Display Controller Market Outlook:

Display Controller Market size was valued at USD 45.19 billion in 2025 and is likely to cross USD 111.99 billion by 2035, expanding at more than 9.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of display controller is assessed at USD 49.05 billion.

The primary growth driver of the display controller market is the rising demand for consumer electronics products due to increasing demand for higher resolution devices such as 4K and beyond, and advanced display technologies such as OLED, AMOLED, and foldable screens. The consumer electronics segment includes smartphones, tablets, laptops, smart TVs, domestic appliances, kitchen products and more. Further, growth in the entertainment sector and gaming has spurred demand for ultra-HD displays with superior color accuracy and refresh rates. The rising trend of compact wearable devices such as smartwatches and fitness trackers has also enhanced the need for high performance display controllers.

The global smartphone market experienced a steadfast 10% growth in the first quarter of 2024. Samsung ranked first by shipping 60.0 million units due to its updates to the A-series and premium offerings. Whereas, Apple dropped to the second place by shipping 48.7 million units. Xiaomi held the third spot with 40.7 million shipments, capturing 14% of the market share. Other notable companies such as Transsion and Oppo shipped 28.6 million and 25.0 million units, taking 10% and 8% market shares respectively. China leads the world display controller market with the most smartphone users, reaching 974.69 million, followed by India with 659 million users.

Key Display Controller Market Insights Summary:

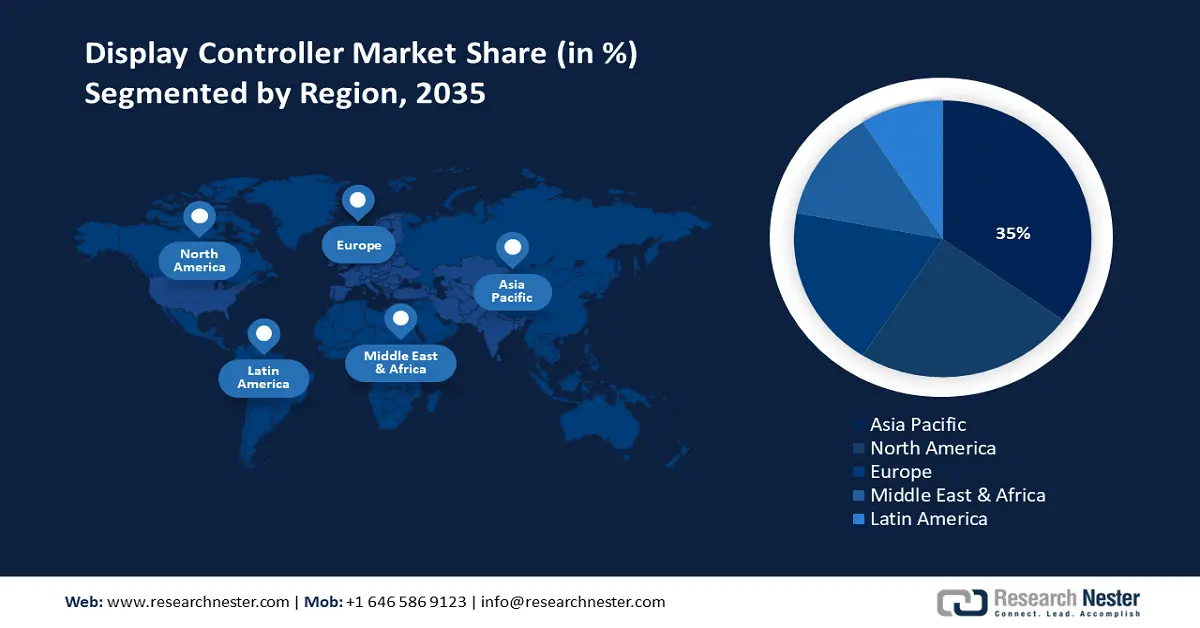

Regional Highlights:

- Asia Pacific dominates the Display Controller Market with a 35% share, fueled by rising demand for electronics and strong semiconductor industry, driving growth through 2026–2035.

- North America's Display Controller Market is projected to see significant growth by 2035, fueled by technological innovation and robust demand across sectors.

Segment Insights:

- The LCD Display Controller segment is expected to achieve a 45% share by 2035, fueled by technological advancements in display technologies and growing demand in consumer electronics, automotive, and healthcare applications.

- The Consumer Electronics segment is anticipated to hold a significant share by 2035, fueled by high adoption rates of smartphones, smart TVs, and feature-rich products like advanced gaming laptops.

Key Growth Trends:

- Advancements in display technologies

- Expansion of smart devices and IoT

Major Challenges:

- Increasing complexity of display technologies

- High development and manufacturing costs

- Key Players: Samsung Electronics, LG Display Co., Ltd, Texas Instruments, Analog Devices, STMicroelectronics, Qualcomm Technologies, Inc. NXP Semiconductors.

Global Display Controller Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 45.19 billion

- 2026 Market Size: USD 49.05 billion

- Projected Market Size: USD 111.99 billion by 2035

- Growth Forecasts: 9.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, South Korea, Germany

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 13 August, 2025

Display Controller Market Growth Drivers and Challenges:

Growth Drivers

- Advancements in display technologies: In recent years, the need for high quality display technologies such as micro LED and OLED panels, and flexible and foldable displays have increased. The major application areas include the health sector, gaming, and automotive industries. In the automotive sector, the rising adoption of infotainment systems with touchscreens and digital dashboards in vehicles, and advanced driver assistance systems (ADAS) are highly advantageous and enhance the driving experience. The growing trend of electric vehicles is expected to boost the demand for advanced display technologies, subsequently driving the graphics display controller market.

All EVs rely on display systems for energy management and help in user interaction. For instance, the Tesla Model comes with a large 17-inch touchscreen display which controls everything in the car virtually, from climate control to infotainment system. Its inbuilt interface and steady air updates ensure the vehicle always has the latest features and improvisations as per the situation. Digital displays can adapt to various parameters like themes and color schemes, according to outside conditions. These smart displays show real-time data about navigation, fuel economy, range, and other diagnostics to maintain the car’s health. Inbuilt features like Apple CarPlay and Android Auto enable hands-free calling, messaging, and accessing media. These higher-resolution panels can be customized to see multiple functions on the same display as per the driver’s requirements. - Expansion of smart devices and IoT: The proliferation of consumer electronics, including smartphones, tablets, laptops, and smart TVs increases the demand for advanced display controllers to support features such as high resolution, HDR, and touchscreen features. Additionally, the use of smart devices and IoT technology has increased the need for display controllers that support touchscreens, gesture controls, and other interactive features. Consumer electronics, such as smartwatches, smart speakers, and home automation systems heavily rely on display controllers for easy user interaction and visual feedback. Currently, the number of IoT devices has grown from 10 billion in 2019 to approximately 18.8 billion at the end of 2024 due to the expanding 5G network and other related technologies. Additionally, the video entertainment segment is the biggest reason for the rise of IoT devices. This figure is expected to double up to USD 41.1 billion in total IoT devices by 2030.

The consumer electronics segment dominates the global display controller market. For instance, smart home devices connected to the internet can be controlled by using smartphones or other smart devices via remote access. These devices are convenient and increase home safety and energy efficiency. The devices used in smart homes include door locks, security cameras, thermostats, lighting systems, kitchen appliances, entertainment systems, and more. For instance, in November 2023, Amazon’s Alexa app launched a new user interface called Map View. This new interface allows users to create a digital version of their home and pin Alexa-connected devices to each room. It allows users to check device status, control lights, adjust thermostats, and more facilities from the app itself.

In a study about smartwatches in the consumer electronic devices segment, it has been noticed that as of 2024, there are about 224.31 million smartwatch users worldwide. The key drivers of growth of this segment are the health and fitness tracking features in smartwatches. Nearly 70% of consumers are likely to prioritize these features by 2024. In addition, Apple holds 30% of the global smartwatch market share. - Increasing adoption of smart retail solutions: The adoption of smart retail solutions is a significant key driver of the display controller market. It uses advanced technologies, interactive displays, and digital signage to enhance customer experience, improve operational efficiency and drive sales. Display controllers are widely used to display vital information such as directions, advertisements, announcements, and promotions. For instance, Adastra’s Smart Retail Solution used advanced IoT technology to improve retail operations. It enables communication between shelves, pallets, and displays to track sales and customer interactions. Real-time data helps stores analyze customer behavior, boost sales, prevent stockouts, and enhance performance across locations. This solution also helps retailers and brands make better use of retail space and maximize marketing investments. Further, Adastra’s smart retail tools are trusted by brands such as Pilsner Urquell, Coca-Cola, and Lego. It includes innovative technologies such as smart fridges, shelves, displays, pallets, scales, and ceiling sensors.

In healthcare, display controller systems are used in medical imaging devices and diagnostics equipment. The use of HD LED screens in medical imaging systems such as X-rays, CT scans, and MRIs helps to improve diagnostic capabilities. The clear image quality and accurate color representation enable doctors to analyze medical images with greater precision, leading to more accurate diagnosis and treatment.

Challenges

- Increasing complexity of display technologies: Technological advancements such as OLED, Micro LED, foldable displays and high refresh rate screens require sophisticated and costly display controllers. Thus, the integration of multiple functionalities such as touch sensing, and power management increases design complexity and development time. Additionally, ensuring seamless compatibility between display controllers and various display types e.g., LCD, OLED, and interfaces such as HDMI, Displayport poses technical challenges. Moreover, integration with devices having different operating systems and hardware configurations can be complex.

- High development and manufacturing costs: The need for advanced materials and precise manufacturing processes raises production costs. Smaller players may struggle to invest in research and development for next-generation display controllers.

Display Controller Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.5% |

|

Base Year Market Size (2025) |

USD 45.19 billion |

|

Forecast Year Market Size (2035) |

USD 111.99 billion |

|

Regional Scope |

|

Display Controller Market Segmentation:

Type (LCD Controller, Touchscreen Display Controller, Multi-display Controller, Smart Display Controller, Digital Display Controller)

By type, the LCD display controller segment is expected to account for more than 45% display controller market share by the end of 2035. The growth can be attributed to rising technological advancements in display technologies, rising demand for consumer electronics, automobile industry expansion, growing adoption in health care, and many more.

The LCD display is an important segment of the display controller industry because of its versatility across multiple applications, including mobile phones, computers, televisions, and various other electronic devices. With the increasing reliability of digital screens in everyday life, this segment has become integral to consumer electronics, automotive systems, and industrial applications. The scope of the LCD display sector is huge, consisting of various display types, technologies, and innovative applications that continue to evolve every day.

Emerging technologies such as flexible displays and enhanced color reproduction systems push the boundaries for innovation in display technology. These advancements not only improve visual quality and user experience but also open new opportunities for applications across various industries, from entertainment to healthcare. The industrial control and medical devices sectors also present substantial growth opportunities for the LCD controller board market. In industrial applications, LCDs are used in human-machine interfaces (HMIs), process control systems, and monitoring equipment. Similarly, in the medical industry, LCD screens are used in diagnostic equipment, patient monitoring systems, and medical imaging devices.

Technological advancements in the LCD display segment such as Mini-LED, Quantum Dot, and flexible LCDs are expected to grow steadily, supporting both consumer and industrial requirements. Recently, LG Corporation introduced the world's first stretchable display capable of expanding up to 50%, which is the highest elongation rate in the industry to date. This new prototype has a 12-inch screen that can stretch up to 18 inches while keeping a clear high resolution of 100ppi and displays full red, green, and blue color.

End use (Consumer Electronics, Aerospace & Defense, Automotive, Gaming & Entertainment, Healthcare, Industrial Control)

By end use, the consumer electronics segment is expected to show a significant display controller market share by the end of 2035. The consumer electronics segment is the largest segment driven by high smartphone and smart TV adoption. About 98% of the U.S. population own a cellphone whereas around 91% own a smartphone. The applications include smartphones, tablets, laptops, smartwatches, gaming consoles etc. India is emerging as the fastest-growing major display controller market for technical consumer goods, valued at around USD 23.83 billion. Over 125 million units were sold in the first half of 2024, reflecting an 11% rise in offline sales. Consumers are increasingly choosing premium and feature-rich products, with significant growth in smartphones featuring 256 GB+ storage, high-capacity washing machines, and gaming laptops, as well as premium refrigerators and split inverter ACs.

The rollout of 5G networks and edge computing advancements are transforming consumer electronics connectivity. These technologies are critical for smart home devices and IoT applications, requiring real-time data processing and minimal latency. The introduction of 5G represents a major leap forward by delivering a faster speedy network and reduced delays. This development enables innovations in smart devices, IoT, and mobile connectivity, as manufacturers leverage 5G to enhance device performance and create a more interconnected ecosystem. Features like seamless internet browsing, improved personal computing experiences, and advanced remote functionalities highlight the transformative potential of 5G in consumer electronics.

Our in-depth analysis of the display controller market includes the following segments:

|

Type |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Display Controller Market Regional Analysis:

APAC Market Analysis

Asia Pacific display controller market is set to dominate revenue share of around 35% by the end of 2035. Asia Pacific dominates the market owing to factors such as increasing demand for consumer electronics, growth in automotive displays, expansion of the automotive sector, and strong semiconductor industry. China, Japan, South Korea, and India are the world's greatest consumers of smartphones, televisions, laptop computers, and other electronic devices, driving up demand for display controllers in the Asia Pacific display controller market.

In 2022, China succeeded South Korea by leading the display market which was led by South Korea for over a decade. Local companies are the leading global producers and innovators in display technologies. China leads the display industry as it is backed by several government policies, investments, extensive subsidies, and economies of scale. The global share of liquid crystal display (LCD) production has reached 72%, whereas the share of organic light-emitting diode (OLED) production has now exceeded 50% in China. According to the Information Technology and Innovation Foundation (ITIF), the combination of low costs and growing innovation capability makes China one of the global competitors worldwide. For instance, China surpassed Korea in the LCD market by offering low-priced products. Further, China’s largest panel manufacturer BOE became the world's largest LCD manufacturer with the help of subsidies from the government of China. In April 2022, LCD sales were USD 28.6 billion accounting for 26.3% of the total LCD market. The sales of local companies such as BOE, CSOT, Tianma, and Visionox increased significantly as demand for TV and information technology devices rose with the COVID-19 pandemic and increased price of LCD panels.

The display controller market in India is experiencing steady growth, supported by various factors including increased adoption of digital signage, rapid growth in the consumer electronics market, rising smartphone use, growth in the gaming industry, and a rise in automotive display applications. The Government of India is investing in Make in India and Digital India initiatives to encourage domestic manufacturing of consumer electronics and display parts.

The consumer shift to premium products has driven India’s electronics market growth. The demand for feature-rich smartphones especially with 256 GB+ storage and advanced displays has grown by 140% significantly in the premium category. India is projected to become Apple’s third-biggest display controller market by 2026 after the U.S. and China. Apple is expected to sell nearly 15 million units by 2026. In India, the automotive segment is also on the rise. Companies like Tata Motors, Hyundai, and Mahindra are also integrating advanced display technologies in their vehicles leading to a rise in the display controller market. The growth of the gaming industry in India also witnessed sales of gaming laptops and high-performance monitors increasing by 30%.

North America Market Analysis

The display controller market of North America is poised to register significant revenue growth by 2035. The growth can be attributed to technological innovation, robust demand across sectors, and a competitive ecosystem.

The display controller market in North America especially U.S., is characterized by technological innovation, growing demand for advanced electronics, innovations in automotive and gaming sectors, robust demand across sectors, and a competitive ecosystem. The U.S. is a key player due to its expanding consumer electronics industry, leading technology companies, and noteworthy investments in the research and development field. High disposable income levels in North America encourage consumers to invest in premium devices featuring advanced displays. The tech-savvy population easily adopts new technologies such as 8K TVs, foldable smartphones, and AR/VR devices. Apart from this, the infotainment systems and digital displays in the automotive sector also contribute to display controller market growth in North America.

Key Display Controller Market Players:

- Samsung Electronics

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- LG Display Co., Ltd.

- Texas Instruments

- Analog Devices

- STMicroelectronics

- Qualcomm Technologies, Inc.

- NXP Semiconductors

Key players are driving growth through a combination of technological innovation, strategic partnerships, and expanding automotive industries. These players are particularly focusing on integrating features and innovations in the consumer electronics segment, gaming and entertainment sector, IoT devices, healthcare displays, and many more. The key players operating in the display controller industry are:

Recent Developments

- In January 2023, Asus introduced a new Xbox PC controller called the ROG Raikiri Pro. It includes a 1.3-inch OLED screen above the Xbox button that displays custom graphics, battery life, microphone status, etc. The primary functions of the OLED display (128 x 40 resolution) will be profile switching while playing games, charging, microphone status checks, and Bluetooth pairing.

- In November 2022, Sky Wire Broadcast, known for its wide range of products and services launched a new 5-Channel PTZ Controller. Pan, tilt, zoom, PTZ speed, focus, iris, brightness, white balance, and R/B color are all directly controlled by this product, which is simple to use and install. The 5 Channel Controller is simple to operate, has a great LED display, and works with a variety of common brand cameras that support VISCA and PELCO-D/P.

- Report ID: 6948

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Display Controller Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.