Drone Logistics and Transportation Market Outlook:

Drone Logistics and Transportation Market size was over USD 2.52 billion in 2025 and is anticipated to cross USD 147.27 billion by 2035, growing at more than 50.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of drone logistics and transportation is estimated at USD 3.66 billion.

The drone logistics and transportation market represents one of the rapidly evolving industries catering to innovative solutions for improving the supply chain and promoting last-mile delivery. Investment in drone technology, expanding regulations for drone usage, and collaborations within the full range of the logistics industry drive this growth. For example, in January 2024, Draganfly Inc. entered into a strategic partnership with Mass General Brigham to introduce drone delivery services in healthcare. Moreover, the use of drones has revolutionized the delivery of patient care on time through timely medical supplies. These types of initiatives help indicate how the market is pushing toward leveraging drones for critical, cost-effective, and efficient logistics solutions.

The governments of different countries are also playing a significant role in the development and expansion of the drone logistics sector. Different regulatory bodies are working on promoting regulations that would enable drones to operate widely and safely, especially for delivering different items to areas that are otherwise difficult to reach. For example, in November 2021, Zipline, alongside Pfizer Inc. and BioNTech SE, successfully completed the first long-range drone delivery of authorized mRNA COVID-19 vaccines requiring ultra-cold-chain in Ghana. Coupled with this government support, such innovations in the market are building up a conducive environment for drone logistics adoption across diverse industries, from healthcare to retail.

Key Drone Logistics and Transportation Market Insights Summary:

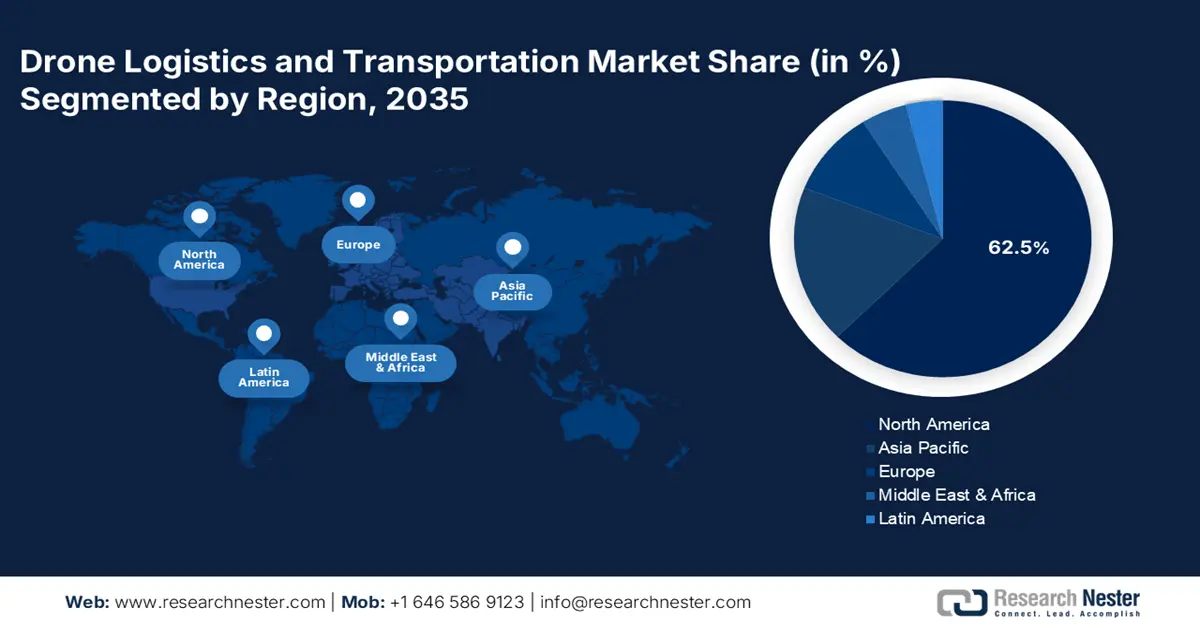

Regional Highlights:

- North America dominates the Drone Logistics and Transportation Market with a 62.50% share, propelled by favorable regulations, supportive infrastructure, and strong public-private partnerships, ensuring significant growth by 2035.

- The Asia Pacific Drone Logistics and Transportation Market is forecasted to experience lucrative growth through 2026–2035, attributed to government initiatives, technology investments, and increasing adoption of drones for commercial logistics.

Segment Insights:

- The Shipping segment is expected to surpass 54% market share by 2035, driven by the demand for faster last-mile delivery solutions.

- The Commercial segment is projected to capture around 72% share by 2035, driven by increased drone use in e-commerce and retail delivery.

Key Growth Trends:

- Technological advancements in drone capabilities

- Growing adoption in the healthcare industry

Major Challenges:

- Regulatory and safety concerns

- Public security concerns

- Key Players: PINC Solutions, Hardis Group, Infinium Robotics, Matternet, CANA Advisors, Drone Delivery Canada, DroneScan, and Workhorse Group.

Global Drone Logistics and Transportation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.52 billion

- 2026 Market Size: USD 3.66 billion

- Projected Market Size: USD 147.27 billion by 2035

- Growth Forecasts: 50.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (62.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, UAE

Last updated on : 14 August, 2025

Drone Logistics and Transportation Market Growth Drivers and Challenges:

Growth Drivers

-

Technological advancements in drone capabilities: The demand for drone logistics and transportation is driven by technological innovations that enhance the payload capacity and range of drones, making them more viable for logistics purposes. In January 2024, DJI launched the FlyCart 30, featuring an efficient 4-axis, 8-blade multi-rotor system that can transport up to 30 kg over 16 km. These advancements are instrumental in overcoming limitations related to distance and payload, thus driving growth in the logistics and transportation industry.

-

Growing adoption in the healthcare industry: Drones are increasingly being adopted in the healthcare industry, which is in dire need of quicker and more efficient methods of delivery. Drones have been found particularly useful for transporting medical supplies, vaccines, and urgent medications to remote or underserved areas where traditional logistics pose a challenge. This capability for time-sensitive deliveries in critical situations has made drones an indispensable element in healthcare logistics.

-

Governments' initiative for drone logistics: Government initiatives and approvals in the regulatory framework are gauging wider applications of drones in logistics. In May 2023, Amazon received FAA approval to operate Prime Air drone delivery services in limited areas across the U.S. These endorsements are needed to legitimize the use of drones in logistics transportation, with increased operational safety, creating a specific legal framework that would encourage further market growth.

Challenges

-

Regulatory and safety concerns: The drone logistics and transportation market faces complex regulatory frameworks that control drone operations. Each country has its laws on flight permissions, airspace, and licensing, which often cause delays and increased costs for logistics companies. Furthermore, safety standards require drones to operate safely around populated areas and not interfere with traditional air traffic. These challenges complicate the operations and make it difficult to scale services properly for drone delivery firms.

-

Public security concerns: Public concerns about drones are related to privacy, safety, and unauthorized surveillance. The usage of drones for logistics raises concerns due to invasive monitoring, especially when they fly over residential areas. The possibility of using drones for malicious reasons, either for spying or even the delivery of harmful payloads, has raised security concerns. These issues have impacted the implementation of drone logistics since both the regulatory bodies and the public demand stern measures that guarantee that drones do not violate privacy or compromise security.

Drone Logistics and Transportation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

50.2% |

|

Base Year Market Size (2025) |

USD 2.52 billion |

|

Forecast Year Market Size (2035) |

USD 147.27 billion |

|

Regional Scope |

|

Drone Logistics and Transportation Market Segmentation:

Solution (Warehousing, Shipping, Infrastructure, Software)

The shipping segment is projected to capture over 54% drone logistics and transportation market share by 2035, owing to growing demands from the industry for faster last-mile delivery solutions. As a result, these drones collectively possess the ability to surpass and avoid traffic and reach remote areas which are difficult to access via conventional logistics. In October 2023, Amazon extended tests of its drone delivery service in Texas with CANA Advisors, with the specific intent of delivering medical supplies into underserved areas. Such developments by key players indicate a growing role for drones in shipping, which further drives the adoption.

Sector (Military, Commercial)

By 2035, commercial segment is anticipated to account for around 72% drone logistics and transportation market share. Such growth has been driven by the increasing use of drones by e-commerce, healthcare, retail, and others for their delivery applications. In July 2021, DRONAMICS signed a partnership agreement with DHL Deutsche Post. Through this collaboration, DHL and DRONAMICS agreed to jointly develop solutions and offer same-day cargo drone deliveries to customers using DRONAMICS’ drone delivery network and Black Swan drones. This underlines how commercial entities increasingly use drones for their core value of logistics optimization, therefore propelling growth within this segment.

Our in-depth analysis of the market includes the following segments:

|

Solution |

|

|

Sector |

|

|

Drone |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Drone Logistics and Transportation Market Regional Analysis:

North America Market Analysis

North America in drone logistics and transportation market is projected to hold over 62.5% revenue share by the end of 2035 owing to favorable regulation, supportive infrastructure, and strong public-private partnerships that foster the adoption of drones. With large investments in last-mile enhancement initiatives, North America is being set up as one of the global leaders in drone logistics. Distribution network growth due to developing urban air mobility projects is the major driving force for this segment.

Due to the proactive regulatory frameworks coupled with considerable investments in drone technologies, the U.S. is anticipated to witness rapid drone adoption during the forecast period. In January 2022, Wingcopter secured a deal worth USD 16 million from Spright for eVTOL delivery drones as part of using drones for healthcare logistics. Moreover, initiatives like UAS integration pilot programs by the FAA encourage more and more integrations of drones into the mainstream supply chains of various industries.

With continuous government support and a growing private sector, Canada is becoming one of the emerging countries in North America market. The government in the country has minimized regulatory barriers to enable the use of commercial drones across industries. Additionally, investments in drone corridors and beyond-visual-line-of-sight (BVLOS) operations are solidifying the country's market position, while plans to expand services into urban and rural areas are being strategized. Companies are also developing partnerships with indigenous communities to make sure the drone technology will serve remote areas.

Asia Pacific Market Analysis

Asia Pacific drone logistics and transportation market is expected to register a strong growth rate between 2026 and 2035. Government initiatives, technology investments, and the increasing adoption of drones for commercial logistics drive the growth in this region. Supply chains are modernizing through investments in smart city initiatives and drone delivery networks. Moreover, with the development of regulatory ecosystems, countries such as Japan and South Korea are now engaging in activities that are likely to spur innovation during the forecast period.

China is one the leading countries in Asia Pacific drone logistics and transportation market, propelled by government incentives and a strong manufacturing hub. The government has also invested significantly in drone infrastructure in order to build better domestic logistics. Additionally, large-scale urban air mobility trials, along with integrating drones with AI-powered logistics platforms, have accelerated the dominance of China in the global market.

Similarly, India has also been witnessing rapid growth in drone logistics, driven by government-backed initiatives such as the Medicine from the Sky project. In June 2024, Blue Dart partnered with Skye Air to commence drone deliveries, illustrating the country’s commitment to using drones for healthcare logistics. Moreover, the policy reforms being carried out by the government include providing subsidies for drone startups and making progress regarding drone traffic management systems to further drive the use of drones in different industries, especially in rural and remote areas.

Key Drone Logistics and Transportation Market Players:

- PINC Solutions

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CANA Advisors

- Drone Delivery Canada

- DroneScan

- Hardis Group

- Infinium Robotics

- Matternet

- Workhorse Group

- Skysense

- Flirtey

The leading players in the drone logistics and transportation market include PINC Solutions, Hardis Group, Infinium Robotics, Matternet, CANA Advisors, Drone Delivery Canada, DroneScan, and Workhorse Group. These companies are investing in strategic initiatives like advanced drone system development, geographical expansion, and partnerships to compete in the market. Entry of established players into the market has heightened competition, with continuous innovations needed to solve unique logistical problems.

In April 2024, Amazon extended its Arizona drone delivery service and promised faster more efficient package delivery. The new service utilizes Amazon's Prime Air drones to transport packages weighing less than five pounds within an hour after they are ordered. This development is an extension of Amazon's larger strategy, securing advanced drone technology and bringing in greener logistics to more effectively target urban and rural areas. Such expansion by companies highlights the effort by companies to push the demand for drone logistics, propelling innovation and sustainability in the delivery sector.

Recent Developments

- In October 2024, Matternet made a significant entry into the home delivery market by launching Silicon Valley’s first-ever drone delivery operation. This fully automated service operates out of Mountain View, allowing drones to deliver food and commercial items directly to residents’ homes. Each drone is loaded at a central hub, flies to the delivery point, and releases packages via a tether system, ensuring minimal human involvement.

- In September 2024, Drone Express launched its drone delivery service in Winston-Salem, North Carolina, with a grand opening attended by local officials, including Mayor Allen Joines. The event featured a live demonstration of drone delivery, showcasing the technology's ability to provide fast and eco-friendly solutions for delivering everyday essentials.

- Report ID: 6620

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Drone Logistics and Transportation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.