DNA Repair Drugs Market Outlook:

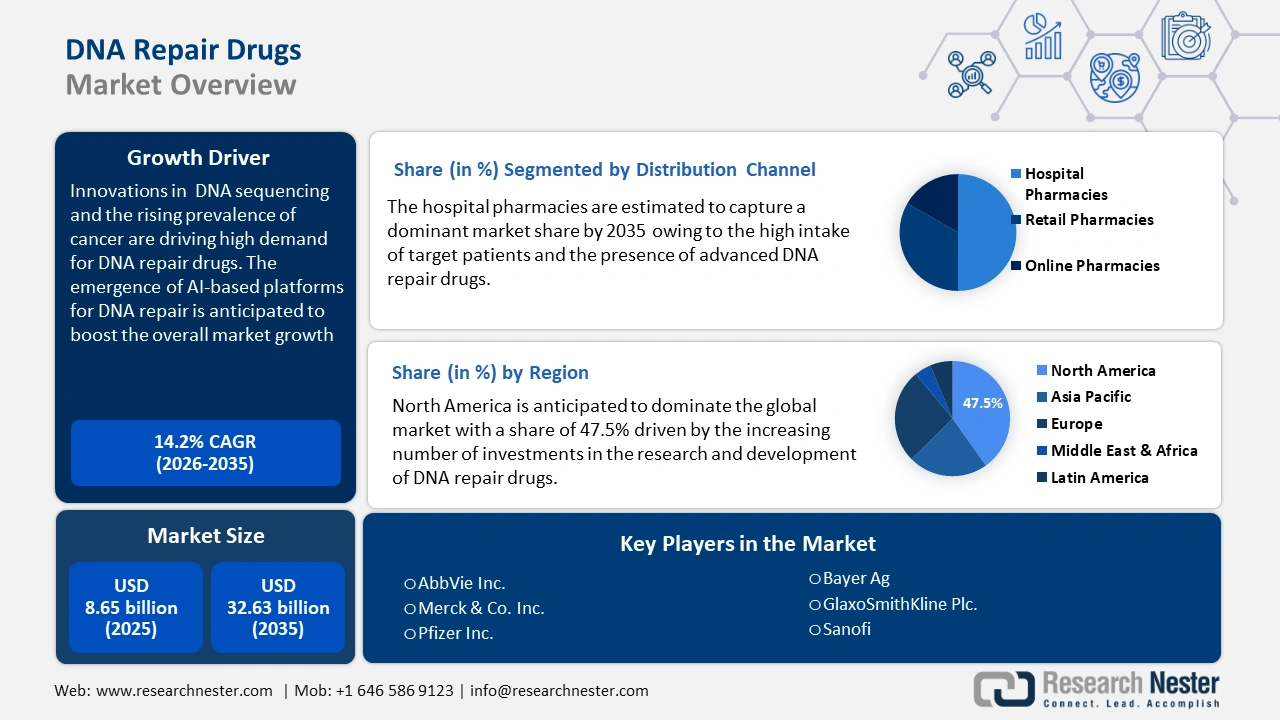

DNA Repair Drugs Market size was valued at USD 8.65 billion in 2025 and is expected to reach USD 32.63 billion by 2035, registering around 14.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of DNA repair drugs is evaluated at USD 9.76 billion.

The advancements in DNA sequencing and the rising prevalence of cancer are some of the major factors boosting the DNA repair drugs market growth. For instance, according to the World Health Organization report, in 2022, an estimated 20 million new cancer cases were detected globally.

Several cancer research organizations including Cancer Research UK are investing heavily in research and development activities to develop advanced DNA repair drugs for effective patient care. PARP inhibitors are emerging as one of the effective technologies for the treatment of breast, prostate, and other types of cancer. Such developments are anticipated to double the profits of DNA repair drug producers in the coming years.

Key DNA Repair Drugs Market Insights Summary:

Regional Highlights:

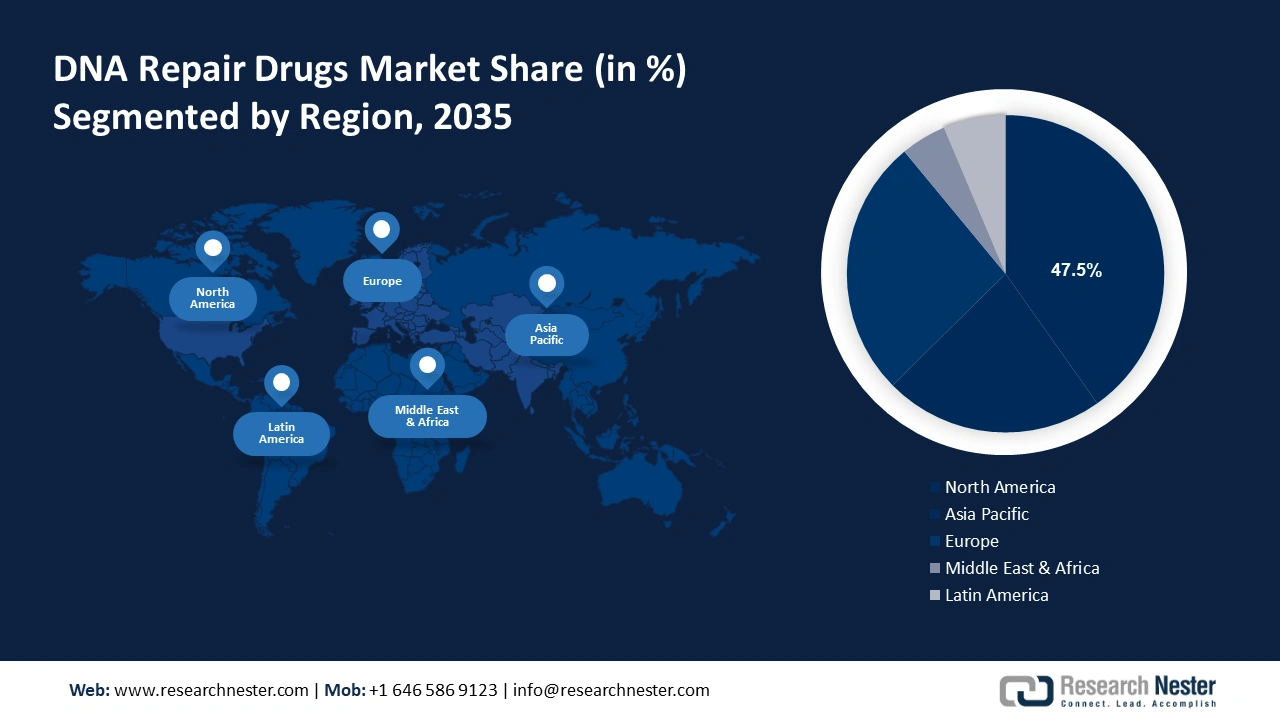

- North America’s DNA repair drugs market is anticipated to capture 47.5% share by 2035, driven by rising burden of cancer and increasing investments in DNA repair drugs R&D.

- Asia Pacific market will exhibit the fastest growth during the forecast timeline, driven by rapid advancements in healthcare infrastructure and increased awareness of chronic disorders.

Segment Insights:

- The hospital pharmacies segment in the DNA repair drugs market is projected to achieve a dominant share by 2035, driven by skilled pharmacists, advanced therapeutic solutions, and high patient admission rates.

- The parp inhibitors segment in the dna repair drugs market is projected to hold the highest market share by 2035, driven by increasing awareness and ongoing R&D in targeted cancer drugs.

Key Growth Trends:

- Integration of AI and genomic developments

- Aging and neurodegenerative diseases

Major Challenges:

- High product cost and lack of awareness

- Lengthy approval processes

Key Players: Pfizer Inc., AstraZeneca plc, Merck & Co., Inc., GlaxoSmithKline plc, Onxeo S.A., Kura Oncology, Inc., Clovis Oncology, Inc., Tesaro, Inc. (GSK), Sierra Oncology, Inc., Artios Pharma Limited.

Global DNA Repair Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.65 billion

- 2026 Market Size: USD 9.76 billion

- Projected Market Size: USD 32.63 billion by 2035

- Growth Forecasts: 14.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (47.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 18 September, 2025

DNA Repair Drugs Market Growth Drivers and Challenges:

Growth Drivers

- Integration of AI and genomic developments: The advancements in genomics are expected to significantly influence the DNA repair drugs market growth. The protein solutions of DNA repair genes can detect and fix mutations in other genes. The integration of artificial intelligence in DNA repair and sequencing is one of the latest market trends uplifting the profits of the key players. For instance, Tailwind Biotech is a Denmark-based start-up that develops synthetic DNA using artificial intelligence (AI). The company’s AI-based platform optimizes DNA sequencing and improves gene expression levels leading to high bioproduction yields.

- Aging and neurodegenerative diseases: With the rise in the aging population, the prevalence of age-related diseases such as cancer and neurodegenerative disorders is also increasing. DNA repair drugs are effective and essential in addressing such conditions and often involve impaired DNA repair mechanisms. For instance, as per WHO analysis, 1 in 6 people across the world will be more than 60 years of age by 2030. DNA repair drugs play a vital role by protecting neurons from damage and offering potential therapeutic benefits.

Challenges

- High product cost and lack of awareness: Innovation is an expensive process, developing an advanced DNA repair drug requires high investments in research, production, and clinical trials. These high production costs directly increase the drug price, which deters low-budget patients from such advancements. Furthermore, the lack of awareness among people in developing regions such as Latin America, Asia Pacific, and MEA limits the sales of DNA repair drugs to some extent.

- Lengthy approval processes: Obtaining regulatory approval for DNA repair drugs is quite challenging due to strict document requirements and a long review process. A lengthy approval process often results in a loss in current market trends and the accessibility to innovative therapeutic approaches. Also, these complex trial and approval processes hamper the profits of DNA repair drug producers.

DNA Repair Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.2% |

|

Base Year Market Size (2025) |

USD 8.65 billion |

|

Forecast Year Market Size (2035) |

USD 32.63 billion |

|

Regional Scope |

|

DNA Repair Drugs Market Segmentation:

Distribution Channel Segment Analysis

Based on distribution channel, hospital pharmacies are projected to hold a dominant DNA repair drugs market share by 2035. Hospital pharmacies are equipped with skilled pharmacists and advanced therapeutic solutions for chronic disorders, also the high admission of patients to hospitals for advanced care makes these pharmacies the prime distribution channel for DNA repair drugs. Hospital pharmacists have specialized training and knowledge of complex medications, including DNA repair drugs that ensure proper handling and patient-specific dosing adjustments. Also, hospitals have advanced infrastructure and budgets which makes easy availability of DNA repair drugs in their pharmacies.

Drug Type Segment Analysis

PARP inhibitors are anticipated to capture a high share in DNA repair drugs market throughout the forecasted period. PARP inhibitors are one of the most effective targeted cancer drugs used for the treatment of ovarian cancer in women. The increasing awareness of the role of PARP inhibitors in oncology coupled with ongoing research and development are driving their demand growth. For instance, in September 2022, Merck joined hands with Nerviano Medical Sciences S.r.l. for the production of a next-generation highly selective and brain-penetrant PARP1 inhibitor. Such developments are contributing to the increasing demand for PARP inhibitors across the world.

Our in-depth analysis of the DNA repair drugs market includes the following segments:

|

Drug Type |

|

|

Application |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

DNA Repair Drugs Market Regional Analysis:

North America Market Insights

North America industry is poised to account for largest revenue share of 47.5% by 2035,share owing to the rising burden of cancer and the increasing number of investments in the research and development of DNA repair drugs. For instance, according to the American Cancer Society, in 2024, more than 20 lakh new cancer cases are estimated to be detected in the U.S.

The U.S. DNA repair drugs market is expected to exhibit high growth throughout the forecasted period due to the rising personalized medication trend. Manufacturers in the country are focused on developing therapeutic approaches based on individual genetic profiles that can specifically address genetic mutations and repair mechanisms.

Canada is also an opportunistic for DNA repair drugs market, several research institutions in the country are focused on developing effective solutions. For instance, researchers from Toronto revealed human DNA repair by nuclear metamorphosis. To explore this mechanism over 8,500 cancer patient’s data was analysed by them.

APAC Market Insights

Asia Pacific DNA repair drugs market is expected to increase at a fast pace during the forecast period owing to rapid advancements in healthcare infrastructure. Countries such as India, China, and Japan are spending more on advancing their healthcare facilities and innovation in drug development. The increasing awareness of chronic disorders and treatment solutions is also expected to fuel the sales of DNA repair drugs in the region.

India is emerging as a lucrative DNA repair drugs market for pharma companies owing to positive government support and policies. For instance, according to estimates by the India Brand Equity Foundation, the pharma market in India is anticipated to reach USD 130 billion by 2030. As per the same source, in December 2020, an MoU was signed between the Tata Memorial Centre of India and Vietnam National Cancer Hospital to promote exchanges in the field of healthcare services, training and scientific research, and collaboration in the diagnosis and treatment of cancer patients. Such initiatives are set to fuel the sales of DNA repair drugs in the country.

DNA Repair Drugs Market Players:

- AbbVie Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Johnson & Johnson Services Inc.

- Merck & Co. Inc.

- GlaxoSmithKline Plc.

- Bayer Ag

- Bristol-Myers Squibb Co.

- Pfizer Inc.

- Sanofi

- Eli Lilly And Co.

- Amgen Inc.

- Abbott

- AstraZeneca Plc

- F. Hoffmann-La Roche Ltd.

- Gilead Sciences Inc.

- Novartis Ag

- Nerviano Medical Sciences S.r.l.

The DNA repair drugs market is competitive due to the existence of industry giants and the entrance of new companies. The key market players are adopting strategies such as collaborations and partnerships to introduce innovative therapeutic solutions and increase their market reach. Collaboration with research organizations is one of the investment-worthy tactics widely adopted by leading companies. New companies are concentrated on introducing advanced and latest DNA repair cancer drugs. Such moves are widely adopted by start-ups to stand out from the crowd.

Some of the key players include:

Recent Developments

- In November 2023, pharmaand GmbH (pharma&) received approval from the European Commission (EC) for the use of Rubraca (rucaparib) a PARP inhibitor as a first-line treatment for women with ovarian cancer.

- In June 2023, Pfizer eceived FDA approval for the use of TALZENNA (talazoparib) and PARP inhibitor in combination with XTANDI (enzalutamide) to treat prostate cancer patients. The phase 3 clinical trial by the company reveals that this drug reduces 55% of disease progression or death risks in patients with homologous recombination repair (HRR) gene-mutated metastatic castration-resistant prostate cancer (mCRPC).

- Report ID: 6411

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

DNA Repair Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.