- An Outline of the Global Downhole Fishing Equipment Market

- Market Definition

- Market Segmentation

- Product Overview

- Assumptions & Abbreviations

- Research Methodology & Approach

- Research Process

- Primary Research

- Manufacturers/Service Providers

- Suppliers/ Distributors

- End Users

- Secondary Research

- Market Size Estimation

- Summary of the Report for Key Decision Makers

- Forces of Market Constituents

- Factors/drivers impacting the growth of the market

- Market trends for better business practices

- Key Market Opportunities for Business Growth

- Major Roadblocks for the Market Growth

- Decarbonization Strategy and Carbon Credit Benefits for Market Players

- Global Government Decarbonization Plans/Goals by Each Country under 2015 Agreement Agreed by 200 Countries

- Measures taken by Countries to Reduce Carbon Footprints

- Carbon Credits and Subsidy Plans/Benefits Rolled out by the Government for Market Players

- Effective Ways to Harness Carbon-Credits and Impact on Profit Margins

- Demand Impact on the Companies Opting for Carbon Credits

- Government Regulation: How they would aid business?

- Technology Transition and Adoption Analysis

- Industry Risk Analysis

- Global Economic Outlook: Challenges for Global Recovery and its Impact on Global Downhole Fishing Equipment Market

- Ukraine-Russia crisis

- Potential US economic slowdown

- Impact of Recession in the Global Economy

- Industry Pricing Benchmarking and Analysis

- Industry Growth Outlook

- Industry Supply Chain Analysis

- Analysis on the Oil & Gas Sector and Demand for Fishing Equipment

- Porter’s Five Forces Analysis

- Analysis on Application and Running Parameters for Mills

- Analysis on Case Study

- Company-wise Product Feature Analysis

- Analysis on the Future Trends in the Downhole Tool Industry

- Competitive Positioning: Strategies to Differentiate a Company From its Competitor

- Competitive Model: A Detailed Inside View for Investors

- Company Market Share (2022)

- Business Profile of Key Enterprise

- SHANDONG SAIGAO GROUP CORPORATION

- Tobitem DownHole Solutions

- Innovex

- DOSCO

- Wenzel Downhole Tools

- SLB

- Coil Solutions, Inc.

- Halliburton

- Baker Hughes Company

- NOV Inc.

- Weatherford

- Wellbore Integrity Solutions

- Other major players

- Global Downhole Fishing Equipment Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Thousand Units), and Compound Annual Growth Rate (CAGR)

- Growth Factors, Future Trends, and Recent Developments in the Downhole Fishing Tool Industry

- Year-on-Year (YoY) Growth Trend Analysis

- Global Downhole Fishing Equipment Market Valuation, Business Viewpoint, and Forecast by Offering, 2023-2036

- Solution, Market Value (USD Million) and CAGR, 2023-2036F

- Services, Market Value (USD Million) and CAGR, 2023-2036F

- Global Downhole Fishing Equipment Market Valuation, Business Viewpoint, and Forecast by Product Type, 2023-2036

- Sub-segmented by Internal and External Cutting Tools, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Hydraulic External Cutters, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Multi String Cutter, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Inside Hydraulic Cutter, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Sub-segmented by Internal Catch Tools, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Fishing Spears, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Taper Tap, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Packer Retrievers, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend,2023-2036F

- Others, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Sub-segmented by External Catch Tools, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Overshot, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Box Tap/ Die Collar, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Sub-segmented by Milling, Drilling & Washover Tools, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Cone Buster Mill, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Pilot Mill, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Economill / Cement Mill, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Drive Subs, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Rotary Shoe, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Sub-Segmented by Junk Retrieval Tool, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Ditch Magnet, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Junk Magnet, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Cutting & Underreaming Tools, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Connectors & Disconnects, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Handling Tools, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Sub-segmented by Remedial & Repair Tools, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Casing & Tubing Patches, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Rollers & Scrapers, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Impacting Tools, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Wash & Jetting Equipment, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Accessory Tools, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Sub-segmented by Internal and External Cutting Tools, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Global Downhole Fishing Equipment Market Outlook & Projections, Opportunity Assessment by Deployment, 2023-2036

- Onshore, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Offshore, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Global Downhole Fishing Equipment Market Demand Outlook & Projections, Market Performance by Geography, 2022 to 2035

- Market Overview

- Market Revenue by Value (USD Million), Volume (Thousand Units) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Comparative Analysis

- North America

- Mexico

- Rest of World

- Global Downhole Fishing Equipment Market Valuation, Business Viewpoint, and Forecast by Offering, 2023-2036

- Cross Analysis of Offering w.r.to. Deployment (USD Million), 2022

- North America Downhole Fishing Equipment Market Outlook & Projections, Opportunity Assessment, 2022 to 2035

- Market Overview

- Market Revenue by Value (USD Million), Volume (Thousand Units), and Compound Annual Growth Rate (CAGR)

- Growth Factors, Future Trends, and Recent Developments in the Downhole Fishing Tool Industry

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- North America Downhole Fishing Equipment Market Valuation, Business Viewpoint, and Forecast by Offering, 2023-2036

- Solution, Market Value (USD Million) and CAGR, 2023-2036F

- Services, Market Value (USD Million) and CAGR, 2023-2036F

- North America Downhole Fishing Equipment Market Valuation, Business Viewpoint, and Forecast by Product Type, 2023-2036

- Sub-segmented by Internal and External Cutting Tools, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Hydraulic External Cutters, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Multi String Cutter, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Inside Hydraulic Cutter, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Sub-segmented by Internal Catch Tools, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Fishing Spears, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Taper Tap, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Packer Retrievers, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend,2023-2036F

- Others, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Sub-segmented by External Catch Tools, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Overshot, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Box Tap/ Die Collar, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Sub-segmented by Milling, Drilling & Washover Tools, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Cone Buster Mill, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Pilot Mill, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Economill / Cement Mill, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Drive Subs, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Rotary Shoe, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Sub-Segmented by Junk Retrieval Tool, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Ditch Magnet, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Junk Magnet, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Cutting & Underreaming Tools, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Connectors & Disconnects, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Handling Tools, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Sub-segmented by Remedial & Repair Tools, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Casing & Tubing Patches, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Rollers & Scrapers, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Impacting Tools, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Wash & Jetting Equipment, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Accessory Tools, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Sub-segmented by Internal and External Cutting Tools, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- North America Downhole Fishing Equipment Market Outlook & Projections, Opportunity Assessment by Deployment, 2023-2036

- Onshore, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- Offshore, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2023-2036F

- North America Downhole Fishing Equipment Market Outlook & Projections, Opportunity Assessment by Country, 2023-2036

- US, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- Canada, Market Value (USD Million), Volume (Thousand Units) CAGR & Y-o-Y Growth Trend, 2023-2036F

- North America Downhole Fishing Equipment Market Valuation, Business Viewpoint, and Forecast by Offering, 2023-2036

- US Downhole Fishing Equipment Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Thousand Units), and Compound Annual Growth Rate (CAGR)

- Growth Factors, Future Trends, and Recent Developments in the Downhole Fishing Tool Industry

- Year-on-Year (YoY) Growth Trend Analysis

- US Downhole Fishing Equipment Market Valuation, Business Viewpoint, and Forecast by Offering, 2023-2036

- US Downhole Fishing Equipment Market Valuation, Business Viewpoint, and Forecast by Product Type, 2023-2036

- US Downhole Fishing Equipment Market Outlook & Projections, Opportunity Assessment by Deployment, 2023-2036

- Canada Downhole Fishing Equipment Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Thousand Units), and Compound Annual Growth Rate (CAGR)

- Growth Factors, Future Trends, and Recent Developments in the Downhole Fishing Tool Industry

- Year-on-Year (YoY) Growth Trend Analysis

- Canada Downhole Fishing Equipment Market Valuation, Business Viewpoint, and Forecast by Offering, 2023-2036

- Canada Downhole Fishing Equipment Market Valuation, Business Viewpoint, and Forecast by Product Type, 2023-2036

- Canada Downhole Fishing Equipment Market Outlook & Projections, Opportunity Assessment by Deployment, 2023-2036

- Mexico Downhole Fishing Equipment Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Thousand Units), and Compound Annual Growth Rate (CAGR)

- Growth Factors, Future Trends, and Recent Developments in the Downhole Fishing Tool Industry

- Year-on-Year (YoY) Growth Trend Analysis

- Mexico Downhole Fishing Equipment Market Valuation, Business Viewpoint, and Forecast by Offering, 2023-2036

- Mexico Downhole Fishing Equipment Market Valuation, Business Viewpoint, and Forecast by Product Type, 2023-2036

- Mexico Downhole Fishing Equipment Market Outlook & Projections, Opportunity Assessment by Deployment, 2023-2036

- Rest of World Downhole Fishing Equipment Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Thousand Units), and Compound Annual Growth Rate (CAGR)

- Growth Factors, Future Trends, and Recent Developments in the Downhole Fishing Tool Industry

- Year-on-Year (YoY) Growth Trend Analysis

- Rest of World Downhole Fishing Equipment Market Valuation, Business Viewpoint, and Forecast by Offering, 2023-2036

- Rest of World Downhole Fishing Equipment Market Valuation, Business Viewpoint, and Forecast by Product Type, 2023-2036

- Rest of World Downhole Fishing Equipment Market Outlook & Projections, Opportunity Assessment by Deployment, 2023-2036

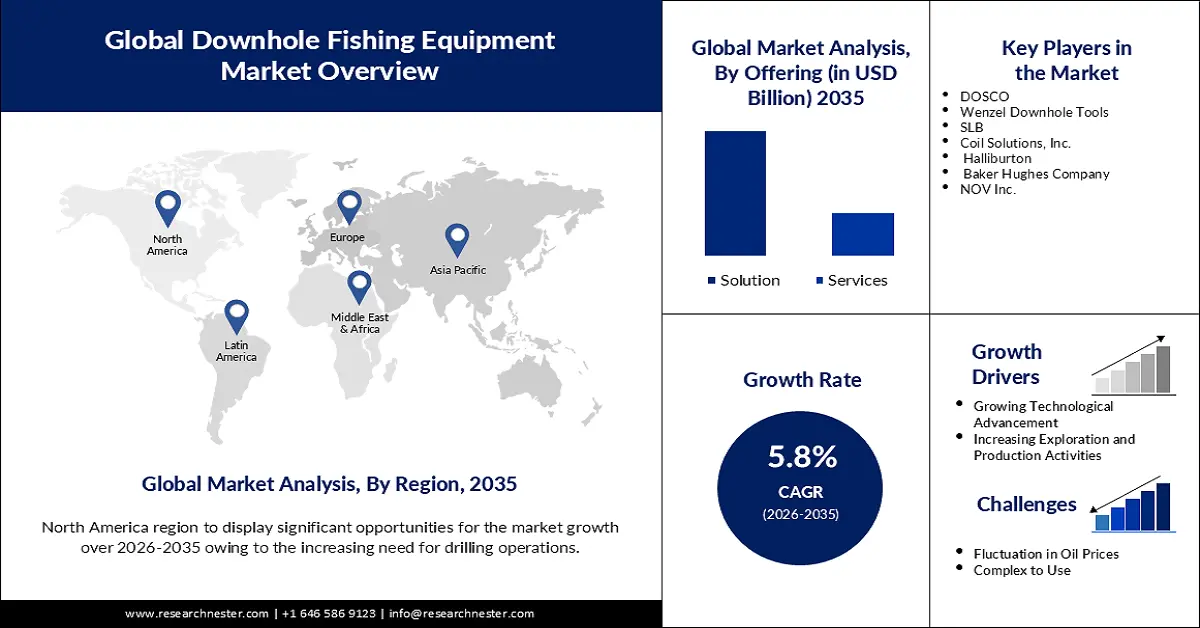

Downhole Fishing Equipment Market Outlook:

Downhole Fishing Equipment Market size was valued at USD 1.48 billion in 2025 and is likely to cross USD 2.6 billion by 2035, expanding at more than 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of downhole fishing equipment is assessed at USD 1.56 billion.

The need for downhole fishing gear is driven by the large projects related to the drilling activities. In 2023, there are plans by a private company from Mexico to drill eight exploration wells on Area 1 which covers three fields in the Amca and Mishiton basins as well as Tecoalli, moreover, it has recently installed a floating production storage and unloading unit that simplifies its operations.

Moreover, older or more antiquated infrastructure may be more susceptible to unanticipated issues including equipment failure or wellbore obstructions. Downhole fishing equipment become essential for mitigating these risks and ensuring safe and efficient operations. In addition to impairing the oil and gas industry's capacity to satisfy the downhole fishing equipment market growing demand, this also raises the possibility of an ecological catastrophe due to oil leaks and other operational problems. Globally maintaining the effectiveness of oil and gas activities requires downhole fishing equipment. They keep manufacturing moving forward and reduce downtime.

Key Downhole Fishing Equipment Market Insights Summary:

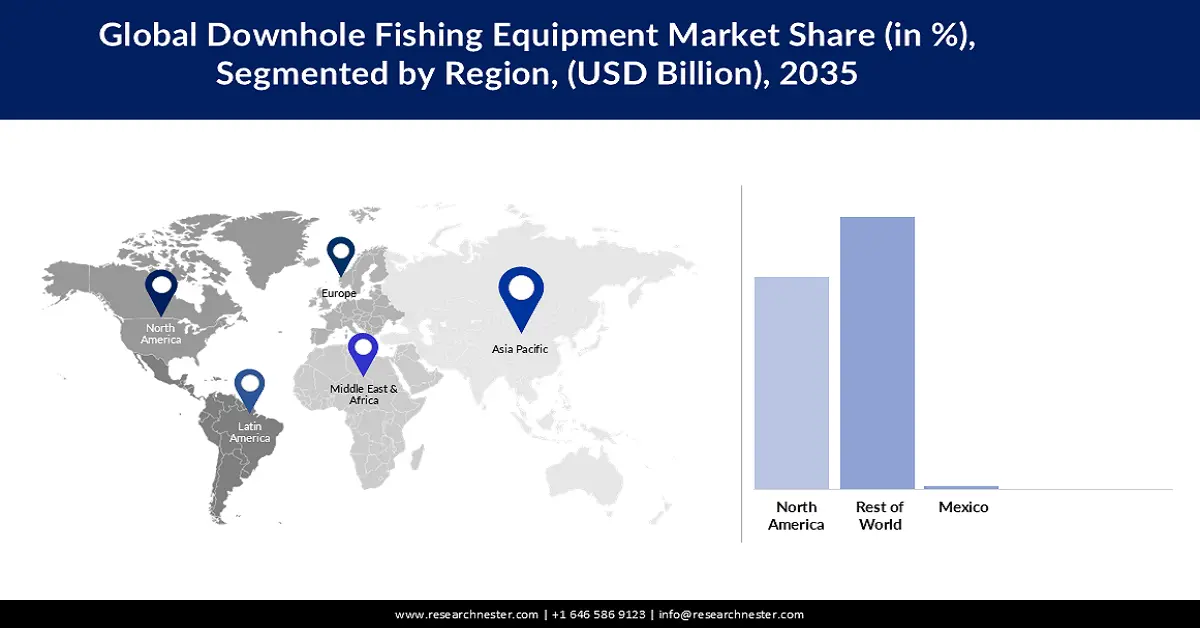

Regional Insights:

- By 2035, North America is projected to command a dominant 43% revenue share in the downhole fishing equipment market as operators enhance well intervention activity fueled by the rising need for efficient drilling operations.

- The rest of world region is anticipated to record a 5.5% CAGR through 2026–2035, supported by expanding exploration drilling initiatives and increasing land-rig deployments across Asia-Pacific.

Segment Insights:

- By 2035, the solution segment in the downhole fishing equipment market is expected to secure the highest revenue share as operators adopt integrated recovery offerings propelled by the necessity to minimize downtime during drilling.

- The onshore segment is set to achieve the largest revenue share with the highest CAGR over 2026–2035, reinforced by its comparatively lower operating costs relative to offshore activity.

Key Growth Trends:

- Increasing Technological Advancements

- Increasing Number of New Development, Launches and Partnerships among Market Players

Major Challenges:

- Damage to Downhole Fishing Equipment

- Fluctuating Oil Prices

Key Players: Shandong Saigao Group Corporation, Tobitem DownHole Solutions, Innovex, DOSCO Co Ltd., Wenzel Downhole Tools, SLB, Coil Solutions, Inc., Halliburton Company, Baker Hughes Company, NOV Inc.

Global Downhole Fishing Equipment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.48 billion

- 2026 Market Size: USD 1.56 billion

- Projected Market Size: USD 2.6 billion by 2035

- Growth Forecasts: 5.8%

Key Regional Dynamics:

- Largest Region: North America (43% Share by 2035)

- Fastest Growing Region: Rest of World

- Dominating Countries: United States, China, India, Canada, United Kingdom

- Emerging Countries: Brazil, Indonesia, Australia, Saudi Arabia, UAE

Last updated on : 26 November, 2025

Downhole Fishing Equipment Market - Growth Drivers and Challenges

Growth Drivers

-

Increasing Technological Advancements- The downhole fishing equipment market has been impacted by technological developments. The efficacy and efficiency of these instruments have increased thanks to advancements in automation, materials, and sensors. In order to improve the effectiveness of interventions, these services offer real-time footage, dimension, temperature, pressure, and velocity data during operations. It reduces the need for several runs and highlights the advantages of good imaging, fewer runs, and more success in downhill operations.

-

Increasing Number of New Development, Launches and Partnerships among Market Players- Increasing number of new development, product launches and partnerships among the market players is estimated to boost the downhole fishing equipment market expansion in the forecast period. As an instance, Axis' downhole division announced in July 2022 the introduction of drilling motors intended for use on coil tubular and stick pipe. Their fishing tool specialists provide round-the-clock support, supported by decades of experience, to handle a wide range of downhole problems. Its 1.69" to 3.5" OD downhole drilling motors are examined both before and after installation to ensure that the motors fulfill original equipment manufacturer (OEM) requirements.

Challenges

-

Damage to Downhole Fishing Equipment - Downhole fishing equipment, such as specialized tools and implements used in oil and gas drilling operations, can be expensive to produce and purchase. When this equipment is damaged during drilling, it requires costly replacement, which can put a strain on drilling companies' budgets. Additionally, equipment damage can pose safety risks to employees and the environment. Damaged tools can malfunction, causing accidents and potentially hindering future drilling or production operations.

-

Fluctuating Oil Prices - Crude oil market volatility has increased significantly in recent years due to frequent clashes in the Middle East, the Russia-Ukraine conflict and other regions. China depends on imported crude oil to maintain high-quality economic growth, and the volatility of the global crude oil market has increased the need to assess the impact of oil price fluctuations on the economy of China. Although studies have shown that crude oil market fluctuations do not significantly affect short-term economic growth, they also show that oil price fluctuations clearly affect long-term economic growth term. Volatility in the global oil industry is discouraging investments in deep-hole mining operations and hindering the growth of the global bottom fishing tackle market.

-

Complexities associated with Downhole Fishing equipment is Set to Hamper the Downhole Fishing Equipment Market Share in the Upcoming Future.

Downhole Fishing Equipment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 1.48 billion |

|

Forecast Year Market Size (2035) |

USD 2.6 billion |

|

Regional Scope |

|

Downhole Fishing Equipment Market Segmentation:

Offering Segment Analysis

Downhole fishing equipment market from the solution segment is anticipated to capture the highest revenue by the end of 2035. The market offers a comprehensive range of solutions to recover lost equipment, debris or stuck pipes in oil and gas wells, ensuring smooth drilling operations by reducing downtime operations and costly interventions. The downhole fishing tool line includes downhole fishing, milling, cleaning and cutting tools, waste collectors, jerk assemblies, pipe and casing patches, accessory tools and others to meet every requirement customer demand. Many players in the market offer integrated fishing solutions that combine tools, technology and services. They provide a one-stop shop for well intervention needs, ensuring seamless operations.

Deployment Segment Analysis

In terms of deployment, the onshore segment in the downhole fishing equipment market is set to capture the highest revenue growing at a largest CAGR over the forecast period. However, the offshore segment is set to hold a significant CAGR in the forecast period and grow substantially. When drilling offshore, only one platform is used, which can be fixed or mobile. Offshore drilling costs are higher than onshore drilling. Fixed platforms are more expensive than mobile platforms. Most production facilities are located on the coast, near offshore drilling platforms. Offshore operations often require more durable and rugged tools due to harsh conditions. Currently, most offshore oil and gas leasing and development occurs in the central and western Gulf of Mexico, with thousands of rigs operating at depths of up to 10,000 feet or more. Additionally, in 2021, federal Gulf of Mexico offshore oil and gas production accounted for about 15% of U.S. crude oil production and about 2% of U.S. dry natural gas production.

Our in-depth analysis of the global downhole fishing equipment market includes the following segments:

|

Offering |

|

|

Product Type |

|

|

Deployment |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Downhole Fishing Equipment Market - Regional Analysis

North America Market Insights

North America industry is predicted to dominate majority revenue share of 43% by 2035, driven by growing need for efficient drilling operations in the region. The demand for downhole fishing equipment in North America is driven by the growing need for efficient drilling operations. The North American oil drilling industry saw a surge in activity after the pandemic began, as demand for crude oil returned to pre-Covid levels. North America is expected to see significant investments in well intervention infrastructure. Following the boom in US shale oil and natural gas production, the country has focused on building new intervention wells to meet growing demand for crude oil and natural gas. According to an energy report, by 2027, North America is expected to account for 64% of all potential completed oil and gas wells. Additionally, according to World Oil, US well production is expected to increase 8.2% in 2023, reaching 20,655 wells. Drilling footage is expected to grow at a slightly higher rate, reaching 289 million feet in 2023, an increase of 8.7%.

Rest of World Market Insights

The downhole fishing equipment market for rest of world is anticipated to account for a CAGR of 5.5% in the forecast period. The rest of the world includes Europe, Asia-Pacific countries, Latin American countries except Mexico, the Middle East and Africa. The Asia-Pacific region is seeing an increase in the number of exploration drilling projects. Additionally, as of December 2022, there were 197 platforms operating in the Asia-Pacific region, of which 116 were onshore, excluding operations in China. In the APAC region, there are 63 onshore platforms operating in India, 18 in Australia and 26 in Indonesia. An increase in the number of land-based rigs often leads to higher demand for bottom fishing tools.

Downhole Fishing Equipment Market Players:

- Shandong Saigao Group Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Tobitem DownHole Solutions

- Innovex

- DOSCO Co Ltd.

- Wenzel Downhole Tools

- SLB

- Coil Solutions, Inc.

- Halliburton Company

- Baker Hughes Company

- NOV Inc.

Recent Developments

- April 28, 2020: DOSCO announces new cooperation agreement in Norway with Innovar Solutions. After meeting with company representatives in 2019, both companies agreed that cooperation would be mutually beneficial. Dosco is confident that this new partnership agreement will be a significant step forward in providing the best tools available.

- September 4, 2023: Venture Global LNG announces long-term expansion plan to expand LNG export capacity from 70 million tonnes per annum (MTPA) to over 100 MTPA. To support this effort, Venture Global and Baker Hughes have signed an Enhanced Major Equipment Supply Agreement to provide additional liquefaction transmission systems and islanding systems for Venture Global's future LNG export projects. With Venture Global CEO Mike Sabel and Baker Hughes Chairman and CEO Lorenzo Simonelli in attendance, the expansion deal was announced on the sidelines of Gastech in Singapore.

- Report ID: 5369

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Downhole Fishing Equipment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.