Direct Air Capture Market Outlook:

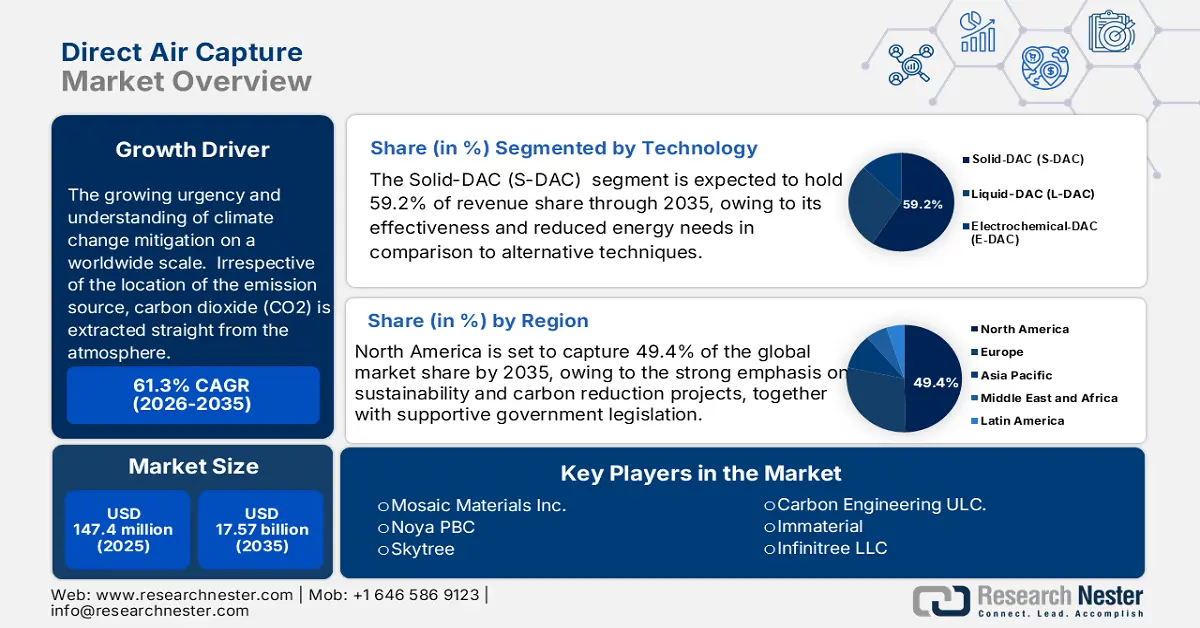

Direct Air Capture Market size was valued at USD 147.4 million in 2025 and is expected to reach USD 17.57 billion by 2035, expanding at around 61.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of direct air capture is evaluated at USD 228.72 million.

Direct air capture market growth is driven by the growing urgency and understanding of climate change mitigation on a worldwide scale. Irrespective of the location of the emission source, carbon dioxide (CO2) is extracted straight from the atmosphere. This is in contrast to conventional carbon detection, which usually takes place at the source of emissions, such as in steel mills or other industrial sites. The CO2 that has been detected can either be used for other purposes, such as creating synthetic fuels, or it can be permanently stored in deep geological formations.

The need for carbon reduction solutions is rising as a result of stricter government regulations and a greater emphasis on environmental sustainability. The global effort to achieve net-zero emissions by 2050 is a major component of this trend. Over 140 countries, including significant carbon emitters, have committed to achieving the objective. The U.S., the world's largest historical greenhouse gas emitter and the second-largest current emitter, had initially promised to reduce total greenhouse gas emissions by 26 to 28% below 2005 levels by 2025. India aimed to reduce emissions intensity by 33 to 35% below 2005 levels and generate 40% of its electricity from non-fossil fuel sources by 2030; in 2021, the country revised these targets to 45% below 2005 levels and half of its electricity from non-fossil fuel sources.

Key Direct Air Capture Market Insights Summary:

Regional Highlights:

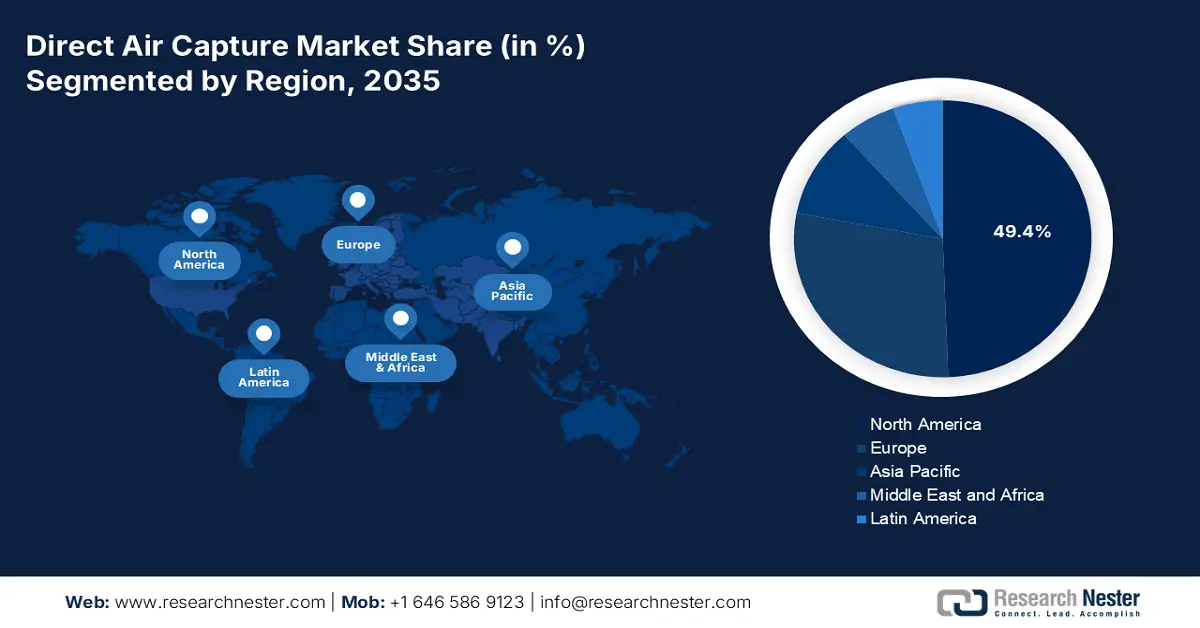

- North America leads the Direct Air Capture Market with a 49.4% share, propelled by sustainability efforts, government legislation, and strong carbon management infrastructure, ensuring robust growth through 2035.

Segment Insights:

- The Carbon Capture and Storage (CCS) segment is projected to capture 59.2% market share by 2035, driven by growing interest in lowering carbon footprints and regulatory support.

Key Growth Trends:

- Growing infrastructure development for carbon utilization and storage

- Expansion of carbon neutrality in the food industry

Major Challenges:

- High implementation cost

- Restricted regulatory framework

- Key Players: Mosaic Materials Inc., Noya PBC, Skytree.

Global Direct Air Capture Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 147.4 million

- 2026 Market Size: USD 228.72 million

- Projected Market Size: USD 17.57 billion by 2035

- Growth Forecasts: 61.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (49.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, United Kingdom, Germany, Japan

- Emerging Countries: China, Japan, South Korea, India, Brazil

Last updated on : 12 August, 2025

Direct Air Capture Market Growth Drivers and Challenges:

Growth Drivers

- Growing infrastructure development for carbon utilization and storage: The direct air capture (DAC) industry is growing due to the development of carbon utilization and storage infrastructure, which offers feasible paths for acquired CO₂. New uses of collected carbon, such as materials, chemicals, and synthetic fuels, are making them more commercially viable and drawing in industrial involvement. Furthermore, there is an increasing need for DAC-based CO₂ supply due to the growth of enhanced oil recovery (EOR) activities and dedicated carbon storage sites. Transportation infrastructure investments, such as shipping logistics and CO₂ pipelines, are increasing the effectiveness of carbon dispersion across a range of businesses. DAC is becoming a crucial component of the larger carbon management ecosystem as carbon storage and use technologies develop, enabling the long-term removal of CO₂ from the atmosphere.

Heimdal Inc. introduced Bantam in 2024. Bantam is now the largest DAC facility in the U.S. and the second largest in the world, with a nameplate capacity of over 5,000 tons of CO2 that can be captured from the atmosphere each year. The launch is a major turning point in the nation's larger carbon capture and storage (CCS) boom and the beginning of Heimdal's commercial carbon capture operations in the US. Bantam stands out among the quickly expanding area of CCS technologies due to its development speed and construction cost, which are significantly lower than those of other DAC systems to date.

- Expansion of carbon neutrality in the food industry: The increasing implementation of direct air capture in food companies as part of their initiatives to achieve carbon neutrality. As sustainability emerges as a key economic strategy, food firms are using cutting-edge tools such as DAC to offset their carbon emissions and achieve global climate goals. The increasing demand on companies to address climate change from customers, authorities, and environmental groups is driving this transition. The objective of research and development is to increase the DAC technology' scalability and efficiency. It is anticipated that DAC's potential will be further increased by integration with other sustainable technologies, such as carbon capture and storage, and renewable energy.

Climeworks and Coca-Cola collaborated in 2024 to remove CO₂ from the atmosphere and reuse it in the beverages sector. Climeworks, a direct air capture (DAC) technology startup, is attempting to combat climate change while also adding fizz to Valser sparkling mineral water, a Coca-Cola product. Climeworks will provide Coca-Cola with air-captured CO₂ to carbonate Valser. Climeworks plans to capture 1% of the world's CO₂ emissions by 2025. Coca-Cola sells over two billion products every day around the world. It is now focusing on product innovation, sustainability initiatives, and extending its non-alcoholic options to match changing consumer demands with incorporating direct air capture technology.

Challenges

- High implementation cost: The high initial expenditures and huge energy consumption associated with establishing and operating direct air capture systems are a significant impediment to the implementation of this technology. Despite the potential environmental benefits, enterprises may be hesitant to deploy DAC technology due to financial and resource constraints. The atmosphere has a relatively low CO2 concentration (about 0.04%), making capture more difficult and expensive than capturing CO2 from concentrated industrial sources. In addition, the cost of renewable energy or carbon-free power, which is required to make DAC genuinely sustainable, contributes to the overall costs.

- Restricted regulatory framework: The lack of clear and encouraging regulatory frameworks for DAC may limit the direct air capture market's capacity to expand. Uncertainties in the regulatory landscape can stifle investment and the creation of a business-friendly environment. Various subsidies and financial incentives are required to make DAC more accessible and inexpensive to food groups. Programs that fund research and development in energy-efficient DAC technologies may also help reduce the overall energy consumption of these systems, making them more viable for broad usage.

Direct Air Capture Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

61.3% |

|

Base Year Market Size (2025) |

USD 147.4 million |

|

Forecast Year Market Size (2035) |

USD 17.57 billion |

|

Regional Scope |

|

Direct Air Capture Market Segmentation:

Technology (Solid-DAC (S-DAC), Liquid-DAC (L-DAC), and Electrochemical-DAC (E-DAC))

Solid-DAC (S-DAC) segment is poised to capture direct air capture market share of around 59.2% by the end of 2035, primarily due to its effectiveness and reduced energy needs in comparison to alternative techniques. Solid-DAC absorbs CO2 from the atmosphere using solid sorbents, which are subsequently released for usage or storage after heating. The solid segment's growth is largely due to the growing interest in lowering carbon footprints and the growing regulatory support for sustainable practices.

Liquid-DAC (L-DAC) absorbs CO2 straight from the air using a liquid solvent. It is valued for its capacity to scale and integrate with current industrial facilities. Businesses and academic institutions are looking into methods to increase the solvent's effectiveness and lower the process's overall energy usage.

Electrochemical-DAC (E-DAC) is another cutting-edge section that extracts CO2 from the air through electrochemical processes. Due to its reduced energy needs and possibility for renewable energy sources, E-DAC was showing promise as a technology. Although this technology is still in its early stages of development, it has enormous growth potential, particularly in areas where renewable energy is widely used.

Source (Electricity and Heat)

The electricity segment in direct air capture market is projected to gain a significant share through 2035, primarily due to its broad availability and decreasing cost of renewable energy sources, making electrically powered DAC systems both viable and sustainable. DAC systems use electricity to fuel important processes such as CO₂ sorbent regeneration, compression, and transportation. Furthermore, electricity provides the ability to easily expand processes, from small modular units to big industrial facilities. These systems, which rely solely on electricity to power the entire CO2 capture and release process, benefit from the ongoing global trend toward renewable energy, lowering operational costs and increasing environmental appeal.

Heat as an energy source is also important in DAC technologies, notably in procedures that need thermal reactions to release absorbed CO2 from absorbents. Although it has a smaller share than electricity, the utilization of heat is critical in systems that require high temperatures to regenerate sorbents. Heat can be collected from waste heat sources or integrated into industrial processes, improving energy efficiency and lowering the technology's overall carbon footprint.

Our in-depth analysis of the global direct air capture market includes the following segments:

|

Technology |

|

|

Source |

|

|

Number of Collectors |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Direct Air Capture Market Regional Analysis:

North America Market Statistics

North America in direct air capture market is expected to dominate over 49.4% revenue share by 2035. The market is highly driven by the strong emphasis on sustainability and carbon reduction projects, together with supportive government legislation. The region includes an effective carbon storage infrastructure, including CO₂ pipeline networks and sequestration sites. Leading academic institutions and private firms are driving continual innovation to improve capture efficiency and reduce costs.

The U.S. leads from the forefront owing to significant government incentives, private sector investments, and advanced carbon management infrastructure. Federal financing, tax rebates, and legislative support are speeding up commercial-scale DAC adoption. The country has a well-established research ecosystem, which promotes ongoing technological improvement. Large-scale projects become more feasible when carbon storage networks and specific sequestration locations expand. Corporate commitments to achieve net-zero emissions are boosting demand for DAC-based carbon removal certificates. The Energy Modeling Forum 37 study integrates the results of 16 climate models with a common set of U.S. decarbonization scenarios. To attain net-zero emissions by 2050, the U.S. must deploy DAC to capture between 100 million to two billion tons of CO2 every year, according to EMF 37 models. Currently, the country emits more than six billion tons of CO2 equivalent.

On the other side, in Canada, direct air capture is primarily growing due to collaboration among energy corporations, technology enterprises, and governments providing an enabling climate for DAC expansion and incorporation into national carbon reduction programs. Manufacturing, energy generation, and transportation are major drivers of demand for carbon capture technologies that reduce greenhouse gas emissions and comply with environmental requirements. Canada increased its climate ambition, aiming to reduce greenhouse gas (GHG) emissions by 40-45% below 2005 levels by 2030, and enacted legislation to achieve net-zero emissions by 2050. To practically eliminate CO2 pollution over the next three decades, meeting these targets will require a transformation in the production and use of energy and industrial products. In response to the climate imperative, global momentum in the carbon management sector has increased significantly in recent years, with over 570 carbon capture, utilization, and storage (CCUS) projects in the works. By 2030, 368 plants are scheduled to be operational, with the potential to capture 743 Mt of CO2 per year.

Europe Market Analysis

Europe's direct air capture market is undergoing significant transformation, driven by a high emphasis on carbon neutrality, financial support systems, and strict climate policies. The region's existing regulatory frameworks and carbon pricing mechanisms promote investment in carbon removal technologies. Research and development activities have accelerated advancements in storage solutions, cost reduction, and capturing efficiency.

The U.K. is researching and investing in direct air capture (DAC) technology to collect CO2 from the atmosphere to assist in reaching net-zero emissions by 2050. The remotely-operated electrochemical machine will recover 50 tons of high-purity CO₂ from the atmosphere using water and solar electricity generated on the TERC site. TERC will use CO₂ in a unique U.K. research project to evaluate the synthesis of sustainable aviation fuel (SAF) from atmospheric carbon. The project's goal is to eventually certify this fuel so that it may be rapidly scaled to help reduce carbon emissions in the U.K. aviation sector. The deployment is a key step in scaling DAC, which is recognized by the Intergovernmental Panel on Climate Change (IPCC) as a vital technology for humanity to fulfill its 1.5°C commitments. It also strengthens the U.K.'s position as an international climate leader, advancing essential solutions to achieve Net Zero.

Germany's growing venture capital and funding rounds are accelerating the development of innovative DAC technologies, enabling engineering-scale demonstrations, commercial pilot testing, and direct air capture market expansion for cost-effective carbon removal solutions. The paths are based on a selected, existing climate neutrality scenario that requires the removal of 20 Mt of carbon dioxide (CO2) per year by DACCS from 2045. The analysis focuses on the low-temperature DAC process, which might be more advantageous for Germany than the high-temperature one. The total electrical energy demand of 14.4 TWh per year, of which 46% is needed to operate heat pumps to supply the heat demand of the DAC process, corresponds to around 1.4% of Germany's envisaged electricity demand in 2045.

Key Direct Air Capture Market Players:

- Climeworks AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Avnos, Inc.

- Capture6

- Carbon Capture Inc.

- Carbon Collect Limited

- Carbon Engineering ULC.

- Immaterial

- Infinitree LLC

- MISSION ZERO TECHNOLOGIES

- Mosaic Materials Inc.

- Noya PBC

- Skytree

Leading companies in the direct air capture market are actively engaged in research and development to innovate and introduce new products to maintain a competitive advantage. The majority of the important businesses are strategically increasing their geographic presence by creating new production facilities at the national and international levels. Long-term methods for direct air capture market growth include investment, production, expansion, distribution agreements, collaborations, new establishments, mergers, and acquisitions.

Recent Developments

- In December 2024, ReCarbn, a Dutch DAC company, was purchased by Skytree, which integrated its cutting-edge chemical sorbent and filtration technology. With their backgrounds in R&D, product development, and finance, the three ReCarbn co-founders will assume senior positions at Skytree. Skytree's standing as a world leader in direct air capture technology was reinforced by this acquisition.

- In October 2024, Carbyon worked with four designers to redesign the look and feel of their CO₂ capturing devices. To improve the public's view of direct air capture technology, the designers sought to make the equipment both aesthetically pleasing and efficient.

- Report ID: 7492

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Direct Air Capture Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.