Dry Lubricants Market Outlook:

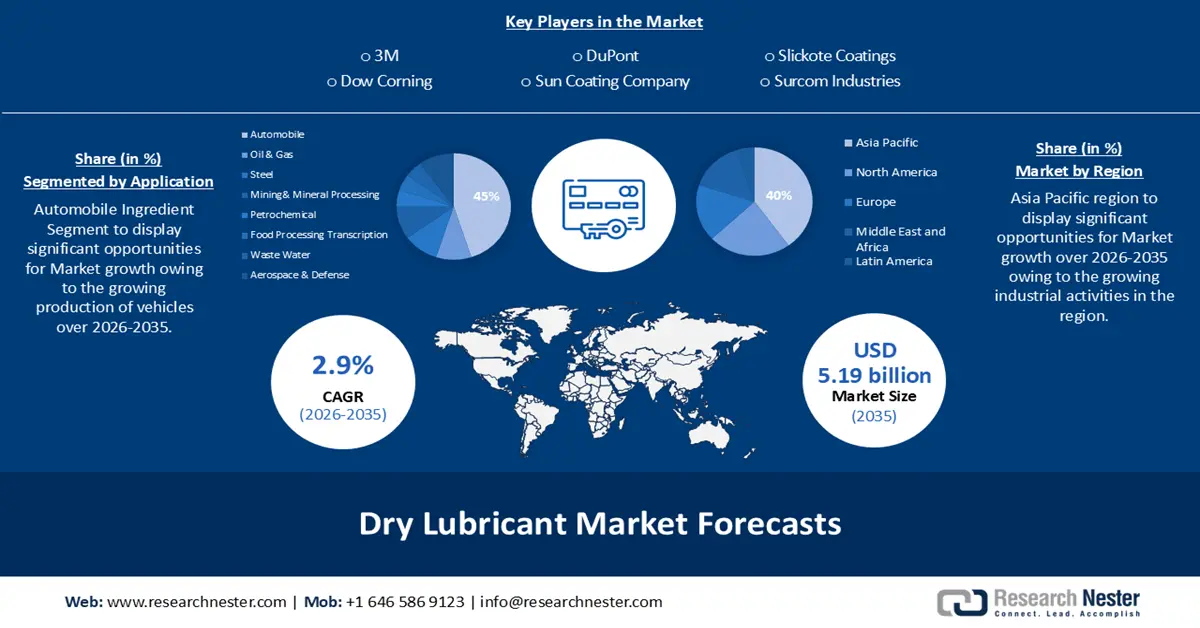

Dry Lubricants Market size was valued at USD 3.9 billion in 2025 and is likely to cross USD 5.19 billion by 2035, expanding at more than 2.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of dry lubricants is assessed at USD 4 billion.

The reason behind the growth is impelled by the growing spending in the construction industry across the globe. Growth in the overall output of construction is mostly driven by investment in the energy and utility sectors as well as in infrastructure, and the rise in demand for infrastructure, commercial buildings, and housing.

For instance, construction spending is predicted to reach over USD 17 trillion globally by 2030, with the US, China, and India leading the way and contributing around 55% of the growth in this sector.

The growing focus on sustainability is believed to fuel the dry lubricants market growth. There's an added benefit of reduced friction when using a dry lubricants since it translates into fewer products that collapse which aids in conserving energy, which is a primary objective of sustainability.

Key Dry Lubricants Market Insights Summary:

Regional Insights:

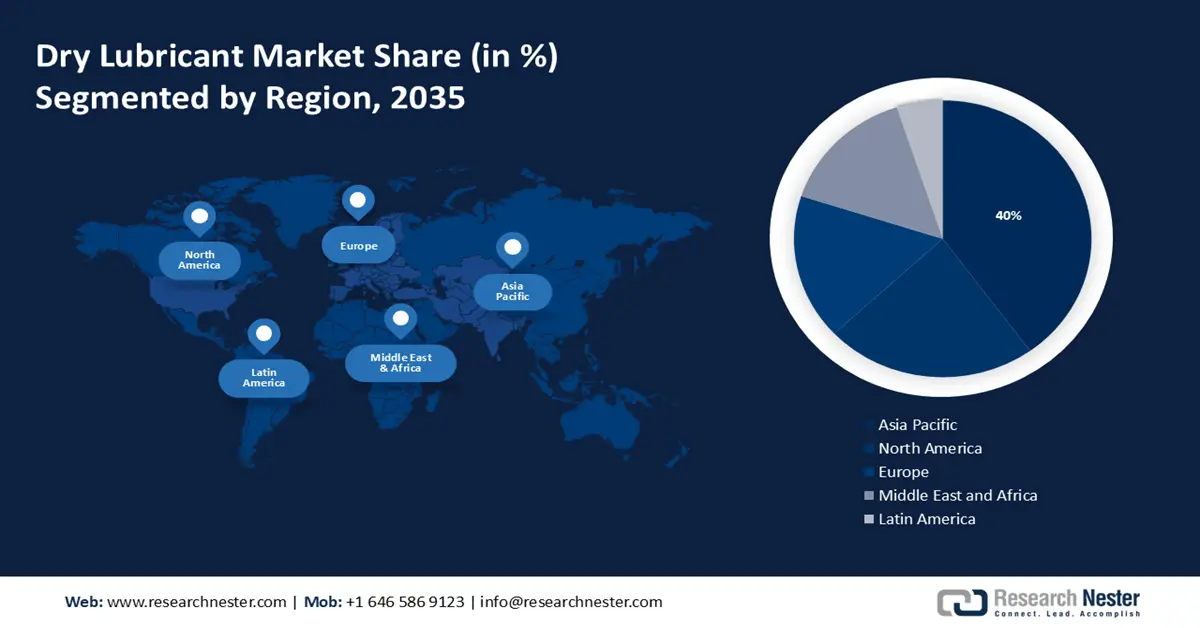

- The Asia Pacific region is projected to command a 40% share dry lubricants market by 2035, impelled by the growing industrial activities.

- North America is anticipated to hold the second-largest share by 2035, underpinned by the growing automotive industry.

Segment Insights:

- The automobile segment in the Dry Lubricants Market is expected to secure a 45% share by 2035 propelled by the growing production of vehicles driven by economic, technological, social, and environmental factors.

- The graphite segment is set to garner a notable share by 2035 supported by the growing production of graphite.

Key Growth Trends:

- Rising Mining Industry

- Growing Demand for Food

Major Challenges:

- Availability of Alternative Lubricants

- Stringent regulations as some dry lubricants contain chemicals that can affect the environment

Key Players: Dow Corning, DuPont, Sun Coating Company, Slickote Coatings, Kal-Gard F.A., Everlube, Surcom Industries (DYNACRON), CHP, Everlube, Sandstrom, Freudenberg (OSK), Castrol-Lubecon.

Global Dry Lubricants Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.9 billion

- 2026 Market Size: USD 4 billion

- Projected Market Size: USD 5.19 billion by 2035

- Growth Forecasts: 2.9%

Key Regional Dynamics:

- Largest Region: Asia Pacific (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Indonesia, Mexico, Vietnam

Last updated on : 28 November, 2025

Dry Lubricants Market - Growth Drivers and Challenges

Growth Drivers

- Rising Mining Industry – The dry lubricants is suggested for use in the mining industry as it has exceptional resistance to salt spray is suggested for use in a range of lubricating applications on offshore drilling sites, and demonstrates exceptional resilience to high pressures and shear encountered in mining and drilling machinery.

- Growing Demand for Food- Solid or dry lubricants that have received NSF certification for food processing are perfect for use in the food sector since the equipment used in food preparation needs to be kept lubricated to function properly. For instance, it is estimated that the amount of food consumed will be over 10,092 million tons in 2030 and around 14,885 million tons in 2050.

- Increasing Usage in Aerospace & Defense Industry- Dry lubricants work at extremely high and low temperatures where the viscosity of oils and greases prevents them from doing their jobs thus, they are suitable for a wide range of industries, including aerospace and the military.

- Expanding Applications in Steel- Dry lubricants, whether zinc-coated or uncoated, are applied to carbon steel to lessen friction in your manufacturing process and enhance the formability of steel.

Challenges

- Availability of Alternative Lubricants – Dry lubricants compete with a wide variety of alternative lubrication methods such as oil-based lubricants, and advanced surface treatments. The cost of the dry lubes is typically higher as compared to petroleum-based oils which are readily available in large quantities, and are cost-effective. The most widely used lubricants in industry are those based on petroleum which are used in a variety of applications and are available in different forms, including sprays, oils, and greases. However, petroleum-based lubricants are not as effective as synthetic lubricants and can be found in a variety of forms, including silicones, polyglycols, esters, and fluorocarbons. Besides this, bio-based lubricants offer an eco-friendly substitute for lubricants derived from petroleum, improve engine efficiency, lower emissions, and biodegradability.

- Stringent regulations as some dry lubricants contain chemicals that can affect the environment

- Limited usage in several industries owing to compatibility issues

Dry Lubricants Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

2.9% |

|

Base Year Market Size (2025) |

USD 3.9 billion |

|

Forecast Year Market Size (2035) |

USD 5.19 billion |

|

Regional Scope |

|

Dry Lubricants Market Segmentation:

Application Segment Analysis

The automobile segment in the dry lubricants market is estimated to gain a robust revenue share of 45% in the coming years owing to the growing production of vehicles driven by economic, technological, social, and environmental factors. Vehicles provide mobility, especially in urban areas, and an increase in dual-income households, and a desire for convenience. For instance, more than 85 million motor vehicles were produced globally in 2022, a 5% increase from 2021.

Dry lubricants, which are essentially solid in their solid state, shield car engine gaskets from fretting and corrosion and are employed in transmissions, brake systems, and even as coatings to lessen wear on specific engine parts. Recent research has demonstrated that dry-film lubricants provide superior lubrication conditions than liquid lubricants based on oil which makes it essential in the automotive sector to achieve a high-quality forming behavior. Moreover, dry lubricants are ideal for automotive applications where conditions might be tough as they can withstand extreme temperature variations as well and are employed in tie rod ends, brake calipers, fluid delivery tubes, and fasteners.

Type Segment Analysis

The graphite segment in the dry lubricants market is set to garner a notable share shortly owing to the growing production of graphite. Amorphous carbon compounds are processed at high temperatures to create the synthetic material known as graphite, which is a commonly used industrial material used as a recarburizer to increase the carbon content while steel is being produced. Graphite finds application in pencils, lubricants, crucibles, polishes, arc lights, batteries, and electric motor brushes, and is often employed in batteries to increase electrical conductivity while maintaining stability and chemical inertness against corrosion. Graphene, the component of graphite, has excellent lubricating qualities and is hydrophobic owing to the weak van der Waals forces between the layers.

Graphite lubricants are "dry" lubricants that function in oxidizing conditions and high temperatures, whereas liquid lubricants often break down quickly, They are perfect for routine maintenance since they adhere quickly to most substrates, including metal, rubber, and plastic, to create a barrier that repels debris and lubricates the surface while shielding it from pressure and friction.

For instance, China accounted for more than 60% of global graphite production in 2022, making it the top producer in the world. Particularly, the last five years saw around a 50% increase in the global demand for graphite, and the following five years are predicted to see over 65% increase.

Our in-depth analysis of the global dry lubricants market includes the following segments:

|

Application |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dry Lubricants Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is poised to account for largest revenue share of 40% by 2035, impelled by the growing industrial activities. The concentration of economic activity in urban areas owing to rapid urbanization is a major contributing factor to the rise of the industrial products sector in the Indian economy. According to estimates, India's industrial production increased from around 2% in November 2023 to over 3% in December 2023.

In addition, India's manufacturing sector is expanding quickly, and the country has a huge chance to grow its export portion of manufactured goods worldwide. For instance, in 2023, the manufacturing industry experienced an annual production growth rate of more than 4%.

North American Market Insights

The North America dry lubricants market is estimated to be the second largest, during the forecast period led by the growing automotive industry. There is no denying the auto industry's significance to the US economy, which is now the importer of automobile-related goods to more nations. For instance, the US automotive industry was projected to be valued at around USD 1514 billion in 2022.

Dry Lubricants Market Players:

- 3M

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dow Corning

- DuPont

- Sun Coating Company

- Slickote Coatings

- Kal-Gard F.A.

- Everlube

- Surcom Industries (DYNACRON)

- CHP

- Everlube

- Sandstrom

- Freudenberg (OSK)

- Castrol-Lubecon

- SKF

- B’laster

- ADNOC Distribution

- Metal Coatings Corp

Recent Developments

- DuPont a premier multi-industrial company announced the launch of DuPont Kalrez perfluoroelastomer parts and DuPont Vespel parts and shapes for the oil and gas industry that make high-performance sealing possible in harsh industrial settings, and assist in resolving difficult sealing issues related to energy and oil and gas.

- ADNOC Distribution partnered with Hindustan Petroleum Corporation Limited (HPCL) to increase its lubricant business in India, the United Arab Emirates, and other possible areas and hopes to take advantage of HPCL's wide network of more than 25,000 retail stations to enter this enormous market.

- Report ID: 5852

- Published Date: Nov 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dry Lubricants Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.