Direct Carrier Billing Market Outlook:

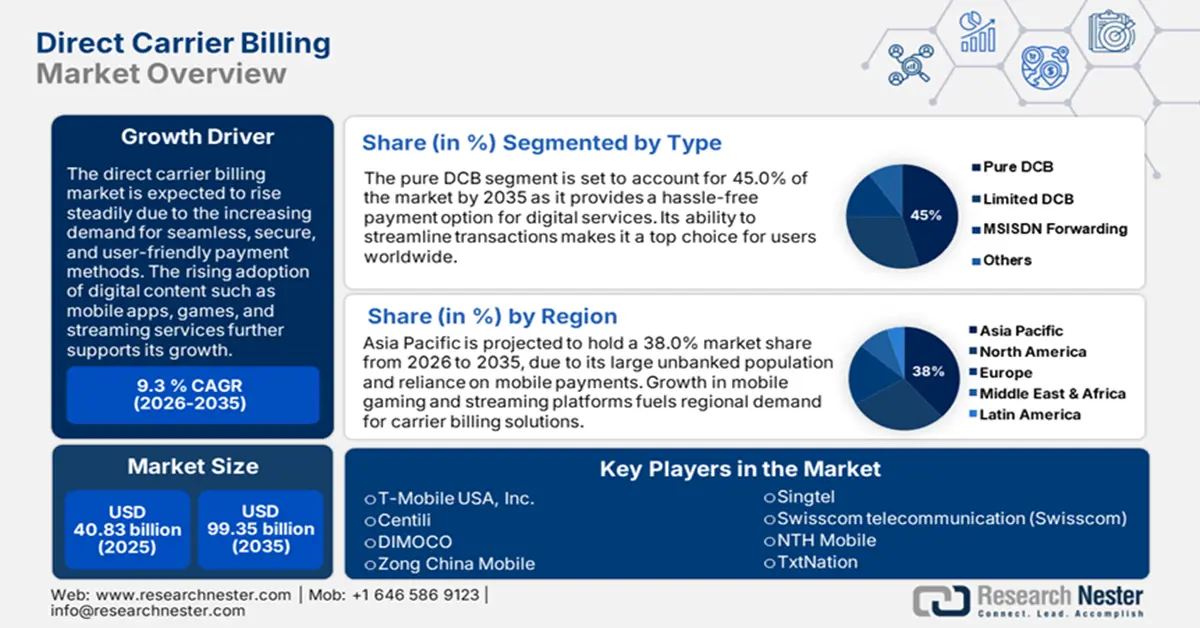

Direct Carrier Billing Market size was valued at USD 40.83 billion in 2025 and is expected to reach USD 99.35 billion by 2035, expanding at around 9.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of direct carrier billing is evaluated at USD 44.25 billion.

Global smartphone penetration and mobile internet usage are accelerating the direct carrier billing (DCB) market expansion. The growing popularity of DCB is observed in the fact that, in 2023, 66% of global DCB sales came from smartphone users. Furthermore, the adoption of DCB is being driven by the increasing demand for digital services like video streaming, gaming, and e-publishing. Vodafone Group partnered with a fintech startup in August 2024 to improve its DCB solutions for Europe, particularly with regard to security and simplified billing, demonstrating the market’s development to cater to end users’ needs.

The direct carrier billing market is further propelled by government initiatives and industry collaborations. For example, in September 2024, Google expanded its DCB options on the Google Play Store in Asia, making digital content purchases easier and increasing engagement in emerging markets like India and Indonesia. According to reports, there were 4.6 billion mobile internet users worldwide in 2023. Fulfilling the demand, DCB opens a promising avenue for telecom operators and service providers to serve a tech-savvy audience while resolving the issues of traditional payment systems.

Key Direct Carrier Billing Market Insights Summary:

Regional Highlights:

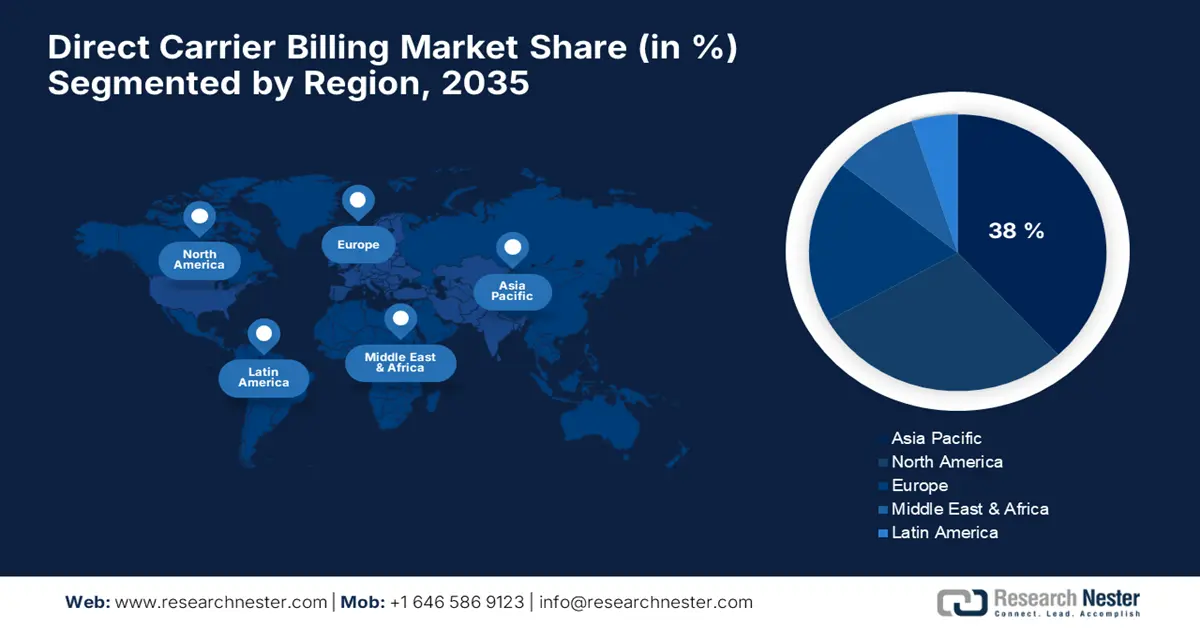

- Asia Pacific commands a 38.00% share in the Direct Carrier Billing Market, driven by the rapidly growing digital economy and high smartphone adoption rates, ensuring robust growth by 2035.

Segment Insights:

- The Android Platform segment is set to capture a 75% market share by 2035, attributed to Android’s open-source support for seamless DCB integration.

- The Pure DCB segment of the Direct Carrier Billing Market is projected to maintain over 45% share by 2035, driven by ease of use and financial inclusion for the unbanked population.

Key Growth Trends:

- Increasing smartphone penetration

- Rising adoption of digital content

Major Challenges:

- Data privacy concerns

- Lack of universal adoption

- Key Players: T-Mobile USA, Inc., DIMOCO, Bango.net Ltd, Singtel, Swisscom telecommunication (Swisscom), Infobip, NTH Mobile, TxtNation, Centili, Paymentwall, Boku Inc.

Global Direct Carrier Billing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 40.83 billion

- 2026 Market Size: USD 44.25 billion

- Projected Market Size: USD 99.35 billion by 2035

- Growth Forecasts: 9.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, United States, Germany, South Korea

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 13 August, 2025

Direct Carrier Billing Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing smartphone penetration: As smartphones have become the main device for internet access, the need for hassle-free payment options has increased, and DCB has been the answer to this need. In Feb 2024, Vodafone Oman launched carrier billing for Apple services, allowing users to pay for apps and subscriptions through their mobile accounts. It makes payments convenient and easy and is especially useful in areas with low credit card penetration.

-

Rising adoption of digital content: DCB adoption is driven by the growing consumption of digital content like streaming services, gaming, and e-publishing. This payment method allows users to conveniently charge purchases directly to their mobile phone bills. DIMOCO Payments entered into a partnership with Nextory in May 2024 and made DCB options available for audiobooks and e-books, just like other mobile payments were integrated with digital platforms.

- Shift towards cashless transactions: The direct carrier billing market is being driven by governments worldwide who are encouraging cashless economies. As an example, the Japan government intends that 40% of all transactions be cashless by 2025 end, a favorable environment for DCB. In March of 2023, T-Mobile extended its 5G capabilities and DCB offerings, making it possible for customers to benefit from services frictionlessly, as DCB contributes to the general digitalization.

Challenges

-

Data privacy concerns: As mobile payments, including Direct Carrier Billing (DCB), become more and more relied upon, data privacy and security are becoming a major area of concern. Mobile networks increase the risk of breaches and unauthorized access to user information. However, cyber attacks are still a big problem for users in many regions that do not have robust regulations to protect sensitive payment data. With the rise of DCB adoption, compliance with global and regional data protection laws becomes more and more difficult. The lack of standardized security protocols only makes it more difficult to secure user information. All this calls for robust encryption and multi-factor authentication solutions.

-

Lack of universal adoption: The adoption of DCB continues to be extremely fragmented across global direct carrier billing markets with wide variation in acceptance and use. In regions with widespread credit card penetration, such as North America and parts of Europe, uptake is slower as there are already well established payment alternatives. However, DCB’s growth potential is hindered even more in developing markets, where infrastructure is limited, and regulatory frameworks are inconsistent. Another barrier is consumer trust as many consumers are still not aware of the security and convenience of carrier billing.

Direct Carrier Billing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.3% |

|

Base Year Market Size (2025) |

USD 40.83 billion |

|

Forecast Year Market Size (2035) |

USD 99.35 billion |

|

Regional Scope |

|

Direct Carrier Billing Market Segmentation:

Type (Limited DCB, Pure DCB, MSISDN Forwarding, and Others)

Pure DCB segment is expected to account for more than 45% direct carrier billing market share by the end of 2035. This growth is due to the level of accessibility, allowing for payments without a bank account or credit card. In August 2024, Digital Turbine teamed up with Motorola to bring customers around the world cutting edge Pure DCB solutions for enhanced payment experiences. This segment is critical to serving the unbanked population, bridging the financial inclusion gap, and meeting the demand for easy-to-use mobile transactions.

Platform (Android, iOS, and Others)

Due to its wide global penetration and compatibility with DCB services, the Android platform is expected to account for a direct carrier billing (DCB) market share of 75% through 2035. The growth is attributed to the open source framework that supports carrier billing systems, helping to integrate with them and increase transaction speed seamlessly. In February 2023, T-Mobile joined forces with AWS to integrate Android-based DCB solutions to support scalable cloud applications for mobile payment. Android’s ascendancy in this sector emphasizes its ability to catalyze innovation and promote the widescale deployment of DCB services worldwide.

Our in-depth analysis of the global market includes the following segments

|

Type |

|

|

Platform |

|

|

End user |

|

|

Authentication type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Direct Carrier Billing Market Regional Analysis:

North America Market Analysis

North America direct carrier billing market is set to witness high growth rate till 2035. Some of the key drivers include the region’s robust technological infrastructure, as well as the increasing adoption of digital payment solutions. The Federal Communications Commission’s (FCC) transparency standards in mobile payments are designed to increase consumer confidence in DCB and encourage broader adoption. Advanced technologies, including secure invoicing and fraud prevention systems, are integrated into seamless and reliable payment processes. The efforts have placed North America as a leader in the advancement of DCB solutions for digital commerce.

The direct carrier billing market in the U.S. continues to enjoy the benefits of a mature telecom industry and rising demand for mobile payment solutions. In fact, the nation’s commitment to improving digital financial systems is demonstrated by the introduction of innovative payment frameworks by leading carriers. Across sectors such as e-commerce and entertainment, they are taking initiatives to increase security and simplify transactions, which is driving DCB adoption. As consumers increasingly depend on mobile technology, DCB is gaining ground as a preferred payment option for digital content and services.

Growing smartphone penetration and growing digital media consumption in Canada are driving the steady growth of the country’s direct carrier billing market. Mobile payment systems operate securely and reliably owing to the country’s strong regulatory framework that builds consumer trust. To meet the growing demand for frictionless digital transactions, regional carriers are investing heavily in DCB infrastructure. Moreover, the adoption of mobile billing solutions is further supported by government initiatives promoting cashless payments throughout urban and rural areas.

Asia Pacific Market Analysis

Asia Pacific direct carrier billing market is set to hold revenue share of over 38% by the end of 2035, attributed to its rapidly growing digital economy. The key growth drivers for the region include high smartphone adoption rates and the transition to cashless payment systems. Investment in DCB platforms is led by countries like India and China to expand mobile payment solutions for digital content and services. DCB providers stand to benefit from the region’s diverse population and growing internet penetration.

India direct carrier billing market is expanding at a fast pace due to an increase in smartphone penetration and government backing for digital payments. Legislation by the Ministry of Electronics and Information Technology (MEITY) to standardize mobile payment technologies is a step towards promoting secure and user-friendly payment solutions for the country. DCB adoption is spreading across rural and urban areas, providing hassle-free transactions for digital content, e-commerce, and other services. As a result of India digital transformation efforts and tech-savvy population, the country is becoming a potential direct carrier billing market for innovative DCB solutions.

China strong telecom infrastructure and commitment to digital payments have helped make the country’s market flourish. Advanced DCB platforms launched by China Mobile in 2024 further reflect the country’s push to provide more mobile payments for digital services. DCB adoption is driven by high mobile internet penetration and increasing adoption of 5G networks in urban and rural areas. The country’s major investments in digital payment ecosystems help it stay ahead of the Asia Pacific direct carrier billing (DCB) market, and likely to continue witnessing growth in the sector.

Key Direct Carrier Billing Market Players:

- T-Mobile USA, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Centili

- DIMOCO

- net Ltd

- Singtel

- Swisscom telecommunication (Swisscom)

- NTH Mobile

- TxtNation

- Infobip

- Paymentwall

- Zong China Mobile

- Telenor

- Orange S.A.

The direct carrier billing (DCB) market is highly competitive, with the key players T-Mobile USA, Inc., DIMOCO, Bango.net Ltd., Centili, Infobip, and Boku Inc. leading the innovation and market growth. These companies are already busy strategizing to forge strategic partnerships, integrate technology, and expand their global reach to meet the burgeoning demand for a seamless and secure mobile payment solution. In September 2024, Google extended its DCB capabilities to Asia, allowing users to make purchases from the Google Play Store, a move that reflects the rising significance of emerging markets in defining the global market.

In November 2024, Bharti Airtel and Bango.net Ltd. teamed up to bring advanced DCB solutions to India, taking on the payment challenge of the vast unbanked population of the country. The nature of this collaboration mirrors the rising trend of regional opportunities as companies increasingly embrace localized strategies to unlock growth and improve access. Both are innovation and customer-centric, showing the dynamic evolution of the market to meet the needs of consumers worldwide.

Here are some leading players in the direct carrier billing market:

Recent Developments

- In September 2024, Google expanded Direct Carrier Billing (DCB) capabilities on its Play Store to additional Asian countries, including India and Indonesia. This initiative simplifies digital purchases and enhances accessibility, aligning with Google’s strategy to strengthen its market presence in emerging regions and increase app store engagement.

- In July 2024, Samsung Electronics introduced a new Direct Carrier Billing (DCB) feature for its Galaxy Store. This feature allows users to charge app and in-game purchases directly to their mobile accounts, streamlining the checkout process and encouraging broader adoption of Samsung’s digital services ecosystem.

- Report ID: 7057

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Direct Carrier Billing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.