Drones for Emergency Responders Market Outlook:

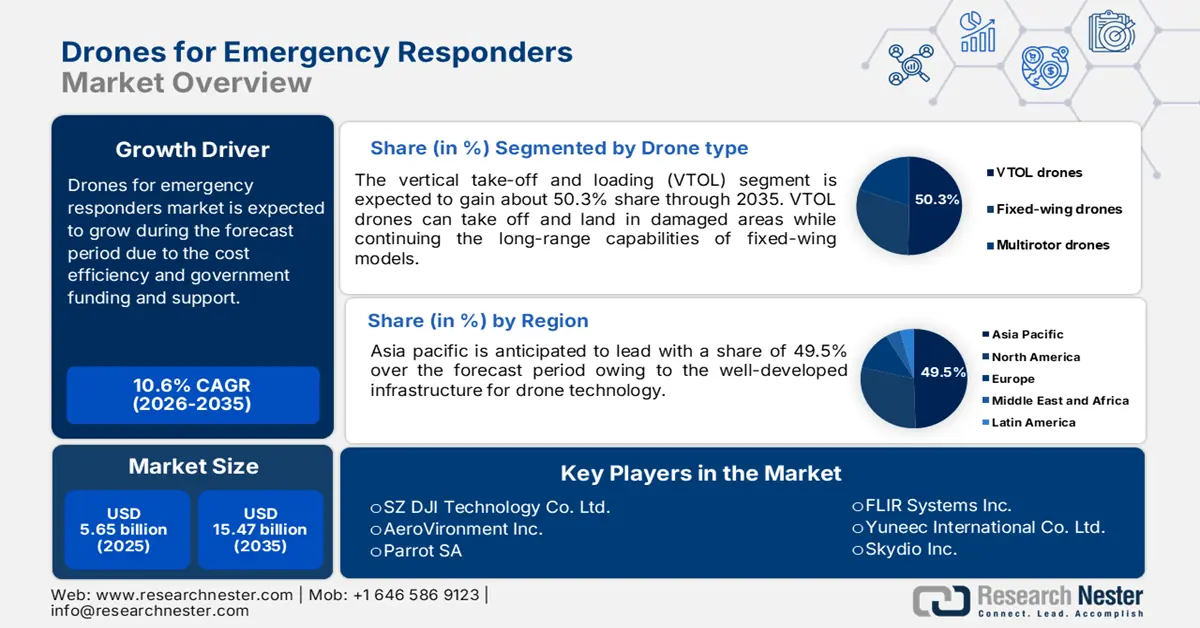

Drones for Emergency Responders Market size was valued at USD 5.65 billion in 2025 and is likely to cross USD 15.47 billion by 2035, expanding at more than 10.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of drones for emergency responders is assessed at USD 6.19 billion.

In high-pressure situations such as fire, natural disaster, or large-scale accidents responders need comprehensive and real-time information to evaluate the situation precisely. Drones equipped with high-definition cameras, thermal imagining devices, and many other progressive technologies provide emergency teams with a bird’s-eye view of affected areas. This allows responders to quickly gather data on the scope of the emergency, recognize potential hazards, and locate survivors, even in challenging situations that are tough or impossible for individuals to access. Its ability to operate effectively in inclement conditions corroborates readiness around the clock and proactive responses in challenging terrains.

Drones used by public safety agencies differ from the ones used by hobbyists and commercial entities. Public safety drones must be durable enough to withstand harsh environments and strenuous situations, including long flight times. Modern drones have transformed how first responders operate and companies are strategically utilizing automation and AI to help on-ground teams make informed and better decisions. For example, in March 2024, DJI, a global leader in civil drones and creative camera technology, launched DJI Dock 2 designed to support automatic drone operations. The Dock 2 is compatible with the new DJI Matrice 3D/3TD drones, which feature progressive obstacle sensing, thermal imaging, and long flight periods.

AI in drones has further boosted their capabilities, enabling them to analyze massive amounts of data separately, identify patterns such as human movements, and forecast potential dangers, all while reducing human error. For instance, in 2023, AI-powered drones were utilized during the wildfires in Canada. They were able to detect fire hotspots and track the progression of fires, providing critical data to firefighting teams.

Furthermore, the global trading landscape has positively influenced the drones for emergency responders market. China’s supremacy in battery manufacturing for EVs and drones has positioned the country as the biggest economy in the sector and gives fierce competition to Germany-based giants. Centre for Prospective Studies and International Information (Cepii) has studied the value chain of the USD 630 billion low-carbon technologies market to understand the strategic aspect of battery production. It revealed that the sector's manufacturing capacity is highly concentrated in China and Australia, with the former representing 77% of graphite and 18% of lithium production. China held the highest revenue share in 2023 for extracting minerals used in li-ion batteries including bauxite, graphite, and lithium, thus, positioning itself as a top contender in the drone batteries segment.

In 2022, the OEC measured the concentration using Shannon Entropy, which was 2.77. This meant that most of the exports of Drones are typically dominated by 6 countries. Drones were the 733rd most traded product out of 1228 products, worldwide, with China being the top exporter and it accounted for USD 1.48 billion in trade, followed by The U.S. (USD 171 million), Netherlands (USD 140 million), Hong Kong (USD 123 million), and Malaysia (USD 99.9 million). Based on HS6 level, drone trade has been classified as small drones (250g-7kg), remote-controlled (RC) flight only (USD 1.09 billion), Mini drones (weighing <25g), RC Only (USD 872 million), Large drones (25-150kg), RC Only (USD 171 million), Heavy drones (weighing>150kg), RC Only (USD 112 million), and medium-sized drones (7-25kg), RC Only (USD 93.3 million).

A large number of emergency UAVs are being launched with a drone payload of 2-9kg range, while some are in the dispensable payload range and can handle a weight of upto 40 kg. Additionally, the Operation of Unmanned Aircraft Systems Over People final rule rolled out in April 2021, has removed mandates for part 107 certificate of waivers compliance. The rule has eliminated the need for typical operations to receive individual part 107 certificate of waivers from the Federal Aviation Administration (FAA), thus, becoming an incremental step towards UA integration in the National Airspace System. This has further penetrated the small UAVs as emergency responders.