Drug Screening Market Regional Analysis:

North American Market Insights

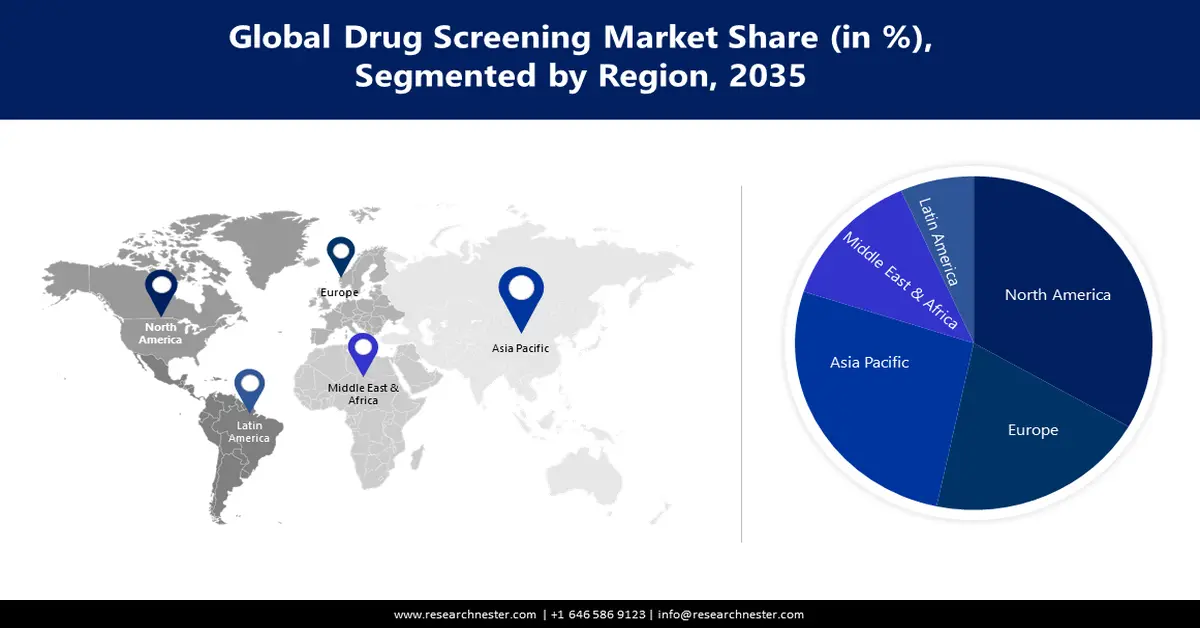

The drug screening market in North America is poised to capture the largest market share of 35% throughout the analysed timeframe. The increasing number of SUD-related accidents, owing to drug impairment or overdose, in the region is presenting a large consumer base for this sector. According to CDC reports, the rate of deaths due to cocaine and psychostimulants increased by 4.9% and 1.9%, respectively, in the U.S. in 2023 from 2022. In the same year, nationwide 105,007 people lost their lives due to drug overdose. Furthermore, increasing government funding, technological advancements, and pharmaceutical R&D in the region are fuelling this landscape.

The U.S. is augmenting the market with a stringent regulatory framework and increasing investments from employers. In this regard, Quest Diagnostics released a Drug Testing Index Analysis in 2024, revealing a 633.0% increment in substituted urine specimens collected from over 5.5 million general employees of this country in 2023. Additionally, among 9.8 million samples from the U.S. workforce, the marijuana positivity increased by 4.7% in the same year from 2022. Thus, to prevent accidental events, federal organizations such as the Department of Transportation, the Nuclear Regulatory Commission and the Department of Defense have mandated daily basis drug testing for their safety-sensitive workers.

APAC Market Insights

The drug screening market in Asia Pacific is predicted to register the 2nd largest share of close to 24% and a significant CAGR by the end of 2035. The region’s growth is impelled by the rising awareness and government initiatives. This is further leading to an increase in demand and discoveries for associated services and testing devices. For instance, in October 2023, the Kerala Police Department commenced the real-time trial on a hand-held drug screening device, SoToxa Mobile Test System, in Thiruvananthapuram. Considering the 5 minutes response time and accuracy of this tool, the government estimated a state-wide expansion of this product. Such efforts from these authorities are inspiring both local and foreign pioneers to participate in this merchandise.

China is propagating the market with its ambitious goal of achieving the top position in pharmaceutical development and production. The country is rigorously conducting R&D to secure the global leadership in clinical trials for various life science products. This can be testified by the report from WHO, where it highlighted China to be the country with highest registries for clinical trials in the world between 2023 and 2024, accounting for 23,768. Further, with the supportive government subsidies in pharmaceutical research and manufacturing is creating new business opportunities and attracting global leaders in this sector. For instance, in SPT Labtech collaborated with ICE Bioscience to enable intelligent drug screening and life sciences automation for researchers in China.