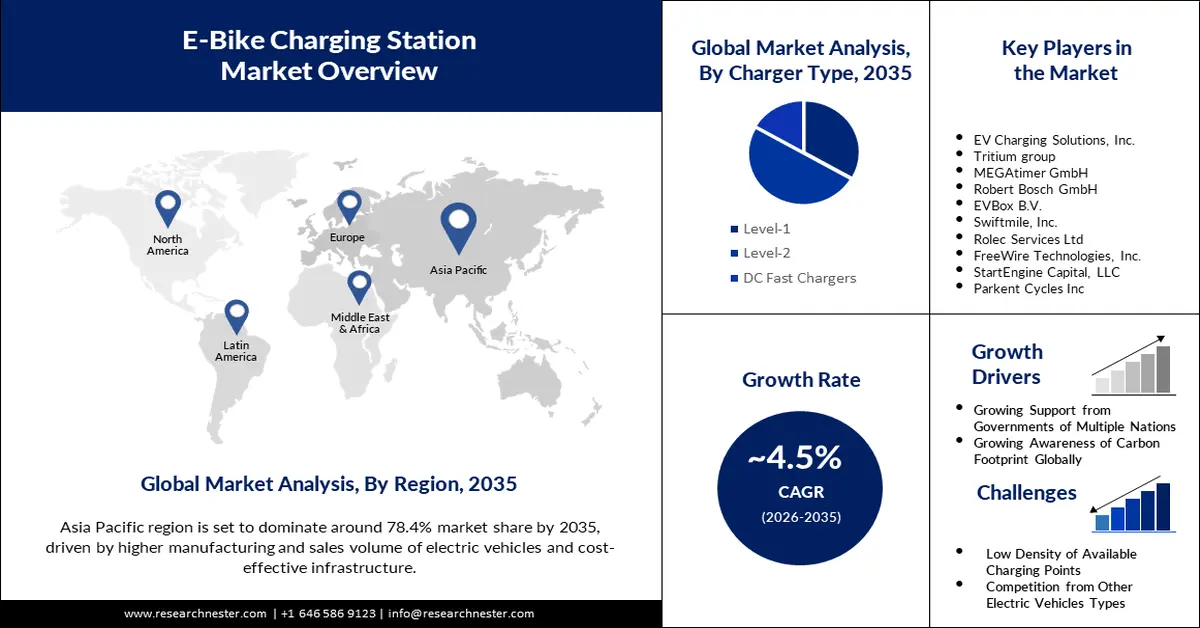

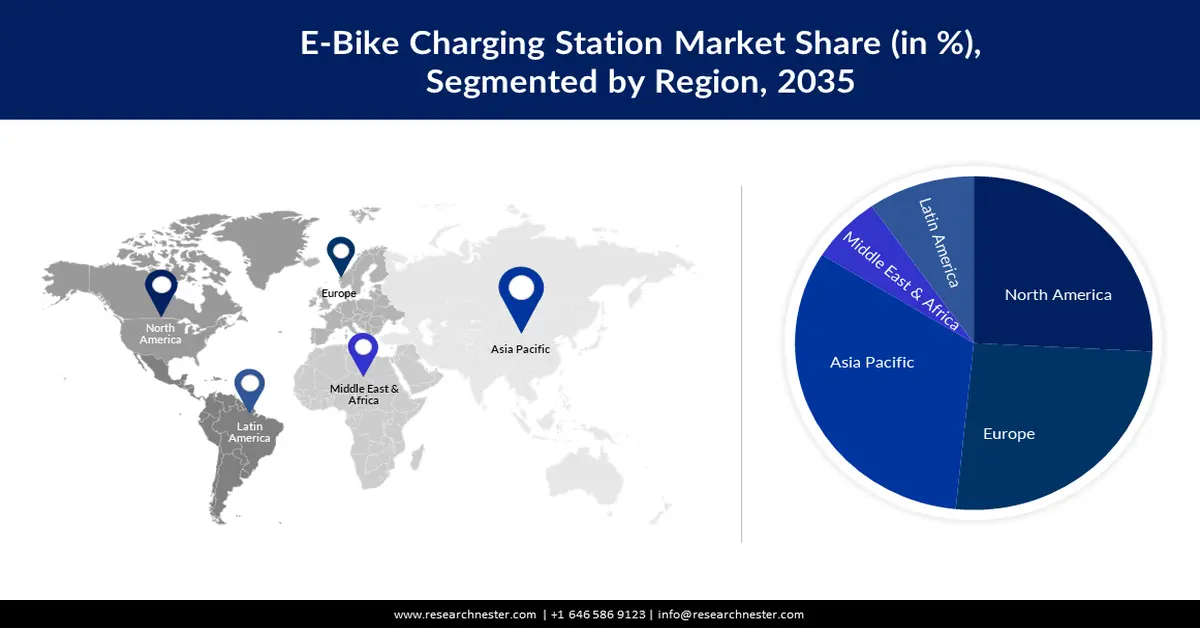

Regional Highlights:

- Asia Pacific e-bike charging station market will dominate more than 78.4% share by 2035, driven by higher manufacturing and sales volume of electric vehicles and cost-effective infrastructure.

Segment Insights:

- The level-2 charger segment in the e-bike charging station market is projected to hold a 60% share by 2035, driven by higher efficiency and lower energy consumption compared to other charger types.

- The lithium-ion battery segment in the e-bike charging station market is projected to exhibit noteworthy growth from 2026-2035, attributed to the excellent power-to-weight ratio and enhanced performance of lithium-ion batteries.

Key Growth Trends:

- Growing Support from Governments of Multiple Nations

- Growing Awareness of Carbon Footprint Globally

Major Challenges:

- Slow Charging Speeds at Various Charging Points

- Low Density of Available Charging Points

Key Players: EV Charging Solutions, Inc., Tritium group, MEGAtimer GmbH, Robert Bosch GmbH, EVBox B.V., Swiftmile, Inc., Rolec Services Ltd, FreeWire Technologies, Inc., StartEngine Capital, LLC, Parkent Cycles Inc.

Global E-Bike Charging Station Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.26 billion

- 2026 Market Size: USD 3.39 billion

- Projected Market Size: USD 5.06 billion by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (78.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, Netherlands

- Emerging Countries: China, India, Indonesia, Thailand, Mexico

Last updated on : 10 September, 2025

E-Bike Charging Station Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Support from Governments of Multiple Nations - According to the document, relevant authorities will exempt NEVs from vehicle purchase tax until the end of 2022.

-

In China, the announcement about Exempting Vehicle Acquisition Tax for NEVs (New-Energy Vehicles) was issued jointly by the Ministry of Finance (MOF), the State Taxation Administration (STA), and the MIIT on April 22, 2020. EVs across the world are gaining recognition for their cleanliness and efficiency. Governments are now providing subsidies and the required infrastructure to boost the use of EVs.

-

Growing Awareness of Carbon Footprint Globally - It has been estimated that EVs in Europe emit less than three times CO2 than petrol cars of the same class.

-

Rising Sales Volume of Electric Vehicles EVs - The global sales of EVs are projected to cross over 10 million in 2022, an increment of over 50% from 2021. By the end of 2022, over 26 million EVs are expected to be in use, including light vehicles.

-

E-Bikes Becoming a Cost-Effective Option - In the U.S. the average yearly cost of owning a car, including fuel, parking, maintenance and insurance amounts to about 4000 USD. The cost of owning an e-bike, whereas is a meagre 300 USD on an average.

-

Increased Mobility and More Time-Saving - As per statistics, traffic jams cost Americans over USD 85 billion in 2018, with over 95 hours of lost time annually. The mobility of an e-bike can help people, especially in metropolitan cities, save a huge amount of time.

Challenges

-

Slow Charging Speeds at Various Charging Points

-

Low Density of Available Charging Points

- It hasn’t been that long since the debut of electric vehicles across the globe, hence the need of charging station was not that high as well. It was estimated that USA launched first successful electric car. Now a sudden surge in the manufacturing of electric vehicles has been observed and the lack of charging station is now appearing as a major hurdle and owing to which people hesitates to purchase electric vehicles. Another reason responsible for the low density of available charging points is high electric utility fees on charging stations. Therefore, lack of charging infrastructure is estimated to limit the market’s growth over the forecast period.

- Competition from Other Electric Vehicles Types

E-Bike Charging Station Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 3.26 billion |

|

Forecast Year Market Size (2035) |

USD 5.06 billion |

|

Regional Scope |

|

E-Bike Charging Station Market Segmentation:

Charger Type Segment Analysis

The global e-bike charging station market is segmented and analyzed for demand and supply by charger type into level-1, level-2, and DC fast chargers, out of which, the level-2 segment is projected to witness noteworthy growth over the forecast period. The growth of the segment can be accounted to the fact that they are more efficient and convenient than level 1. Moreover, level-2 chargers consume less energy which results into less expensive electricity bills. For instance, in the U.S., level 2 clearly outpaces the other two charging methods, with over about 4 times as many ports and 6 times as many locations than DC fast chargers. Furthermore, by 2030, level-2 chargers are projected to dominate charging technology by consuming nearly 60% of the energy.

Battery Type Segment Analysis

Additionally, the global e-bike charging station market is segmented and analyzed for demand and supply by battery type into lead acid, lithium-ion, others, out of which, the lithium-ion segment is projected to witness noteworthy growth over the forecast period. Lithium-ion batteries are highly used in the e-bikes and charging stations, since they provide excellent power to weight ratio along with enhanced performance at a low self-rate and high temperature. Hence, this type of battery is high in demand in electric vehicles and charging stations. For instance, the demand for lithium batteries to be used in the electric vehicles was anticipated to be around 18 kt in 2019 across the globe. Furthermore, lithium-ion is observed to constitute approximately 95% of the batteries.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Charger Type |

|

|

By Battery Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

E-Bike Charging Station Market Regional Analysis:

APAC Market Insights

Asia Pacific region is anticipated to hold over 39.8% market share by 2035, driven by low-cost domestic manufacturing and abundant labor force. For instance, currently in China, more than 290 million e-bikes are present on the road and the number is forecasted to rise exponentially. Additionally, Asia Pacific accounted for the significant share of electric vehicle supply equipment (EVSE) bases based on the installation. In 2020, in the Asia-Pacific region, the total share of alternating current (AC) charge point was estimated to around 60% while the share of direct current (DC) high power charge points was anticipated to be approximately 22%. Additionally, in 2023, the Indian government is planning to add more than 1000 electric vehicle charging stations which is a part of Phase 2 of the FAME scheme. Moreover, Asian countries are known to adopt electric vehicle earlier than other countries, which is estimated to be one of the major growth factors of the that is expected to boost the growth of the market in the region. Furthermore, the availability of cost-effective e-bike charging infrastructure component and the less expensive manufacturing of the batteries is further predicted to surge the market’s growth in the region. For instance, China’s electronics manufacturing enterprises exhibited a total profit nearly 40% higher in 2021 than the previous year summing up to approximately USD 1000 million.

E-Bike Charging Station Market Players:

- EV Charging Solutions, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Tritium group

- MEGAtimer GmbH

- Robert Bosch GmbH

- EVBox B.V.

- Swiftmile, Inc.

- Rolec Services Ltd

- FreeWire Technologies, Inc.

- StartEngine Capital, LLC

- Parkent Cycles Inc.

Recent Developments

-

Tritium group to announce that the company will provide fast chargers for a new EV highway that will span more than 7,000 kilometers (4,350 miles) across the state of Western Australia. It also obtained a notable amount of sum from Western Australian government. The company is a well-known name in the field of fast charging technology for electric vehicles.

-

EV Charging Solutions, Inc. announced that beginning in October 2021, EV owners will be able to take advantage of free charging at West Coast Electric Highway (WCEH) charging points in Oregon and Washington until network upgrades are completed in late 2021/early 2022.

- Report ID: 4609

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

E-Bike Charging Station Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.