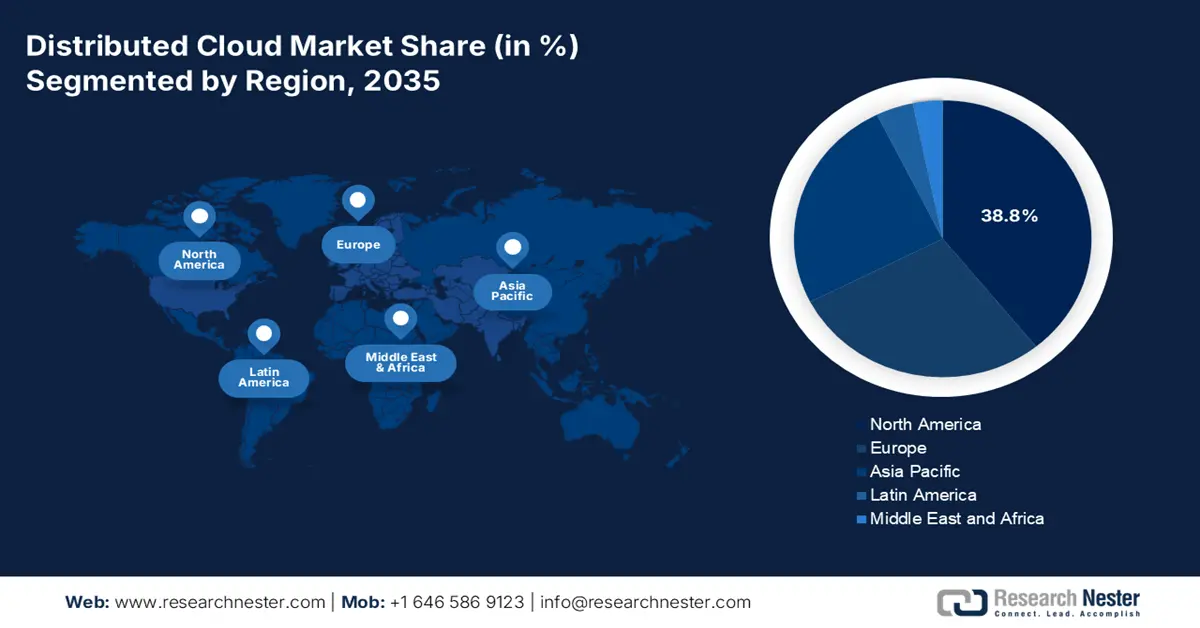

Distributed Cloud Market - Regional Analysis

North America Market Insights

North America is dominating the market and is poised to hold the largest share of 38.8% by 2035. The market leadership is anchored in early adoption by hyperscalers, substantial private and public sector investment in edge infrastructure, and robust regulatory requirements for data security and sovereignty. The key drivers include federal cloud modernization, massive private investment in 5G and IoT ecosystems, and the demand for low latency application in healthcare finance and manufacturing. A primary trend is the integration of distributed cloud with zero-trust cybersecurity architectures mandated for U.S. federal agencies, making secure decentralized infrastructure a compliance requirement. Further significant cross-border data flow between the U.S. and Canada, governed by frameworks such as the USMCA, fuels demand for the compliant, geographically optimized cloud services across the region.

In the U.S. distributed cloud market, the push for operationalizing AI is fundamentally reshaping the distributed cloud infrastructure demand and is driven by the federal mandates for secure, low-latency computing at the edge. Announcements such as the Cisco in November 2025 depict that the new Cisco Unified Edge platform directly addresses this critical need by integrating compute networking and security closer to data sources in retail, healthcare, and factory settings. This aligns with the binding requirements of the U.S. Zero Trust architecture mandate and leverages funding from the Infrastructure Investment and Jobs Act for modernizing physical infrastructure. The U.S. trend is the convergence of compliance-funded modernization and AI, where the distributed platforms are no longer optional but the essential foundation for real-time AI inferencing and secure sovereign data processing across the enterprise edge.

Canada market is defined by the strategic public-private partnerships that prioritize data sovereignty and enhanced connectivity. A prime example is Bell Canada’s deployment of Google Distributed Cloud Edge in its network in February 2022, the world’s first implementation of core network functions on this platform. This initiative directly supports national objectives outlined in the Government of Canada’s cloud adoption strategy and aligns with the Canadian Centre for Cyber Security’s guidance on secure sovereign data processing. By integrating Google Cloud’s infrastructure directly into its network, Bell can deliver lower-latency services and keep sensitive data within national borders. This move stimulates the development of a distributed cloud ecosystem vital for serving Canada’s vast geography, supporting everything from remote healthcare to smart cities, while ensuring compliance with robust national cybersecurity and data residency requirements.

APAC Market Insights

The Asia Pacific is the fastest-growing distributed cloud market and is expected to grow at a CAGR of 22.7% during the forecast period 2026 to 2035. The market is driven by rapid digitalization, government-led digital sovereignty initiatives, and the proliferation of data-intensive applications. The primary demand stems from the national strategies such as China’s Digital China, India’s Digital India, and Japan’s Society 5.0, which all incentivize building domestic cloud and edge infrastructure. A key trend is the rise of sovereign cloud ecosystems where the governments mandate local data storage and processing, pushing global hyperscalers to partner with the local telecoms and IT firms. Further, massive investment in 5G rollout and smart city projects across South Korea, Japan, and ASEAN nations is creating a built-in demand for low-latency edge computing nodes.

India’s distributed cloud market is experiencing explosive growth and is driven by the government’s Digital India initiative and a massive, rapidly digitalizing population. The demand is underpinned by the need to support scalable public digital infrastructure, such as the Unified Payments Interface, and to bring low-latency services to a vast geography. The key statistical indicator from the Invest UP in December 2024 shows the scale of this push as over 300 government departments are now using cloud services, which indicates the rapid growth of India’s digital public infrastructure. This government-led migration creates a foundational demand that is being met by strategic partnerships, such as Reliance Jio with Microsoft Azure, to build localized data centers and edge networks ensuing data sovereignty and performance for enterprise and consumer applications alike.

The distributed cloud market in China is the largest in APAC and is fundamentally shaped by the robust data sovereignty laws under the Cybersecurity Law, Data Security Law, and Personal Information Protection Law. These regulations mandate in-country data processing, pushing both the domestic and international businesses to utilize localized cloud infrastructure. A concrete statistical mandate from the People’s Republic of China in May 2025 outlines the government’s direct investment in Digital China’s development plan, released in 2025, indicating a national goal to exceed 300 EFLOPS of computing capacity, which cannot be achieved through centralized data centers alone. It requires geographically distributed compute infrastructure spanning regional data centers, edge facilities, industrial zones, and public-sector nodes. This directly supports demand for distributed cloud architectures that can aggregate, orchestrate, and manage compute capacity across locations.

Europe Market Insights

Europe is leading the distributed cloud market and experiencing a high-growth sector fundamentally shaped by the European Union’s dual strategic imperatives of digital sovereignty and sector-specific digital transformation. Major policy initiatives such as the EU’s Digital Decade targets and the GAIA X project are creating a unified demand for secure federated cloud infrastructure that keeps data within European jurisdiction. This regulatory push, coupled with substantial public funding stimulating the adoption of hybrid and edge cloud models. The core demand is driven by the modernization of critical sectors, most notably healthcare mandates cross-border data sharing for research and care, and manufacturing, where the Industry 5.0 vision necessitates real time on premise data processing in smart factories. Further, this creates a market where compliance with regulations is a significant driver of commercial innovation, enabling the region to be the leader in the market.

Germany’s distributed cloud market is a powerhouse in Europe and is driven by its advanced industrial sector and robust regulatory environment. The primary catalyst is Industry 4.0, where manufacturing giants require real-time analytics and control at the factory edge, necessitating on-premises and hybrid cloud solutions. The demand is reinforced by the government’s national cloud and data strategy, which emphasizes digital sovereignty and secure infrastructure. A recent development is the report from the AtlasEdgein July 2025, indicating it has expanded its footprint in Germany with a new state-of-the-art data center in Stuttgart. The Stuttgart (STR001) facility adds 20 MW of power and 10,000 m² of space in a major industrial hub. Distributed cloud architectures mainly depend on the regionally distributed data centers to place the compute closer to the enterprises, factories, and regulated workloads. Facilities such as the STR001 serve as physical anchor points for distributed and hybrid cloud deployments.

Some Recent Advancement in Germany Related to Distributed Cloud

|

Company |

Launch Month/Year |

Development Details |

|

Alibaba Cloud |

May 2022 |

Third Frankfurt data center with C5 compliance, 100% green electricity, free cooling (>7,000 hours/year), supporting storage/network/database for European digital transformation. |

|

nLighten |

February 2023 |

Edge data center platform for businesses, enhancing low-latency distributed cloud in Germany. |

|

Oracle |

July 2025 |

€2 billion investment in AI/cloud infrastructure, expanding distributed capacity for workloads. |

|

Acronis |

October 2024 |

New cyber-cloud data center in Berlin for secure, distributed cloud services. |

Source: Alibaba Cloud, nLighten, Oracle, Acronis

The UK distributed cloud market is defined by its mature digital economy and a strategic post Brexit focus on becoming a global technology hub. The growth is propelled by a strong financial services sector in London, which demands low-latency secure cloud for algorithmic trading and compliance, and by the government’s plan for digital regulation, aiming to boost innovation while ensuring security. The report from the Cubbit in July 2024 has reported that the company positions itself as a geo-distributed cloud storage enabler where data and storage are spread across multiple geographic locations rather than centralized regions. This directly aligns with the market and is driven by data locality, resilience, and regulatory compliance. Furthermore, the USD 12.5 million funding round signals investor confidence in geo-distributed cloud models, indicating that demand for distributed cloud infrastructure is transitioning from pilot deployments to scalable commercial adoption across Europe.