Document Management System Market Outlook:

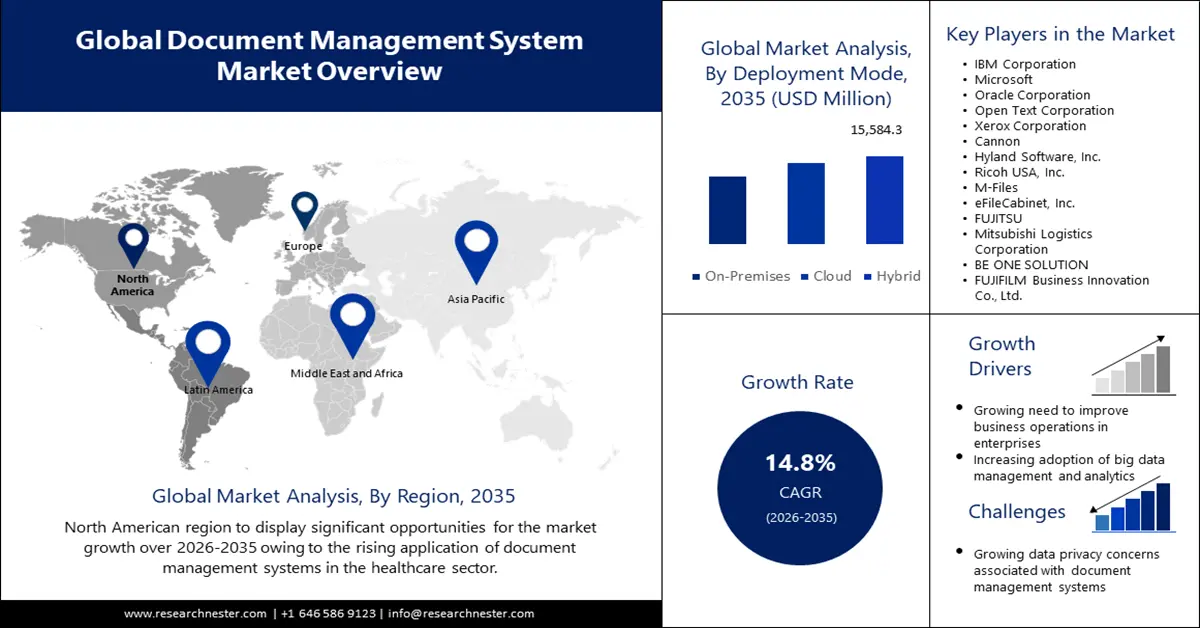

Document Management System Market size was over USD 9.34 billion in 2025 and is poised to exceed USD 37.13 billion by 2035, growing at over 14.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of document management system is estimated at USD 10.58 billion.

The global market is experiencing rapid growth, driven by increasing digital transformation initiatives, regulatory compliance requirements, and the shift towards cloud-based solutions. Key trends include the integration of artificial intelligence, and machine learning for automated document processing, natural language processing for intelligent search capabilities, and blockchain technologies for enhanced security and authentication.

Stringent data protection regulations, including GDPR, HIPAA, and Sarbanes-Oxley, which mandate secure document storage and management, is also driving the market. In August 2023, taxpayers were permitted to go paperless for IRS correspondence by the 2024 filing season, intending to contribute towards the IRS’s aim to achieve paperless processing for all tax returns by the 2025 filing season. Such initiatives adopted by the governments worldwide are also boosting the market growth significantly.

Key Document Management System Market Insights Summary:

Regional Highlights:

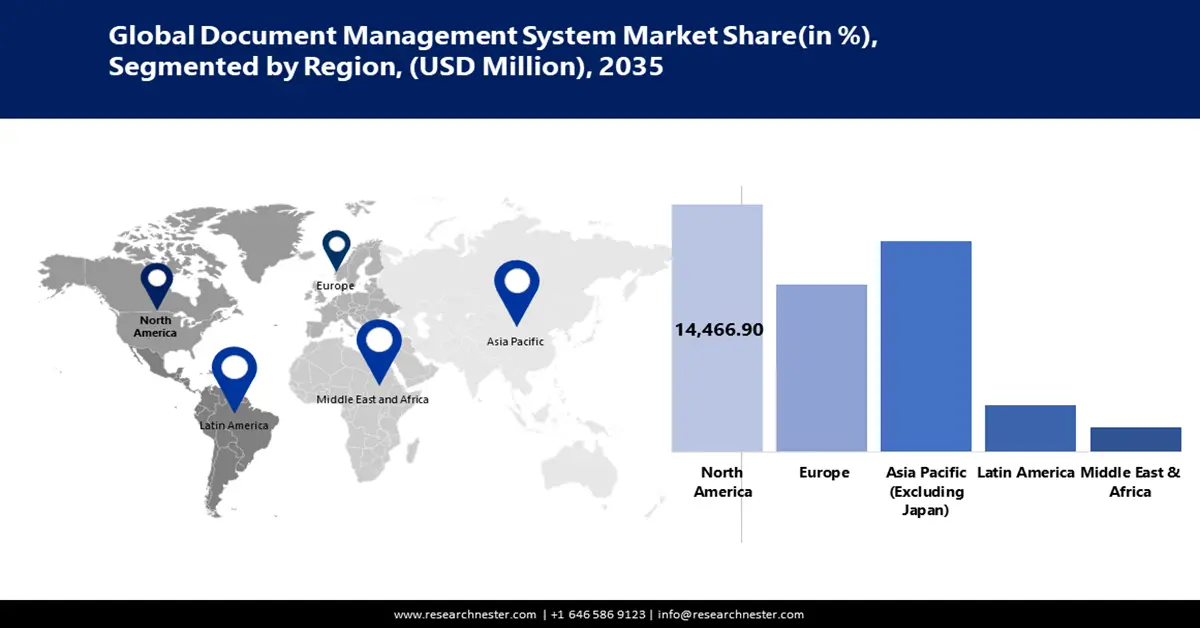

- North America document management system market will hold over 34% share by 2035, driven by the intensifying adoption of cloud-hosted document management systems and significant government IT spending.

- Asia Pacific market will achieve the highest CAGR during 2026-2035, driven by government initiatives to boost adoption of document management systems, public-sector compliance needs, and rise of AI-powered automation.

Segment Insights:

- The solutions offering segment segment in the document management system market is expected to experience the fastest growth over 2026-2035, driven by the rising need for electronic document management solutions in organizations.

- The hybrid deployment mode segment in the document management system market is poised for substantial growth over 2026-2035, influenced by hybrid cloud benefits simplifying processes and improving productivity.

Key Growth Trends:

- Paperless strategies by governments propelling market growth

- Growing cloud computing and software-as-a-service implementation

Major Challenges:

- Integration of document management systems with internal applications incurs high costs

- Growing data privacy concerns associated with document management systems

Key Players: IBM Corporation, Microsoft, Oracle Corporation, Open Text Corporation, Xerox Corporation, Cannon, Hyland Software, Inc., Ricoh USA, Inc., M-Files, eFileCabinet, Inc., FUJITSU, Mitsubishi Logistics Corporation, BE ONE SOLUTION, FUJIFILM Business Innovation Co., Ltd.

Global Document Management System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.34 billion

- 2026 Market Size: USD 10.58 billion

- Projected Market Size: USD 37.13 billion by 2035

- Growth Forecasts: 14.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, China

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 11 September, 2025

Document Management System Market Growth Drivers and Challenges:

Growth Drivers

-

Paperless strategies by governments propelling market growth: Implementation of several paperless strategies worldwide to enhance efficiency, reduce costs, and promote sustainability, drives the growth of the document management system market. Initiatives such as e-governance, digital documentation, and regulatory mandates push organizations to adopt DMS for secure storage, retrieval, and compliance. For instance, in 2021, the Dubai government announced going fully paper-free, removing over 336 million sheets of paper used for government transactions every year, marking a major step towards making Dubai a smart city of the future.

-

Growing cloud computing and software-as-a-service implementation: Firms are adopting various strategies for cloud computing and software implementation in document management systems. For Instance, in November 2021, Open Text Corporation revealed a detailed update to the OpenText Content Cloud, the Cloud Editions (CE) 21.4 launch at OpenText World. The platform is further expected to have profound integrations with Salesforce and Microsoft 365. Such developments are projected to boost the market significantly in the upcoming years.

Challenges

-

Integration of document management systems with internal applications incurs high costs: The average prices of the most popular document management systems can vary significantly based on the number of consumers, the features required, the installation fees, and the system's type (cloud-based, on-premises, or hybrid). In addition to the price of the software itself, the costs of system upkeep and installation must also be considered. Even though the preliminary cost of the software may be low, there are frequently additional costs to consider. Numerous of these price barriers contribute to the market's slowing expansion.

-

Growing data privacy concerns associated with document management systems: It is challenging the market by increasing the need for compliance with regulations such as GDPR and HIPAA, securing against unauthorised access, and preventing data breaches. Organizations must implement encryption, role-based access controls, and secure cloud storage to protect sensitive information. Additionally, user concerns over data tracking, third-party access, and cyber threats make trust and transparency essential for DMS providers to remain viable.

Document Management System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.8% |

|

Base Year Market Size (2025) |

USD 9.34 billion |

|

Forecast Year Market Size (2035) |

USD 37.13 billion |

|

Regional Scope |

|

Document Management System Market Segmentation:

Offering Segment Analysis

Based on offering, the solution segment in the document management system market is estimated to grow at the fastest CAGR over the projected time frame. The market is being driven by an increasing need for solutions that allow organizations to electronically incorporate traditional physical document filing processes. For instance, in April 2021, IBM announced key innovations across the company’s storage portfolio. The innovations are intended to fuse IBM's general parallel file system technology, and advance data access and management across progressively multifaceted hybrid cloud environments for larger data availability and resilience. As organizations go farther into the digital arena, the demand for the solutions segment is further expected to increase.

Deployment Mode Segment Analysis

Based on deployment mode, the hybrid segment in is estimated to expand at a substantial growth rate over the projected time frame. Hybrid cloud platforms enable organizations to cover all of their bases while simplifying processes, streamlining invoicing and support services, providing the benefits of both on-premise and cloud deployment modes. For instance, in February 2024, Xerox Holdings Corporation announced a brand-new collection of solutions and services, designed to fast-track digital revolution, productivity, and security for workplaces in hybrid setting, while saving time and reducing IT hassles.

Our in-depth analysis of the global document management system market includes the following segments:

|

Offering |

|

|

Deployment Mode |

|

|

Organization Size |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Document Management System Market Regional Analysis:

North American Market Insights

North America industry is expected to dominate the majority revenue share of 34% by 2035 owing to the intensifying implementation of cloud-hosted document management systems in the region. According to the U.S. Government Accountability Office, in May 2023, the U.S. government devotes more than USD 100 billion to information technology every year. Furthermore, the CSIS in July 2023 stated that the U.S. government spent over USD 100 billion in the 2022 fiscal year on IT, with USD 12 billion spent on cloud services.

The market in the U.S. is robust and continually evolving, driven by the need for efficient information management and regulatory compliance across various industries. The U.S. market’s focus on digital transformation and operational efficiency continues to drive the adoption of advanced DMS solutions further. Additionally, the growing shift towards cloud-based solutions is accelerating market growth.

APAC Market Insights

The Asia Pacific market is anticipated to grow at the highest CAGR till 2035. The governments boosted the adoption of document management systems, intending to prevent illegal trade and transportation and to improve workflow. The cumulative need for public-sector organizations to maintain compliance requirements while securely archiving old information and records is another factor driving market expansion in the region. For instance, in 2022, India-based Cybernetik Technologies Pvt. Ltd. partnered with CloudFront for the deployment of its document management system.

India market witnesses a strong emphasis on customer communications management. The country’s businesses, particularly in banking, insurance, and healthcare, are adopting advanced document management solutions to enhance efficiency and maintain compliance with data security laws. Rise of AI-powered automation is also a key driver, allowing organizations to streamline their workforce.

Document Management System Market Players:

- IBM Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Microsoft

- Oracle Corporation

- Open Text Corporation

- Xerox Corporation

- Cannon

- Hyland Software, Inc.

- Ricoh USA, Inc.

- M-Files

- eFileCabinet, Inc.

- FUJITSU

- Mitsubishi Logistics Corporation

- BE ONE SOLUTION

- FUJIFILM Business Innovation Co., Ltd

Key companies in the document management system market are increasingly adopting cloud-based solutions to enhance scalability and accessibility. They are also integrating artificial and machine learning technologies to automate workflows and improve data processing. Additionally, there is a strong emphasis on mobile accessibility and advanced security measures to support remote work and ensure data protection.

Recent Developments

- In May 2024, Noventiq announced the launch of uDMS, which is a smart, serverless document management system intended to enhance operational productivity and flexibility for businesses of all sizes.

- In October 2022, Oracle Corporation and HSBC partnered, intending to accelerate the bank’s digital transformation. Under the multi-year agreement, HSBC will upgrade and migrate select database systems to Oracle Exadata Cloud@Customer, a cloud platform delivered as a managed infrastructure service in HSBC’s own data centers.

- In January 2022, Ricoh USA, Inc. introduced RICOH Claims Management Services, an intent-integrated service that addresses a significant obstacle for insurance providers: accelerating claims resolution to boost retention and satisfaction with clients.

- In September 2021, Laserfiche launched Laserfiche Cloud in the Europe, Middle East and Africa (EMEA) region, intending to deliver an advanced and trusted system for secured content management and automated business processes across the enterprise.

- Report ID: 5107

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Document Management System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.