Dry Vacuum Pump Market Outlook:

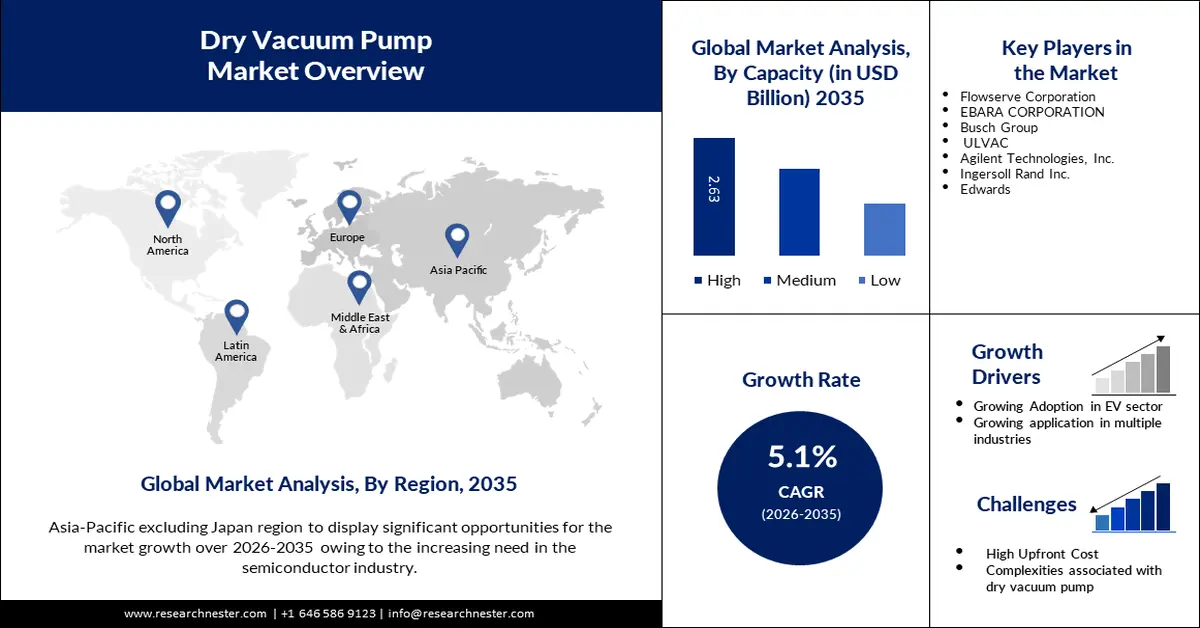

Dry Vacuum Pump Market size was over USD 4.68 billion in 2025 and is poised to exceed USD 7.7 billion by 2035, witnessing over 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of dry vacuum pump is estimated at USD 4.89 billion.

Dry vacuum pumps have several benefits over other vacuum pump types, such as oil-sealed rotary vane pumps or liquid ring pumps, that increase energy efficiency and reduce running costs. Sealing solutions and lubricating lubricants are not necessary for the operation of dry vacuum pumps. This eliminates the extra expense of purchasing, getting rid of, and maintaining these fluids. Additionally, it eliminates the possibility of oil contamination throughout the procedure, which is very important for applications that need for clean environments. In March 2023, the European Union approved strict measures aimed at boosting energy efficiency. These roughly quadruple the annual energy savings rate that EU countries are happy to share annually for each year between 2024 and 2030, up to 1.49% from 0.8% previously.

Dry vacuum pumps are mostly used on production lines that produce semiconductors, screens, solar cells, and other related products. Oil-sealed rotary vacuum pumps, on the other hand, are mostly used in the automotive, metal, and food industries. Vacuum machines are often used in large businesses for applications where the generated gases contain solvents or water. Moving to dry vacuum pumps requires strong criteria because oil-sealed rotary vacuum pumps require frequent oil changes.

Key Dry Vacuum Pump Market Insights Summary:

Regional Highlights:

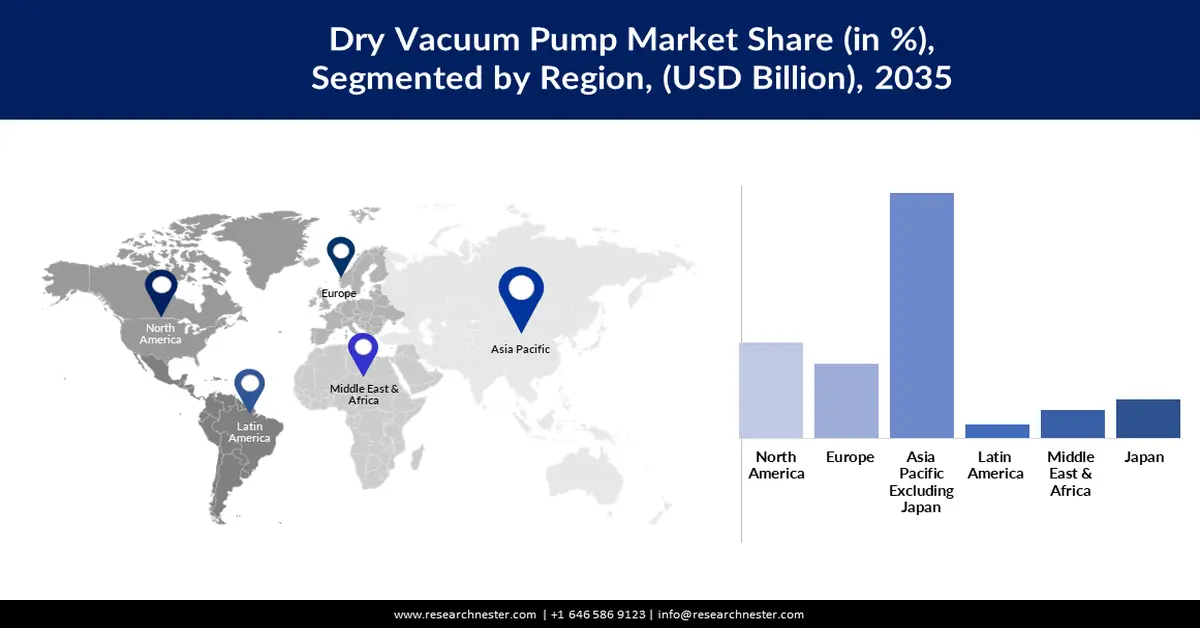

- Asia Pacific dry vacuum pump market is expected to capture 42% share by 2035, attributed to the increasing use of dry vacuum pumps in the chemical industry.

- North America market will account for 19% share by 2035, driven by the increasing demand for pharmaceutical production and immunizations.

Segment Insights:

- The high capacity segment in the dry vacuum pump market is projected to experience significant growth through 2035, driven by the suitability of large-capacity pumps for demanding industrial applications.

- The dry screw vacuum pump segment in the dry vacuum pump market is projected to capture a 40% share by 2035, driven by the pump’s oil-free, low-maintenance design and ability to handle harsh materials.

Key Growth Trends:

- Increasing Number of Product Development and Acquisitions Made by Market Players

- Government Initiative Focusing on Electric and Hybrid Vehicles

Major Challenges:

- Increasing Number of Product Development and Acquisitions Made by Market Players

- Government Initiative Focusing on Electric and Hybrid Vehicles

Key Players: of Flowserve Corporation, EBARA CORPORATION, Busch Group, ULVAC, Agilent Technologies, Inc., Ingersoll Rand Inc., Edwards.

Global Dry Vacuum Pump Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.68 billion

- 2026 Market Size: USD 4.89 billion

- Projected Market Size: USD 7.7 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 16 September, 2025

Dry Vacuum Pump Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Number of Product Development and Acquisitions Made by Market Players - Dry vacuum pump demand is predicted to rise in the upcoming year due to rising development of goods and acquisitions by major players for the launch and development of novel products. Such as, in 2023, Busch Vacuum Solutions USA revealed that it will acquire Vac-Tech Inc., a vacuum pump service and sales business that serves the semiconductor, electronics, and solar industries with accurate high vacuum pumps. Vac-Tech operates out of two locations: Richardson, Texas, and Phoenix, Arizona. By constructing a supplemental high vacuum facility to its repair, restoration, and installation operations nearer to clients in the Western region, this project expands Busch USA's national footprint.

- Government Initiative Focusing on Electric and Hybrid Vehicles - Li-ion cells, which are crucial parts of electric vehicles (EVs), are produced using vacuum technologies, which provide a contamination-free process and maximize battery cell performance. In this procedure, dry screw-in pumps are crucial. Another crucial part of electric vehicles is the electric motor. Electric motor windings with vacuum penetration provide better insulation and longer lifespans. Before resin impregnation, air, and vapor are removed from the winding gaps using a vacuum pump during the vacuum impregnation process. The vacuum pumps that are most frequently used in this operation are rotary vane vacuum pumps with oil seals.

Challenges

- Issues Associated with Compatibility of Vacuum Pumps - Vacuum pumps have applications in several industrial processes such as filtration, distillation, and drying. However, incorrect pump sizing could be caused by a number of straightforward errors. One such example is the pump's incapacity to maintain the necessary pressure and temperature to prevent condensation and polymerization. The management of gases and vapours at the pump's emission and its impact are additional factors to take into account.

- Performance Limitation Associated are Expected to Pose Restriction on the Market Growth in the Forecast Period

- Limited Technology Options are Expected to Hinder the Expansion of the Industry in the Future

Dry Vacuum Pump Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 4.68 billion |

|

Forecast Year Market Size (2035) |

USD 7.7 billion |

|

Regional Scope |

|

Dry Vacuum Pump Market Segmentation:

Capacity Segment Analysis

In terms of capacity, the high-capacity segment in the dry vacuum pump market is set to hold the largest revenue share of 46% by 2035. For demanding applications in very difficult circumstances, large-capacity vacuum pumps with a single stage are ideal. These robust pumps can be used in a variety of tasks, such as vacuum filtration for mineral extraction or dewatering at the paper mill. A wide range of materials, such as cast iron and stainless steel, are used for large-capacity pumps, with some models having a polyisoprene lining.

Type Segment Analysis

Based on type, the dry screw vacuum pump segment is set to dominate the dry vacuum pump market share of 40% by the end of 2035. A dry screw vacuum pump is a type of vacuum pump that uses two screw rotors to compress and capture gas to create a vacuum. The highly efficient and reliable design has low noise levels, low maintenance requirements, and no oil pollution. The oil-free, non-contact screw design allows dry screw pumps to handle corrosive, organic, and inorganic materials and solvents, making them ideal for the chemical, plastics, industrial, petrochemical, and packaging industries.

Our in-depth analysis of the global dry vacuum pump market includes the following segments:

|

Type |

|

|

Capacity |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dry Vacuum Pump Market Regional Analysis:

APAC Market Insights

The Asia Pacific dry vacuum pump market is set to hold the highest revenue share by 2035. The use of dry vacuum pumps in the chemical and petroleum sectors in the region is contributing to the growth of the regional market. For use in the chemical industry, solvents may be concentrated and recovered at the site of vacuum pump discharge. Therefore, it is an ideal design for the extraction of solvents. Most chemical-duty dry pumps can achieve vacuum values of between 5 and 6, according to their designs. 05 Torr. These benefits are relatively high in terms of their costs from the point of view of competing technologies. In the Asia Pacific region, the chemical industry accounts for more than 45% of global chemical production and 69% of global job opportunities. The demand for dry vacuum pumps will therefore increase as a result of the growth of the chemical industry in the Asia Pacific region.

North America Market Insights

The dry vacuum pump market in the North America region is set to hold a significant share of 19% by the end of forecast period. Several chemistries specially developed for dry pump technology are used by the pharmaceutical sector in the region. Hydrocarbon cracking and stripping, compound synthesis, neutralisation and adsorption reactions as well as pharmaceutical intermediates are the most common chemical reactions used. Approximately 45% of the global pharmaceuticals market and 22% of world production are expected to be held by the US. Due to the continued spread of worldwide immunizations and rising demand for essential and ancillary healthcare, U.S. pharmaceutical production and sales continue to grow strongly in 2022.

Dry Vacuum Pump Market Players:

- SKY Technology Development

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Atlas Copco AB

- Pfeiffer Vacuum GmbH

- Flowserve Corporation

- EBARA CORPORATION

- Busch Group

- ULVAC

- Agilent Technologies, Inc.

- Ingersoll Rand Inc.

- Edwards

Recent Developments

- Edwards will introduce in February 2020 a highly efficient small dry pump, nXRi with reduced input power and no maintenance required, which can lead to real performance gains and cost reductions for a large number of applications.

- Ingersoll Rand, a global provider of mission-critical power generation and industrial solutions, purchases Everest Blower Private Limited, Everest Blower Systems Private Limited and AirMax Group for approximately USD 86 million in cash. They have entered into an agreement to acquire the company at a price. Consideration may be based on achieving Everest's economic goals.

- Report ID: 5573

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dry Vacuum Pump Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.