Disconnect Switch Market - Regional Analysis

Asia Pacific Market Insights

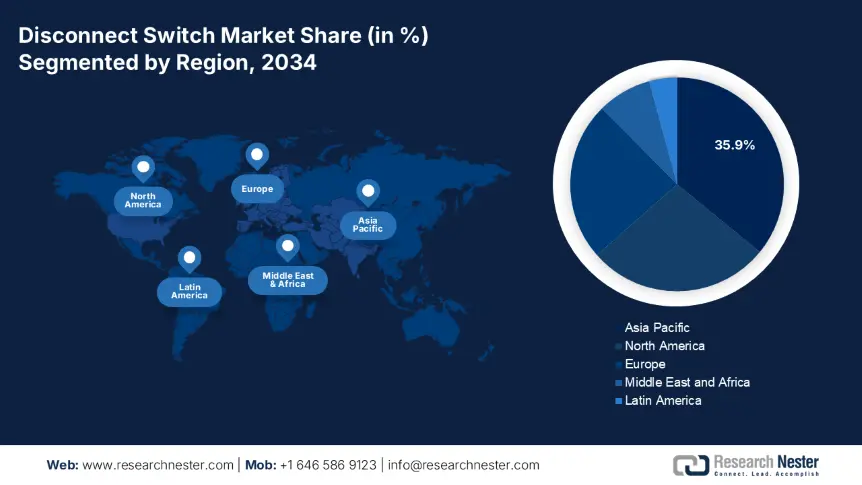

By 2034, the Asia Pacific disconnect switch market is expected to hold 35.9% of the market share due to both industrial automation and infrastructure expansion within the energy sector. The growing demand for renewable energy and new manufacturing investments is likely driving increased disconnect switch demand in this region. The disconnect switch market is expected to grow to USD 2.4 billion by 2034 and expand at a CAGR of 6.3% (2025-2034). Major manufacturers are increasing production capabilities around Southeast Asia to take advantage of lower manufacturing costs.

China is the leading disconnect switch market across APAC, with an anticipated share of greater than 41% of the region in 2025. China will continue to grow as more power is delivered and dispersed across the country. The disconnect switch market in China is expected to reach USD 951 million by 2034, expanding at a CAGR of 6.6%. China's need for disconnect switches is driven by the 14th Five-Year Plan, which aggressively promotes large-scale grid modernization, industrial electrification, and renewable integration. Domestic manufacturers are projected to increase their ability to create disconnect switches for medium and high voltage switch applications, while foreign manufacturers will expand their production capabilities in China.

Disconnect Switch Market In APAC, Focusing on Industrialization, Urbanization, and Infrastructure Development Trends

|

Country |

Industrialization & Manufacturing Growth |

Urbanization & Infrastructure Development |

Demand Drivers for Disconnect Switches |

|

China |

- World's largest manufacturing hub; expanding heavy industries. |

- Over 60% urbanization rate. |

- Rising need for safe electrical isolation in factories & power plants. |

|

India |

- "Make in India" boosting industrial zones. |

- Urban population to reach 600M by 2030. |

- Grid modernization and substation upgrades. |

|

Japan |

- High-tech manufacturing (robotics, semiconductors). |

- Smart city initiatives (e.g., Toyota Woven City). |

- Safety compliance in earthquake-prone zones. |

|

South Korea |

- Advanced electronics & shipbuilding industries. |

- Smart grid projects (Jeju Island). |

- Data center safety protocols. |

|

Southeast Asia (Indonesia, Thailand, Vietnam) |

- FDI-driven industrial growth (e.g., EVs in Thailand, textiles in Vietnam). |

- Urbanization rates >50%. |

- Mining & oil refinery safety standards. |

|

Australia |

- Mining boom (iron ore, lithium). <br.- Renewable energy projects (solar/wind farms). |

- Smart city projects (e.g., Melbourne). <br.- Grid stability initiatives. |

- Hazardous environment switches for mining. <br.- Microgrid and battery storage installations. |

North America Market Insights

North America disconnect switch market is expected to hold 27.6% of the market share due to industrial electrification and grid modernization. The U.S. Energy Information Administration (EIA) estimates U.S. electricity use will increase at a rate of 1.7% per annum through 2050, which will increase the need for safe disconnect switches. The Occupational Safety and Health Administration (OSHA) requires compliance with lockout/tagout (LOTO) regulations under standard 1910.147, increasing demand for disconnect switches in manufacturing. Clean energy renovations and smart grid improvements for Canada's grid modernization program will continue to promote significant growth.

In the U.S., disconnect switches are used as crucial electrical separation points for safe isolation in residential, commercial, and industrial applications. Following the passage of the Infrastructure Investment and Jobs Act (IIJA), the U.S. Department of Energy (DOE) announced $12 billion in programs to improve U.S. grid resilience and modernization. The National Institute of Standards and Technology (NIST) reports the growth of smart grid technologies to meet electric power reliability and safety, all leading to switch innovations in support of electrification. With OSHA reporting over 120 fatalities each year due to improper safety lockout/tagout, investments in compliance practices help drive ongoing market demand.

Europe Market Insights

Europe disconnect switch market is expected to hold 24.1% of the market share due to industrial automation practices and the ongoing digitalization initiatives undertaken in the region, as well as grid modernization initiatives for the integration of renewables. The size of the disconnect switch market was around USD 2.5 billion in 2024 and will grow to USD 3.6 billion by 2034, with an estimated CAGR of 3.9%. Future demand is aided by European Union safety standards for a changing workforce and society (including retrofit and upgrade projects for the power distribution industry) and EN 60947-3 industrial safety regulations. Key manufacturers across Europe have increased production capacity to support growing energy and manufacturing sector demand.

Disconnect Switch Market in Europe – Country-wise Insights

|

Country |

Industrial Automation & Manufacturing |

Power Distribution & Grid Upgrades |

Renewable Energy Projects |

|

Germany |

- Leading Industry 4.0 adoption; robotics & automotive sectors driving demand. |

- Smart grid investments (~€20B by 2030). |

- Solar capacity expansion (target: 215 GW by 2030). |

|

France |

- Automation in aerospace & automotive industries. |

- €30B grid modernization plan (RTE). |

- Offshore wind targets (40 GW by 2050). |

|

UK |

- Growth in data centers & pharmaceutical automation. |

- £20B+ investment in smart grids. |

- World’s largest offshore wind capacity (50 GW by 2030). |

|

Italy |

- Rising automation in machinery & textiles. |

- €5B grid resilience projects (Enel). |

- Solar PV additions (3 GW/year). |

|

Spain |

- Automotive & renewable equipment manufacturing growth. |

- €6.9B smart grid plan (Red Eléctrica). |

- Wind & solar dominate (renewables ~50% of energy mix). |

|

Netherlands |

- High-tech & semiconductor industries. <br.- Automation in logistics & ports. |

- €4B grid expansion for data centers & EVs. |

- North Sea wind farms (21 GW by 2030). |

|

Nordics (Sweden, Norway, Denmark) |

- Mining & EV battery production (Sweden). <br.- Oil & gas automation (Norway). |

- Cross-border grid interconnections. <br.- Green data center investments. |

- Hydropower dominance (Norway). <br.- Wind energy (Denmark targets 12 GW offshore by 2030). |

|

Poland |

- Manufacturing hub for Eastern Europe. <br.- Rising FDI in automotive & electronics. |

- €9B grid modernization. |

- Solar PV boom (10 GW capacity in 2023). <br.- Baltic offshore wind projects. |