Display Bonding Adhesive Market Outlook:

Display Bonding Adhesive Market size was valued at USD 4.7 billion in 2025 and is set to exceed USD 11.23 billion by 2035, expanding at over 9.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of display bonding adhesive is evaluated at USD 5.08 billion.

The reason behind the growth is impelled by the growing demand for smartphones across the globe driven by factors including convenience, the capacity of applications to enable more beneficial tasks, enhanced user-friendliness, reduced product costs, improved handset design and functionality, rising disposable incomes, more affordable internet, and the necessity of always being connected.

For instance, Globally, there are more than 6 billion smartphones, and over the past five years, there has been around 4% annual growth in the number of smartphone users worldwide.

The growing advancement in display technologies is believed to fuel the market growth. For instance, Tokyo Tech researchers have developed an OLED that produces blue light at a record-low voltage of 1.47 V which is essential for large-screen displays, smartphone screens, and light-emitting gadgets and is said to lead to prospective developments for large-screen displays and commercial smartphones.

Key Display Bonding Adhesive Market Insights Summary:

Regional Highlights:

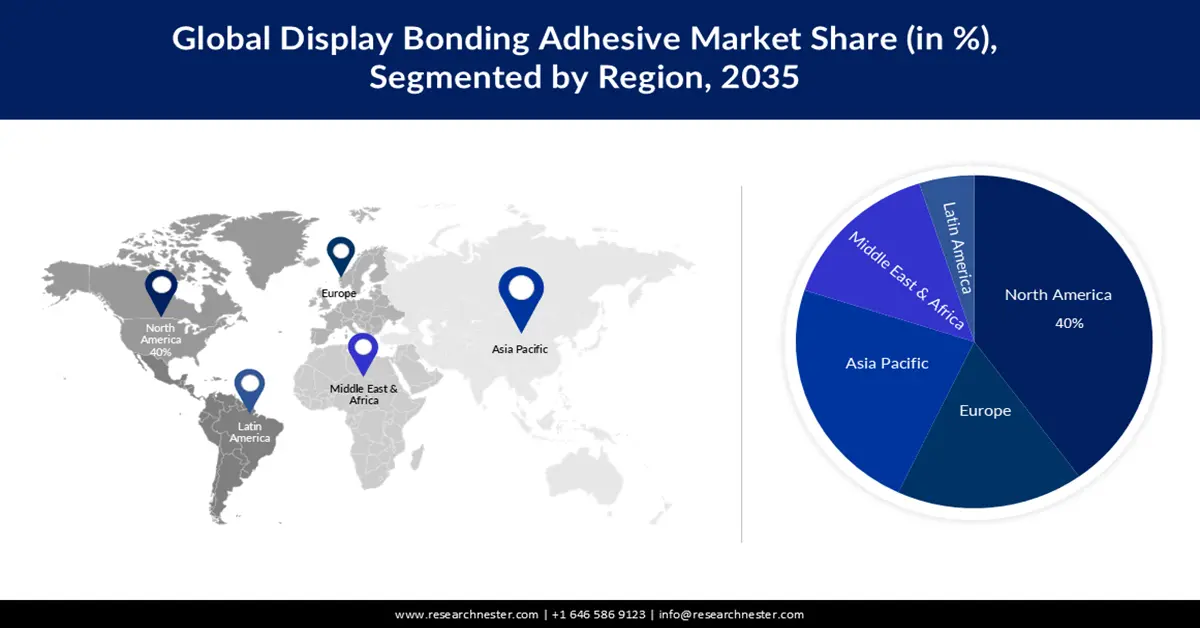

- By 2035, North America in the Display Bonding Adhesive Market is predicted to capture a leading 40% share, owing to rising urbanization.

- By 2035, Asia Pacific is set to secure the second-largest share, attributed to the growing production of electronics.

Segment Insights:

- By 2035, the optically clear adhesive segment in the Display Bonding Adhesive Market is projected to secure a 55% revenue share, propelled by the growing integration of touchscreen.

- By 2035, the LCD displays segment is anticipated to command a notable share, supported by the increasing need for adhesives in LCDs.

Key Growth Trends:

- Rising Popularity of Adhesives in the Automotive Sector

- Increasing Pharmaceutical Industry

Major Challenges:

- Exorbitant Cost of Raw Materials

- Stringent Regulatory Requirements Can Result in Higher Costs of Production

Key Players: H.B. Fuller Company, Ashland Inc., Dymax Corporation, Henkel AG & Co. KGaA, Permabond Engineering Adhesives, Bohle Group, The Dow Chemical Company, ThreeBond Holdings Co., Ltd., and Sika A.G.

Global Display Bonding Adhesive Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.7 billion

- 2026 Market Size: USD 5.08 billion

- Projected Market Size: USD 11.23 billion by 2035

- Growth Forecasts: 9.1%

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Emerging Countries: India, Vietnam, Indonesia, Mexico, Brazil

Last updated on : 20 November, 2025

Display Bonding Adhesive Market - Growth Drivers and Challenges

Growth Drivers

- Rising Popularity of Adhesives in the Automotive Sector - Adhesives help the transportation sector to boost security and energy efficiency. Heat shields, air filters, and other pieces can be attached to the engine block or other metal parts using adhesives, which leads to weight reduction, and increases vehicle rigidity. Moreover, nowadays, touchscreens are a standard component in many cars, which necessitates the use of high-performance optical bonding since it enables delicate touchscreen features that provide interior systems more control, and provide optical clarity and minimize reflection for enhanced visibility in automotive displays.

- Increasing Pharmaceutical Industry - In the healthcare sector, displays are now an essential component of active smart and intelligent packaging, which incorporates the use of sensors, tracking, and ePaper technologies to provide various functionalities. These technologies often require the need of display bonding adhesives to attach the display components to the smart packaging. According to estimates, the global pharmaceuticals market is anticipated to increase by over 5% by 2027, with a market value of more than USD 1430.

- Growing Demand for Wearable Technology- Wearable device components, including sensors, batteries, screens, and straps, are bonded together using a high-performance adhesive as it offers strong structural integrity, excellent performance in drops, shocks, and impacts, thermal stability, and moisture resistance.

- Rising Need for the Product from the Furniture Sector- The furniture sector focuses on innovation to meet the market trends, as a result, the demand for smart furniture is increasing. To integrate displays into smart furniture companies in the area are widely using display bonding adhesives to ensure stability and increase functionality.

Challenges

- Exorbitant Cost of Raw Materials - The high cost of raw materials required for the production of display bonding adhesives is one of the major factors predicted to slow down the market growth. Various raw materials such as resins, and fillers, are used in the production of bonding adhesives since they require specialized formulations. The cost of these raw materials keeps fluctuating which makes it difficult for the producer to acquire the raw materials and makes them switch to alternate options.

- Growing Advancements in Conventional Technologies Leading to Higher Adoption of Alternative Bonding Methods

- Stringent Regulatory Requirements Can Result in Higher Costs of Production

Display Bonding Adhesive Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.1% |

|

Base Year Market Size (2025) |

USD 4.7 billion |

|

Forecast Year Market Size (2035) |

USD 11.23 billion |

|

Regional Scope |

|

Display Bonding Adhesive Market Segmentation:

Type Segment Analysis

The optically clear adhesive segment in the display bonding adhesive market is estimated to hold 55% of the revenue share in the coming years owing to the growing integration of touchscreen. With the advancement of technology, touch screens are widely integrated into modern displays. Optical clear adhesives (OCAs) or "display adhesives" are made specifically to join display components together and provide enormous adhesion properties between the display panel and the touch sensor. For every LCD and OLED that needs a GG or OGS touchscreen, optical bonding is the process of laminating, where a layer of resin is applied between the glass to ensure seamless integration and optimal touch sensitivity.

Additionally, the Liquid-based bonding technique, known as liquid optically-clear adhesive (LOCA), is utilized owing to its strong overall performance and high degree of impact resistance and is used for many display screens, touch panels, and other lens bonding applications to offer strong bond holds.

Application Segment Analysis

Display bonding adhesive market from the LCD displays segment is set to garner a notable share shortly. owing to the increasing need for adhesives in LCDs. In the creation of liquid-crystal displays, adhesives are used as a key component to improve the optical and durability properties. Display bonding adhesives are used as an interface between the layers of the LCD monitor display which helps in improving the impact resistance and screen clarity. As a base material for display optical performance, these adhesives have been employed to maximize the amount of light that reaches liquid crystal displays (LCDs) and their ability to display accurate color, and brightness, and withstand vibrations. Besides this, they also decrease the chance of display failure making them reliable across various applications.

Our in-depth analysis of the global display bonding adhesive market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Display Bonding Adhesive Market - Regional Analysis

North American Market Insights

Display bonding adhesive market in North America is predicted to account for the largest share of 40% by 2035 impelled by rising urbanization. It is expected that rapid urbanization will generate a huge demand for adhesives since urbanization and the development of infrastructure go in tandem. Offices, Restaurants, and other commercial buildings often require display panels for informative purposes which may raise the demand for display bonding adhesives to securely attach the display panels. For instance, the percentage of Americans who live in cities is predicted to be over 82%, up from 64% in 1950, and by 2050 more than 85% of Americans worldwide are expected to live in cities.

APAC Market Insights

The Asia Pacific display bonding adhesive market is estimated to be the second largest, during the forecast timeframe led by the growing production of electronics. China is the world's largest center for electronics manufacturing and is a notable leader in the outsourcing of electronics manufacturing. Moreover, with an annual growth rate of more than 15%, electronics has become the largest industry in China. Additionally, the world's most smartphones are sold and produced in the Asia-Pacific area since countries including Japan and South Korea are switching from feature phones to smartphones. This as a result may raise the demand for display bonding adhesive in the region.

Display Bonding Adhesive Market Players:

- 3M Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- H.B. Fuller Company

- Ashland Inc.

- Dymax Corporation

- Henkel AG & Co. KGaA

- Permabond Engineering Adhesives

- Bohle Group

- The Dow Chemical Company

- ThreeBond Holdings Co., Ltd.

- Sika A.G.

Recent Developments

- 3M Company introduced a new adhesive Medical Tape 4578 with longer wear periods that are intended to interact with a variety of long-term medical wearables, sensors, and health monitors. Further, this tape might help reduce expenses, gather more data for better decision-making, and can be stored for up to a year.

- H.B. Fuller Company launched a new biocompatible adhesive, Swift melt 1515-I, to provide efficient, high-tack bonding which can be utilized in stick-to-skin microporous medical tape applications in hospitals and at home. Further, the product is ISO 10993-5 certified and is known to exhibit great performance, balancing adhesion, and ease of removal.

- Report ID: 3940

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Display Bonding Adhesive Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.