Dynamic Light Assist Technology Market Outlook:

Dynamic Light Assist Technology Market size was valued at USD 2.5 billion in 2025 and is likely to cross USD 6.48 billion by 2035, expanding at more than 10% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of dynamic light assist technology is assessed at USD 2.73 billion.

The market is primarily driven by the automotive industry’s continuous innovation in safety features, promoting the adoption of dynamic light assist technology. These systems enhance nighttime visibility as they automatically adjust headlights and reduce the chances of accidents. A recent advancement in automotive safety within the dynamic light assist technology market is the development of an HD lighting system by Hyundai Mobis in May 2023. This innovative system enhances nighttime driving safety by projecting real-time driving information directly onto the road surface, including road signs and pedestrian crosswalks. By utilizing approximately 25,000 micro-LEDs and a Digital Micro Mirror Device (DMD) composed of 1.3 million microscopic mirrors, the system can display clear and precise information regardless of road conditions. The integration with front sensors and GPS navigation allows the system to provide timely alerts about construction zones, speed limits, and pedestrian crossings, thereby reducing the risk of accidents during night driving.

Additionally, government regulations and safety standards emphasizing road safety have accelerated the incorporation of advanced lighting systems in vehicles. For instance, in February 2022, the U.S. National Highway Traffic Safety Administration’s amendment to Federal Motor Vehicle Safety Standards (FMVSS) No. 108 led to the adoption of energy-efficient lighting solutions including DLA technologies. This amendment permits the use of Adaptive Beam (ADB) headlight systems on vehicles sold in the U.S. ADB systems enhance nighttime driving safety by automatically adjusting the headlight beams to provide optimal illumination without causing glare to oncoming drivers.

Key Dynamic Light Assist Technology Market Insights Summary:

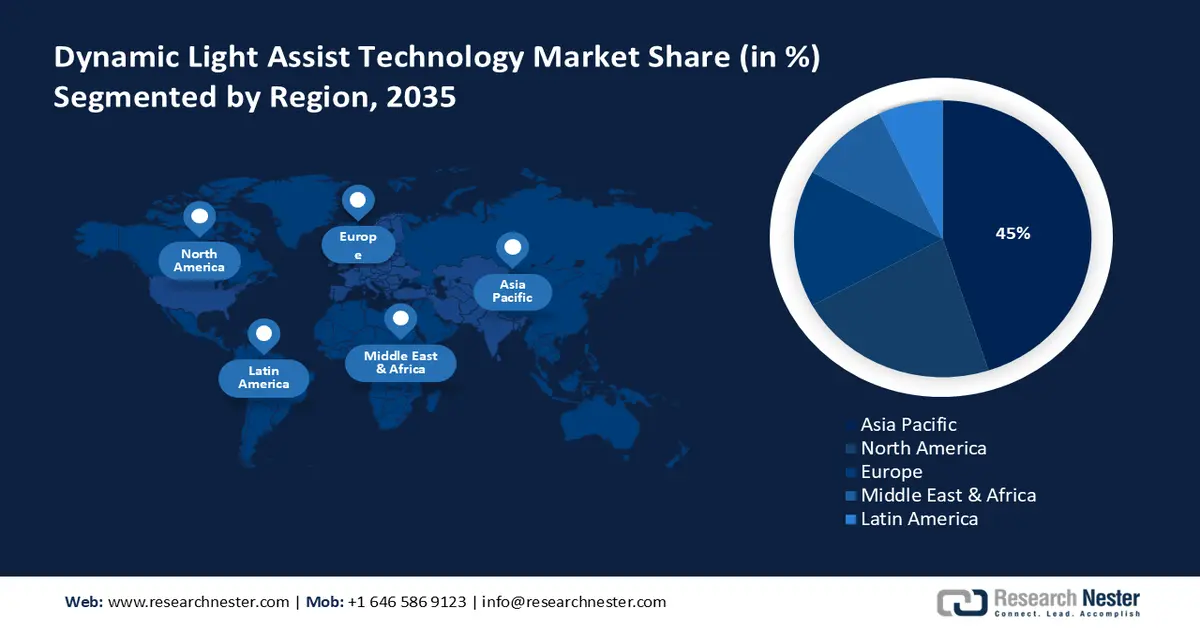

Regional Insights:

- Asia Pacific is projected to command a 45% share of the dynamic light assist technology market by 2035, spurred by escalating vehicle production, rapid urbanization, and strengthened ADAS regulatory support.

- North America is set to capture a substantial share through 2035 as increasing adoption of adaptive headlights elevates safety performance, reinforced by progress in projector lamp and sensor technologies.

Segment Insights:

- The camera-based system segment in the dynamic light assist technology market is anticipated to secure a dominant 55% share by 2035, propelled by advancements in image processing, affordability of high-resolution cameras, and ADAS integration.

- The dynamic high beam control segment is expected to account for 42% share by 2035, supported by rising safety standards and growing consumer preference for intelligent, glare-free driving experiences.

Key Growth Trends:

- Rising consumer demand for safety and comfort

- Integration with electric and autonomous vehicles

Major Challenges:

- High development and integration costs

- Regulatory fragmentation across global markets

Key Players: Valeo, Osram Licht AG, Robert Bosch GmbH, Magneti Marelli (Marelli Holdings Co., Ltd.), Hella KGaA Hueck & Co., Zizala Lichtsysteme GmbH (ZKW Group), Continental AG, Lumileds Holding B.V.

Global Dynamic Light Assist Technology Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.5 billion

- 2026 Market Size: USD 2.73 billion

- Projected Market Size: USD 6.48 billion by 2035

- Growth Forecasts: 10%

Key Regional Dynamics:

- Largest Region: Asia Pacific (45% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Thailand, Mexico, Turkey, Brazil

Last updated on : 3 December, 2025

Dynamic Light Assist Technology Market - Growth Drivers and Challenges

Growth Drivers

- Rising consumer demand for safety and comfort: Increasing consumer expectations for high-end safety and comfort features, especially among mid-to-premium segment buyers, are fueling OEM investments in dynamic light assist technologies. For instance, in March 2025, Valeo, a global leader in automotive lighting systems, licensed TactoTek’s In-Mold Structural Electronics (IMSE) technology to develop advanced interior and exterior lighting applications. Dynamic light assistance technology addresses safety preferences by enhancing driving comfort and reducing eye strain during nighttime driving.

- Integration with electric and autonomous vehicles: The shift towards electric and autonomous vehicles presents new opportunities for dynamic light assist technology. As these vehicles rely heavily on advanced driver assistance systems (ADAS), incorporating DLA systems enhances their safety. A recent advancement exemplifying the integration of dynamic light assist technology with electric and autonomous vehicles is the Hyundai Mobis development of the lighting grille system in October 2023. This innovative technology incorporates LED lighting into the vehicle’s front grille, enabling communication with pedestrians and other vehicles which is a crucial feature for autonomous driving scenarios. The lighting can display various patterns and signals such as indicating when the vehicle operating in self-driving mode or projecting warnings to pedestrians.

Challenges

- High development and integration costs: The implementation of dynamic light assistance systems requires advanced components such as adaptive LED or laser headlights, camera modules, real-time processing units, and integration with vehicle control systems. These technologies are cost-intensive and often reserved for premium vehicle segments that limit adoption across mid-range or economy models.

- Regulatory fragmentation across global markets: While dynamic light assistance systems are widely accepted in regions such as the European Union and Japan, other key dynamic light assist technology markets such as the U.S. have only recently begun updating their regulatory frameworks. This lack of harmonization creates challenges for manufacturers aiming to develop and deploy unified lighting solutions globally.

Dynamic Light Assist Technology Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10% |

|

Base Year Market Size (2025) |

USD 2.5 billion |

|

Forecast Year Market Size (2035) |

USD 6.48 billion |

|

Regional Scope |

|

Dynamic Light Assist Technology Market Segmentation:

Technology Type Segment Analysis

The camera-based system segment in dynamic light assist technology market is expected to hold a dominant share of 55% by 2035 as it is a core technology in dynamic light assist solutions that enable real-time detection of oncoming traffic and environmental conditions. These systems automatically adjust beam patterns to maximize visibility while minimizing glare for other drivers. The growth is driven by advancements in image processing, affordability of high-resolution cameras, and integration of with ADAS platforms. Automakers prefer camera-based dynamic light assist technology for its precision and compatibility with intelligent safety systems. As regulatory bodies push for adaptive lighting, demand for camera-based solutions continues to rise.

Lighting Type Segment Analysis

The dynamic high beam control segment is anticipated to hold a notable 42% dynamic light assist technology market share through 2035 as it is an advanced lighting type in the dynamic light assist technology market. It is designed to optimize night driving visibility without dazzling other road users. It automatically adjusts the beam pattern based on real-time traffic and environmental conditions maintaining safety for all drivers. For example, in November 2021, MG Motor integrated an Intelligent headlamp control in its Astor model. This feature utilizes cameras and sensors to automatically switch between high and low beams based on the detection of oncoming traffic, ensuring that the high beams are used effectively without causing discomfort to other drivers. Thus, the rising safety standards and consumer demand for intelligent, glare-free driving experiences along with ADAS integration reflect the automotive industry’s commitment to enhancing driver safety and comfort through intelligent lighting solutions which in turn drive dynamic light assist technology market adoption.

Our in-depth analysis of the global market includes the following segments:

|

Technology Type |

|

|

Lighting Type |

|

|

Vehicle Type |

|

|

Component |

|

|

Sales Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dynamic Light Assist Technology Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is expected to dominate the dynamic light assist technology market with the largest share of a 45% share through 2035 due to rising vehicle production, increasing urbanization, and growing concerns around road safety. Governments in Japan, South Korea, and China are promoting advanced driver assistance systems (ADAS) through supportive regulations and safety ratings. Additionally, the rising consumer demand for premium features in mid-range vehicles is fueling adoption as regional OEMs are investing in intelligent lighting to differentiate their offerings and meet evolving safety standards.

The dynamic light assist technology market in China is expanding rapidly owing to the adoption of electric vehicles and an increased focus on road safety. Consumers in China are highly demanding advanced safety features in vehicles, prompting automakers to integrate intelligent lighting systems such as dynamic lighting assistance. This trend is further supported by government initiatives such as the Made in China 2025 strategy that promotes the development and adoption of smart automotive technologies.

The dynamic light assist technology market in South Korea is growing due to the government's development of intelligent transportation infrastructures and autonomous vehicles. This initiative encourages the widespread adoption of adaptive headlights, enhancing vehicle visibility and safety. Companies such as Hyundai, Kia, and Samsung Electronics are the key players in South Korea, developing AI-powered dynamic headlight technologies that adjust beam patterns in real time based on traffic conditions. Additionally, the integration of 5G connectivity with vehicle-to-everything (V2X) communication enhances adaptive lighting systems as it provides early warning mechanisms and improved driver guidance.

North America Market Insights

North America is predicted to garner a significant share during the forecast time due to the increasing adoption of adaptive headlights that enhance driver visibility in challenging conditions. These systems, which adjust headlight angles and intensity, are becoming more prevalent even in mid-price segment vehicles due to their safety benefits. The dynamic light assist technology market’s expansion is further supported by advancements in projector lamp systems and sensor technology addressing the limitations of static headlights, particularly in high-traffic accident areas.

In the U.S., the dynamic light assist technology market is bolstered by regulatory changes and a strong emphasis on road safety. The National Highway and Traffic Safety Administration (NHTSA) has implemented regulations to enhance visibility and road safety that encourage the use of advanced lighting technologies. For instance, NHTSA’s Vehicle-to-Vehicle Communication rule promotes the adoption of adaptive lighting systems that improve night driving visibility and reduce crash risks.

Canada’s dynamic light assist technology market is rising, driven by government initiatives promoting vehicle safety and environmental sustainability. The Canada government’s commitment to reducing road accidents and improving vehicle safety has led to the adoption of advanced automotive technologies such as dynamic light assist technology. Additionally, the emphasis on reducing carbon emissions is pushing for energy-efficient solutions such as LED-based adaptive lighting, which consumes less power and contributes to a greener automotive industry.

Dynamic Light Assist Technology Market Players:

- Valeo

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Osram Licht AG

- Robert Bosch GmbH

- Magneti Marelli (Marelli Holdings Co., Ltd.)

- Hella KGaA Hueck & Co.

- Zizala Lichtsysteme GmbH (ZKW Group)

- Continental AG

- Lumileds Holding B.V.

The competitive landscape of the dynamic light assist technology market is shaped by leading players such as Hella GmbH, Valeo, and Marelli. These companies focus on innovations in adaptive lighting, sensor integration, and energy efficiency to gain a technological edge. Here are some leading players in the dynamic light assist technology market:

Recent Developments

- In April 2025, Continental will present its latest smart lighting technologies at Auto Shanghai to be held from April 23 to May 2, 2025, in China. These include affordable to premium solutions such as automatic head light leveling and new laser based lighting, aimed at improving safety and driving comfort.

- In December 2024, Valeo, and ams Osram partnered to improve vehicle interior lighting using advanced sensors and lighting tech. They introduced a smart LED OSIRE E3731i and an ambient lighting system to enhance the design and function of car interiors.

- Report ID: 7602

- Published Date: Dec 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.