Distribution Planning Software Market Outlook:

Distribution Planning Software Market size was over USD 3.1 billion in 2025 and is projected to reach USD 7.9 billion by 2035, growing at around 9.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of distribution planning software is evaluated at USD 3.37 billion.

The increasing complexity of global supply chains and the rise of supply chain management solutions are key factors expected to boost global market grwoth. Distribution planning software solutions are vital in optimizing logistics, inventory management, and overall supply chain processes. Two key factors amplifying the demand for distribution planning software market are the surge of e-commerce and globalization. Furthermore, businesses seek to meet evolving customer expectations for faster deliveries. The U.S. International Trade Administration estimated that worldwide e-commerce sales have steadily risen this decade, with the market for e-commerce B2B businesses set to exceed USD 30 trillion by 2026. A prominent trend in the distribution planning software market is the rapid adoption of cloud-based solutions. The advent of SaaS solutions has benefited the expansion of applications and accessibility of distribution planning software solutions to clients of various enterprise sizes.

However, Businesses face challenges in reducing transport and inventory costs which drives the requirement for a centralized inventory view. Trends within the sector highlight that the major players can plug the pain points of businesses by providing automation solutions, such as delivery flow optimization. Additionally, optimization of distribution planning can help businesses with accurate calculations of demand and capacities, along with details on each part of the distribution chain. The distribution planning software market analysis indicates that industries such as manufacturing, retail, and e-commerce are at the forefront of adopting software solutions to improve supply chain visibility. The United Nations Conference on Trade and Development (UNCTAD) reported that global e-commerce sales increased to USD 26.7 trillion in 2020 fueled by COVID-19, and the current market trends indicate that e-commerce penetration is rising across multiple regional markets, which is primed to create a sustained demand for distribution planning software by the conclusion of 2037.

Key Distribution Planning Software Market Insights Summary:

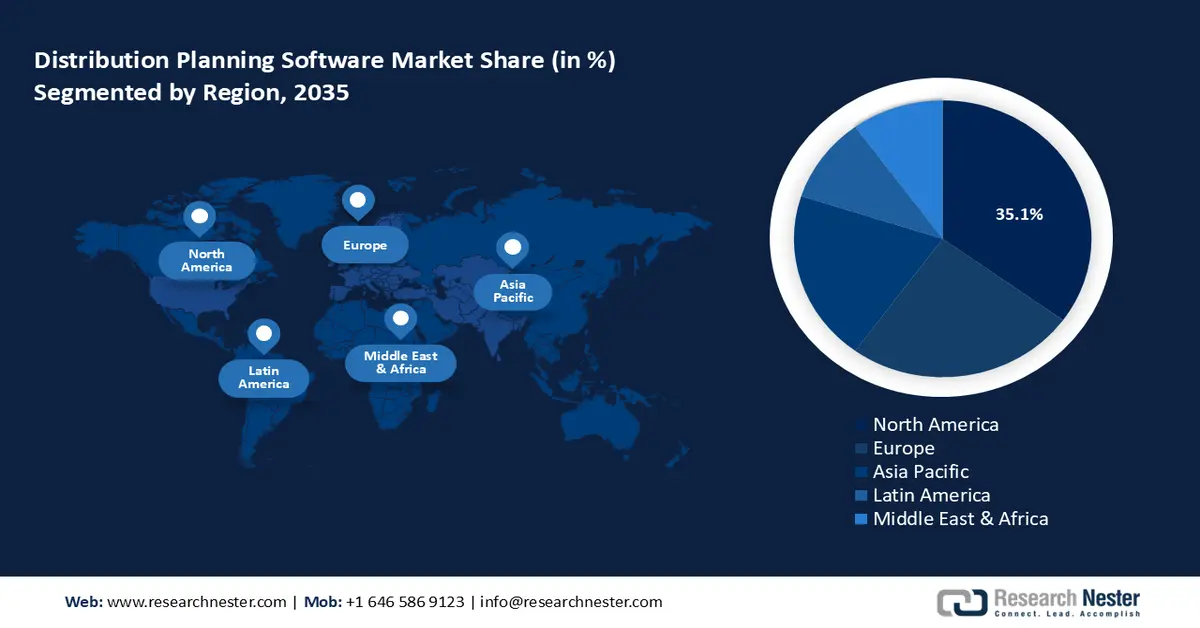

Regional Insights:

- By 2035, the North America distribution planning software market is anticipated to secure over 35.1% share owing to the region’s intensified focus on efficient supply chain management and expanding SaaS adoption.

- The Europe distribution planning software market is set to witness robust growth through 2035, propelled by the region’s heightened commitment to strengthening supply chain visibility and digitalization.

Segment Insights:

- By 2035, the cloud-based segment in the distribution planning software market is projected to command about 57.2% share, underpinned by the segment’s ability to deliver scalable, flexible, and cost-efficient deployment options.

- Across 2026–2035, the distribution expansion planning segment is expected to grow rapidly as organizations increasingly adopt advanced simulation tools to design future-ready infrastructure and optimize resource allocation.

Key Growth Trends:

- Rising focus on green logistics

- Increasing demand for real time visibility and control

Major Challenges:

- Barriers to integration with existing systems

- Constraints in seamless customization

Key Players: Oracle, Salesforce, Blue Yonder, Intuit, SAP, Infor, Manhattan Associates, Simio LLC, Kinaxis.

Global Distribution Planning Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.1 billion

- 2026 Market Size: USD 3.37 billion

- Projected Market Size: USD 7.9 billion by 2035

- Growth Forecasts: 9.8%

Key Regional Dynamics:

- Largest Region: North America (35.1% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, Brazil, Indonesia, Vietnam, Mexico

Last updated on : 2 December, 2025

Distribution Planning Software Market - Growth Drivers and Challenges

Growth Drivers

- Rising focus on green logistics: Environmental sustainability is a key focus for businesses with shifting consumer demands driving greater accountability for businesses to create a sustainable supply chain. Distribution planning software solutions can answer the challenge by assisting in the optimization of delivery routes, reducing fuel consumption, and cutting down emissions. Moreover, meeting green logistics targets can be difficult for medium-scale enterprises, leading to opportunities for the adoption of distribution planning software solutions for cost-effective solutions while lowering operational costs.

Furthermore, opportunities are set to arise from emerging economies as major institutions and corporations seek to build robust and sustainable supply chains. For instance, in August 2024, the International Finance Corporation (IFC) and Citi agreed to implement a USD 500 million facility in Mexico as the first project under the USD 2 billion sustainable supply chain program focused on rising distribution planning software markets. Such major investments are expected to drive key companies with suppliers or manufacturing hubs in emerging markets to adopt distribution planning software solutions to optimize supply chain management. - Increasing demand for real-time visibility and control: The distribution planning software market is set to benefit from emerging trends where businesses demand real-time visibility over the distribution networks. Businesses that do not invest in real-time visibility and control may lose revenue share compared to businesses that are adopting robust distribution planning software solutions. Furthermore, distribution planning software equips companies with advanced tracking and monitoring capabilities that help in detecting issues such as shipment delays, route deviations, and inventory shortages. Transparency allows businesses to maintain operational efficiency.

In November 2024, E2Open, a key player in the market, released its Ocean Shipping Index to highlight a year-over-year (YoY) increase in the global average shipment time. In the third quarter of 2023, the average shipment duration was 58 days, which increased to 68 days in the third quarter of 2024. Geopolitical tensions and port congestions have contributed to increasing delays. The challenges are positioned to drive the adoption rates of distribution planning software solutions, owing to their ability to provide real-time visibility on shipments while providing predictions on delays to mitigate losses. - Advent of customizable solutions for industry-specific needs: A key factor boosting the growth of the distribution planning software market is the advent of AI and ML allowing the SaaS solutions to meet unique requirements of various industries. Distribution planning for different sectors has varying requirements, and businesses that can provide customized and tailored solutions for industries are expected to maintain a competitive advantage in the distribution planning software market. Use cases are software that can assist the pharmaceutical sector in precise temperature control for cold chain logistics to help manufacturers with just-in-time delivery planning while offering accurate last-mile delivery solutions for retailers. For instance, in September 2024, Overhaul announced the launch of its cutting-edge cold supply chain solution with the software providing quality management for time and temperature-sensitive cargo, to ensure the best conditions throughout the supply chain for the healthcare, pharmaceutical, food & beverage industries.

Challenges

- Barriers to integration with existing systems: With the advent of IoT and cloud-based solutions, businesses require seamless integration with existing systems to reduce downtimes. However, the integration of new distribution software with existing tech stocks such as ERP systems or legacy software, can pose a challenge. The lack of compatibility can limit efficiency gains. Furthermore, key players in the sector must adapt to the rapid growth of the technological ecosystem to maintain relevancy.

- Constraints in seamless customization: Despite the rising demand for customized solutions for various industries, the challenge arises in the cost of delivering specific solutions. Smaller-scaled enterprises may be deterred from adopting customized distribution planning solutions if the costs do not align with their ROI. Key players in the sector are actively seeking to strike a balance between industry-specific requirements and scalable solutions for vendors and customers to mitigate the impacts of the challenge.

Distribution Planning Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.8% |

|

Base Year Market Size (2025) |

USD 3.1 billion |

|

Forecast Year Market Size (2035) |

USD 7.9 billion |

|

Regional Scope |

|

Distribution Planning Software Market Segmentation:

Deployment Mode Segment Analysis

By deployment mode, the cloud-based segment is set to dominate distribution planning software market share of around 57.2% by the end of 2035. The growth of the segment is owed to the cost-effective and scalable solutions offered by cloud-based distributing planning software systems. Furthermore, the cloud-based deployment model allows businesses flexibility to access distribution planning tools without substantial infrastructural investments. A key trend in the segment is the rising demand for digital management platforms. For instance, in September 2024, Oracle CloudWorld announced the new Oracle Cloud Infrastructure Distributed Cloud to provide customers the flexibility to leverage cloud-based services.

Application Segment Analysis

By application, the distribution expansion planning segment in distribution planning software market is expected to register rapid revenue growth during the forecast period. The distribution expansion planning application serves the purpose of designing new infrastructure to meet future demand. Businesses leverage advanced simulation tools to plan optimal resource allocation and forecast market demands. Industries such as utilities and logistics drive demand for distribution expansion planning to ensure adaptation to the changing technological aspect, such as the integration of renewable energy with automated delivery systems.

In November 2022, the National Renewable Energy Laboratory published a whitepaper stating that objective metrics and decision-making frameworks must be clearly defined to align corporate utility goals with shareholders and regulatory bodies, and industries would benefit from having a distribution planning guide. Such findings encourage businesses to adopt distribution expansion planning software solutions.

Our in-depth analysis of the global market includes the following segments:

|

Deployment Mode |

|

|

Application |

|

|

End user |

|

|

Organization Size |

|

|

Optimization Scope |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Distribution Planning Software Market - Regional Analysis

North America Market Insights

North America distribution planning software market is predicted to hold revenue share of over 35.1% by the end of 2035, attributed to the region’s emphasis on efficient supply chain management and the proliferation of SaaS solutions. The rising demand for cloud-based software solutions has created a burgeoning market to supply distribution planning software to businesses operating in various sectors in the region.

The U.S. distribution planning software market is projected to expand during the stipulated timeline. A major factor in the market’s profitable expansion in the U.S. is the proliferation of cloud-based solutions. Key players in the sector can expand into the U.S. market owing to the rapid adoption of cloud-based solutions which allows businesses in the country to outsource the requirements for software solutions to regions offering comparatively cost-effective solutions. Furthermore, the U.S. has been at the forefront of the AI race which benefits the distribution planning software sector. Furthermore, the power distribution system market in the U.S. is poised to drive demand for Volt/Var optimization solutions for voltage optimization.

The Canada distribution planning software market is expected to hold a significant share of the revenue during the designated timeframe. The dispersed population centers within the country offer unique distribution challenges which creates a necessity for businesses to invest in advanced planning tools that can optimize delivery schedules. The Government of Canada reported that from February 2020 to July 2022, retail e-commerce sales increased by 67.9%. Furthermore, changes in consumer spending habits are poised to boost continued increases in retail e-commerce sales. The trends bode well for a spike in the demand for distribution planning software in the domestic businesses of Canada.

Europe Market Insights

The Europe distribution planning software market is projected to register rapid growth during the forecast period. Europe’s push to strengthen its supply chain is a major driver of the sector’s growth. In October 2024, the European Investment Bank released a report to highlight the importance of intra-EU trade to cushion trading firms from supply chain disruptions and the need for digitalization and better management to boost the firms’ resilience to trade shocks. The heightened focus on supply chain visibility is poised to drive continued demand for distribution planning software solutions in the region.

The Germany distribution planning software market is estimated to exhibit robust growth in the stipulated timeframe. The industry 4.0 initiatives of Germany bolstering IoT integration into logistics operations is set to be a major factor in the lucrative opportunities for vendors to supply distribution planning software solutions. Furthermore, Germany accounts for a well-established automotive sector which drives demand for distribution planning solutions to manage just-in-time delivery schedules.

The France distribution planning software market is poised to register growth by the end of 2035. Businesses in France are integrating environmental sustainability drives into distribution strategies that require robust software solutions. In January 2025, EIB and the Societe Generale of France announced an agreement to advance the USD 8.4 billion investment in the wind industry. The deal will benefit new wind farm projects across the EU along with their supply chain and power grid interconnection, and bolster demand for distribution planning software solutions to assist in effective management. The trends forecast a steady growth for the distribution planning software market in France during the forecast period.

Distribution Planning Software Market Players:

- Oracle

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Salesforce

- Blue Yonder

- Intuit

- SAP

- Infor

- Manhattan Associates

- Simio LLC

- Kinaxis

The distribution planning software market is predicted to expand during the forecast period. Leading companies in the market are investing in integrating AI and ML solutions to improve the predictive analytics capabilities of the software solutions. Furthermore, the expansion of the cloud-based offerings will assist in broadening its footprint in emerging markets in APAC, Latin America, and the Middle East. Companies with user-friendly interfaces in software solutions and comprehensive customer support are expected to maintain an advantage in the competitive market. Here are some key players in the distribution planning software market:

Recent Developments

- In July 2024, UPS Healthcare announced an investment of over USD 20.57 million in the EU cold chain fleet. With around 80% of pharmaceutical products in Europe requiring temperature-controlled transportation, the investment bolsters UPS Healthcare’s capacity to deliver vital products efficiently.

- In February 2024, Siemens announced that its software enables utilities to gain visibilities of the distribution grid and assist in reaching net-zero goals. The Gridscale X software offerings distribution utilities to gain better visibility and insights into distributed energy resources (DERs).

- Report ID: 7037

- Published Date: Dec 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.