Global Dump and Mining Trucks Market

- An Outline of the Global Dump and Mining Trucks Market

- Market Definition

- Market Segmentation

- Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

- Growth Drivers

- Major Roadblocks

- Opportunities

- Market Trends

- Government Regulation

- Recent Technological Advancement

- Root Cause Analysis (RCA)

- Industry Growth Outlook

- Risk Analysis

- Pricing Benchmarking

- SWOT

- Supply Chain

- Sensor Technology Adoption Scenario

- Key Sensor Technology Suppliers

- Regional Demand

- Key End use Application

- High-Performance Windows Analysis

- Key Developments

- Comparative Positioning

- Competitive Landscape

- Competitive Model

- Company Market Share

- Business Profile of Key Enterprise

- AB Volvo

- BELAZ

- Caterpillar

- Epiroc AB

- Hitachi Construction Machinery Co., Ltd. (HCM)

- Komatsu Ltd.

- Liebherr-International AG

- Sany Heavy Equipment International Holdings Company Limited

- Scania AB

- XCMG Group

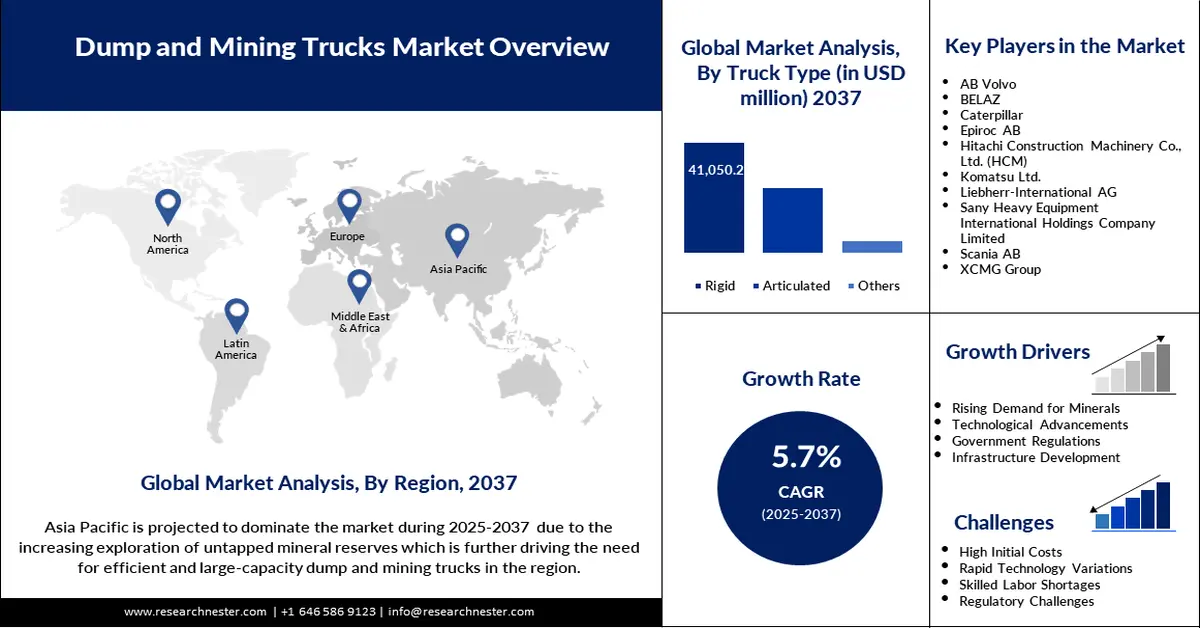

- Global Dump and Mining Trucks Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Global Dump and Mining Trucks Market Segmentation Analysis (2014-2037)

- By Truck Type

- Rigid, Market Value (USD Million), and CAGR, 2014-2037F

- Articulated, Market Value (USD Million), and CAGR, 2014-2037F

- Others, Market Value (USD Million), and CAGR, 2014-2037F

- By Capacity

- Less than 50 Tons, Market Value (USD Million), and CAGR, 2014-2037F

- 50 to 150 Tons, Market Value (USD Million), and CAGR, 2014-2037F

- Above 150 Tons, Market Value (USD Million), and CAGR, 2014-2037F

- By Propulsion Type

- Diesel Powered Trucks, Market Value (USD Million), and CAGR, 2014-2037F

- Electric & Hybrid Trucks, Market Value (USD Million), and CAGR, 2014-2037F

- By End use Application

- Mining, Market Value (USD Million), and CAGR, 2014-2037F

- Construction, Market Value (USD Million), and CAGR, 2014-2037F

- Quarrying, Market Value (USD Million), and CAGR, 2014-2037F

- Others, Market Value (USD Million), and CAGR, 2014-2037F

- By Region

- North America, Market Value (USD Million), and CAGR, 2014-2037F

- Europe, Market Value (USD Million), and CAGR, 2014-2037F

- Asia Pacific Excluding Japan, Market Value (USD Million), and CAGR, 2014-2037F

- Japan, Market Value (USD Million), and CAGR, 2014-2037F

- Latin America, Market Value (USD Million), and CAGR, 2014-2037F

- Middle East and Africa, Market Value (USD Million), and CAGR, 2014-2037F

- By Truck Type

- Cross Analysis of Truck Type W.R.T. End user (USD Million), 2014-2037

- North America Dump and Mining Trucks Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Units) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Dump and Mining Trucks Market Segmentation Analysis (2014-2037)

- By Truck Type

- Rigid, Market Value (USD Million), and CAGR, 2014-2037F

- Articulated, Market Value (USD Million), and CAGR, 2014-2037F

- Others, Market Value (USD Million), and CAGR, 2014-2037F

- By Capacity

- Less than 50 Tons, Market Value (USD Million), and CAGR, 2014-2037F

- 50 to 150 Tons, Market Value (USD Million), and CAGR, 2014-2037F

- Above 150 Tons, Market Value (USD Million), and CAGR, 2014-2037F

- By Propulsion Type

- Diesel Powered Trucks, Market Value (USD Million), and CAGR, 2014-2037F

- Electric & Hybrid Trucks, Market Value (USD Million), and CAGR, 2014-2037F

- By End use Application

- Mining, Market Value (USD Million), and CAGR, 2014-2037F

- Construction, Market Value (USD Million), and CAGR, 2014-2037F

- Quarrying, Market Value (USD Million), and CAGR, 2014-2037F

- Others, Market Value (USD Million), and CAGR, 2014-2037F

- By Country

- U.S., Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- Canada, Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- By Truck Type

- Market Overview

- Cross Analysis of Truck Type W.R.T. End user (USD Million), 2014-2037

- Europe Dump and Mining Trucks Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Units) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Dump and Mining Trucks Market Segmentation Analysis (2014-2037)

- By Truck Type

- Rigid, Market Value (USD Million), and CAGR, 2014-2037F

- Articulated, Market Value (USD Million), and CAGR, 2014-2037F

- Others, Market Value (USD Million), and CAGR, 2014-2037F

- By Capacity

- Less than 50 Tons, Market Value (USD Million), and CAGR, 2014-2037F

- 50 to 150 Tons, Market Value (USD Million), and CAGR, 2014-2037F

- Above 150 Tons, Market Value (USD Million), and CAGR, 2014-2037F

- By Propulsion Type

- Diesel Powered Trucks, Market Value (USD Million), and CAGR, 2014-2037F

- Electric & Hybrid Trucks, Market Value (USD Million), and CAGR, 2014-2037F

- By End use Application

- Mining, Market Value (USD Million), and CAGR, 2014-2037F

- Construction, Market Value (USD Million), and CAGR, 2014-2037F

- Quarrying, Market Value (USD Million), and CAGR, 2014-2037F

- Others, Market Value (USD Million), and CAGR, 2014-2037F

- By Country

- UK, Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- Germany, Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- France, Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- Italy, Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- Spain, Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- BENELUX, Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- Poland, Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- Russia, Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- Rest of Europe, Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- By Truck Type

- Market Overview

- Cross Analysis of Truck Type W.R.T. End user (USD Million), 2014-2037

- Asia Pacific Excluding Japan Dump and Mining Trucks Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Units) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Dump and Mining Trucks Market Segmentation Analysis (2014-2037)

- By Truck Type

- Rigid, Market Value (USD Million), and CAGR, 2014-2037F

- Articulated, Market Value (USD Million), and CAGR, 2014-2037F

- Others, Market Value (USD Million), and CAGR, 2014-2037F

- By Capacity

- Less than 50 Tons, Market Value (USD Million), and CAGR, 2014-2037F

- 50 to 150 Tons, Market Value (USD Million), and CAGR, 2014-2037F

- Above 150 Tons, Market Value (USD Million), and CAGR, 2014-2037F

- By Propulsion Type

- Diesel Powered Trucks, Market Value (USD Million), and CAGR, 2014-2037F

- Electric & Hybrid Trucks, Market Value (USD Million), and CAGR, 2014-2037F

- By End use Application

- Mining, Market Value (USD Million), and CAGR, 2014-2037F

- Construction, Market Value (USD Million), and CAGR, 2014-2037F

- Quarrying, Market Value (USD Million), and CAGR, 2014-2037F

- Others, Market Value (USD Million), and CAGR, 2014-2037F

- By Country

- China, Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- India, Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- Indonesia, Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- South Korea, Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- Malaysia, Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- Australia, Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- Singapore, Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- Vietnam, Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- New Zealand, Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- Rest of Asia Pacific Excluding Japan, Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- By Truck Type

- Market Overview

- Cross Analysis of Truck Type W.R.T. End user (USD Million), 2014-2037

- Japan Dump and Mining Trucks Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Units) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Dump and Mining Trucks Market Segmentation Analysis (2014-2037)

- By Type

- Smart Electricity Meter, Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- Smart Gas Meter, Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- Smart Water Meter, Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- By Component

- Hardware, Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- Software, Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- By Technology

- Automatic Meter Reading (AMR), Market Value (USD Million), and CAGR, 2014-2037F

- Advanced Metering Infrastructure (AMI), Market Value (USD Million), and CAGR, 2014-2037F

- By End user

- Residential, Market Value (USD Million), and CAGR, 2014-2037F

- Commercial, Market Value (USD Million), and CAGR, 2014-2037F

- Industrial, Market Value (USD Million), and CAGR, 2014-2037F

- By Type

- Market Overview

- Cross Analysis of Truck Type W.R.T. End user (USD Million), 2014-2037

- Latin America Dump and Mining Trucks Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Units) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Dump and Mining Trucks Market Segmentation Analysis (2014-2037)

- By Truck Type

- Rigid, Market Value (USD Million), and CAGR, 2014-2037F

- Articulated, Market Value (USD Million), and CAGR, 2014-2037F

- Others, Market Value (USD Million), and CAGR, 2014-2037F

- By Capacity

- Less than 50 Tons, Market Value (USD Million), and CAGR, 2014-2037F

- 50 to 150 Tons, Market Value (USD Million), and CAGR, 2014-2037F

- Above 150 Tons, Market Value (USD Million), and CAGR, 2014-2037F

- By Propulsion Type

- Diesel Powered Trucks, Market Value (USD Million), and CAGR, 2014-2037F

- Electric & Hybrid Trucks, Market Value (USD Million), and CAGR, 2014-2037F

- By End use Application

- Mining, Market Value (USD Million), and CAGR, 2014-2037F

- Construction, Market Value (USD Million), and CAGR, 2014-2037F

- Quarrying, Market Value (USD Million), and CAGR, 2014-2037F

- Others, Market Value (USD Million), and CAGR, 2014-2037F

- By Country

- Brazil, Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- Argentina, Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- Mexico, Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- Rest of Latin America, Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- By Truck Type

- Market Overview

- Cross Analysis of Truck Type W.R.T. End user (USD Million), 2014-2037

- Middle East & Africa Dump and Mining Trucks Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Units) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Dump and Mining Trucks Market Segmentation Analysis (2014-2037)

- By Truck Type

- Rigid, Market Value (USD Million), and CAGR, 2014-2037F

- Articulated, Market Value (USD Million), and CAGR, 2014-2037F

- Others, Market Value (USD Million), and CAGR, 2014-2037F

- By Capacity

- Less than 50 Tons, Market Value (USD Million), and CAGR, 2014-2037F

- 50 to 150 Tons, Market Value (USD Million), and CAGR, 2014-2037F

- Above 150 Tons, Market Value (USD Million), and CAGR, 2014-2037F

- By Propulsion Type

- Diesel Powered Trucks, Market Value (USD Million), and CAGR, 2014-2037F

- Electric & Hybrid Trucks, Market Value (USD Million), and CAGR, 2014-2037F

- By End use Application

- Mining, Market Value (USD Million), and CAGR, 2014-2037F

- Construction, Market Value (USD Million), and CAGR, 2014-2037F

- Quarrying, Market Value (USD Million), and CAGR, 2014-2037F

- Others, Market Value (USD Million), and CAGR, 2014-2037F

- By Country

- GCC, Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- Israel, Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- South Africa, Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- Rest of Middle East & Africa, Market Value (USD Million), Volume (Million Units), and CAGR, 2014-2037F

- By Truck Type

- Market Overview

- Cross Analysis of Truck Type W.R.T. End user (USD Million), 2014-2037

- Global Economic Scenario

- About Research Nester

Global Market Size, Forecast, and Trend Highlights Over 2025-2037

Dump and Mining Trucks Market size was over USD 26 billion in 2024 and is poised to exceed USD 53.45 billion by 2037, witnessing over 5.7% CAGR during the forecast period i.e., between 2025-2037. In the year 2025, the industry size of dump and mining trucks is evaluated at USD 27.19 billion.

The dump and mining trucks market is expanding due to the global demand for heavy-duty vehicles, essential for large-scale mining operations, construction projects and infrastructure development, and continues to grow. Furthermore, the key players are pressing towards automation, electrification, and decarbonization in order to achieve efficiency and lower environmental impact. In July 2024, Fortescue and Liebherr Mining built a strategic partnership to develop zero-emission haul trucks, marking a revolution for mining practices. As part of the broader trend of the industry looking for innovative solutions to meet global sustainability goals and governmental mandates, this partnership demonstrates the companies’ commitment to long-term resilience within the sector.

The industry is witnessing heavy investments in infrastructure and renewable energy projects, leading to higher demand for high-capacity mining vehicles and driving technological development within the industry. Electrified, hybrid, and autonomous mining trucks are now transforming operations through increased productivity and decreased carbon footprints. In January 2024, Hitachi Construction Machinery unveiled its prototype fully electric dump truck powered by ABB's cutting-edge battery systems, representing a milestone in low-emission mining equipment. These public-private partnerships and technological investments highlight the significance of sustainable growth and innovation in the mining and heavy machinery sectors around the globe.

Key Dump and Mining Trucks Market Insights Summary:

Regional Highlights:

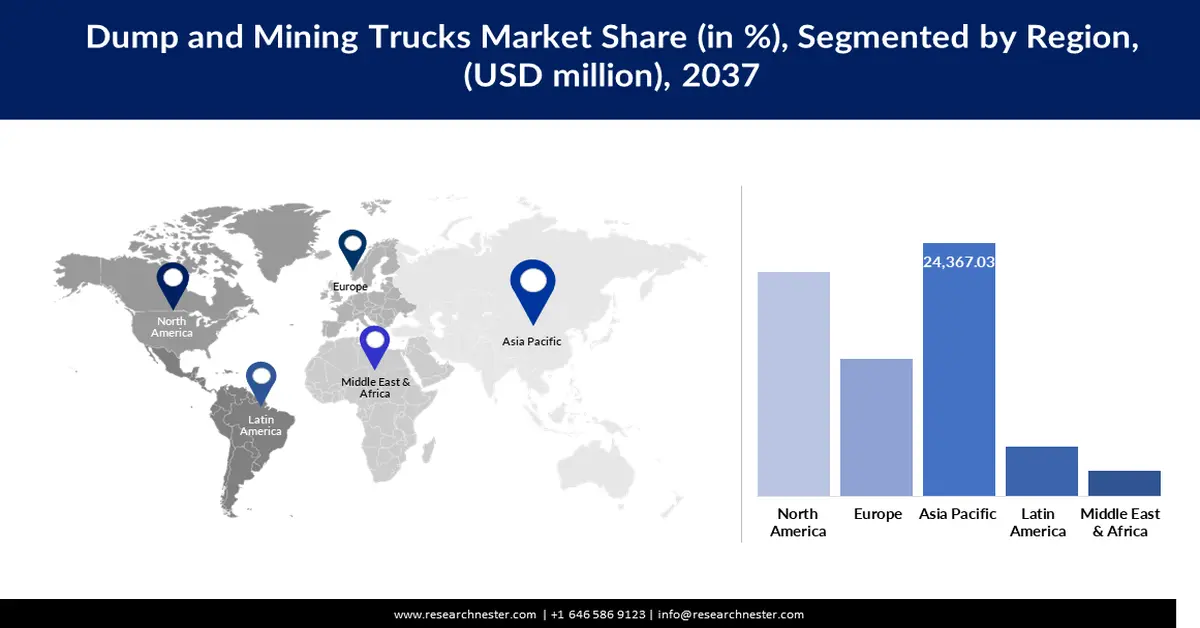

- Asia Pacific in the dump and mining trucks market is projected to secure over 34.5% revenue share by 2037, underpinned by rapid industrialization, expanding mining activities, and accelerating adoption of electric and autonomous heavy-duty vehicles.

- North America is expected to witness robust growth by 2037, supported by rising investments in mining automation, stringent emission management initiatives, and the integration of AI-enabled and battery-electric hauling solutions.

Segment Insights:

- The rigid truck segment in the dump and mining trucks market is expected to account for over 58% share by 2037, supported by its superior durability, high payload capability, and suitability for intensive mining environments, reinforced by sustained investments in robust heavy-duty mining fleets.

- The 50 to 150 tons capacity segment is forecast to secure around 48.3% market share by 2037, attributed to its balanced payload efficiency and operational flexibility, encouraged by the rising adoption of cost-effective and environmentally optimized mid-capacity mining trucks.

Key Growth Trends:

- Rising demand for autonomous haulage Systems (AHS)

- Decarbonization and electrification initiatives

Major Challenges:

- Infrastructure limitations in developing regions

- Operational safety and workforce adaptation

Key Players: AB Volvo, BELAZ, Caterpillar, Epiroc AB, Hitachi Construction Machinery Co., Ltd. (HCM), Komatsu Ltd., Liebherr-International AG, Sany Heavy Equipment International Holdings Company Limited, Scania AB, XCMG Group.

Global Dump and Mining Trucks Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2024 Market Size: USD 26 billion

- 2025 Market Size: USD 27.19 billion

- Projected Market Size: USD 53.45 billion by 2037

- Growth Forecasts: 5.7% CAGR (2025-2037)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34.5% Share by 2037)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Canada, Australia, India

- Emerging Countries: India, Brazil, Chile, Indonesia, Mexico

Last updated on : 2 January, 2025

Dump and Mining Trucks Market: Growth Drivers and Challenges

Growth Drivers

- Rising demand for autonomous haulage Systems (AHS): Autonomous haulage systems (AHS) are transforming mining operations by increasing efficiency, decreasing human error, and lowering operational costs, allowing continuous operations with low risk of safety associated with manual labor can be performed with these systems. In April 2023, Komatsu unveiled its AHS, an AI and robotics-powered AHS with fully autonomous truck capabilities. This increasing demand for automation also indicates an increasing focus on sustainable and cost-effective mining solutions within the industry.

- Decarbonization and electrification initiatives: Electrified and hybrid mining trucks are gaining momentum and accelerating toward becoming the new norm of mining truck adoption. At the same time, traditional diesel-powered vehicles are being progressively replaced by global initiatives to cut carbon emissions. In January 2024, Hitachi Construction Machinery unveiled its electric dump truck prototype, which is being developed with zero emissions in mind. The vehicle takes advantage of trolley-assist technology along with regenerative braking systems to increase energy efficiency and reduce fuel costs. This is part of a broader industry commitment to sustainability, which is pushing other manufacturers to create low-emissions mining trucks that fit with strict environmental rules and support decarbonization goals.

- Infrastructure development and resource extraction: Increased investment in infrastructure and mining and construction works has led to an increased need for high-carrying capacity dump trucks. Rio Tinto and Scania started autonomous mining truck trials at Pilbara, Australia, in April 2022 to show how advanced technologies can help minimize the cost of transporting ores. These trials emphasize the importance of heavy mining trucks in providing high productivity for the mining and construction industries and contributing to the development of economies of a rapidly industrialized world.

Challenges

- Infrastructure limitations in developing regions: The regions that are involved in the mining activities are usually not well developed in terms of infrastructure, which is a major challenge that affects the use of high-end dump and mining trucks, including electric and automated ones. Some of the challenges include poor road infrastructure, limited charging or refueling stations for the high-tech mining machinery, and instability of power supply. These constraints not only slow down the rate of project delivery but also lead to the increment of operational costs for mining companies.

- Operational safety and workforce adaptation: The implementation of self-driven and battery-powered haul trucks presents new hazards and organizational change management concerns in mining sites. Current safety practices have to be reassessed and adapted in order to include the case of self-driving cars and other possible failures. Moreover, workers in the mining sector need to be trained to use, control, and service these complex technologies. This change in the skills needed is a potential source of workforce resistance or slow uptake.

Dump and Mining Trucks Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

5.7% |

|

Base Year Market Size (2024) |

USD 26 billion |

|

Forecast Year Market Size (2037) |

USD 53.45 billion |

|

Regional Scope |

|

Dump and Mining Trucks Segmentation

Truck Type (Rigid, Articulated, Others)

Rigid truck segment is anticipated to capture over 58% dump and mining trucks market share by 2037. Rigid trucks are very popular for their durability and high payload capacity and for their ability to work in heavy-duty mining conditions. At MINExpo 2024 in October 2024, Hitachi Construction Machinery introduced the EH4000AC-5 rigid dump truck to underline the importance of rigid trucks in big mining projects. This launch underscores the need to put resources into sturdy, durable trucks that can endure tough usage in the course of mining operations in order to increase efficiency and safety across mining endeavors across the world.

Capacity (Less than 50 Tons, 50 to 150 Tons, Above 150 Tons)

By the end of 2037, 50 to 150 tons segment is projected to dominate around 48.3% dump and mining trucks market share, due to the need for medium-capacity vehicles that provide increased working range and payload utilization. In April 2024, Sany India launched the SKT105E Electric Dump Truck in response to the growing trend towards sustainable mid-capacity trucks that will help reduce carbon footprint. This segment is fast becoming popular due to its versatility in managing various mining operations while optimizing cost and environmental impact, thus suitable for medium to large scale mining operations.

Our in-depth analysis of the dump and mining trucks market includes the following segments:

|

Truck Type |

|

|

Capacity |

|

|

Propulsion Type |

|

|

End use Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dump and Mining Trucks Industry - Regional Synopsis

Asia Pacific Market Statistics

Asia Pacific in dump and mining trucks market is set to capture over 34.5% revenue share by 2037, due to the increased industrialization, expansion of mining operations, and rising need for minerals. The mining industry in the region is underpinned by innovation in heavy machinery and equipment, as well as the transition to electric and self-driven vehicles. With governments across Asia giving importance to the development of infrastructure, the dump and mining trucks market is projected to record strong growth. The region's leading position in terms of global mineral production continues to fuel the need for new-age mining trucks.

India mining industry is steadily inclining due to booming infrastructure projects and a rising demand for minerals within the country. Since mining plays a major role in the Indian economy, there is a steady increase in investments in upgrading fleets and introducing electric mining trucks. The Indian government is also supporting sustainable mining by implementing the use of fuel-efficient and self-driving vehicles. This trend is in line with the increasing focus on improving efficiency and minimizing the effects of operations on the environment, making India a strategic dump and mining trucks market for dump and mining trucks in the region.

As per statistics, China is expected to account for the largest share of the APEJ mining truck market in 2023, with a 10% share of the global market, making it the biggest producer globally. The nation's mining industry and the expansion of infrastructure development necessitate the need for dump and mining trucks. With the enhanced focus on renewable energy in China, mining companies are also using battery-electric mining vehicles to cut emissions. Owing to government support of green technology, China is expected to continue dominating the market for mining equipment while promoting autonomous and electric mining fleets.

North America Market Analysis

North America dump and mining trucks market is set to register significant growth during the forecast period, owing to the rising spending on mining automation and environmental management. The increasing emphasis on emission cuts and improved efficiency is driving the use of electric and self-driving mining trucks in the region. In an attempt to conform to environmental requirements, the use of battery-electric mining vehicles is gradually gaining significance. Also, collaborations between the truck makers and the AI technology suppliers are rapidly enhancing the self-governed hauling systems in mining activities within the region.

In the U.S., mining operations are changing at a very fast rate through the incorporation of artificial intelligence and self-governance technology in large mining trucks. Bell Trucks America signed a deal with Pronto AI in March 2022 to launch autonomous systems on articulated dump trucks to improve efficiency and safety in U.S. mining operations. This partnership is in line with the increasing digitalization in the industry. The automation of the U.S. mining industry is expected to cut down operational costs and enhance efficiency in the mining processes, thus cementing the U.S. as the global leader in mining technology.

Canada dump and mining trucks industry has been focusing on the reduction of carbon footprint and mine site sustainability, which is fostering the electrification of dump and mining trucks. In September 2022, Newcrest Mining, a gold producer based in Australia, said it would transition the Brucejack gold-silver mine located in British Columbia to using only electric trucks. This initiative plans to reduce CO2 emissions by 65,000 tons by 2030, which is the mining sector’s contribution towards sustainable mining. Canada has developed a strong focus on the use of renewable energy and sustainable mining solutions, which makes it one of the most environmentally conscious mining nations in the region.

Companies Dominating the Dump and Mining Trucks Market

- AB Volvo

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BELAZ

- Caterpillar

- Epiroc AB

- Hitachi Construction Machinery Co., Ltd. (HCM)

- Komatsu Ltd.

- Liebherr-International AG

- Sany Heavy Equipment International Holdings Company Limited

- Scania AB

- XCMG Group

The dump and mining trucks market is highly competitive, with the key players emphasizing concepts such as sustainability, innovation, and the use of technologies. The key industry participants, including Caterpillar, Komatsu, Liebherr, Hitachi Construction Machinery, and Volvo, are fueling the dump and mining trucks market growth through product portfolio expansion and the development of new autonomous, electric, and hybrid offerings. This competitive environment is driving innovation that focuses on fuel economy, operational technology, and emissions-cutting, making these firms leaders in the industry.

In July 2024, SANY released the SET320S, a 300-ton hybrid mining truck that is suitable for large-scale open-pit mining. This model is an indication of the trend towards the use of both electric and diesel power to achieve increased efficiency in the automotive industry. With an emphasis on the advancement of new-generation mining trucks, key vendors are consolidating their market standing and underlining their strategic interest in the dump and mining trucks category.

Here are some leading companies in the dump and mining trucks market:

Recent Developments

- In August 2024, Antofagasta Minerals and ABB signed a Memorandum of Understanding (MoU) to accelerate decarbonization in Chile’s mining sector. The partnership focuses on electrifying and automating key mining processes to lower emissions and enhance operational efficiency. This initiative aligns with Antofagasta’s long-term sustainability goals and ABB’s expertise in mining automation technologies.

- In February 2024, Eicher Trucks & Buses launched the Pro 8035XM, equipped with E-Smart Shift Automated Manual Transmission (AMT). This launch aims to enhance productivity and reduce driver fatigue in mining operations. The Pro 8035XM offers improved fuel efficiency and reliability, catering to the growing demand for automation in the mining industry.

- In December 2023, General Motors (GM) and Komatsu announced a collaboration to design hydrogen fuel cells for mining trucks, with a prototype hydrogen-powered 930E expected by 2030. This initiative aligns with industry goals to reduce carbon emissions and develop alternative energy solutions for large-scale mining equipment, enhancing the sustainability of mining fleets globally.

- Report ID: 6904

- Published Date: Jan 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dump and Mining Trucks Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.