Dupuytren's Disease Therapeutics Market Outlook:

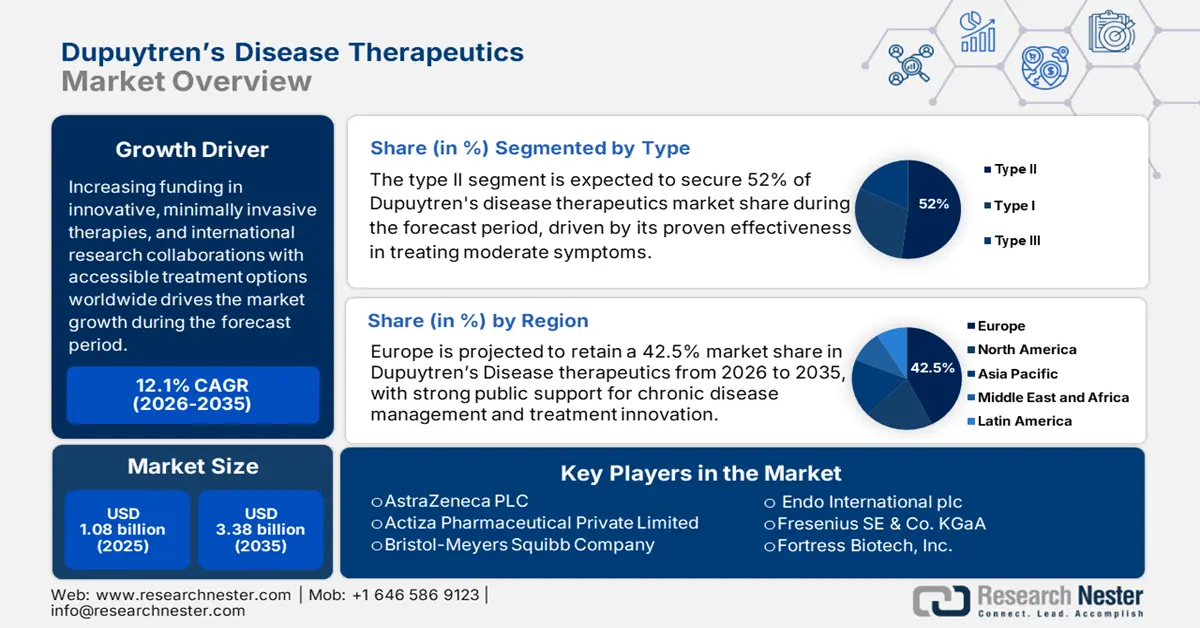

Dupuytren's Disease Therapeutics Market size was valued at USD 1.08 billion in 2025 and is likely to cross USD 3.38 billion by 2035, expanding at more than 12.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of dupuytren's disease therapeutics is estimated at USD 1.2 billion.

Advancements in non-invasive treatments, complemented by increasing patient awareness, are some of the major drives of the dupuytren’s disease therapeutics market. Industry players continue to develop and enhance therapeutic options targeting the cause of this condition. For instance, effective injections containing collagenase are used for early-stage treatments, which further drives the adoption. Initiatives, including public awareness campaigns, are driving market growth as more patients seek treatment options at an earlier stage. Furthermore, an aging global population prone to Dupuytren’s disease is anticipated to contribute to increased demand.

Government support through health policies focused on furthering research and development of treatments for rare and chronic diseases is also driving dupuytren’s disease therapeutics market expansion. For example, government-led programs are improving access to healthcare solutions in various countries for Dupuytren's disease. The U.S. National Institutes of Health have supported research programs aimed at gaining better insights into fibrotic diseases to offer more therapeutic alternatives. These initiatives, combined with emerging treatments from key industry players, make for a healthy and promising landscape for continued progress in Dupuytren's disease therapeutics industry.

Key Dupuytren's Disease Therapeutics Market Insights Summary:

Regional Highlights:

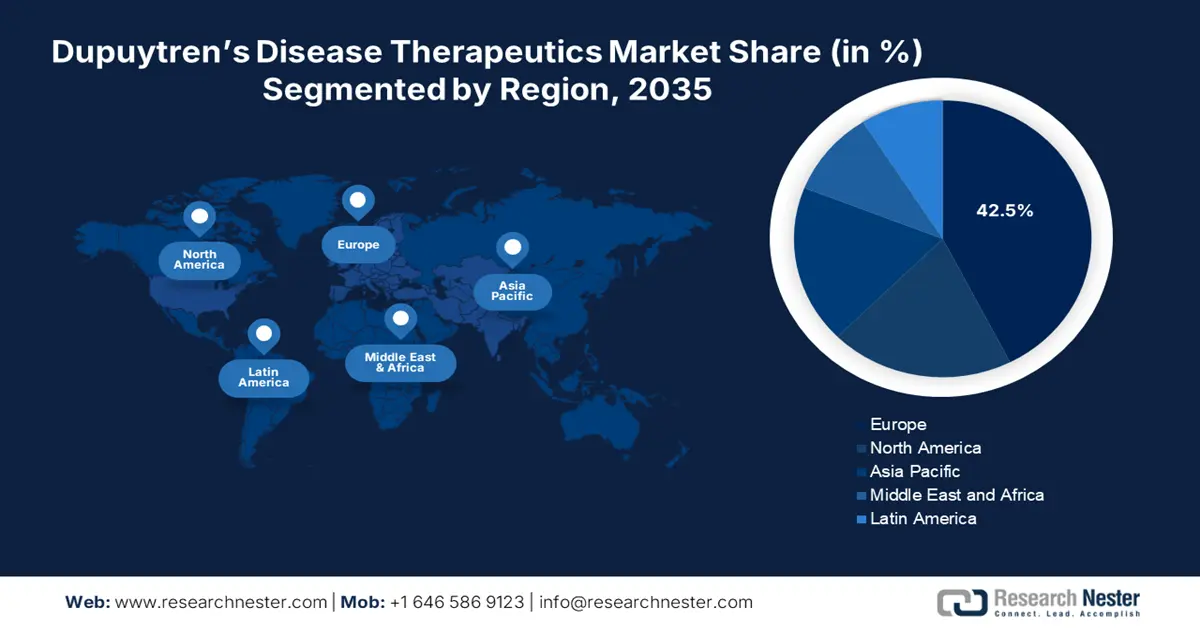

- Europe commands a 42.5% share in the Dupuytren's Disease Therapeutics Market, driven by increased healthcare expenditure and a focus on managing chronic diseases, ensuring robust growth through 2026–2035.

- Asia Pacific's Dupuytren's Disease Therapeutics Market is expected to grow significantly by 2035, fueled by improved healthcare facilities and aging demographics.

Segment Insights:

- Collagenase Injection segment is anticipated to hold over 54.2% share by 2035, fueled by the preference for non-invasive treatments and high patient compliance.

- The Type II segment is projected to hold around 52% share by 2035, fueled by the prevalence of mid-stage cases and targeted treatment effectiveness.

Key Growth Trends:

- Rising technological advancements

- Higher funding and partnerships

Major Challenges:

- Regulatory hurdles and approval delays

- Safety and efficacy concerns in emerging treatments

- Key Players: Bristol-Meyers Squibb Company, Endo International plc, AstraZeneca PLC, Actiza Pharmaceutical Private Limited, Bayer AG, Fresenius SE & Co. KGaA, Fortress Biotech, Inc., and GSK plc.

Global Dupuytren's Disease Therapeutics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.08 billion

- 2026 Market Size: USD 1.2 billion

- Projected Market Size: USD 3.38 billion by 2035

- Growth Forecasts: 12.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (42.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Germany, United Kingdom, France, United States, Italy

- Emerging Countries: Germany, UK, France, Italy, Spain

Last updated on : 14 August, 2025

Dupuytren's Disease Therapeutics Market Growth Drivers and Challenges:

Growth Drivers

- Rising technological advancements: Technological innovations in non-invasive treatments are making dupuytren’s disease therapeutics safer and more effective. This trend is exemplified by Endo’s GRASP-DC program, launched in June 2023, designed to gather patient data for refining Dupuytren's care. Improved understanding of treatment efficacy fosters innovation, leading to more accessible therapeutic options. These advancements are crucial for creating patient-centric solutions, enabling faster recovery, and minimizing treatment risks.

- Higher funding and partnerships: More funding and partnerships are also driving the development of actual therapies. For instance, in April 2022, 180 Life Sciences partnered with the University of Oxford to demonstrate real efficacy in the treatment of Dupuytren's disease. Such collaborations enable groundbreaking therapies that help companies enter markets more quickly, helping to meet unmet needs in the management of fibrotic diseases. This surge in funding for research aligns with a broader mission to develop long-term solutions for Dupuytren's disease care.

- Rising Awareness and direct-to-consumer campaigns: Rising public awareness further drives the demand for Dupuytren’s therapies. Companies in the market are organizing campaigns to promote their products and raise awareness. For example, Endo’s ‘Reminders’ campaign in June 2024 highlights the value of early intervention, reducing severe disease progression. Increased awareness encourages proactive treatment-seeking behavior, enabling earlier therapeutic engagement and bolstering market growth as more patients pursue preventive measures. Public education initiatives further destigmatize the condition, encouraging wider acceptance and support for early intervention therapies.

Challenges

- Regulatory hurdles and approval delays: Regulatory requirements present significant challenges for market players. For instance, in August 2023, 180 Life Sciences sought Conditional Marketing Authorization from the U.K.’s MHRA for adalimumab, underscoring the complexity of regulatory compliance. Lengthy approval processes hinder the timely introduction of innovative treatments, affecting both patients and market expansion. Such delays also discourage smaller companies from entering the market, restricting innovation and accessibility.

- Safety and efficacy concerns in emerging treatments: New therapeutics are subject to strict safety protocols by regulatory agencies like the U.S. FDA, which may limit the dupuytren’s disease therapeutics market growth. Safety concerns also require extended clinical trials, complicating the treatment landscape and limiting access to sophisticated patient care. This may also increase the costs associated with comprehensive trials, potentially affecting the affordability and dupuytren’s disease therapeutics market reach of treatments.

Dupuytren's Disease Therapeutics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.1% |

|

Base Year Market Size (2025) |

USD 1.08 billion |

|

Forecast Year Market Size (2035) |

USD 3.38 billion |

|

Regional Scope |

|

Dupuytren's Disease Therapeutics Market Segmentation:

Type, (I, II, III)

The Type II segment is anticipated to dominate dupuytren’s disease therapeutics market share of around 52% by the end of 2035. Type II is dominating as most of Dupuytren's patients are affected by this condition. Furthermore, the growth is accelerated by the effective management of mid-stage symptoms with targeted therapeutics before severe contracture occurs. In July 2022, a study on combining aponeurotomy with adipose tissue grafting to reduce recurrence rates highlighted demand in this segment, as treatments for Type II cases are essential in minimizing disease progression. Furthermore, ongoing research initiatives continue to improve mid-stage intervention strategies, solidifying Type II’s market dominance.

Therapeutics (Collagenase Injection, Steroids, Immune-modulators)

In dupuytren’s disease therapeutics market, collagenase injection segment is set to hold revenue share of more than 54.2% by 2035 due to its non-invasive method and high patient compliance rates. Collagenase injections break down collagen build-up in affected areas, making the treatment effective without surgery. In February 2023, Endo's ‘Man with a Plan’ campaign emphasized awareness of collagenase treatments for related conditions, noting that this segment of non-invasive Dupuytren's treatment plays a vital role. With a strong preference for non-invasive treatments, collagenase injections continue to gain widespread acceptance, making them an important segment of dupuytren's disease therapeutics market.

Our in-depth analysis of the dupuytren’s disease therapeutics market includes the following segments:

|

Type |

|

|

Therapeutics |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dupuytren's Disease Therapeutics Market Regional Analysis:

Europe Market Analysis

Europe industry is poised to dominate majority revenue share of 42.5% by 2035. This growth results from increased healthcare expenditure and a robust focus on managing chronic diseases in Europe. Healthcare policies in most countries in Europe favor treatments for fibrotic diseases, facilitating the adoption of non-surgical treatments and ensuring easy patient access to developing therapies. Europe pipeline of advanced Dupuytren's solutions is also bolstered by partnerships with research institutions, driving market growth.

A key player in Europe, Germany finances research on rare diseases and supports the development of Dupuytren's treatments through robust healthcare policies and research funding. In addition, several pharma companies are solidifying their market position in Germany, strengthening their focus on innovative Dupuytren solutions. Germany’s support for non-invasive treatments and early intervention strategies underpins its role in healthcare advancements. German institutions also participate in clinical trials that accelerate early access to breakthrough treatments.

France is another strong market for Dupuytren's therapeutics, supported by government investments in healthcare technologies. According to the European Health Data Space recommendations, improving communication and patient support systems is key to tackling chronic disease adherence challenges, a focus area for France healthcare system. Such advancements strengthen France position in Dupuytren's disease therapeutics market. The government also awards grants supporting innovative treatment research, allowing patients to access advanced therapies.

Asia Pacific Market Analysis

Asia Pacific dupuytren’s disease therapeutics market is poised to register steady growth through 2035 due to rising healthcare expenditure and improved healthcare facilities in underserved regions. This growth boosts demand for fibrotic disease treatments in a region with aging demographics and high awareness of Dupuytren's disease. Enhanced healthcare infrastructure in urban areas also facilitates access and distribution of advanced therapies.

China is an emerging market for Dupuytren's disease therapies, bolstered by government policies promoting healthcare innovation and significant M&A activity in its life sciences and healthcare (LSHC) sector. In 2021, M&A transactions in China’s LSHC industry reached 263 deals, marking a 72-deal increase over 2020 and totaling a disclosed value of USD 28 billion, an impressive year-on-year increase of 27.9%. Over half of the 109 deals valued at over USD 100 million each were concentrated in the biotech and drug sectors, reflecting substantial investment in healthcare advancements.

Awareness and Government Health Initiatives in India for unmet medical needs create significant growth opportunities. The Ministry of Health and Family Welfare started the National Programme for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases, and Stroke (NPCDCS) to integrate chronic disease interventions into the public health delivery system. This would encourage healthy lifestyle habits and early diagnosis to reduce the growing burden of non-communicable diseases.

Key Dupuytren's Disease Therapeutics Market Players:

- Bayer AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Actiza Pharmaceutical Private Limited

- Hikma Pharmaceuticals PLC

- Johnson & Johnson

- AstraZeneca PLC

- Merck & Co., Inc.

- Nantong Jinghua Pharmaceutical Co., Ltd

- Novartis AG

- LEO Pharma A/S

- Pfizer Inc.

- Bristol-Meyers Squibb Company

- Endo International plc

- Fresenius SE & Co. KGaA

- Fortress Biotech, Inc.

- GSK plc

The market for dupuytren's disease therapeutics is highly competitive; major players are continuously innovating to capture market share. Key players include Bristol Myers Squibb, Endo International plc, AstraZeneca PLC, and Bayer AG, all leveraging strong R&D capabilities to improve therapeutic options. These companies focus on non-invasive solutions, meeting patient needs, capturing growth in emerging markets, and staying ahead of regulatory changes. Bristol Myers Squibb's acquisition of Karuna Therapeutics in March 2024 highlights the intensity of competition as companies expand their portfolios to meet the demand for diverse therapies. This competitive scenario is likely to drive further strategic investments to address the evolving needs of Dupuytren's disease therapeutics market.

Here are some leading players in the dupuytren's disease therapeutics market:

Recent Developments

- In July 2024, Connext successfully administered the first dose of CNT201, a genetically recombinant collagenase therapeutic for Dupuytren's contracture, in patients during its Phase 1/2 clinical trials in Australia. This represents a significant milestone as CNT201 aims to provide a non-surgical treatment option that could enhance patient quality of life by targeting the underlying fibrosis characteristic of Dupuytren's Disease.

- In July 2024, Ventoux Biosciences announced its plan to develop innovative treatments for Dupuytren's disease, focusing on two small molecules, VEN-201 and VEN-202. These compounds are designed to address the disease's progression in patients who currently have limited treatment options.

- Report ID: 6630

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.