Drones for Emergency Responders Market Outlook:

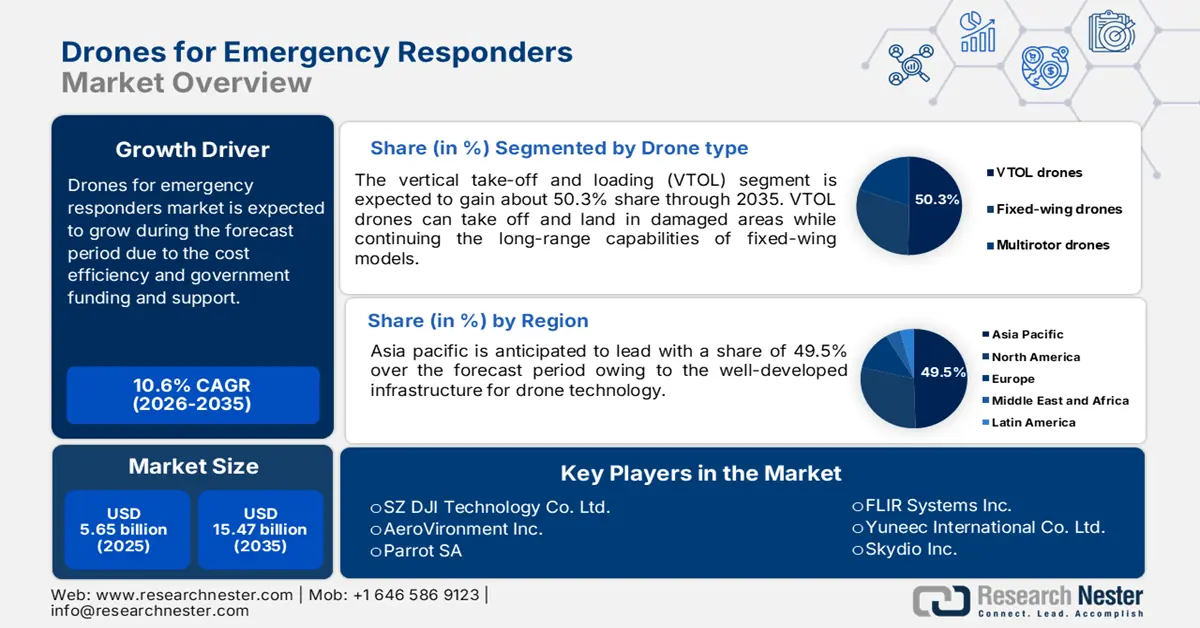

Drones for Emergency Responders Market size was valued at USD 5.65 billion in 2025 and is likely to cross USD 15.47 billion by 2035, expanding at more than 10.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of drones for emergency responders is assessed at USD 6.19 billion.

In high-pressure situations such as fire, natural disaster, or large-scale accidents responders need comprehensive and real-time information to evaluate the situation precisely. Drones equipped with high-definition cameras, thermal imagining devices, and many other progressive technologies provide emergency teams with a bird’s-eye view of affected areas. This allows responders to quickly gather data on the scope of the emergency, recognize potential hazards, and locate survivors, even in challenging situations that are tough or impossible for individuals to access. Its ability to operate effectively in inclement conditions corroborates readiness around the clock and proactive responses in challenging terrains.

Drones used by public safety agencies differ from the ones used by hobbyists and commercial entities. Public safety drones must be durable enough to withstand harsh environments and strenuous situations, including long flight times. Modern drones have transformed how first responders operate and companies are strategically utilizing automation and AI to help on-ground teams make informed and better decisions. For example, in March 2024, DJI, a global leader in civil drones and creative camera technology, launched DJI Dock 2 designed to support automatic drone operations. The Dock 2 is compatible with the new DJI Matrice 3D/3TD drones, which feature progressive obstacle sensing, thermal imaging, and long flight periods.

AI in drones has further boosted their capabilities, enabling them to analyze massive amounts of data separately, identify patterns such as human movements, and forecast potential dangers, all while reducing human error. For instance, in 2023, AI-powered drones were utilized during the wildfires in Canada. They were able to detect fire hotspots and track the progression of fires, providing critical data to firefighting teams.

Furthermore, the global trading landscape has positively influenced the drones for emergency responders market. China’s supremacy in battery manufacturing for EVs and drones has positioned the country as the biggest economy in the sector and gives fierce competition to Germany-based giants. Centre for Prospective Studies and International Information (Cepii) has studied the value chain of the USD 630 billion low-carbon technologies market to understand the strategic aspect of battery production. It revealed that the sector's manufacturing capacity is highly concentrated in China and Australia, with the former representing 77% of graphite and 18% of lithium production. China held the highest revenue share in 2023 for extracting minerals used in li-ion batteries including bauxite, graphite, and lithium, thus, positioning itself as a top contender in the drone batteries segment.

In 2022, the OEC measured the concentration using Shannon Entropy, which was 2.77. This meant that most of the exports of Drones are typically dominated by 6 countries. Drones were the 733rd most traded product out of 1228 products, worldwide, with China being the top exporter and it accounted for USD 1.48 billion in trade, followed by The U.S. (USD 171 million), Netherlands (USD 140 million), Hong Kong (USD 123 million), and Malaysia (USD 99.9 million). Based on HS6 level, drone trade has been classified as small drones (250g-7kg), remote-controlled (RC) flight only (USD 1.09 billion), Mini drones (weighing <25g), RC Only (USD 872 million), Large drones (25-150kg), RC Only (USD 171 million), Heavy drones (weighing>150kg), RC Only (USD 112 million), and medium-sized drones (7-25kg), RC Only (USD 93.3 million).

A large number of emergency UAVs are being launched with a drone payload of 2-9kg range, while some are in the dispensable payload range and can handle a weight of upto 40 kg. Additionally, the Operation of Unmanned Aircraft Systems Over People final rule rolled out in April 2021, has removed mandates for part 107 certificate of waivers compliance. The rule has eliminated the need for typical operations to receive individual part 107 certificate of waivers from the Federal Aviation Administration (FAA), thus, becoming an incremental step towards UA integration in the National Airspace System. This has further penetrated the small UAVs as emergency responders.

Key Drones for Emergency Responders Market Insights Summary:

Regional Highlights:

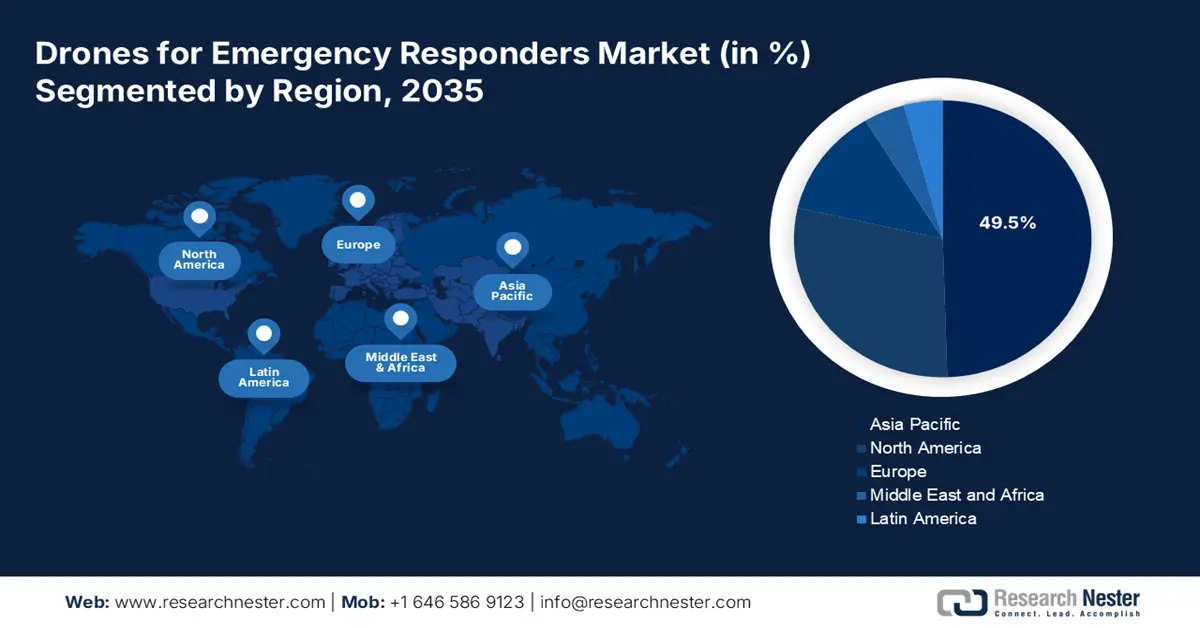

- Asia Pacific drones for emergency responders market will account for 49.50% share by 2035, supported by infrastructure readiness and increased disaster response needs.

Segment Insights:

- The vertical take-off and loading segment in the drones for emergency responders market is projected to hold a significant share by 2035, driven by its hybrid capability for long-range emergency operations.

- The semi-autonomous drones segment in the drones for emergency responders market is projected to achieve a 45.30% share by 2035, driven by the balance between manual and automated functionality.

Key Growth Trends:

- Cost efficiency has led to market penetration

- Government funding and support

Major Challenges:

- Regulatory barriers

- Data security and privacy concerns

Key Players: SZ DJI Technology Co. Ltd., AeroVironment Inc., Parrot SA, FLIR Systems Inc., Yuneec International Co. Ltd., Skydio Inc., Draganfly, Inc., Teledyne FLIR LLC, Zipline International Inc., and DronDeploy Inc.

Global Drones for Emergency Responders Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.65 billion

- 2026 Market Size: USD 6.19 billion

- Projected Market Size: USD 15.47 billion by 2035

- Growth Forecasts: 10.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (49.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 18 September, 2025

Drones for Emergency Responders Market Growth Drivers and Challenges:

Growth Drivers

- Cost efficiency has led to market penetration: Drone technology has become affordable through improvements in battery life, autonomous flight capabilities, and payload capacities, making drones more versatile and reliable.

Companies such as DJI and Zipline are developing drones proficient in carrying heavyweight payloads, and long-range flights which significantly reduces the need for several trips or larger, more expensive aircraft. These developments allow emergency responders to cover more ground at a section of the cost, particularly in hard-to-reach or dangerous areas where traditional vehicles may face difficulty. For instance, in January 2024, DJI launched FlyCart 30 which came up with a new era of dynamic aerial delivery with some characteristics such as large payload capacity, high reliability, long operation range, and intelligent features.

The demand for drones in medical supply is also increasing. Drones from Zipline, in Rwanda and Ghana have been used to deliver vaccines, blood, and other medical supplies to distant areas, which decreases delivery time and costs associated with ground transportation. This model is gaining importance worldwide, as governments and organizations recognize cost benefits. During natural disasters, such as the August 2023 wildfires in Maui and earthquakes in Turkey in February 2023, drones were positioned to assess damage, locate survivors, and deliver supplies in inaccessible areas, reducing the need for expensive and fuel-intensive helicopters.

Drones provide a cost-effective solution for emergency response squads by lessening operational expenses improving efficiency, and enabling rapid deployment in diverse situations. These benefits are important drivers behind the rising adoption of drones in emergency response operations globally. - Government funding and support: Governments contributing to drones for emergency responders market through funding for research and development of UAV technologies. For example, in the U.S., the Federal Aviation Administration (FAA), in 2020, launched some programs such as the Integration Pilot Program (IPP) and the BEYOND program, to accelerate the integration of drones into the national airspace, mainly for public safety purposes. These programs provide regulatory support and funding to promote the usage of drones for tasks such as disaster relief, search and rescue, and medical supply deliveries. Likewise, the European Union (EU) has funded projects such as the U-Space, which focuses on generating a safer environment for the integration of drones into emergency and disaster situations.

Challenges

- Regulatory barriers: Obedience to rules and regulations for airspace integration, flight authorization, and privacy laws can be time-consuming mainly for emergency responders in urgent circumstances. In the U.S., the FAA requires waivers for hazardous operations such as flying drones beyond visual line of sight (BVLOS), at night, or over people in disaster scenarios. FAA reported that drone operators had obtained these needed waivers, significantly hindering their real-time use in crises. This delay can be serious when time is more crucial while saving lives or distributing medical supplies.

These barriers not only lead to the sluggish adoption of drones but also prevent its integration into emergency operations. Efforts to reorganize and standardize guidelines are crucial for solving the full potential of drones in emergencies. - Data security and privacy concerns: One of the main problems is how data is stored, transmitted, and protected from misuse or breaches. Various drones rely on cloud-based storage or outside servers for data processing which increases the risk of cyberattacks. For example, in 2024, the Department of Homeland Security, in the U.S. issued a warning about the vulnerability of drones to hacking, noticing systems could lead the data theft or manipulation during dangerous rescue tasks. It is common in disaster areas, where secure communication and sensitive information such as the strategic rescue operations or the location of survivors is important to be protected.

Drones for Emergency Responders Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.6% |

|

Base Year Market Size (2025) |

USD 5.65 billion |

|

Forecast Year Market Size (2035) |

USD 15.47 billion |

|

Regional Scope |

|

Drones for Emergency Responders Market Segmentation:

Drone Type Segment Analysis

Vertical take-off and loading (VTOL) drones segment is projected to hold over 50.3% drones for emergency responders market share by the end of 2035. VTOL drones can take off and land in imperfect areas while continuing the long-range capabilities of fixed-wing models. VTOL technology has enhanced payload capacities and longer flight strength. For example, in 2023, Quantum Systems launched Trinity F90+, an advanced VTOL drone specifically designed for emergency responders, boasting a flight time of over 90 minutes and the ability to cover over 100 km in a single flight. This hybrid capability makes VTOL drones ideal for operations in distant or rough ground, such as mountainous or disaster-hit areas where traditional ground transport is restricted.

Level of Autonomy Segment Analysis

By 2035, semi-autonomous drones segment is expected to dominate over 45.3% drones for emergency responders market share. These drones are evolving as the most widely adopted, providing a balance between manual control and automated functionality. These drones can be programmed for precise tasks, such as search and rescue tasks or damage assessment, while still permitting manual involvement, making them ideal for random emergency environments.

As demand for advanced solutions in emergency response rises, development in drone technology continues to progress operational efficiency. For example, in May 2024, BRINC Drones Inc. launched a new drone precisely designed for 911 response which is proficient in handling up to 25% of emergency calls autonomously. This drone arrives at the site ahead of human responders and provides vital information to operators, which leads to quicker and more informed decision-making during disasters.

Our in-depth analysis of the drones for emergency responders market includes the following segments

|

Drone Type |

|

|

Application |

|

|

Level of Autonomy |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Drones for Emergency Responders Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific drones for emergency responders market is expected to account for revenue share of more than 49.5% by the end of 2035. This dominance is due to the well-developed infrastructure for drone technology, which includes training programs, established manufacturers, and an airspace management system. This enables faster adoption of drones by emergency response teams. Also, frequent natural disasters led to growing government funding and technological development.

China is developing drone technology for large-scale disaster management. During the floods in 2023, the government deployed drones logistical support, and aerial surveillance which enhanced response times and operational efficiency. This rapid growth across the Asia Pacific is fueled by strong government support and a high focus on disaster precautions.

India is exploring drone applications for rescue missions, and flood monitoring which is reflecting an increasing commitment to integrating unmanned aerial systems into emergency response frameworks. For example, in October 2024, ideaForge launched the Drone as a Service (DaaS) model in India which is known as Flyght Franchise. ideaForge aims to provide this on-demand UAV model to large enterprises and organizations.

North America Market Insights

North America drones for emergency responders market is expected to experience a stable CAGR during the forecast period due to substantial government support and technological advancement. Governments also gradually recognized the value of drones in emergency response and came up with some initiatives such as training initiatives, drone procurement, and pilot programs which led to the growth of drones for emergency responders market.

The United States has invested in drones for disaster management with organizations such as the Federal Emergency Management Agency (FEMA) operating drones for search and rescue, wildfire management, and damage assessment.

Canada is also growing its use of drones mainly in the healthcare sector. Drone delivery Canada has been working on medical delivery drones to reach inaccessible regions this move highlights the partnership with healthcare agencies to enable fast supply delivery in hard-to-reach zones.

Drones for Emergency Responders Market Players:

- SZ DJI Technology Co. Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AeroVironment Inc.

- Parrot SA

- FLIR Systems Inc.

- Yuneec International Co. Ltd.

- Skydio Inc.

- Draganfly, Inc.

- Teledyne FLIR LLC

- Zipline International Inc.

- DronDeploy Inc.

Companies such as DJI, AeroVironment, and Parrot are developing drones with innovative capabilities such as real-time data, transmission, thermal imaging, and high endurance which is critical in disaster response, search and rescue operations, and firefighting. These companies are also working together with emergency response agencies to modify drones for precise needs such as assessing hazardous areas, enhancing situation awareness, and deploying medical supplies. Advancements such as AI-powered autonomous drones, payload flexibility, and integration with communication systems are helping responders to work faster and more carefully in emergencies.

Here are some leading players in the drones for emergency responders market:

Recent Developments

- In May 2024, Teledyne FLIR launched the rogue 1 loitering munition system at SOF week. This innovative drone has been integrated with the company’s public and safety portfolio which precisely enhances its Drones First Response (DFR) segment to effective and rapid response in emergencies.

- In April 2024, Draganfly integrated ParaZero safety technology into its Commander 3XL drones, designed for home hospital deliveries and emergencies. This integration improves safety for slights in overpopulated areas and enables beyond-visual line of sight (BVLOS) operations which makes Commander 3XL best suited for dangerous missions that require safe and efficient drone use in hazardous environments.

- Report ID: 6642

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.