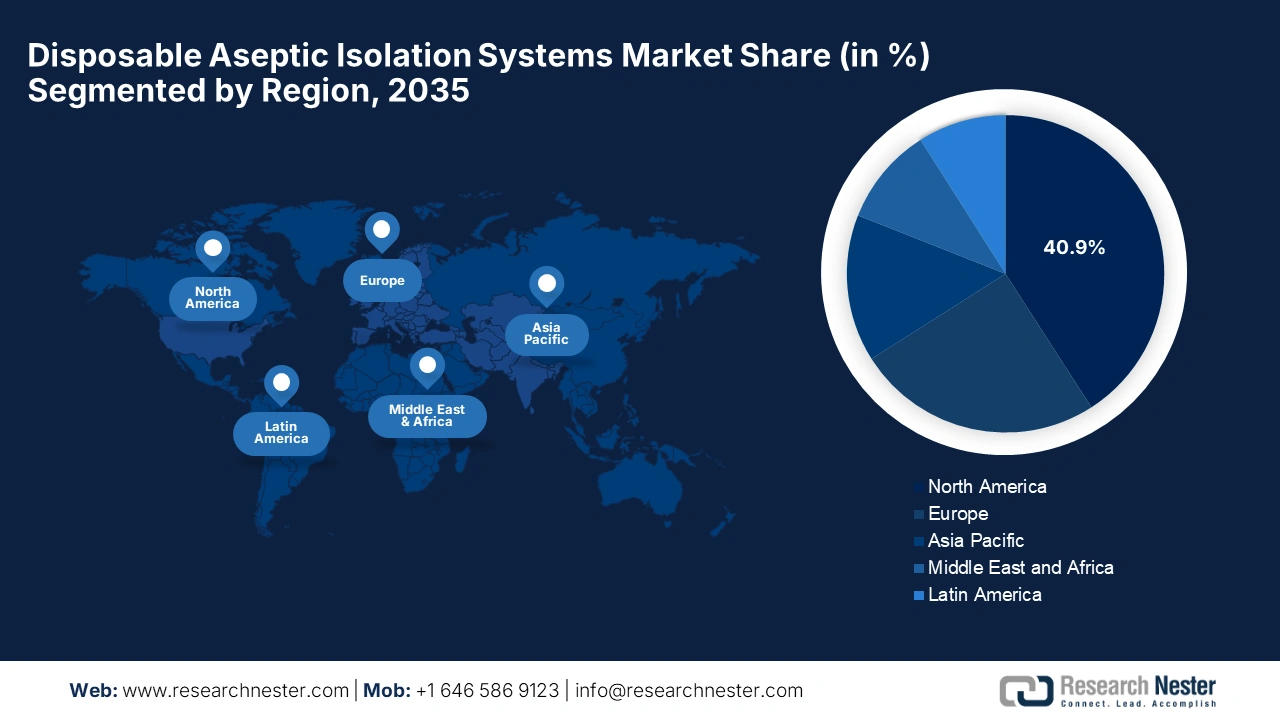

Disposable Aseptic Isolation Systems Market - Regional Analysis

North America Market Insights

North America in the disposable aseptic isolation systems market is projected to dominate with the largest share of 40.9% by the end of 2035. The region’s dominance in this sector is propelled by the presence of regulatory policies that have mandated innovative aseptic technologies and increasing collaborations between the pioneering healthcare firms. In July 2025, TurboFil Packaging Machines announced that it is collaborating with Ravona to provide integrated and standalone isolation technologies for pharmaceutical and biotech manufacturers in North America, hence benefiting the overall market growth.

The disposable aseptic isolation systems market in the U.S. is dominating the overall region, attributed to the presence of key product manufacturers and suitable reimbursements. In May 2021, the U.S. Department of Defense, in coordination with the Department of Health and Human Services, granted a total of USD 226.3 million to expand domestic production capacity of critical aseptic products, which include nitrile gloves essential for sterile pharmaceutical manufacturing, supporting increased manufacturing of sterile gloves and raw materials, and strengthening the supply chain for aseptic isolation systems.

The disposable aseptic isolation systems market in Canada is significantly growing due to green and sustainable isolators, cross-province reimbursement, and public-private research and development, which are other trends that are responsible for uplifting the market in the country. As per an article published by Health Canada in May 2024, it underscored the pivotal role of contamination control strategies and the use of barrier technologies such as isolators to lower human intervention and maintain Grade A conditions. It also supports single-use systems for reducing contamination risks, since they are effectively validated for sterility, integrity, and compatibility with the product.

Healthcare-Associated Infection (HAI) Metrics and Historic Trends in the U.S.

|

Metric |

Value / Change |

|

Patients with ≥1 HAI on any given day |

1 in 31 hospital patients |

|

Increase in surgical site infections after abdominal hysterectomy |

8% |

|

Increase in CAUTI infections in IRFs |

8% |

|

States performing better on ≥3 infection types (compared to 2015 baseline) |

49 states |

|

Estimated HAIs in US acute care hospitals (2015) |

687,000 |

|

Estimated deaths in patients with HAIs during hospitalization (2015) |

72,000 |

Source: CDC,2024

APAC Market Insights

The Asia Pacific region is expected to capture the fastest growth trajectory of the international disposable aseptic isolation systems market during the forecast timeline. The market’s development in the region is subject to expansion in biopharmaceuticals and the existence of strict administrative reforms. Manufacturers in prominent countries such as Japan, South Korea, and Southeast Asia are readily making investments in systems that reduce cleaning validation and downtime, thereby significantly maintaining high levels of contamination control.

The disposable aseptic isolation systems market in China is anticipated to grow due to the isolators mandate required for biologics production, and the government is increasing spending. In January 2025, Shanghai Marya notified that it has completed a turnkey cleanroom HVAC project that spans 427 square meters, built in compliance with GMP and ISO standards for solid preparations in Ecuador, underscoring its capability as a total solution provider in sterile pharmaceutical filling, hence suitable for standard market growth.

The disposable aseptic isolation systems market in India is displaying expedited growth, effectively backed by increasing integration of isolator-based systems in fill-finish, R&D, and quality control environments. In November 2023, CPHI & PMEC India reported that Syntegon and its joint venture partner, Klenzaids, showcased advanced pharmaceutical solutions, which include the semi-automated VIS 1000 vial inspection system and the IsoKlenz ISP 1000, which is an aseptic filling line isolator for prefilled syringes, facilitating effective sterilization with minimal residual hydrogen peroxide.

Europe Market Insights

Europe in the disposable aseptic isolation systems market is expected to garner a significant share by the end of the forecast period. This upliftment is highly propelled by the existence of strict EMA regulatory policies that contribute towards biopharmaceutical expansion. In December 2024, Farmak International reported that it had expanded its European footprint with a new sterile medicines production facility in Barberà del Vallès, Spain, which was engineered and constructed by Telstar. It spans around 1,800m² and features advanced production, R&D labs, and logistics areas designed for scalability and future automation.

The disposable aseptic isolation systems market in Germany is readily dominating the region, which is highly fueled by innovation in biopharmaceutical and the presence of strong government support. In September 2025, the Groninger Group reported that it had acquired Reinraumtechnik Ulm GmbH to expand its cleanroom and isolator technology expertise, which is extremely crucial for the pharmaceutical industry. Further, this move underscores the responsible approach respecting industry standards and existing partnerships, hence boosting market growth.

The disposable aseptic isolation systems market in the UK is expected to showcase evident growth owing to its highly influential pharmaceutical industry. Besides the country’s regulatory bodies, such as the Medicines and Healthcare products Regulatory Agency, which is deliberately enforcing robust aseptic manufacturing standards, thereby encouraging adoption of single-use isolator systems. In September 2022, Extract Technology announced an expansion of its ISO 9001 manufacturing facility in the country, adding a new building to support growing global demand for aseptic and containment pharmaceutical solutions.