Dimethylacetamide Market Outlook:

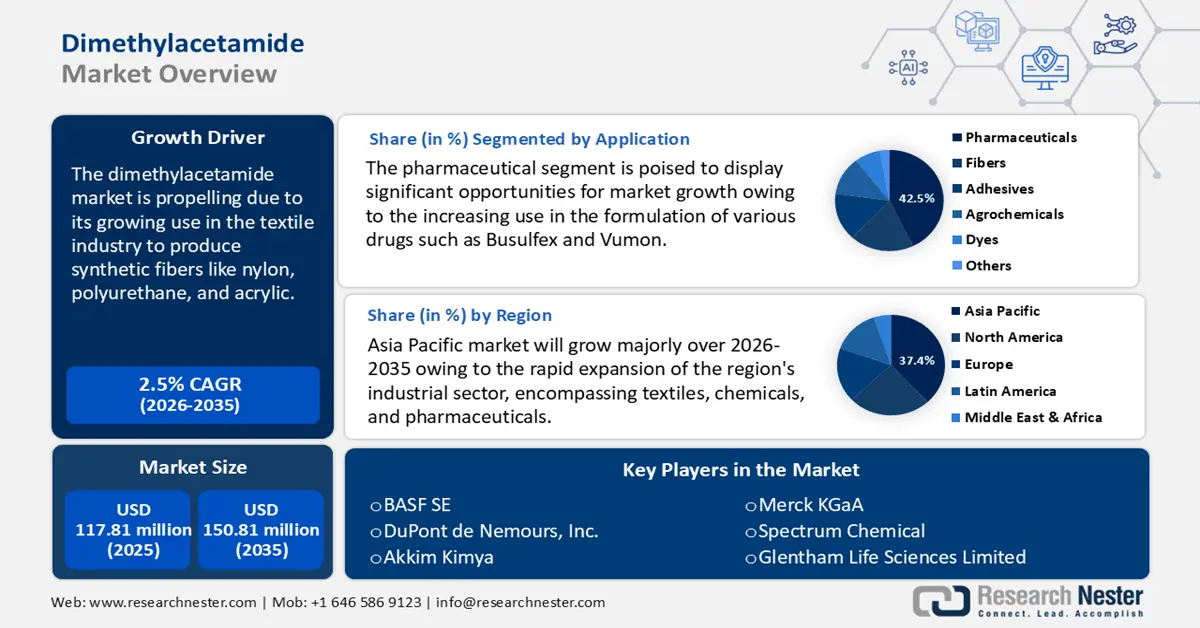

Dimethylacetamide Market size was valued at USD 117.81 million in 2025 and is set to exceed USD 150.81 million by 2035, expanding at over 2.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of dimethylacetamide is estimated at USD 120.46 million.

The global dimethylacetamide market will expand significantly due to its widespread application in fiber production for the textile sector. In the fiber and textile industry, dimethylacetamide is a crucial substance. DMAc is a multipurpose substance with outstanding qualities like high solvency, regulated viscosity, and chemical and thermal stability. It is essential to the wet spinning of polyacrylonitrile, another name for acrylic fibers. These fibers are extensively utilized in various textiles, such as industrial fibers, blankets, carpets, rugs, sportswear, and clothing. Furthermore, the chemical is used in synthetic fibers like nylon and polyurethane in addition to acrylic.

The Textile Exchange reported that since 2000, the world's fiber production has more than doubled. The 124 million tons from the previous year is a 7% increase from the 116 million tons in 2022, and if current trends continue, they are predicted to reach 160 million tons in 2030. Also, in 2023, 75 million tons of virgin fossil-based synthetic fibers were produced, up from 67 million tons in 2022. With 57% of all fiber production, polyester remains the most produced fiber in the world. Recycled fibers accounted for just 2% of the overall market share for polyamide (nylon), the second most popular synthetic fiber. Therefore, the growing production of these fibers is consequently driving the dimethylacetamide.

Dimethylacetamide, commonly referred to as DMA or DMAc, is a clear liquid that is water-soluble. It is predominantly utilized as an industrial solvent for a diverse array of organic and inorganic compounds, owing to its characteristics as a dipolar aprotic solvent. The synthesis of dimethylacetamide occurs through the reaction of dimethylamine and methyl acetate at temperatures exceeding 95 degrees Celsius, with the assistance of sodium methoxide.

As the supply of dimethylamine increases, manufacturers are positioned to enhance the production of DMAc, thereby addressing the rising demand in various sectors. According to the Environmental Clearance, the global production capacity of dimethylamine is estimated to be between 2500 and 3000 metric tons per month annually. Moreover, several companies, including Arclin, Balaji Amines Limited, and Methanol Chemical Company, are actively expanding their production capacities for dimethylamine, which ensures a stable and cost-effective supply for the dimethylacetamide market.

Key Dimethylacetamide Market Insights Summary:

Regional Highlights:

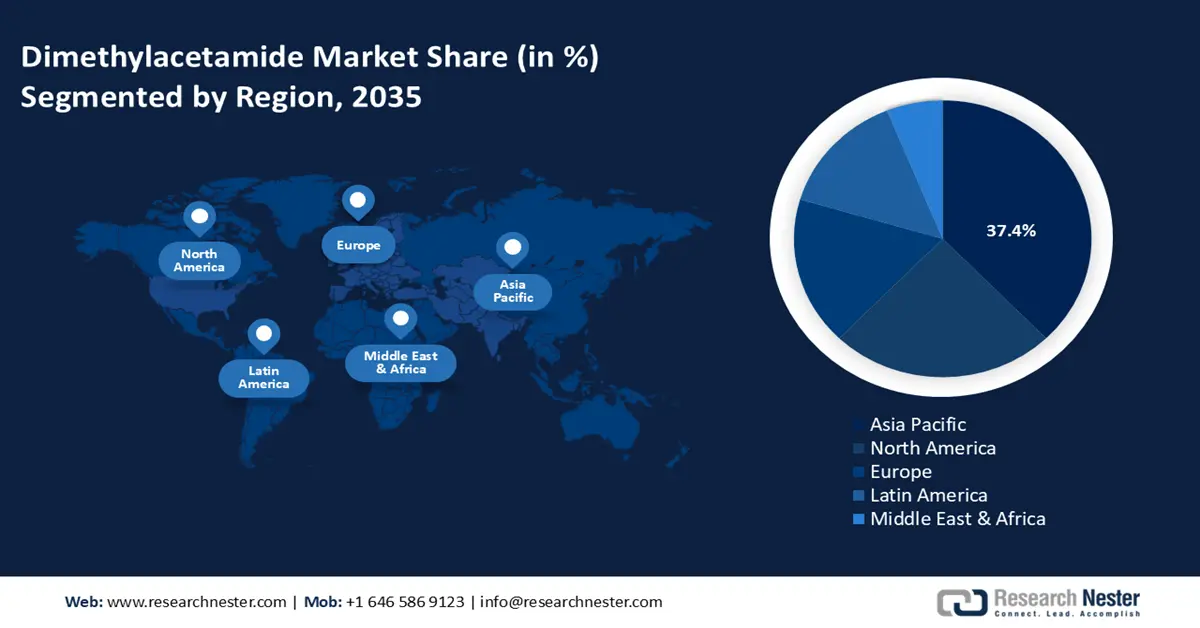

- Asia Pacific holds a 37.4% share in the dimethylacetamide market, driven by expansion in industrial sectors, rising disposable income, and government investments in manufacturing infrastructure, positioning it for significant growth through 2035.

- North America is projected to experience significant growth in the Dimethylacetamide Market from 2026 to 2035, driven by increasing demand in pharmaceuticals, advanced drug formulations, and chemical industry focus on high-performance polymers.

Segment Insights:

- The Drum Segment of the Dimethylacetamide Market is poised for significant growth through 2035, driven by the demand for safe storage and transport of chemicals in drums.

- The Pharmaceutical segment of the Dimethylacetamide Market is forecasted to achieve a 45.20% share from 2026 to 2035, driven by DMAc’s use as a reagent in drug manufacturing.

Key Growth Trends:

- Rising demand in the pharmaceutical industry

- Increasing application in various industries

Major Challenges:

- Increased environmental and health concerns

- Fluctuating raw material prices

- Key Players: BASF SE, DuPont de Nemours, Inc., Akkim Kimya, Merck KGaA, Spectrum Chemical, Glentham Life Sciences Limited, Akkshat Pure Chem, LG Chem Ltd. Arkema, Agilent Technologies Inc..

Global Dimethylacetamide Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 117.81 million

- 2026 Market Size: USD 120.46 million

- Projected Market Size: USD 150.81 million by 2035

- Growth Forecasts: 2.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Dimethylacetamide Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand in the pharmaceutical industry: Dimethylacetamide is widely utilized within the pharmaceutical sector as a process intermediate, functioning both as a solvent and a reagent. This compound serves as an effective solvent in the production of cardiovascular, anti-inflammatory, and antibacterial medications. The World Health Organization (WHO) revealed that an estimated 17.9 million people die from cardiovascular diseases (CVDs) each year, making it the world's leading cause of mortality.

Moreover, DMAc is integral to the mobile phase in analytical procedures such as Liquid Chromatography Mass Spectrometry (LCMS) and High-Performance Liquid Chromatography (HPLC). The increasing demands of the pharmaceutical industry, coupled with rising healthcare costs, are propelling the demand for dimethylacetamide, thereby contributing to dimethylacetamide market expansion. Also, dimethylacetamide, for instance, is frequently used as a medication excipient in pharmaceutics products like Vumon, Busulfex, and others. Furthermore, DMAc suppresses inflammation and osteoclastogenesis while promoting bone repair in vivo. - Increasing application in various industries: The compound is a colorless, polar organic solvent with exceptional solvency properties. In addition to pharmaceuticals and fibers, it is used in several applications, such as industrial coatings, films, adhesives, dyes, and agrochemicals. DMAc's capacity to dissolve specific resins makes it a useful solvent and viscosity modifier in the formulation of adhesives used in a variety of industries, and in the production of plastics, it aids in the dissolution and processing of polyvinyl chloride during the pipe, and film, and flooring manufacturing processes. Therefore, the increasing international trade of polyvinyl chloride, driven by infrastructure development and industrialization, boosts the consumption of DMAc, as manufacturers scale up their production to meet global demand.

|

Country |

Export Value of Polyvinyl Chloride (in USD Million) |

Country |

Import Value of Polyvinyl Chloride (in USD Million) |

|

U.S |

3270 |

India |

2320 |

|

China |

2560 |

Turkey |

1250 |

|

Chinese Taipei |

1350 |

Germany |

1040 |

|

Germany |

1260 |

Italy |

979 |

|

France |

1080 |

Vietnam |

821 |

Source: OEC

The Observatory of Economic Complexity (OEC) reported that polyvinyl chloride ranked as the 193rd most traded product worldwide, with a total trade of USD 17.8 billion in 2022. Polyvinyl chloride trade accounts for 0.075% of the global trade.

Challenges

- Increased environmental and health concerns: DMAc is categorized as an eye, skin, and respiratory irritant as well as a possible reproductive toxin. Stricter laws and increased handling expenses result from concerns about the influence on the environment and worker safety. The examination also shows that it is a combustible and volatile chemical that needs to be handled and stored carefully, which raises production and transportation costs. In a similar vein, unintentional spills or leaks may endanger public health and safety. Therefore, these factors will hinder the growth of the dimethylacetamide market.

- Fluctuating raw material prices: Price pressure on dimethylacetamide has persisted, though, as a result of changes in production costs brought on by the prices of mixed feedstocks, particularly acetic acid, and dimethylamine. Some variables influencing dimethylacetamide market dynamics, significant supply restrictions, and increased demand from important downstream sectors contributed to this variation in raw material costs. Natural catastrophes and labor strikes are major factors in the global shortage of DMAc since they affect both the production process and the routes used for transportation. Therefore, these factors are impeding the expansion of the dimethylacetamide market.

Dimethylacetamide Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

2.5% |

|

Base Year Market Size (2025) |

USD 117.81 million |

|

Forecast Year Market Size (2035) |

USD 150.81 million |

|

Regional Scope |

|

Dimethylacetamide Market Segmentation:

Application (Fibers, Adhesives, Pharmaceuticals, Dyes, Agrochemicals)

Pharmaceutical segment is set to dominate dimethylacetamide market share of around 45.2% by the end of 2035. Dimethylacetamide is utilized both as a solvent and as a reagent in the manufacturing of numerous medicinal products. It is employed as a solvent in the innovative X-ray contrast medium. The pharmaceuticals segment is anticipated to be driven by several variables, including trade liberalization, changes in sociodemographic, scientific, and technological advancements, and the need for medications.

The production of N, N Dimethylacetamide is expanding due to its widespread acceptance as a medication excipient in the formulation of many pharmaceutical products, such as Busulfex and Vumon. A chemotherapeutic drug called teniposide (marketed under the brand Vumon) is used to treat several cancers, including Hodgkin's lymphoma, juvenile acute lymphocytic leukemia (ALL), and some brain tumors. It suppresses the body's cancer cells' proliferation and belongs to a class of medications called podophyllotoxin derivatives. According to the National Institutes of Health, in 2019, there were 347,992 new cases of brain cancer worldwide. Therefore, the increasing prevalence of these conditions will proliferate the DMAc market growth. As a result of its chemical stability, it is also widely accepted in terms of inflammation and osteoclast generation.

Packaging Type (Glass Bottle, Tank, Drum)

The drum segment in dimethylacetamide market will garner a significant share during the assessed period. The substance is an organic chemical that is a colorless, water-soluble liquid used as a flexible solvent in various industrial processes, such as manufacturing organic materials, textiles, and medications. Usually composed of materials such as high-density polyurethane, this chemical is packaged and transported in big drums. The segment expansion may be fueled by the safe storage and transportation of liquid chemicals, which is ensured by the design of these barrels.

Our in-depth analysis of the global dimethylacetamide market includes the following segments:

|

Packaging Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dimethylacetamide Market Regional Analysis:

APAC Market Statistics

Asia Pacific dimethylacetamide market is predicted to account for revenue share of more than 37.4% by the end of 2035. The growth of the market can be attributed to the rapid expansion of the region's industrial sector, encompassing textiles, chemicals, and pharmaceuticals. The increase in disposable income within the region is bolstering the demand for products such as apparel and furnishings that incorporate dimethylacetamide (DMAc). Dimethylacetamide Market growth and developments in the dimethylacetamide sector are further driven by the region's burgeoning population, which has escalated the demand for textiles and has prompted significant investments in pharmaceutical research and development. Moreover, governments in the Asia Pacific region are making substantial investments in manufacturing initiatives and infrastructure development, thereby creating an environment that is favorable for the production and application of DMAc.

In China, the dimethylacetamide market is driven by its robust textile and pharmaceutical industries, as well as government economic initiatives. Government policies aimed at stabilizing the real estate market and stimulating economic growth have also boosted industries that depend on DMAc. Additionally, the market saw some respite from its general downward trend when dimethylacetamide saw a modest plunge in the country due to government backing and a slight increase in production costs. The market had a minor 0.5% price gain in 2024, reaching USD 895/MT. The trend was also influenced by the moderate demand from downstream industries like construction and medicines.

Moreover, India's thriving pharmaceutical, textile, and electronics sectors are escalating the demand for DMAc in the nation. The textile industry's growth, fueled by the increasing production of synthetic fibers such as spandex, propels DMAc consumption. The International Fiber Journal stated that consumer demand for spandex-blended apparel has increased in recent years as a result of the versatility these garments provide. Seizing the chance, Indorama India, a division of the USD 25 billion Indorama Group, was the first to establish a spandex production facility in India in 2011 under the Inviya brand. In 12 years, Indorama India quadrupled its capacity from a modest 5,000 tons annually to 20,000 tons. The company's product line includes knits, spandex for woven and air-covered yarns, and specialty items like SnugFit for diapers and other hygiene goods.

North America Market Analysis

North America dimethylacetamide market is expected to grow at a significant rate during the projected period. The pharmaceutical industry's increasing need for dimethylacetamide as a reagent and preferred solvent is responsible for the market's expansion. DMAc is also utilized to make several medications since it is quickly absorbed through the mouth and skin. Additionally, it is anticipated that the growing need for fibers, films, and coatings will effectively propel the growth of the dimethylacetamide market in the region. In the U.S., the market is fueled by the increased demand for advanced drug formulations and the chemical industry’s focus on high-performance polymers and coatings. In 2023, the U.S. paint and coatings industry was valued at approximately USD 37.1 billion. By 2031, this value is expected to rise to almost USD 49.6 billion.

Key Dimethylacetamide Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DuPont de Nemours, Inc.

- Akkim Kimya

- Merck KGaA

- Spectrum Chemical

- Glentham Life Sciences Limited

- Akkshat Pure Chem

- LG Chem Ltd.

- Arkema

- Agilent Technologies Inc.

Numerous small and medium-sized businesses coexist with several major companies in the fiercely competitive dimethylacetamide market. These businesses are well-equipped to do research and development, and their wide range of products and distribution systems give them a significant market presence. There is fierce rivalry in the industry, and businesses are concentrating on growing their product lines and market share through partnerships, mergers, and acquisitions. Among the major participants in the dimethylacetamide market are

Recent Developments

- In January 2025, Arkema, a leader in Specialty Materials, introduced ENCOR bio-based aqueous dispersions for textile printing and finishing. These binders, with up to 30% bio-based content and up to 40% carbon footprint reduction compared to typical textile resins, help the textile sector reduce its carbon footprint and promote a sustainable lifestyle.

- In June 2023, Agilent Technologies Inc. announced two new liquid chromatography-mass spectrometry systems (LCMS), the Agilent 6495D LC/TQ and the Agilent Revident LC/Q-TOF. Facilitating the high-end performance of the Revident LC/Q-TOF, Agilent is also announcing the new Agilent MassHunter Explorer Profiling software and the new Agilent ChemVista library manager software.

- Report ID: 7073

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dimethylacetamide Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.