Digital Substation Market Outlook:

Digital Substation Market size was valued at USD 8.31 billion in 2025 and is expected to reach USD 16.97 billion by 2035, expanding at around 7.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of digital substation is evaluated at USD 8.86 billion.

The market is growing remarkably, driven by a combination of technological advancements, regulatory mandates, and the increasing demand for reliable and efficient power distribution systems. For instance, in February 2021, Hitachi ABB Power Grids announced the launch of its Smart Digital Substation offering. It combined the capabilities of Hitachi's industry-leading Lumada Asset Performance Management (APM) solution with the most recent advancements in digital substation technology. As utilities and energy providers transition from traditional electrical infrastructure to digital solutions, the integration of IoT, AI, and big data analytics is revolutionizing the operational capabilities of substations.

The enhanced capabilities of digital substations involve real-time monitoring, predictive maintenance, and automatic control capabilities. Moreover, a strong global drive towards renewable sources of energy calls for existing infrastructure to be updated with decentralized energy generation and smart grids. For instance, in June 2020, LF Energy launched its Digital Substation Automation Systems (DSAS) initiative. It aimed to increase the power grid's modularity, interoperability, and scalability to hasten the global effort to become carbon neutral by 2050. Collectively, these exceptional growth drivers underscore the pivotal role of digital substations in shaping the future of energy management and distribution, positioning them as a cornerstone of the evolving energy landscape.

Key Digital Substation Market Insights Summary:

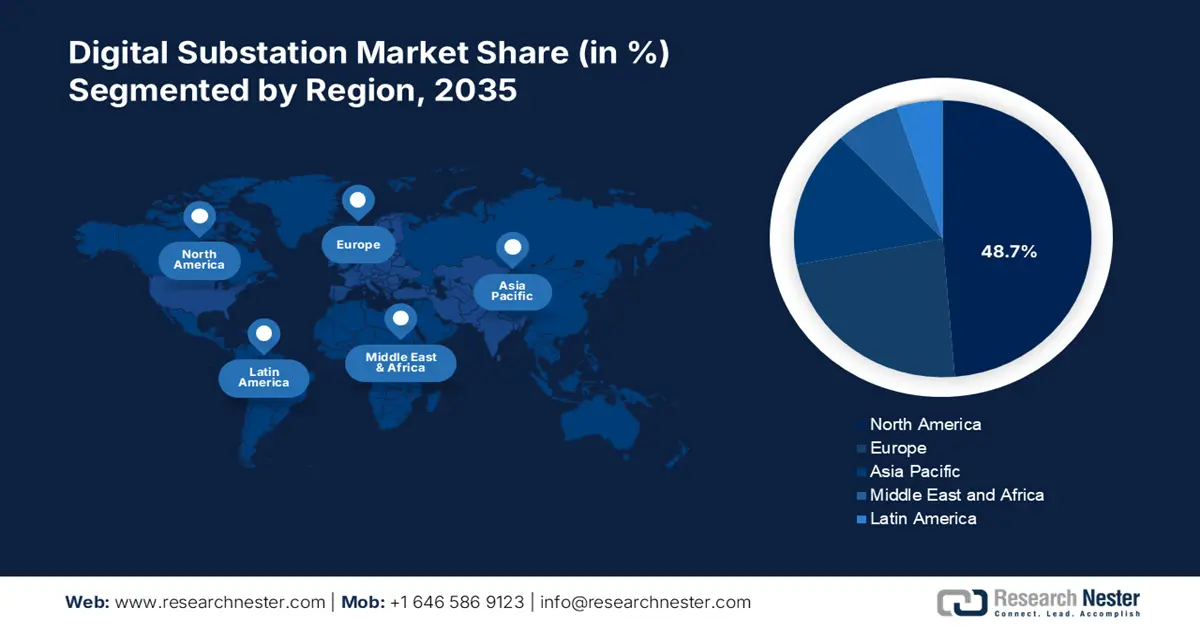

Regional Highlights:

- North America commands a 48.7% share in the Digital Substation Market, driven by the challenges of aging infrastructure and the integration of renewable energy sources, bolstering growth prospects through 2026–2035.

- The digital substation market in Europe is poised for substantial growth by 2035, attributed to the ambitious decarbonization targets and integration of renewable energy.

Segment Insights:

- The Utility segment is expected to experience significant growth by 2035, driven by the increasing necessity of digital substations for efficient electricity transmission.

- The Distribution Substation segment is projected to hold a 79.7% share by 2035, driven by the need for efficient power delivery and growing requirements for reliable electricity supply in urban areas.

Key Growth Trends:

- Smart grid initiatives

- Data-driven decision-making

Major Challenges:

- High initial investment costs

- Interoperability issues

- Key Players: ABB Ltd., Cisco Systems Inc., General Electric Co., Honeywell International Inc., Eaton Corporation plc., Emerson Electric Co.

Global Digital Substation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.31 billion

- 2026 Market Size: USD 8.86 billion

- Projected Market Size: USD 16.97 billion by 2035

- Growth Forecasts: 7.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (48.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Australia

Last updated on : 13 August, 2025

Digital Substation Market Growth Drivers and Challenges:

Growth Drivers

- Smart grid initiatives: A pivotal growth driver in the digital substation market, is the integration of smart grids that is fundamentally transforming how electricity is generated, distributed, and consumed. For instance, in October 2024, Schneider Electric Introduced new smart grid solutions at Enlit Europe 2024. It signified boosting grid flexibility and resilience to handle net-zero demands. In addition, the integration of new technology in communication promotes the enhancement of automation across the grid. As digital substations continue to become more interlinked with smart grid systems, they optimize energy management while enabling the integration of renewable energy sources.

- Data-driven decision-making: In the digital substation market, data-driven decision-making is the most significant growth driver that empowers utilities to drive performance and strategic planning by leveraging vast amounts of operational data. For instance, in April 2024, LF Energy announced four new open-source technical projects. These projects gave the energy industry new tools related to digital substations, leveraging data and artificial intelligence technologies, and getting ready for severe weather. As utilities increasingly adopt data-driven methodologies, digital substations become integral to fostering a more responsive and resilient energy infrastructure, thus driving the market's growth.

Challenges

- High initial investment costs: Among the most exceptional cost factors are comprehensive infrastructure upgrades, which not only install new, leading-edge technologies but also retrofit existing systems for compatibility and functionality. This vast investment is expensive, especially for the small utilities, which makes them hesitant to opt for the digital substation despite all its long-term advantages. Utilities are forced to weigh immediate costs against long-term opportunities for efficiency and reliability in operations. Moreover, addressing this requirement needs innovative financing models and strategic partnerships to facilitate the transition to digital infrastructure which poses a challenge.

- Interoperability issues: One of the biggest challenges in the market, as diverse technologies and systems from multiple vendors may cause compatibility problems and operational inefficiencies. Furthermore, the lack of standardized protocols and communication frameworks across industries, and the absence of uniformity complicates the seamless exchange of data and control between components of the digital substation. Thus, impeding the overall performance and reliability of the grid. The inability to guarantee interoperability may cause costs for integration to escalate further, project timelines to prolong even longer, and perhaps bring the service to a stop.

Digital Substation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.4% |

|

Base Year Market Size (2025) |

USD 8.31 billion |

|

Forecast Year Market Size (2035) |

USD 16.97 billion |

|

Regional Scope |

|

Digital Substation Market Segmentation:

Type (Distribution Substation, Transmission Substation)

Distribution substation segment is expected to account for market share of more than 79.7% by the end of 2035. This is attributable to the efficient delivery of power from the transmission networks to consumers. For instance, in October 2023, Adani Transmission Limited (ATL) declared that it was constructing a transmission line and substation from Kharghar to Vikhroli. This distribution network aimed at adding 1500 MVA 400kV GIS Substation and 74 Ckm of 400kV and 220kV transmission lines. Thus, growing requirements for a reliable supply of electricity in cities necessitate mature power grids towards the spur of economic, as well as industrial development and new influxes of populations.

Industry (Utility, Metal, Mining, Oil & Gas, Transportation)

The utility segment is projected to garner significant growth traction in the digital substation market during the forecasted timeline Within the market, the utility substation segment is leading in terms of revenue owing to its necessity in the transmission and distribution of electricity through an electrical grid. For instance, in January 2023, ABB introduced its ground-breaking virtualized protection and control solution, Smart Substation Control and Protection SSC600 software. Utility customers can easily use a full suite of dependable protection and control features while personalizing their hardware selections. Power distribution system reliability is improved and grid management techniques are revolutionized by this innovation. Thus, utilities have deployed digital utility substations that reduce operational costs, minimize maintenance, and optimize outage response times.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Module |

|

|

Voltage |

|

|

Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Digital Substation Market Regional Analysis:

North America Market Analysis

North America in digital substation market is projected to hold more than 48.7% revenue share by 2035. Utilities are facing the challenges of aging infrastructure and the integration of renewable energy sources, hence the adoption of digital substations becomes essential. Advanced systems facilitate real-time monitoring and automation, which can greatly improve operational performance and minimize downtime. Probably, it has to do with the desperate desire to modernize the electrical infrastructure to support more sustainable and resilient energy structures means of ensuring timely distribution for evolving energy requirements.

The U.S. digital substation market is growing at a rapid pace on account of an urgent desire to modernize old electrical network structures. For instance, in February 2024, GE Vernova introduced a new line of grid automation products, GridBeats to improve grid resilience. The innovative software-defined automation solutions are intended to modernize and digitize grid operations in utilities with cutting-edge capabilities for substation digitization. In addition, the implementation of smart grid initiatives aims to increase the efficiency of operations and facilitate a more sustainable energy system.

In Canada, the market will grow at a moderate pace due to government commitments to shift to a low-carbon economy. As Canada continues to increase its reliance on renewable energy sources, digital substations are necessary to enhance grid efficiency and reliability. This strategic shift supports sustainability and also gives a resilient energy infrastructure that would be ready to address future demands. In addition, the rise of smart cities and the increasing deployment of smart grids globally are contributing to the market's expansion.

Europe Market Statistics

Europe is expected to witness substantial growth in the digital substation market during the forecast timeline from 2026 to 2035. It is driven by the ambitious decarbonization targets set by the region and the integration of renewable energy. In addition, Europe nations are raising their demand for advanced grid technologies based on the ambition of meeting climate goals, with enhanced operational efficiency and reliability. The most relevant growth reason is the commitment of the European Union to smart grid initiatives, which relate to modernizing energy infrastructure and facilitating the smooth integration of distributed energy resources.

The digital substation market is especially gaining high prominence in France due to the country's focus on a shift towards a more sustainable system by installing digital substations. For instance, in February 2022, Enedis and Schneider Electric implemented an initiative centered on a new generation of MV/LV substation equipment to substitute SF6 gas. Enedis has committed to a 20% reduction in its carbon footprint by 2025. Meeting these ambitious energy transition goals calls for strategic modernization.

The driver of the digital substation market in Germany can be attributed to the increasing need for high-level solutions to be placed on grids, in a bid to absorb the share of intermittent renewable energy sources such as wind and solar power. Installing digital substations is an important step toward this transition because it opens the door to real-time analysis and automation of data. For instance, in October 2021, Siemens Energy launched the world's first environmentally friendly facility, the new high-voltage substation in Burladingen, Germany. It runs without SF6 and has been digitalized with new equipment for connectivity and intelligence.

Key Digital Substation Market Players:

- ABB Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens AG

- General Electric Co.

- Schneider Electric

- Honeywell International Inc.

- Cisco Systems Inc.

- Eaton Corporation plc

- Emerson Electric Co.

- NR Electric Co. Ltd.

- OMICRON

- NovaTech

- Belden Inc

- Net Control Group

In the market companies are transforming the entire digital landscape of the substation. Through their innovative efforts in automation, real-time monitoring makes it effortless and frictionless for utilities to optimize distributed renewable energy. For instance, in September 2023, One Energy Enterprises Inc. declared that it had finished building America's first plug-and-play transmission voltage level substation that was fully digital. Additionally, this transformation is a crucial step towards cybersecurity, which safeguards digital infrastructures from threats.

Here’s the list of some key players:

Recent Developments

- In March 2024, WEG carried out energizing a digital substation to transmit energy. Its digital substations, which use state-of-the-art technology, are transforming the electrical industry by increasing the speed, safety, and cost-effectiveness of substation projects.

- In May 2022, ABB India announced the expansion of its factory for digital substation products and digital systems. It was designed to handle the increasing demand for a variety of digital substation products and digital solutions in India and more than 50 other countries.

- Report ID: 6820

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Digital Substation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.