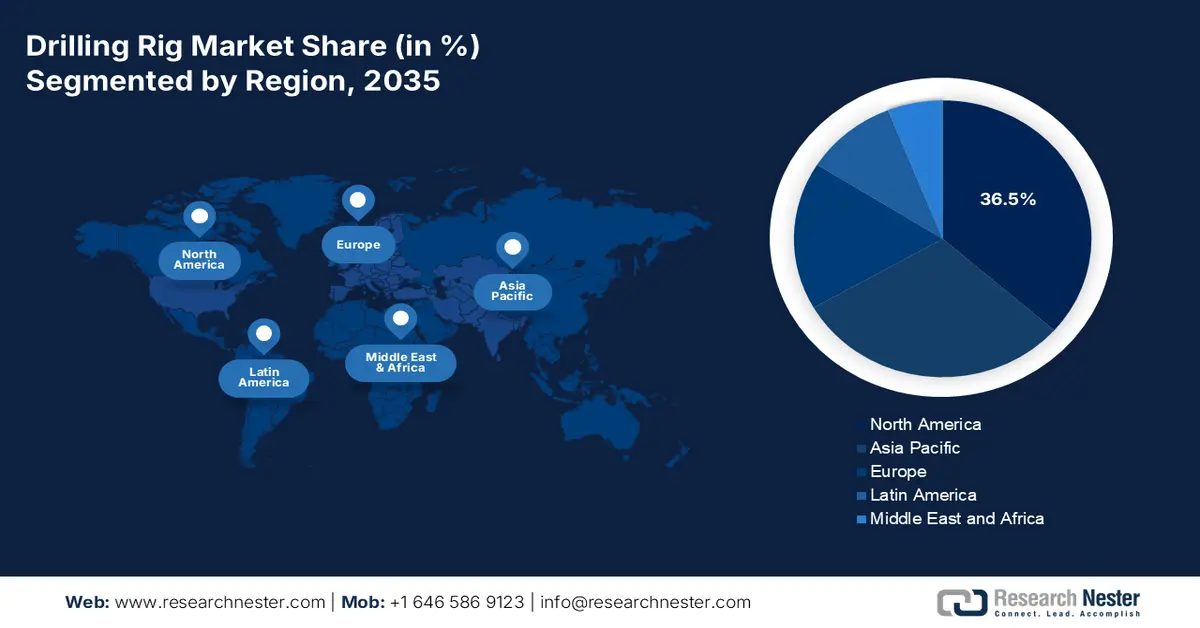

Drilling Rig Market - Regional Analysis

North America Market Insights

North America is projected to hold the largest share of 36.5% in the drilling rig market by the end of 2035. The market’s uplift in the region is highly driven by shale redevelopment, increased feedstock demand, and the presence of resilient upstream activity. According to an article published by the Department of Energy in December 2024, the administrative body, along with the U.S. Environmental Protection Agency (EPA), notified an estimated USD 850 million for 43 projects that have been selected for negotiation. This funding opportunity is suitable for assisting regional tribes, oil and gas operators, and other sectors in quantifying, measuring, monitoring, and reducing methane emissions from the oil and gas industry. In addition, the EPA finalization rule has further diminished methane emissions from covered oil and gas sources by 80% as of 2024, thereby suitable for proliferating the market’s growth.

The drilling rig market in the U.S. is growing significantly, owing to shale drilling, the existence of non-traditional wells for crude oil production, as well as methane emissions reduction programs, the chemistry industry feedstock requirement, digitalization and automation. As per a data report published by the EIA Government in December 2025, the oil production in the country averaged 13.3 million barrels per day, while the natural gas production averaged 128.0 billion cubic feet per day. In addition, there has been an increase in domestic oil and natural gas production, along with pricing strategy as of 2024, with natural gas accounting for 128.8 billion cubic feet per day and oil catering to 13.4 million barrels per day. Moreover, the country accounts for 1,031,161 wells, with a surge in horizontal wells increasing from 10% to 22% between 2014 and 2024, thus suitable for boosting the market’s exposure.

Natural Gas 2025 Pricing Strategy in the U.S. (USD per Thousand Cubic Feet)

|

Price Components |

April |

May |

June |

July |

August |

September |

|

Imports Price |

2.2 |

2.0 |

1.9 |

2.0 |

1.7 |

1.7 |

|

By Pipeline |

2.2 |

2.0 |

1.9 |

2.0 |

1.7 |

1.5 |

|

As Liquified Natural Gas |

6.7 |

6.9 |

6.9 |

7.1 |

7.4 |

15.0 |

|

Exports Price |

6.3 |

5.4 |

5.6 |

5.7 |

5.4 |

5.2 |

|

By Pipeline |

2.8 |

2.6 |

2.7 |

2.9 |

2.5 |

2.1 |

|

As Liquefied Natural Gas |

8.4 |

7.4 |

7.6 |

7.6 |

7.5 |

7.0 |

|

Citygate Price |

4.5 |

4.6 |

4.8 |

5.1 |

5.1 |

5.1 |

|

Residential Price |

16.0 |

19.2 |

23.2 |

25.4 |

26.1 |

24.5 |

Source: EIA Government

The drilling rig market in Canada is also growing due to robust oil development, oil sands, the provision of governmental clean energy funding, export and pipeline infrastructure, as well as safety and environmental regulations. As stated in an article published by the Government of Canada in November 2022, the Government of Alberta declared a standard path for net zero, based on which the federal government invested USD 300 million through the Strategic Innovation Fund’s Net Zero Accelerator approach, along with the USD 161.5 million contribution. This is extremely suitable for supporting the USD 1.6 billion project, led by Air Products Canada Ltd, to initiate advancements for clean energy and fuels in the country and secure employment opportunities. Therefore, with such funding provision, there is a huge growth opportunity for the market in the country.

Europe Market Insights

Europe in the drilling rig market is expected to emerge as the fastest-growing region during the forecast timeline. The market’s development in the region is highly attributed to selective offshore redevelopment and has matured a balanced mixture of onshore activities, especially in the East Mediterranean, Barents, and the North Sea. According to an article published by the EIB Government in October 2024, the Sopi-Tootsi farm, developed by Enefit Green, provides generous green energy to effectively power 197,000 homes every year within the region, which is approximately 10% of Estonia’s electricity demands. Besides, countries in the region have readily invested nearly €110 billion in renewable energy generation as of 2023, and the overall region presently spends 10 times more funds for clean energy, thereby driving the market’s growth.

The UK in the market is gaining increased traction, owing to targeted and advanced funding for enhancing environmental performance and operational efficiency, along with decommissioning programs and the North Sea redevelopment. As stated in the July 2025 UK Government article, the Government committed £163 million, as part of the Industrial Energy Transformation Fund, for Phase 1, 2, and 3 projects in the 2024 Autumn Budget. Besides, as per the February 2025 Energy Advice Hub Organization article, the country’s government has estimated that the energy industry significantly employs almost 400,000 skilled workers, resulting in an increase in the overall domestic exports by almost 28%. Moreover, there has been the introduction of the £315 million Industrial Energy Transformation Fund for lowering bills and reducing carbon emissions. This comprises nearly Phase 2 projects offering £70 million in grant funding, thus creating a positive impact on the market.

Norway in the market is also developing due to the high-specific rig demand for complicated wells, electrification of programs, and continuous offshore investment in the Norway Continental Shelf. As per an article published by the ITA in January 2024, the country’s government notified the strategy of promoting offshore wind power for generating 30 GW by the end of 2040. Additionally, for the upcoming 20 years, the government’s plan is focused on constructing 2 offshore wind turbines in operation to have almost 1,500 turbines. To achieve this, 11 8 MW floating turbines have been installed to cover nearly 35% of the needed energy on 5 large-scale offshore oil and gas installations. Besides, the Hywind Tampen project is projected to diminish carbon dioxide emissions by 200,000 metric tons every year, thus denoting an optimistic outlook for the market’s development.

APAC Market Insights

The Asia Pacific in the drilling rig market is predicted to witness considerable growth by the end of the stipulated period. The market’s growth in the region is uplifted by offshore redevelopment in Southeast Asia, upstream expansion in India, and China’s scale. In addition, the aspect of resilience macro momentum, and IMF projects are also responsible for bolstering the market in the overall region. According to an article published by Infrastructure Asia Organization in 2025, the region is expected to make up 61% of the newest wind capacity by the end of 2030 globally. Besides, China is deliberately leading in the international market with more than 76% of the region’s offshore wind installations. Additionally, by the end of 2030, 122 GW of standard capacity from offshore wind is projected to be derived from the region, thereby making it suitable for boosting the market’s exposure.

China in the drilling rig market is gaining increased traction due to the industrial demand, sustained upstream investment, and upscaling. As stated in an article published by the State Council Information Office in February 2025, the China National Petroleum Corporation (CNPC) declared that it has successfully accomplished the drilling of the deepest vertical well in the overall region, with a borehole that reached 10,910 meters in the country’s northwestern desert. Based on this completion, the country effectively strengthened its ultra-deep oil and gas exploration capabilities. Additionally, with upgraded domestically developed drilling equipment and technologies, scientists also initiated a suitable approach for understanding the Earth, ancient climate modifications, and geological evolution. Therefore, with such development, the market is poised to grow in the country.

India in the market is also growing, owing to the support provided by robust upstream redevelopment, industrial decarbonization programs, and unconventional resource exploration. As per an article published by the PIB in July 2025, the country’s 3.5% share in the international chemical value chains, along with its chemical trade deficit, amounting to USD 31 billion as of 2023, has readily underscored its increased dependence on specialty chemicals and imported feedstock. Besides, with targeted reforms gradually encompassing a wide-ranging non-fiscal and fiscal interventions is poised to enable the country to account for a USD 1 trillion chemical industry and significantly gain 12% of global value chain share by the end of 2040. Furthermore, the 2030 vision for the country is to emerge as the international chemical manufacturing powerhouse with a 5% to 6% share of the global chemical value chain, thus suitable for boosting the market’s growth.