Direct Methanol Fuel Cell Market Outlook:

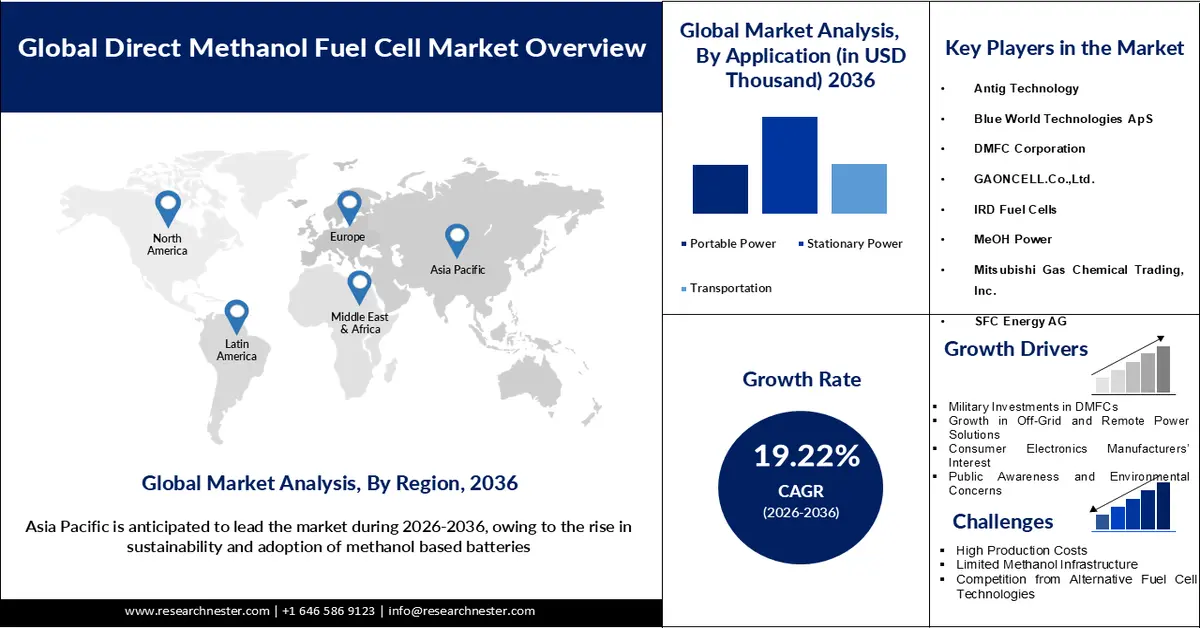

Direct Methanol Fuel Cell Market size is to be valued at USD 1.28 billion in 2025 and is expected to grow to USD 8.23 billion by 2036, registering a CAGR of 19.22% during the forecast period, i.e., 2026-2036. In 2026, the industry size of direct methanol fuel cell is estimated at USD 1.52 billion.

The growth of the direct methanol fuel cell market is driven by the increasing sustainability measures by the government and the innovation in the catalyst and membrane manufacturing. DMFC uses methanol to power the medical devices, laptops, and mobile phones because of the ease of carriage. The demand from the military is further amplifying the growth of the market, as they use remote monitoring devices and other components that require the use of DMFC in their components. Many countries across the globe have enhanced their emission norms, where the aim is to reduce carbon emissions and achieve net zero. Countries like Finland have aimed to neutralize carbon by 2035 as part of their sustainability measure. Methanol is highly compatible with nature and, unlike other alternatives, it burns cleaner and causes less pollution. Methanol is also used as a fuel in ships, thereby reducing pollution levels and operational costs.

Key Direct Methanol Fuel Cell Market Insights Summary:

Regional Highlights:

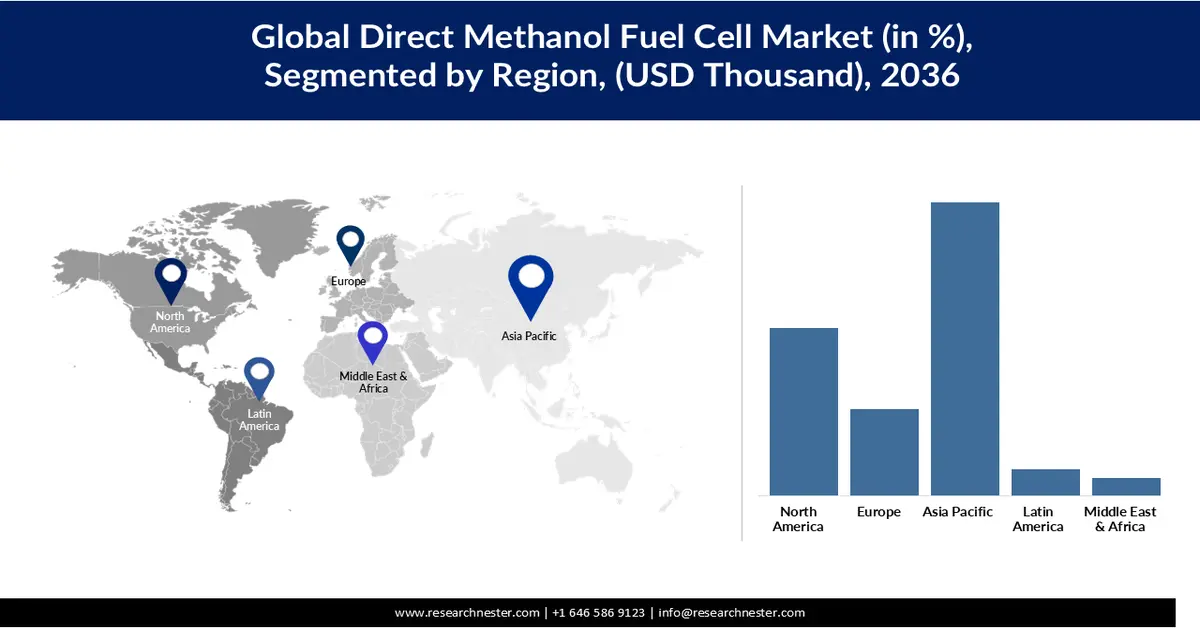

- By 2036, Asia Pacific is anticipated to secure 35% of the share in the direct methanol fuel cell market, supported by the region’s strong electronics manufacturing base and increasing deployment of methanol-powered systems across defence and remote power infrastructure owing to advanced component innovation.

- North America is projected to account for 30% of the market share by 2036, underpinned by the expansion of high-performance off-grid power systems and the region’s growing emphasis on clean-energy utilisation.

Segment Insights:

-

The stationary power segment is projected to command over 33% share by 2036 in the direct methanol fuel cell market, fueled by the demand for reliable off-grid power solutions.

-

Key Growth Trends:

- Military investment in DMFC

- Growth in off-grid power

Major Challenges:

- Rise in production costs

- Limited methanol manufacturing

Key Players: Antig Technology (Taiwan), Blue World Technologies ApS (Denmark), DMFC Corporation (US), GAONCELL.Co.,Ltd. (South Korea), IRD Fuel Cells (Denmark), MeOH Power (US), Mitsubishi Gas Chemical Trading, Inc. (Japan), SFC Energy AG (Germany), SHARP CORPORATION (Japan), Siqens GmbH (Germany), Sushui Energy Technology (Shanghai) Co., Ltd. (China), TOSHIBA CORPORATION (Japan)

Global Direct Methanol Fuel Cell Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.28 billion

- 2026 Market Size: SD 1.52 billion

- Projected Market Size: USD 8.23 billion by 2036

- Growth Forecasts: 19.22% CAGR (2026-2036)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2036)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Canada, United Kingdom, France, Singapore

Last updated on : 4 December, 2025

Direct Methanol Fuel Cell Market - Growth Drivers and Challenges

Growth Drivers

- Military investment in DMFC: The adoption of methanol in ships and other equipment is supporting the growth of the DMFC market. The Jet Propulsion Laboratory of NASA designed a DMFC for armored vehicles that operates quietly with a minimal thermal signature, making it extremely strong in energy capacity. In maritime, the traditional marine batteries would require frequent recharge; however, with the use of a methanol-based fuel cell, the recharge frequency is reduced to a great extent. In many gears and equipment, the military employs the use of DMFC because of its low density and effectiveness. Moreover, the equipment can be used for a long duration without the need for recharge, as methanol-based fuel cells provide long-range operations.

- Growth in off-grid power: Power grids are installed in remote areas, which require continuous power to operate the grid systems. The use of fuel cells can power the grid system without the need for electricity. The fuel cells contain methanol, which, after reacting with oxygen, converts the chemical energy to electricity. Employing fuel cells in remote off-grid power can be beneficial when there is minimal access to electricity. Moreover, these off-grid power sources are located at a distance where frequent recharge of the batteries is not possible. Fuel cells that use methanol are required to recharge at lesser intervals as they have enhanced longevity.

- Increasing environmental concerns and rising awareness: Climate change has become a major concern worldwide, increasing pressure on governments to adopt and promote low-emission technologies. DMFC, when employed in generators, produces minimal pollution when compared to other combustion-based engine generators. Electric generators often use fuel cells that emit less carbon, leading to improved environmental sustainability. The demand for low-noise and emission-free generators in telecom and off-grid locations is supporting the growth of the DMFC market. Methanol is considered a great substitute for diesel, leading to its widespread adoption in developing nations to minimize pollution levels.

Challenges

- Rise in production costs: DMFC needs certain precious metal catalysts, such as rhodium and platinum, in its creation. These metals are quite expensive and have supply chain constraints, which further make them expensive. This often restricts the emerging manufacturers and limits the growth of the DMFC market. Moreover, alternatives such as lithium-ion batteries are also reducing their prices, allowing more adoption in emerging and developing markets as a measure of cost-cutting.

- Limited methanol manufacturing: The refilling stations for methanol are quite scarce, which is causing a barrier to the adoption of DMFC. Countries like China are only powering marine and industrial vehicles through methanol despite large-scale production, which entirely blocks the market and limits growth. To enable broader adoption of methanol, expansion of the refueling network is essential. Many developing regions are lagging in the usage of methanol primarily because of poor investment in R&D, which further restricts the market penetration.

Direct Methanol Fuel Cell Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2036 |

|

CAGR |

19.22% |

|

Base Year Market Size (2025) |

USD 1.28 billion |

|

Forecast Year Market Size (2036) |

USD 8.23 billion |

|

Regional Scope |

|

Direct Methanol Fuel Cell Market Segmentation:

Application Segment Analysis

The stationary power segment will dominate the market with more than 33% market share by 2036, which is fueled by the demand for reliable off-grid power solutions. Off-grid power systems often need continuous electricity, which is powered by a generator and operated on diesel, which emits more carbon. The use of electric generators employs methanol fuel cells, which emit less carbon and keep the environment safe. The Indian Ministry of Defence report on Technology Perspective capability roadmap confirms DMFC as a viable alternative in power solutions. According to a report from Siltec, they have successfully supplied 45,000 fuel cells worldwide to the defence sector, further demonstrating the strong adoption in heavy vehicles. The off-grid radars and UPS unit can be powered more effectively if DMFC is employed in grids; moreover, their maintenance will also be less, as methanol-powered fuel cells are durable in nature, leading to their widespread adoption in Europe and North America.

Our in-depth analysis of the global direct methanol fuel cell market includes the following segments:

| Segment | Subsegment |

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Direct Methanol Fuel Cell Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is the most dominating market, expected to hold a market share of 35% by 2036, as the region is a leader in the manufacturing of electronics and electrical components, where the use of DMFC is quite high. Moreover, strong manufacturing and innovation of the region have fuelled the growth of the market, as defence, power, and transportation highly rely on methanol. The defence sector uses certain equipment and wireless radar systems that are located at distances in order to cover a large geographical space. As these are located in offshore and remote areas, frequent recharge of the battery can be avoided if methanol-based fuel cells are used in the generators.

China is one of the leading manufacturers of smart devices and mobile phones, which are transitioning towards the development of methanol-based batteries that can operate for long durations and are safe to carry. China is always on edge with innovation and the advancement of new technology. Thus, their adoption of DMFC has fuelled the growth of the global market. The adoption of DMFC increases the cost of the products, as there is a huge expense involved in the manufacturing of DMFC; also, the added supply chain risk further prohibits the growth of the market.

India, in its multi-energy strategy, has approved the usage of methanol, which can be obtained from animal waste, coal, and biomass, which is accelerating the expansion of the DMFC market. The defence sector has also enhanced the demand for reusable power systems that can operate for long working hours and minimize the need for frequent maintenance. Larger players such as SFC Energy supply DMFC units to the Indian defence to maintain their surveillance

North America Market Insights

The North American market is expected to hold a market share of 30% fuelled by the rapid expansion of high-performance power systems that can power the off-grid systems, such as telecommunication towers, radars, and solar power plants. North America also focuses on the maximisation of clean energy and reducing carbon emissions, which helps in sustaining clean and green energy. North America has also developed high-performance DMFC systems, which are sourced for military and defence. Soldiers often use night vision goggles and a position tracker that are equipped with methanol-based batteries to ensure superior longevity.

Canada has aimed towards carbon minimization, especially from the manufacturing sector, which contributes hugely to rising pollution levels. Canada has developed a Green Hydrogen Strategy through which the pollution levels would be reduced to a great extent. Canada’s emphasis on methanol adoption has enhanced its use in the production of a renewable source of energy, which is fuelling the DMFC market.

The U.S. has a broad consumer electronics industry that uses batteries made with methanol fuel cells, as they are lightweight and have high durability. Government-run R&D funding to improve the performance of fuel cells is further amplifying the growth of the market. The country hosts multiple off-grid power systems, such as solar power and telecommunication towers, which require reliable power. Methanol fuel cells hold great value for being an alternative viable option that not just reduces emissions but also reduces cost.

Europe Market Insights

The direct methanol fuel cell market of Europe is expected to hold a market share of 22% by the end of the forecast period. The market size in Europe will be USD 97,717.26 thousand by 2036, fuelled by innovation in catalyst and membrane technologies that are important components of a fuel cell. The demand is further driven by the policies of the EU that have enforced certain pollution control norms and increased the use of energy-efficient systems to maintain sustainability. Many regions have accelerated the growth of DMFC to curb carbon minimisation.

The sustainability measure of Germany is at par; the country has used green energy to enhance its sustainability. Germany uses hybrid engines in vehicles that can run on electric as well as methanol, amplifying the growth of DMFC. The low-carbon alternative is supporting the environment and acting as a key strategy in reducing government expenditures on public transportation.

The UK is quite established in terms of fuel cell manufacturing, with key players specialising in bipolar plates and stack components for DMFC. Moreover, companies are planning to expand the infrastructure that would manufacture products locally instead of relying on the volatile supply chain. Off-grid power stations are also increasing in the UK, which is demonstrating a strong demand for the DMFC market.

Key Direct Methanol Fuel Cell Market Players:

- Antig Technology (Taiwan)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Blue World Technologies ApS (Denmark)

- DMFC Corporation (US)

- GAONCELL.Co.,Ltd. (South Korea)

- IRD Fuel Cells (Denmark)

- MeOH Power (US)

- Mitsubishi Gas Chemical Trading, Inc. (Japan)

- SFC Energy AG (Germany)

- SHARP CORPORATION (Japan)

- Siqens GmbH (Germany)

- Sushui Energy Technology (Shanghai) Co, Ltd. (China)

- TOSHIBA CORPORATION (Japan)

- Antig Technology is a fuel cell stack and solutions providers that specialize in micro fuel cells and DMFC. Their own innovative product, H2Powerchip, uses a PCB board technology, making it lighter and smaller in size. The firm claims that the production of PCBs is quite cost-effective, as the PCB market is well established.

- Toshiba Corporation manufactured its first DMFC in 2004, which is potent enough to power a small device for more than 20 hours. Toshiba is skilled in methanol concentration and thermal management. It has recently reformed the methanol fuel cells as a part of innovation that has enhanced its position as a global energy system and solution maker.

- Sharp Corporation has aligned its goals with the SDGs through smart products that limit emissions and enhance sustainability. It manufactures consumer electronics and is a key player in integrated stack structures. The products utilize DMFCs, which are built by the business itself, thereby limiting reliance on other brands.

- IRD Fuel Cell has an expanding global presence across Europe, North America, and the Asia-Pacific region. The company manufactures Membrane Electrode Assemblies, bipolar plates, and PEM fuel cells. It emphasizes that R&D is central to its business success, and continued investment in research and development will further enhance its technological capabilities and market position.

Here are a few areas of focus covered in the competitive landscape of the market:

The players operating in the global direct methanol fuel cell market are expected to face intense competition during the forecast timeline. The market is associated with both established key players and new entrants. However, the market is moderately fragmented. New entrants impose immense competition for the existing players, prohibiting them from acquiring the majority of the revenue share. Specialized manufacturers maintain a competitive landscape in the market. Key players in the market are significantly supported by the governments for research and innovation.

Competitive Landscape of the Global Direct Methanol Fuel Cell Market

Recent Developments

- In November 2024, Toshiba Corporation announced its next collaboration with Nimbus Power System, which will develop a pure hydrogen fuel stack. Nimbus, with its four-fluid-stack technology, will leverage Toshiba’s manufacturing facility.

- In March 2025, Sharp Corporation released its plans to open a new AI data center in collaboration with Nvidia Chips. For funding, SoftBank has been approached with indications of investment nearing 100 billion yen.

- Report ID: 5681

- Published Date: Dec 04, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Direct Methanol Fuel Cell Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.