Drone Sensor Market Outlook:

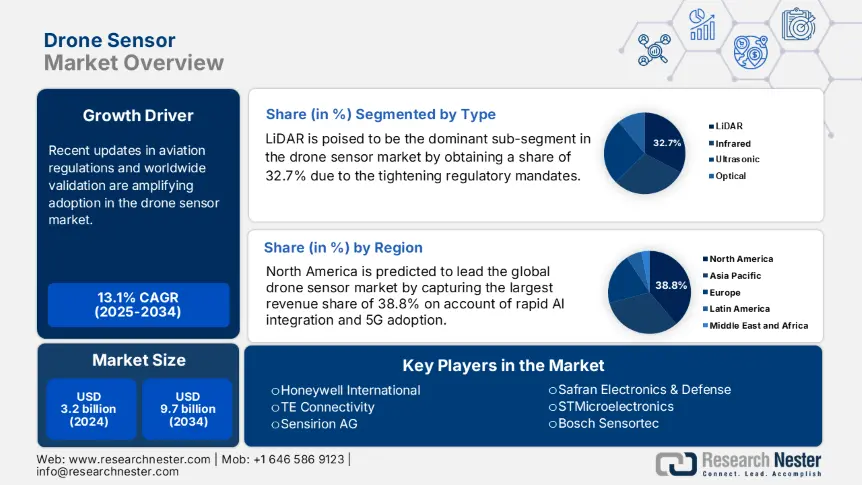

Drone Sensor Market size was over USD 3.2 billion in 2024 and is estimated to reach USD 9.7 billion by the end of 2034, expanding at a CAGR of 13.1% during the forecast timeline, i.e., 2025-2034. In 2025, the industry size of drone sensor is assessed at USD 3.6 billion.

The market relies heavily on a sufficient supply of semiconductor manufacturing, precision optics, and rare-earth materials. According to the U.S. International Trade Commission (USITC), the majority of production hubs originate from the U.S., Germany, Japan, and China. It also mentioned that, in 2023 alone, drone sensor component imports, including MEMS accelerometers and infrared detectors, totaled $1.5 billion, with China representing 38.3% of global exports. This signifies the presence of a sustainable business flow in this category around the globe. Moreover, high-end military-grade sensors are primarily assembled in the U.S. and Europe, while OEMs from China dominate consumer-grade sensor production.

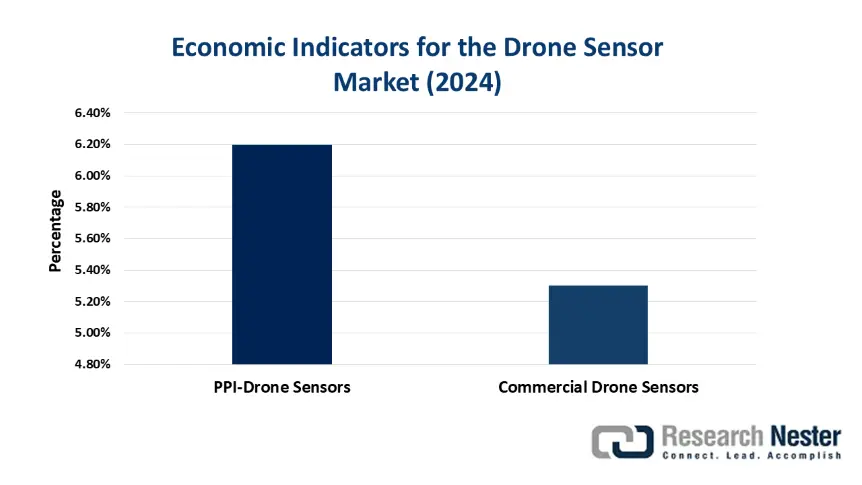

The inflation in key economic indicators remains persistent in the market. As per the U.S. Bureau of Labor Statistics (BLS) records, the producer price index (PPI) rose to 6.2% year-over-year (YoY) during the 1st quarter of 2024 due to semiconductor shortages and increased labor costs in Southeast Asia. Subsequently, the consumer price index (CPI) for commercial drone sensors followed the same upstream trend and climbed by 5.3% in the same year, fueled by growing demand from the agriculture and logistics industries.

Drone Sensor Market - Growth Drivers and Challenges

Growth Drivers

-

Urban air mobility and last-mile delivery: Recent updates in aviation regulations and worldwide validation are amplifying adoption of drone sensors. The Federal Aviation Administration (FAA) mandated the usage of ultrasonic + LiDAR sensors under the BEYOND Program to avoid collision. On the other hand, Amazon Prime Air’s 6-sensor arrays reduced delivery times by 50.3%, establishing the operational benefits of advanced sensing technology. Moreover, 45.5% of global Urban Air Mobility (UAM) investment originates from APAC, which indicates the positive impact of rapid urbanization. Currently, logistics firms are showing interest in investing in modular sensor kits, enhancing payload switching, and compliance.

-

Semiconductor advancements and miniaturization: Technological breakthroughs and advanced manufacturing are also acting as key growth drivers in the market. For instance, from 2022 to 2024, the Micro-Electro-Mechanical Systems (MEMS) Sensor Roadmap of NIST slashed LiDAR costs by 50.5%. Besides, Sony’s IMX459 SPAD sensor improved low-light performance by 70.3%, expanding applications in night operations. On the other hand, the implementation of cutting-edge sensor miniaturization escalated the capacity of key manufacturing hubs. For instance, wafer-level packaging reduced sensor size by 30.3% for next-gen nano-drones, increasing cash flow from the military and precision agriculture segments.

Key Technological Trends Reshaping the Global Market

|

Trend |

Industry Impact |

Adoption Statistic |

Case Study |

|

AI-Powered Sensors |

Agriculture: 30.3% higher crop yield via NDVI analytics |

65% of agri-drones .7use AI (2024) |

John Deere’s See & Spray reduced herbicide use by 60.4% (2023) |

|

Quantum LiDAR |

Defense: 50.3% longer detection range for UAVs |

$480.4 million U.S. DoD investment (2024) |

Lockheed Martin’s HADES program improved threat ID accuracy by 35.4% |

|

Edge Computing |

Telecom: 40.7% faster 5G tower inspections |

70.4% of telecom drones process data onboard (2024) |

AT&T’s Cell Tower Drones cut inspection times from 8 hours to 45 minutes |

|

Thermal Imaging |

Energy: Predictive maintenance cuts downtime by 25.5% |

$220.3 million global thermal sensor demand (2024) |

Shell’s perimeter drones reduced oil rig inspection costs by $1.5 million/year |

|

Nano-Sensors |

Logistics: 50% lighter payloads for last-mile delivery |

45.4% of delivery drones to adopt nano-sensors by 2025 |

Amazon Prime Air increased delivery range by 15 miles |

Drone Sensor Price Trends: A Tech-Driven Market Analysis (2020-2024)

Drone Sensor Price History (2020-2024)

|

Region |

Sensor Type |

2020 Price |

2024 Price |

CAGR |

Key Influencing Factor |

|

North America |

LiDAR Sensors |

$1,204 |

$856 |

-8.1% |

AI-driven automation (2023) |

|

Europe |

Thermal Sensors |

$953 |

$703 |

-6.8% |

Cloud-based analytics (2024) |

|

Asia |

MEMS Sensors |

$153 |

$224 |

9.4% |

5G infrastructure boom (2024) |

|

Global Avg. |

Multispectral |

$1,008 |

$754 |

-7.0% |

Mass production scaling (2024) |

Challenges

-

High cybersecurity compliance costs: Despite a contribution to the adoption increase, regulatory hurdles present a major challenge for the drone sensor market. For instance, in 2023, NIST’s IR 8425 mandating FIPS 140-2 encryption increased sensor costs by 20.4% for startups and small-and medium-sized enterprises (SMEs). However, Parrot SA demonstrated a solution for this problem by implementing post-quantum cryptography that can reduce breach risks by 40.3%, as unveiled by the European Union Agency for Cybersecurity (ENISA).

-

Spectrum allocation conflicts: Interference from 5G networking is becoming a critical problem for the reliability of products from the drone sensor market in Asia. As evidence, in 2024, the C-band spectrum disrupted telemetry signals, causing 15.4% data loss in drone operations, as reported by the Groupe Spécial Mobile Association (GSMA). This roadblock also hampers the performance of drones in precision agriculture and infrastructural inspections. However, Auterion utilized regulatory advocacy to tackle this issue, lobbying Telecom Regulatory Authority of India (TRAI) to allocate dedicated RF bands with a 35.6% reduction in signal dropouts.

Drone Sensor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

13.1% |

|

Base Year Market Size (2024) |

USD 3.2 billion |

|

Forecast Year Market Size (2034) |

USD 9.7 billion |

|

Regional Scope |

|

Drone Sensor Market Segmentation:

Type Segment Analysis

LiDAR is poised to be the dominant sub-segment in the drone sensor market by obtaining a share of 32.7% over the discussed tenure. Tightening regulatory mandates for autonomous operations made these components the gold standard for compliance. For instance, the FAA’s BEYOND Program and the U-space regulations IN Europe demand advanced 3D mapping capabilities, which can be seamlessly delivered by the use of LiDAR. Another report from the U.S. Department of Defense (DoD) unveiled that the surge in this subtype is projected to grow at an 18.5% CAGR due to its critical applications in defense surveillance and logistics route optimization. Moreover, the reliance of autonomous drones on their precision for safety and efficiency is solidifying this leadership.

Application Segment Analysis

The defense & military segment is anticipated to hold the highest share of 28.8% in the drone sensor market throughout the assessed timeframe. The soaring global defense spending and UAV modernization programs are the primary growth factors fueling the segment growth. For instance, in 2024, the U.S. set $886 billion of its defense budget for allocations to advanced drone capabilities. Further, establishing the future proprietorship of this segment, a report from the NATO Defense Expenditure estimated military drones to capture 45.6% of all sensor sales by the end of 2034. This reflects the critical role of drones in the modern culture of surveillance, reconnaissance, and combat operations.

Our in-depth analysis of the drone sensor market includes the following segments:

|

Segments |

Subsegments |

|

Type |

|

|

Application |

|

|

Platform |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Drone Sensor Market - Regional Analysis

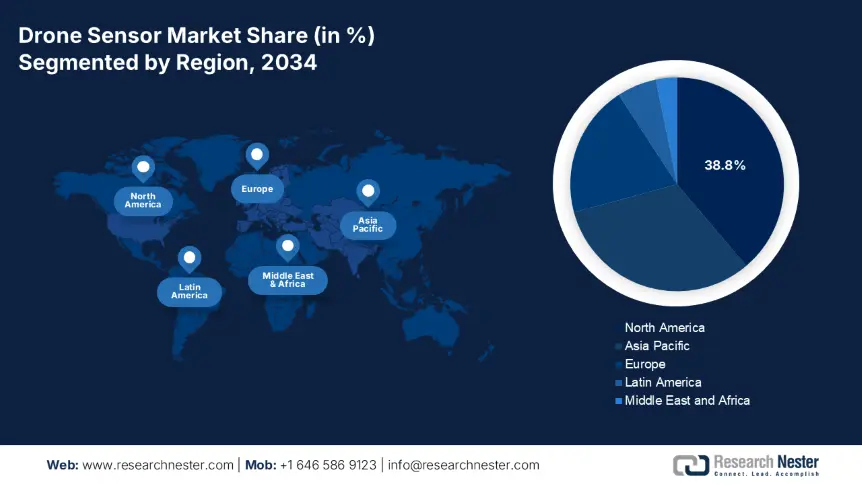

North America Market Insights

North America is predicted to lead the global drone sensor market by capturing the largest revenue share of 38.8% by the end of 2034. As rapid AI integration and 5G adoption significantly reduced operational costs, the demand for drone sensors in this sector is amplifying. Besides, the increased frequency of natural disasters is also pushing authorities to incorporate this technology to monitor and manage emergencies. As a result, 40.6% of global climate drone spending originates from North America. This is further supported by the $300.5 million fund from the National Oceanic and Atmospheric Administration (NOAA) to deploy hyperspectral sensors for wildfire tracking. Besides, the National Aeronautics and Space Administration (NASA) initiated the Drought Resilience Impact Platform (DRIP) that improved hurricane prediction accuracy by 35.6%.

The U.S. dominates the regional drone sensor market with a commanding revenue share, which is primarily fueled by massive defense investments and nationwide 5G expansion. For instance, the Federal Communications Commission (FCC) set an aim to achieve 90.5% rural coverage by the end of 2026. Government initiatives are further filled with the NTIA’s $42.5 billion Broadband Equity Fund, accelerating AI-driven sensor adoption in precision agriculture. Defense contracts with firms are also contributing to the country's leadership. As evidence, the partnership between Skydio and the U.S. DoD spurred a 25.6% YoY surge in LiDAR demand, particularly for autonomous military drones, as reported by the NIST.

The Canada drone sensor market is progressing notably on account of targeted provincial investments and local tech-based advancements. In this regard, the Innovation, Science and Economic Development Canada (ISED) sanctioned a $360.7 million Smart Cities Fund for drone-based IoT solutions. With a similar strategy, in 2023, the Canadian Radio-television and Telecommunications Commission (CRTC) commenced the 5G spectrum auctions to accelerate telecom-integrated drone adoption. In addition, private-sector innovations are contributing to the sector's expansion across the country. For instance, AI-powered crop monitoring drones by Telus reduced operational costs in farms by 30.5%, as reported by the Canadian Information Processing Society (CIPS).

APAC Market Insights

Asia Pacific is poised to emerge as the fastest-growing region in the drone sensor market during the analyzed timeline. Increased public-private partnerships and a 5G infrastructure boom, enabling seamless drone connectivity, are primarily propelling the region's progress in this sector. Its global leadership in military-grade drone adoption, with governments prioritizing advanced sensor technologies for defense and surveillance, is also attracting both domestic and foreign suppliers to invest in this landscape. Such financial backing, combined with rapid urbanization and smart city initiatives, is accelerating demand and positioning APAC as the epicenter of innovation and deployment for this merchandise.

China is set to dominate the APAC drone sensor market by solidifying its control over 45.5% of regional revenue generation by 2034. The country's proprietorship is highly influenced by the $7.4 billion UAV Industry Plan of the Ministry of Industry and Information Technology (MIIT). In addition, more than 500.5 thousand companies are now leveraging drone technology locally, as per the China Academy of Information and Communications Technology (CAICT). Besides, in 2023, the medical drone pilot program implemented by the National Medical Products Administration (NMPA) slashed delivery times by 50.3%, which inspired more healthcare pioneers to adopt this technology.

India is rapidly evolving into a key growth engine for the regional drone sensor market, with $300.6 million investment in 2024 alone, as per the Ministry of Electronics and Information Technology (MeitY). The country also boasts more than 200.5 thousand drone startups, reflecting the significant increase in commercial engagement, according to the National Association of Software and Service Companies (NASSCOM). Additionally, the $1.5 billion indigenous UAV program and Drone Shakti Scheme are collectively boosting local manufacturing. Inspired by such a lucrative business environment, Honeywell started capitalizing on its Chennai plant while reducing production costs by 25.6%.

Government Investments & Policies (2024-2025)

|

Country |

Initiative / Policy |

Budget/Funding (Million) |

Key Focus |

|

Australia |

National Drone Strategy (Infrastructure) |

$50.4 |

BVLOS & AI-based inspections |

|

South Korea |

Defense Drone Sensor Upgrade Program |

$200.3 |

Military-grade LiDAR/thermal |

|

Malaysia |

East Malaysia Rural Connectivity Project |

$45.3 |

Logistics/delivery sensors |

Europe Market Insights

The Europe drone sensor market is anticipated to maintain strong growth between 2025 and 2034. The consistent augmentation of the region is led by defense, agriculture, and industrial automation applications, where the UK, Germany, and France collectively dominate with over 60.5% revenue share. The landscape is also influenced by heavy military-grade UAV utilization for surveillance and the emergence of agri-drones for crop monitoring. Further, the €2.6 billion outlay of the Digital Europe Programme is magnifying the volume of innovation in this category, consolidating the region's global leadership in technology.

Germany is set to dominate the Europe drone sensor market with an astonishing 30.4% revenue share by 2034. The country's proprietorship is backed by rapid industrial automation and €1.4 billion federal funding for UAV integration in logistics and smart cities, as reported by the Ministry for Digital and Transport (BMDV). Furthermore, the €300.4 million Digital Innovation Fund supports GaN-based sensor development, while 5G-enabled drones and AI analytics solidify the country's future progress in this sector.

The UK is engaging resources to establish a strong foundation for the Europe drone sensor market. To achieve this milestone, the country increased its ICT budget allocation for drone sensors by 4.5%, up from 3.2% in 2020, reflecting growing government and industry commitment. With such financial backing, the country has already gained a 22.4% growth in demand from 2021 to 2024. Moreover, the expanding field of applications in defense, logistics, and smart city initiatives is fostering a lucrative atmosphere for this merchandise.

Country-wise Government Provinces (2024-2025)

|

Country |

Initiative / Policy |

Budget/Funding (Million) |

Key Focus |

|

Spain |

Military Drone Sensor Program |

€80.4 |

Defense-grade thermal/LiDAR |

|

Italy |

ENAC Urban Air Mobility Initiative |

€60.6 |

BVLOS & traffic management |

|

Russia |

Arctic Monitoring Drone Program |

~$95.8 |

Harsh-environment sensors |

Key Drone Sensor Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The current dynamics of the drone sensor market is stimulated by intense competition, where pioneers from the U.S. and Europe are leading in defense and industrial applications. On the other hand, Sony focuses on the development of imaging sensors for agriculture. Besides, commercial acquisitions and extensive R&D participations are reshaping the landscape. Moreover, in emerging economies, including India and Malaysia, HAL and Aerodyne are consolidating their foundation in this sector through public UAV programs. Here is a list of key players operating in the global market:

|

Company |

Country |

Market Share (2024) |

|

TE Connectivity |

U.S. |

12.8% |

|

Honeywell International |

U.S. |

10.5% |

|

Sensirion AG |

Switzerland |

9.0% |

|

Bosch Sensortec |

Germany |

8.2% |

|

STMicroelectronics |

Switzerland |

7.5% |

|

Safran Electronics & Defense |

France |

xx% |

|

Trimble Inc. |

U.S. |

xx% |

|

Raytheon Technologies |

U.S. |

xx% |

|

Samsung Electro-Mechanics |

South Korea |

xx% |

|

Flir Systems (Teledyne) |

U.S. |

xx% |

|

Hindustan Aeronautics Ltd |

India |

xx% |

|

Defendec Pty Ltd |

Australia |

xx% |

|

Aerodyne Group |

Malaysia |

xx% |

Below are the areas covered for each company in the drone sensor market:

Recent Developments

- In June 2024, Safran, in collaboration with Thales, launched quantum-secure drone communication technology, featuring encryption resistant to quantum computing attacks. This breakthrough has been adopted by Europe defense agencies, significantly enhancing cybersecurity for drone operations.

- In March 2024, Honeywell introduced its advanced RDR-7000 radar sensor on March 12, 2024, featuring AI-powered obstacle detection and 4D imaging capabilities for autonomous drones. The innovation drove a 15.4% revenue increase for Honeywell in the 2nd quarter of 2024.

- Report ID: 7918

- Published Date: Jul 23, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Drone Sensor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert