Drone-in-a-Box Solutions Market Outlook:

Drone-in-a-Box Solutions Market size was over USD 1.8 billion in 2024 and is estimated to reach USD 9.2 billion by the end of 2034, expanding at a CAGR of 23.3% during the forecast timeline, i.e., 2025-2034. In 2025, the industry size of drone-in-a-box solutions is evaluated at USD 2 billion.

The ongoing trend of automating maximum operations in various industries, including construction, public safety, infrastructure maintenance, mining, and surveillance, is propelling demand for drone-in-a-box solutions. The assembly of a majority portion of these systems mostly occurs in cost-efficient electronics manufacturing hubs, reflecting the industry's globalized production network. As the sector has supply chain dependencies for critical components, such as lithium-ion batteries, carbon fiber composites, and semiconductors, it underscores the untapped potential of emerging economies. Moreover, the field's growth is closely tied to the improving stability of supply channels through localized production.

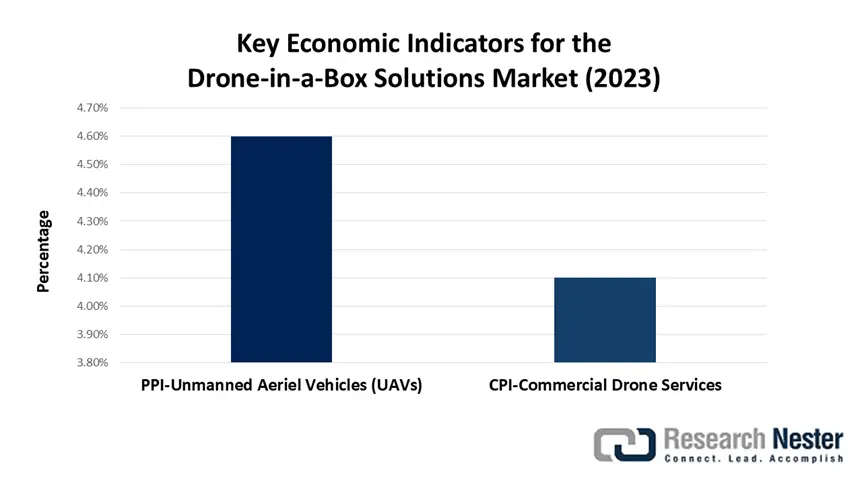

The market faces growing cost pressures from trade tensions and tariffs, which is creating new opportunities for developers and manufacturers of affordable models. As evidence of such inflation, the Bureau of Labor Statistics (BLS) recorded a 4.6% year-over-year (YoY) increase in the producer price index (PPI) for unmanned aerial vehicles (UAVs) in 2023. On the other hand, disruptions in semiconductor supply strained production by extending lead times for critical components to 26 weeks in early 2024, as per the Department of Commerce (DoC). The same can also be observed through a 4.1% rise in the consumer price index (CPI) for commercial drone services in the same year.

Drone-in-a-Box Solutions Market - Growth Drivers and Challenges

Growth Drivers

- Rigorous public and private investments: With amplifying efforts to accelerate innovations in automated functions and battery efficiency, the market is expanding rapidly. For instance, in 2024, the U.S. Department of Defense (DoD) allocated $1.9 billion for UAV R&D. In 2023 alone, private-sector funding for drone automation totaled $850.4 million, according to a report from the National Science Foundation (NSF). Moreover, the growing focus on and participation in cutting-edge R&D underscore the sector's potential in overcoming major roadblocks while enhancing performance, indicating a promising financial outcome in the upcoming year.

- Autonomous navigation advancements: Penetration of AI revolutionized the efficiencies and utility of automation, which is fostering lucrative opportunities for key players in the market. According to the National Institute of Standards and Technology (NIST), the use of AI-assistance in predictive maintenance reduced downtime by 20.5% in 2023. Additionally, machine learning enables beyond-visual-line-of-sight (BVLOS) operations for expanded use in remotely scheduled, executed, and monitored applications. For instance, an oil company from the Middle East deployed AI-powered drone-in-a-box (DIB) for pipeline inspections, which saved $2.4 million annually. Moreover, edge AI processors are eliminating cloud dependency and unlocking new industrial applications.

Challenges

- Delayed approvals and additional compliance costs: Strict airspace and safety regulations often delay deployments, creating difficulty in achieving commercial goals for pioneers in the market. As evidence, in 2023, the Part 107 certification process of the U.S. Federal Aviation Administration (FAA) extended time-to-market by 6-12 months. Also, compliance-related expenses consume 15.4-20.8% of total expenditure on product development, as per the World Trade Organization (WTO). To resolve this issue, in 2023, Skydio partnered with the DoD to streamline approvals, cutting deployment timelines by 30.5% for defense applications.

- Public resistance and safety concerns: Urban noise and privacy concerns often hamper deployment in populated areas, restricting wide adoption in the market. As community resistance rises in multiple cities, the requirement for skilled operators and tech-based advances increases. In response to this surge, in 2024, Zipline reduced its drone noise by 15 decibels to gain community acceptance in Rwanda, as reported by the International Civil Aviation Organization (ICAO). This demonstrates the need for technological upgradations to increase social acceptance while mitigating errors.

Drone-in-a-Box Solutions Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

23.3% |

|

Base Year Market Size (2024) |

USD 1.8 billion |

|

Forecast Year Market Size (2034) |

USD 9.2 billion |

|

Regional Scope |

|

Drone-in-a-Box Solutions Market Segmentation:

Application Segment Analysis

In terms of applications, the infrastructure inspection segment is predicted to emerge as the dominant shareholder in the market with a 32.7% captivity on revenue generation by the end of 2034. The aging infrastructures in key industrial landscapes, such as North America and Europe, are creating a need for regular monitoring and management, as per the U.S. Department of Transportation (USDOT). The adoption of AI-powered drone systems delivered 40.5% cost reductions in inspection operations, and hence, DIBs are highly desired in this segment, as per the NIST report. Moreover, improved safety, efficiency, and data accuracy for critical infrastructure maintenance made these solutions a gold standard for the commercial drone industry.

End user Segment Analysis

The energy & utilities segment is poised to represent the highest share of 28.8% in the drone-in-a-box solutions market over the assessed timeline. Enhanced efficacy and tightening regulatory mandates are the primary drivers behind the proprietorship. This can be validated by a 2023 study under the United Nations Environment Programme, demonstrating 15.3% efficiency gains through solar-powered DIB solutions. Similarly, the International Energy Agency (IEA) reported that the use of DIB in inspecting solar and wind energy facilities reduced the need for dedicated personnel by 50.4%. On the other hand, grid monitoring regulations also rose in adoption due to the contribution of these drones to carbon-neutrality.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

End user |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

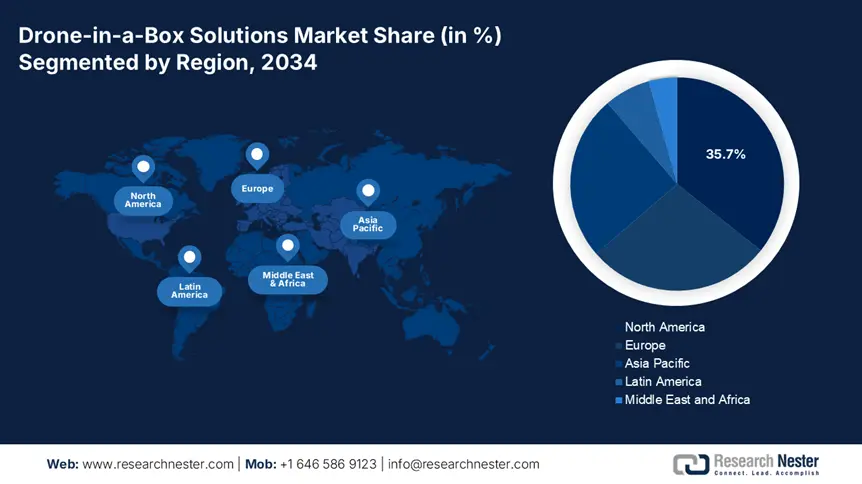

Drone-in-a-Box Solutions Market - Regional Analysis

North America Market Insights

North America is anticipated to dominate the market by capturing the largest share of 35.7% throughout the discussed period. The robust defense spending and rapid industrial automation adoption are securing the region's stability at the forefront of this sector. The investments in drone cybersecurity is also 35.6% higher than in Asia, underscoring prioritization of secure operations. Besides, regulatory advancements, such as the FAA’s BVLOS approvals and 5G coverage expansion, also escalated the volume of deployments in this sector. This combination of defense demand, technological infrastructure, and supportive policies solidifies the global leadership of North America.

The U.S. leads the North America market with a 30.4% global share, as reported by the Federal Communications Commission (FCC). In 2024, the Part 107 waivers implemented by the Federal Aviation Administration (FAA) accelerated beyond the visual line of sight (BVLOS) adoption. On the other hand, the $2.8 billion broadband fund from the National Telecommunications and Information Administration (NTIA) enabled drone-based rural connectivity. Moreover, AI-powered inspections reduced energy sector costs by 25.5%, cementing a strong foundation for the U.S. landscape.

The Canada market is growing at a notable pace, which is stimulated by strategic and targeted investments. For instance, the Canadian Radio-television and Telecommunications Commission (CRTC) released a fund for 5G spectrum auctions that fueled innovations in this sector. Besides, the $360.6 million drone fund from the Innovation, Science and Economic Development Canada (ISED) also contributed to this cohort. In addition, the country's agriculture industry is acting as a key adopter, with precision farming drones cutting labor costs by 30.6%, as per the Agriculture and Agri-Food Canada (AAFC). Moreover, Telecom Alliance Canada requires drone-assisted tower inspections by 2025, fostering a sustainable consumer base for this sector.

APAC Market Insights

Asia Pacific is expected to become the fastest-growing region in the global drone-in-a-box solutions market by the end of 2034. The rapid 5G rollout across the region is enabling real-time drone operations, garnering a favorable business environment for pioneers in this field. The rising security concerns are also accelerating demand for counter-drone technologies, displaying the region's multi-disciplinary field of application. Moreover, despite fragmentation challenges, the massive government investments in infrastructural development and continuous adoption of next-generation technologies are fueling explosive growth in this category.

China is estimated to dominate the APAC market with a revenue share of 58.5% by 2034. The country's leadership is solidified by aggressive government mandates and large-scale security upgrades. For instance, in 2025, the Ministry of Industry and Information Technology (MIIT) mandated a 5G drone network for major cities. As a result, smart city projects accounted for 40.3% of nationwide demand, with Shenzhen already deploying more than 50,005 surveillance drones in 2023.

India is emerging as a pivotal growth engine for the regional drone-in-a-box solutions market, primarily backed by substantial government allocations. According to the Ministry of Electronics and Information Technology (MeitY), in 2023, the Kisan Drone Scheme dedicated $50.6 million to strengthening agricultural DIB adoption. In 2024, the initiative installed over 10,007 UAVs that are specifically designed for use in agriculture, as reported by the National Association of Software and Services Companies (NASSCOM). In the same year, the annual government spending on drone tech reached $300.5, as per the Department of Telecommunications (DoT).

Government Investments & Policies

|

Country |

Year |

Investment/Funding (Million) |

Key Policy/Initiative |

|

Australia |

2025 |

$25.5 |

Drone Logistics Network (rural healthcare deliveries) |

|

South Korea |

2024 |

$60.4 |

Autonomous Drone Act (full regulatory framework) |

|

Malaysia |

2025 |

$18.3 |

Maritime Surveillance Expansion (coastal security) |

Europe Market Insights

Europe is predicted to capture the second-largest revenue share in the global drone-in-a-box solutions market between 2025 and 2034. The region's augmentation in this field is supported by the growing automation demand in logistics, surveillance, and agriculture. Besides, the Digital Decade Policy in Europe targets 80.5% business adoption of AI and drone technology by the end of 2030, and this cohort is led by heavy government-backed funding. For instance, governing bodies in France drafted an outlay of €1.9 billion under the national drone strategy, which prioritizes emergency response and smart cities for reinforcement in security and operational utilities.

Germany is showcasing dominance over the Europe market with a 28.7% revenue share, backed by strategized industrial automation and rapid 5G integration. To support this cohort of advancement, the country invested approximately €2.1 billion in 2024. As a result, the increasing Industry 4.0 adoption fostered a 25.6% annual growth in this category. Besides, in 2023, the Federal Ministry for Digital and Transport (BMDV) allocated €500.5 million to the autonomous drone corridor project, consolidating the nation's leadership in smart manufacturing and logistics.

The UK is maintaining a strong position in the regional market, with 1.5% of its £5.9 billion digital infrastructure budget allocation to DIB in 2023. In this regard, the Office of Communications reported a 40.6% surge in drone-based telecom inspections since 2022. On the other hand, post-Brexit logistics optimization is also propelling demand for automated supply chain solutions, making the UK a key participant in the region's evolving DIB landscape.

Country-wise Government Provinces

|

Country |

Year |

Investment/Funding (Million) |

Key Policy/Initiative |

|

Spain |

2025 |

€25.5 |

EU-UAM Initiative (urban air mobility integration) |

|

Italy |

2024 |

€20.7 |

National Drone Logistics Corridor (Alps region) |

|

Russia |

2025 |

~$27.6 |

Arctic Monitoring Initiative (climate/resource drones) |

Key Drone-in-a-Box Solutions Market Players:

- Skydio

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Percepto

- American Robotics (Ondas)

- Airobotics

- Azur Drones

- Easy Aerial

- H3 Dynamics

- Draganfly

- Aerodyne Group

- Garuda Aerospace

- Sharper Shape (ABB)

- DroneDeploy

- Martek Aviation

- Husarion (Dronehub)

The market is marked as a merchandise with intense competition, where pioneers from the U.S. and Israel are leading through advanced autonomy and regulatory expertise. On the other hand, firms in Europe are dominating their domestic territory with strong emphasis on industrial inspections, while Asian companies target smart city expansion. Key strategies of such leaders include AI-driven automation, telecom partnerships, and BVLOS approvals. Furthermore, market consolidation is also accelerating, which can be evidenced by ABB’s acquisition of Sharper Shape and Ondas Holdings’ merger with American Robotics.

The cohort of key players consists of:

Below are the areas covered for each company in the drone-in-a-box solutions market:

Recent Developments

- In March 2024, Percepto launched its fully autonomous inspection drone, featuring AI-powered anomaly detection for industrial sites. The solution drove 30.8% revenue growth in the 1st quarter of 2024, fueled by strong demand from oil & gas and energy sectors, with deployments across 54+ global sites.

- In February 2024, Skydio introduced its ruggedized X10D Drone-in-a-Box solution, an advanced 3D scanning and real-time thermal analytics for critical infrastructure. The system enabled 5G-connected operations and drove a 25.7% increase in enterprise adoption within just three months of launch.

- Report ID: 7917

- Published Date: Jul 23, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Drone-in-a-Box Solutions Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert