- An Outline of the Distilled Fatty Acids Market

- Market Definition

- Market Segmentation

- Product Overview

- Assumptions and Acronyms

- Research Methodology

- Research Process

- Primary Research

- Secondary Research

- Market Size Estimation

- Summary of the Report for Key Decision Markers

- Forces of the Market Constituents

- Factors/Drivers Impacting the Growth of the Market

- Market Trends for Better Business Practices

- Key Market Opportunities for Business Growth

- Government Regulation: How They Would Aid Business?

- Global Economic Outlook: Challenges for Global Recovery and its Impact on Global Distilled Fatty Acids Market

- Ukraine-Russia Crisis

- Potential US Economic Slowdown

- Industry Value Chain Analysis

- Competitive Model: A Detailed Inside View for Investors

- Market Share Analysis, 2022

- Market Share Analysis of Major Players (%), 2022

- Market Share of Players by Size, 2022

- Competitive Positioning

- KLK OLEO

- Wilmar International Ltd

- Oleon NV

- Lascaray S.A

- Mateos S.L.

- Emery Oleochemicals

- Cremer North America, LP

- Interfat SAU

- Cargill, Incorporated

- Vantage Specialty Chemicals

- Other Key Players

- Agarwal Industries Private Ltd.

- Cailà & Parés

- PMC Biogenix

- Twin River Technologies

- Oxiteno

- AAK

- P&G Chemicals

- Godrej Industries

- Others

- Market Share Analysis, 2022

- Global Distilled Fatty Acids Market Outlook & Projections, Opportunity Assessment, 2022 to 2033

- Market Overview

- Market by Value (USD million)

- Market by Volume (Kilo Tons

- Global Distilled Fatty Acids Market – Segmentation Analysis, 2023-2036

- By Source

- Palm, 2023-2036F (USD million & Kilo Tons)

- Coconut, 2023-2036F (USD million & Kilo Tons)

- Rapeseed, 2023-2036F (USD million & Kilo Tons)

- Soybean, 2023-2036F (USD million & Kilo Tons)

- Others, 2023-2036F (USD million & Kilo Tons)

- By Application

- Cosmetics, 2023-2036F (USD million & Kilo Tons)

- Plastic & Polymers, 2023-2036F (USD million & Kilo Tons)

- Lubricants, 2023-2036F (USD million & Kilo Tons)

- Paints & Coatings, 2023-2036F (USD million & Kilo Tons)

- Soaps & Detergents, 2023-2036F (USD million & Kilo Tons)

- Others, 2023-2036F (USD million & Kilo Tons)

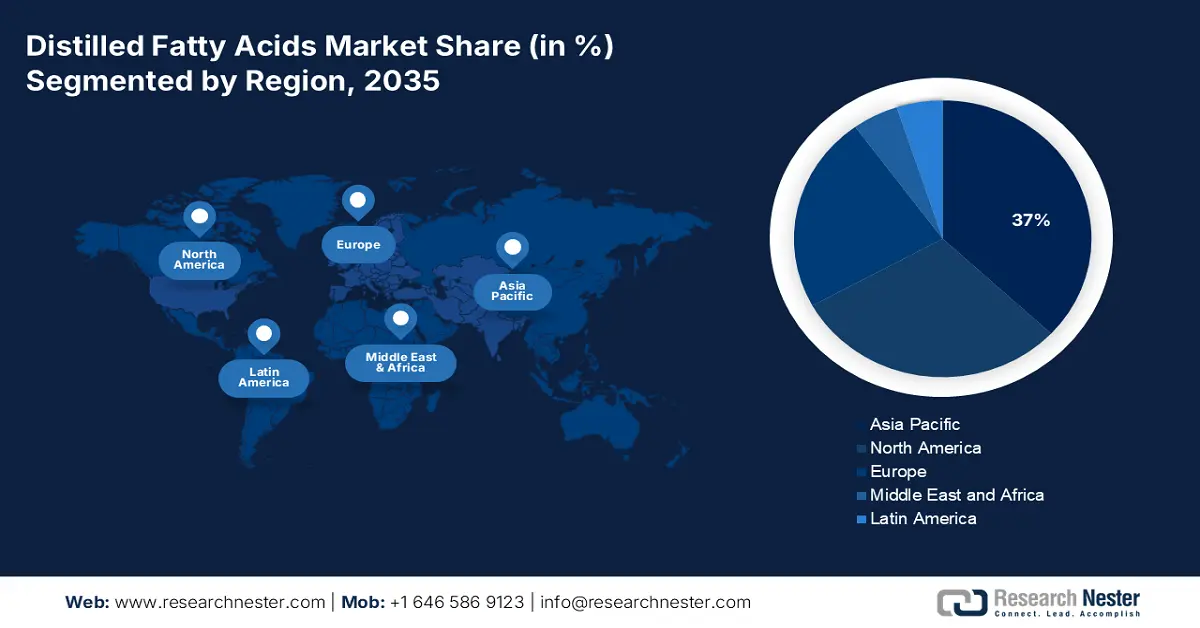

- By Region

- North America, 2023-2036F (USD million & Kilo Tons)

- Latin America, 2023-2036F (USD million & Kilo Tons)

- Europe, 2023-2036F (USD million & Kilo Tons)

- Asia Pacific, 2023-2036F (USD million & Kilo Tons)

- Middle East & Africa, 2023-2036F (USD million & Kilo Tons)

- By Source

- North America Distilled Fatty Acids Market Outlook

- Market Overview

- Market by Value (USD million)

- Market by Volume (Kilo Tons)

- By Source

- Palm, 2023-2036F (USD million & Kilo Tons)

- Coconut, 2023-2036F (USD million & Kilo Tons)

- Rapeseed, 2023-2036F (USD million & Kilo Tons)

- Soybean, 2023-2036F (USD million & Kilo Tons)

- Others, 2023-2036F (USD million & Kilo Tons)

- By Application

- Cosmetics, 2023-2036F (USD million & Kilo Tons)

- Plastic & Polymers, 2023-2036F (USD million & Kilo Tons)

- Lubricants, 2023-2036F (USD million & Kilo Tons)

- Paints & Coatings, 2023-2036F (USD million & Kilo Tons)

- Soaps & Detergents, 2023-2036F (USD million & Kilo Tons)

- Others, 2023-2036F (USD million & Kilo Tons)

- By Source

- Europe Distilled Fatty Acids Market Outlook

- Market Overview

- Market by Value (USD million)

- Market by Volume (Kilo Tons)

- By Source

- By Application

- Asia Pacific Distilled Fatty Acids Market Outlook

- Market Overview

- Market by Value (USD million)

- Market by Volume (Kilo Tons)

- By Source

- By Application

- Latin America Distilled Fatty Acids Market Outlook

- Market Overview

- Market by Value (USD million)

- Market by Volume (Kilo Tons)

- By Source

- By Application

- Middle East & Africa Distilled Fatty Acids Market Outlook

- Market Overview

- Market by Value (USD million)

- Market by Volume (Kilo Tons)

- By Source

- By Application

Distilled Fatty Acids Market Outlook:

Distilled Fatty Acids Market size was over USD 22.57 billion in 2025 and is projected to reach USD 43.99 billion by 2035, witnessing around 6.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of distilled fatty acids is assessed at USD 23.97 billion.

The growth of the market can be attributed to its growing use in cosmetic as an emulsifier or emulsification. Emollient fatty acids improve skin hydration by retaining the moisture in the skin and lowering evaporation into the environment. Whereas, the emulsification abilities of fatty acids act as a thickening factor for skin care products. Hence they are extensively used in cosmetic products. Additionally, since the cosmetics industry places a greater emphasis on quality, it makes sure that its products are of the finest quality, satisfy the needs of the customer, and have no negative consequences. As a result, the growing emphasis on cosmetic items' quality enhancement is drawing in both male and female customers. Around 70% of South Korean men reported using lotion in 2021. In that year, men used an average of 6 cosmetic and beauty items.

In addition, the majority of the cosmetic industry use natural substances obtained from plants in the production of their goods owing to its growing preference. Nearly 39% of American consumers believe that organic personal care and cosmetics goods are healthier than conventional personal care and cosmetics products. As a result, about 27% of men and approximately 21% of women in the country would primarily use organic skin care products. Further, growing prevalence of skin cancer is estimated to boost the demand for sunscreen, hence also anticipated to drive the market growth. The majority of skin malignancies are brought on by excessive UV (ultraviolet) light exposure. According to the World Health Organization, over 1.5 million skin cancer cases were diagnosed worldwide in 2020, and over 120 000 fatalities owing to skin cancer were recorded. Additionally, every year, more than 79,000 new cases of skin cancer are found in Canada. Since UV radiation is thought to cause about 70%-90% of skin cancers, the utilization of sunscreen — that filters ultraviolet radiation — is touted as an essential way to prevent skin cancer.

Key Distilled Fatty Acids Market Insights Summary:

Regional Highlights:

- Asia Pacific is expected to secure a 37% revenue share in the distilled fatty acids market by 2035, supported by escalating demand across lubricants, detergents, soaps, coatings, and personal care industries as well as expanding government-led investment initiatives.

Segment Insights:

- The palm segment in the distilled fatty acids market is projected to command the leading revenue share by 2035, propelled by its abundant availability and high oleochemical yield.

Key Growth Trends:

- Upsurge in Water Supply

- Rise in Construction Activities

Major Challenges:

- High Cost of Distilled Fatty Acids

- Supply Chain Disruption for Raw Material

Key Players: KLK OLEO, Wilmar International Ltd., Oleon NV, Lascaray SA, Mateos, S.L., Emery Oleochemicals, Cremer North America, LP, INTERFAT SAU, Cargill, Inc., Vantage Specialty Chemicals.

Global Distilled Fatty Acids Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 22.57 billion

- 2026 Market Size: USD 23.97 billion

- Projected Market Size: USD 43.99 billion by 2035

- Growth Forecasts: 6.9%

Key Regional Dynamics:

- Largest Region: Asia Pacific (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Indonesia, Vietnam, Brazil, Mexico

Last updated on : 20 November, 2025

Distilled Fatty Acids Market - Growth Drivers and Challenges

Growth Drivers

- Upsurge in Water Supply

- According to the Ministry of Housing and Urban Affairs, the benchmark for urban water delivery in India is 135 liters per capita per day (lpcd). Under the Jal Jeevan Mission, a minimum service delivery standard of 55 lpcd for rural regions was established, which states may raise to a higher standard. Hence, the demand for PVC plastisol is expected to increase. Fatty acids are widely used in the manufacturing of PVC plastisol as they have a strong affinity for vinyl chloride monomer (VCM), which allows for a reduction in polymerization time. Hence, underground irrigation pipes made of PVC are frequently utilized in water distribution systems.

- Rise in Construction Activities

- The global construction industry must develop about 12,000 structures every day until 2050 to accommodate the estimated 6 billion people who would live in cities (around 9 billion people worldwide).

- Growing Automotive Production

- Nearly 70 million automobiles were produced globally in 2021. Comparing this number to the prior year, there has been a rise of about 2%. The top three auto and commercial vehicle makers in 2020 were China, Japan, and Germany.

- Surge in Import and Export of Distilled Fatty Acids All Around Globe

- Fatty acid import shipments in Malaysia were about 3K, with 133 Malaysia Importers purchasing from 141 Suppliers. United States, Sri Lanka, and Netherlands are the top 3 importers of fatty acids, each with approximately 7,490 shipments. Sri Lanka comes in second with about 1,680 shipments, and Netherlands comes in third with about 1,520 shipments.

- Rise in Demand for Hygiene and Personal Care Products

- Among different categories of cosmetics, skincare and makeup powders have seen the biggest gains in sales (up about 23% from 2020), followed by manicure and pedicure supplies (up about 16%), eye makeup supplies (up about 15%), and then skincare products for beauty (up about 14%).

Challenges

- High Cost of Distilled Fatty Acids

- Supply Chain Disruption for Raw Material

- Adverse Effect on Environment of Plantation - Palm tree plantations are sprouting up all across Asia, Africa, and Latin America. However, in order to make room for massive monoculture palm oil plantations, such development has devastated extensive tropical forests, which are vital homes for many endangered species, including rhinos, elephants, and tigers. For instance, between 2010 and 2021, Tesso Nilo National Park lost about 66% of its primary forest, with the rate of deforestation in 2021 nearly double that of 2020 and reaching its highest level since 2016. In 2022, additional removal of the primary forest was visible in satellite photography. The unlawful establishment of large-scale plantations to grow oil palm and other tree crops is responsible for much of Tesso Nilo's destruction.

Distilled Fatty Acids Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 22.57 billion |

|

Forecast Year Market Size (2035) |

USD 43.99 billion |

|

Regional Scope |

|

Distilled Fatty Acids Market Segmentation:

The global distilled fatty acids market is segmented and analyzed for demand and supply by source into palm, coconut, rapeseed, soybean, and others. Out of which, the palm segment is anticipated to hold the largest market revenue by the end of 2035. The growth of this segment can be attributed to rising demand for palm as the primary raw material for industrial applications given to its availability in abundance. For instance, in Malaysia, oil palm was planted on about 4 million hectares of land in 2021. After Indonesia, Malaysia is the second-largest producer of palm oil in the world. Also, palm oil is chosen over other vegetable oils including soybean, canola, and sunflower since it produces oleochemicals with the largest percentage yield and is similarly effective in this regard. However, soybean segment is anticipated to grow at a highest CAGR of 7.5% over the forecast period.

The global distilled fatty acids market is also segmented and analyzed for demand and supply by application into cosmetics, plastics & polymers, lubricants, paints & coatings, soaps & detergents, and others. Amongst these segments, the soaps & detergents segment is anticipated to generate the largest revenue by the end of 2035. However, the cosmetics segment is estimated to grow at a highest CAGR of 7.8% over the forecast period, backed by growing people’s concern for skin health. Additionally, a surge in incidence of skin cancer and other skin illnesses, as well as increased knowledge of the damaging effects of UV radiation on skin is also estimated to boost the segment growth. Further, the majority of cosmetic industries are using natural ingredients obtained from plants in the production of their cosmetics products. Hence, it is predicted that this would encourage the use of distilled fatty acids derived from vegetable oils in cosmetics.

Our in-depth analysis of the global distilled fatty acids market includes the following segments:

|

By Source |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Distilled Fatty Acids Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific industry is set to hold largest revenue share of 37% by 2035, driven by its growing use in sectors such as lubricants, detergents, soaps, paints & coatings, and personal care products, along with surge in government programmes and regulations to entice capital from several multinational businesses., backed by its growing use in sectors such as lubricants, detergents, soaps, paints & coatings, and personal care products, along with surge in government programmes and regulations to entice capital from several multinational businesses. Additionally, Asia-Pacific is the world's greatest producer of items including soap, rubber, and plastics. For instance, Asia was the world's greatest producer of plastic materials in 2019, making up over 50% of all plastic materials produced worldwide. As a result, even this factor is expected to encourage market growth in this region.

Distilled Fatty Acids Market Players:

- KLK OLEO

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Wilmar International Ltd.

- Oleon NV

- Lascaray SA

- Mateos, S.L.

- Emery Oleochemicals

- Cremer North America, LP

- INTERFAT SAU

- Cargill, Inc.

- Vantage Specialty Chemicals

Recent Developments

-

JEEN International Corporation and BotanicalsPlus, Inc. (collectively, "JEEN") were acquired by Vantage Specialty Chemicals ("Vantage" or the "Company"), further expanding its leadership in personal care.

-

Cargill, Inc., disclosed plans to construct a new soybean processing plant in Pemiscot County, Missouri, close to Hayti and Caruthersville, to meet the rising domestic and international demand for oilseeds, which is being driven by the food, feed, and fuel industries. With an annual production capacity of 62 million bushels of soybeans, the plant would be the first of its kind for Southeast Missouri.

- Report ID: 3941

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Distilled Fatty Acids Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.