Dioctyl Adipate Market Outlook:

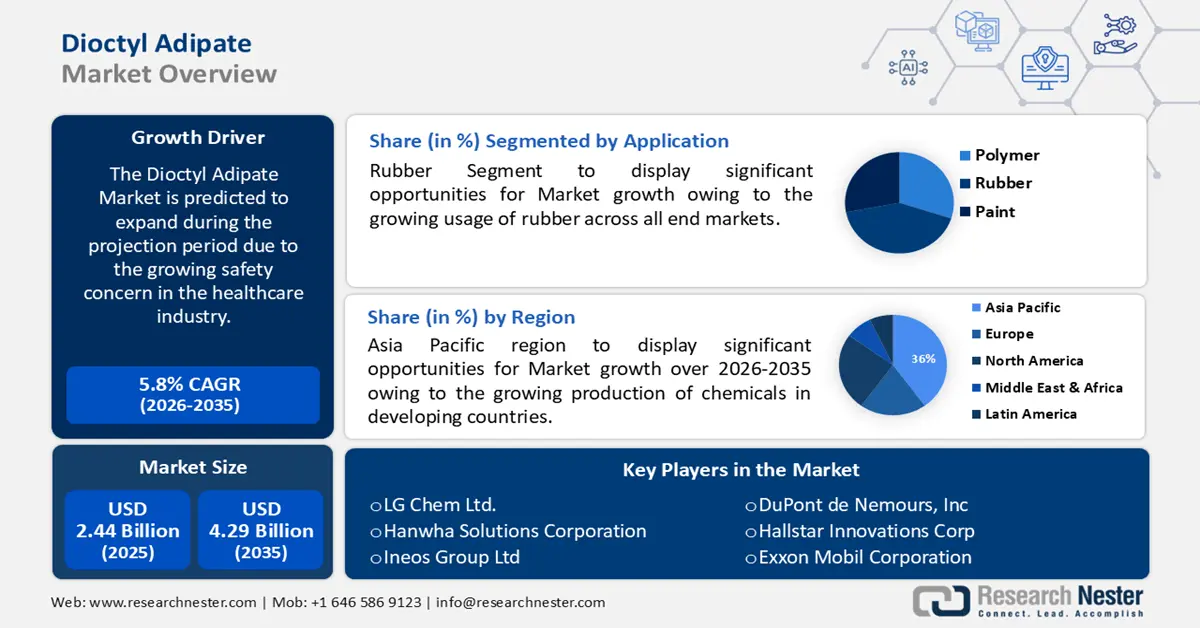

Dioctyl Adipate Market size was valued at USD 2.44 billion in 2025 and is likely to cross USD 4.29 billion by 2035, registering more than 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of dioctyl adipate is estimated at USD 2.57 billion.

The growth of the market can be attributed to the growing safety concern in the healthcare industry. Hospitals can be full of hidden risks owing to the high possibility of infections or medical mistakes. To enhance the manufacturing quality of medical equipment and gadgets, dioctyl adipate is employed as a favored raw material in the healthcare sector. It is used as a biodegradable substance it is utilized in medical gloves, tubes, blood bags, and other items. Further being a suitable material for creating different medical tubes that are inserted into a patient's body, DOA is becoming more and more significant. According to the World Health Organization (WHO), up to 4 out of 10 patients experience injury when receiving primary and outpatient care globally.

In addition to these, factors that are believed to fuel the market growth of dioctyl adipate include the rising demand for personal products. For instance, the growing concern among individuals on personal hygiene and skin health has led to the rise in demand for personal care products. Additionally, dioctyl adipate is included in a number of personal care items, including sunscreen, body lotion, and hair conditioner, which is predicted to present the potential for market expansion over the projected period.

Key Dioctyl Adipate Market Insights Summary:

Regional Highlights:

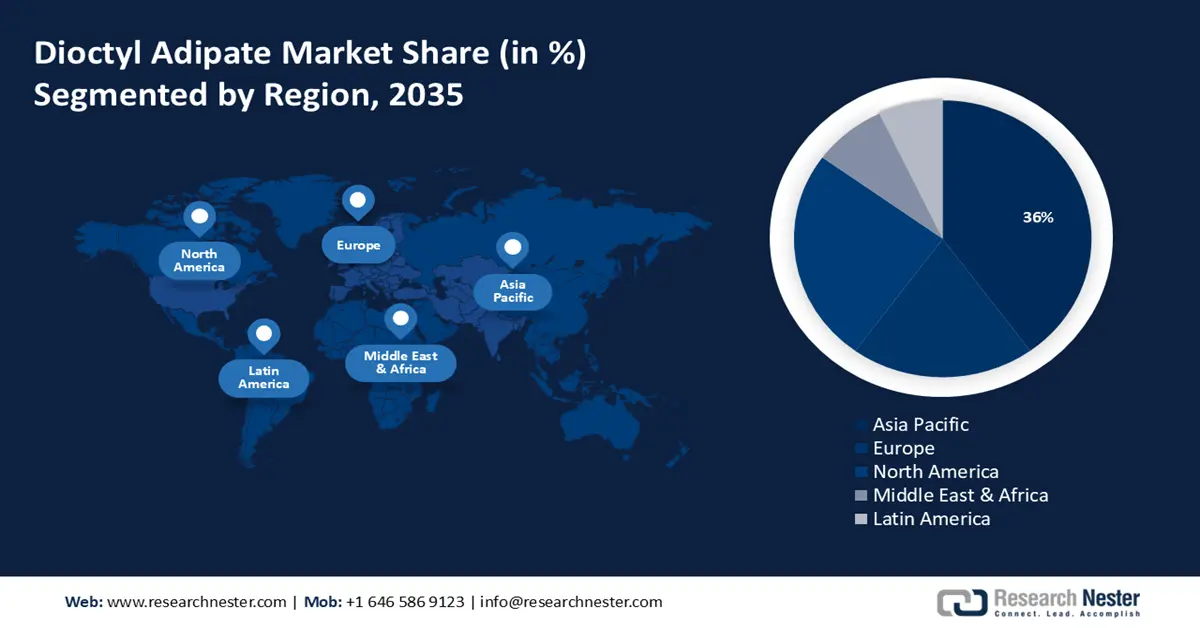

- Asia Pacific is poised to command a 36% share by 2035 in the dioctyl adipate market, propelled by expanding chemical production across developing economies.

- Europe is projected to secure a major share by 2035 owing to the rising use of dioctyl adipate in regional paint applications.

Segment Insights:

- The rubber segment is expected to hold the largest share by 2035 in the dioctyl adipate market, driven by its extensive utilization in diverse molded and industrial rubber applications.

- The consumer goods segment is set to attain a significant share by 2035, underpinned by rising global disposable incomes enhancing demand for DOA-based household and lifestyle products.

Key Growth Trends:

- Growing Food Packaging Industry

- Rising Demand of Electrical Appliances

Major Challenges:

- Decreased Use of Plastics as a result of Increased Environmental Awareness

- Inability to Withstand Hydrolysis Reactions

Key Players: Exxon Mobil Corporation, Hallstar Innovations Corp., DuPont de Nemours, Inc., Ineos Group Ltd., Chongqing Caifchem Co., Ltd., Hanwha Solutions Corporation, LG Chem Ltd., S&P Global Inc., Daihachi Chemical Industry Co., Ltd., Mitsubishi Chemical Holdings Corporation.

Global Dioctyl Adipate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.44 billion

- 2026 Market Size: USD 2.57 billion

- Projected Market Size: USD 4.29 billion by 2035

- Growth Forecasts: 5.8%

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Vietnam, Indonesia, Mexico, Brazil

Last updated on : 21 November, 2025

Dioctyl Adipate Market - Growth Drivers and Challenges

Growth Drivers

- Growing Food Packaging Industry – On account of the increasing working population across the globe, the market is expected to expand more in the upcoming years. Further, dioctyl adipate is used in the production of flexible PVC films used in food packaging, which in turn will boost the market growth over the forecast period. As per statistics, each year, over 10 million more people in India enter the working population.

- Rising Demand of Electrical Appliances – Growing number of households across the globe is estimated to drive market growth. According to estimates, residential appliances make for over 10% of the world's total final power usage.

- Increasing Usage of Plasticizers –Dioctyl adipate is suited for usage as a plasticizer owing to its wide molecular space, high boiling temperature, and low vapor pressure. It is a premium plasticizer that exhibits exceptional mechanical resilience at high temperatures and moderate volatility. Over the next few years, the worldwide consumption of plasticizers will increase by more than 3% annually.

- Growing Demand of Rubber – The growing demand for rubber in automotive applications and latex products, is anticipated to drive the market growth. Dioctyl Adipate is a chemical compound used to make synthetic rubber, it is also used as an essential ingredient in many applications, including tyres, shoe bottoms, and hoses. Moreover, rubber is frequently utilized in flexible materials like sheets, wires, and cables, which increases the need for DOA in the rubber sector. As of 2022, India consumed over 0.70 million metric tonnes of synthetic rubber.

Challenges

- Decreased Use of Plastics as a result of Increased Environmental Awareness - The increasing awareness amongst individuals for the impact on environment associated with the consumption of plastics is one of the major factors predicted to slow down the market growth. For instance, a variety of plastics and coating materials are made using dioctyl adipate, which can lead to environmental degradation.

- Inability to Withstand Hydrolysis Reactions

- Alternative Materials Pose a Serious Threat

Dioctyl Adipate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 2.44 billion |

|

Forecast Year Market Size (2035) |

USD 4.29 billion |

|

Regional Scope |

|

Dioctyl Adipate Market Segmentation:

Application Segment Analysis

The global dioctyl adipate market is segmented and analyzed for demand and supply by application into polymer, rubber, paint, and others. Out of the four types of, the rubber segment is estimated to gain the largest market share over the projected time frame. The growth of the segment can be attributed to the growing usage of rubber across all end markets. For instance, rubber may be readily moulded into a variety of forms and sizes. Further, rubber is used in pipelines, gardening tools and so on. It is also used in a wide variety of products, including tubes, tyres, toys, clothes, tyres for cars and aeroplanes, medical equipment, and surgical gloves, and industrial items. Moreover, dioctyl adipate is a key component of rubber industry plasticizers. It can give products remarkable suppleness at low temperatures. Furthermore, it is also used as an additive in the manufacturing process of rubber. As of 2023, global consumption of natural rubber is expected to reach over 15 million tonnes.

End-user Segment Analysis

The global dioctyl adipate market is also segmented and analyzed for demand and supply by end-user into packaging, cable and wiring, consumer goods, medical applications, wall coverings & flooring, and others. Amongst these six segments, the consumer goods segment is expected to garner a significant share. The growth can be attributed to rising disposable income of consumers across the globe. In consumer products, dioctyl adipate is utilized as a non-flammable solvent, which can be found in a variety of finished goods, such as hoses, floor coverings, paints, varnishes, waterproof membranes, and PVC soles for shoes and slippers. Further, DOA is also a significant component of PVC outside pipes, imitation paper, door mats, and synthetic leather.

Our in-depth analysis of the global market includes the following segments:

|

By Purity Type |

|

|

By Application |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dioctyl Adipate Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is poised to dominate majority revenue share of 36% by 2035. The growth of the market can be attributed majorly to the growing production of chemicals in developing countries such as China and India. For instance, the world's largest chemical industry has historically been that of China, and it continues to lead the world in terms of its chemical sector. Further, owing to its low labor costs, quick investment, favorable government rules, and easy access to raw materials, it has led the world's chemical manufacturing industry. In addition, China is the world's top exporter, producer, and also consumer of dioctyl adipate. It exports the majority of its product to the United States, Bangladesh, and Indonesia. As per estimates, China's market share in chemical sales worldwide, increased by more than 30% in 2018.

North American Market Insights

The North American dioctyl adipate market, amongst the market in all the other regions, is projected to grow with the highest CAGR during the forecast period. The growth of the market can be attributed majorly to the growing demand for dioctyl adipate from electronic industries. It is utilized as an insulating material for cables and wires, owing to extremely low temperatures in the area. In addition, the region's expanding healthcare industry are also anticipated to boost the market growth during the forecast period.

Europe Market Insights

Further, the market in the Europe, amongst the market in all the other regions, is projected to hold a majority of the share by the end of 2035. The growth of the market can be attributed majorly to the growing demand of paints in the region. For instance, owing to the great degree of consumer interest in home décor, architectural paints are growing in demand in Western Europe. Paint uses dioctyl adipate (DOA) as a solvent, dispersion, and thickener. Moreover, it has been discovered that Dioctyl Adipate can successfully replace a variety of organic solvents used in paint. In addition, the region's expanding healthcare industry and rising demand for cosmetics are also anticipated to boost the market growth during the forecast period.

Dioctyl Adipate Market Players:

- Exxon Mobil Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hallstar Innovations Corp.

- DuPont de Nemours, Inc.

- Ineos Group Ltd.

- Chongqing Caifchem Co., Ltd.

- Hanwha Solutions Corporation

- LG Chem Ltd.

- S&P Global Inc.

- Daihachi Chemical Industry Co., Ltd.

- Mitsubishi Chemical Holdings Corporation

Recent Developments

-

Mitsubishi Chemical Holdings Corporation accepted submissions for the KAITEKI Challenge, to encourage sustainable consumption in daily life, research for innovative technologies in alternative proteins, waste plastics recycling, and the avoidance of food loss and waste.

-

Exxon Mobil Corporation boosted its capacity to produce raw materials, used in medical masks and gowns, in order to satisfy this urgent requirement and support the health and safety of medical professionals, nurses, and first responders.

- Report ID: 4081

- Published Date: Nov 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dioctyl Adipate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.