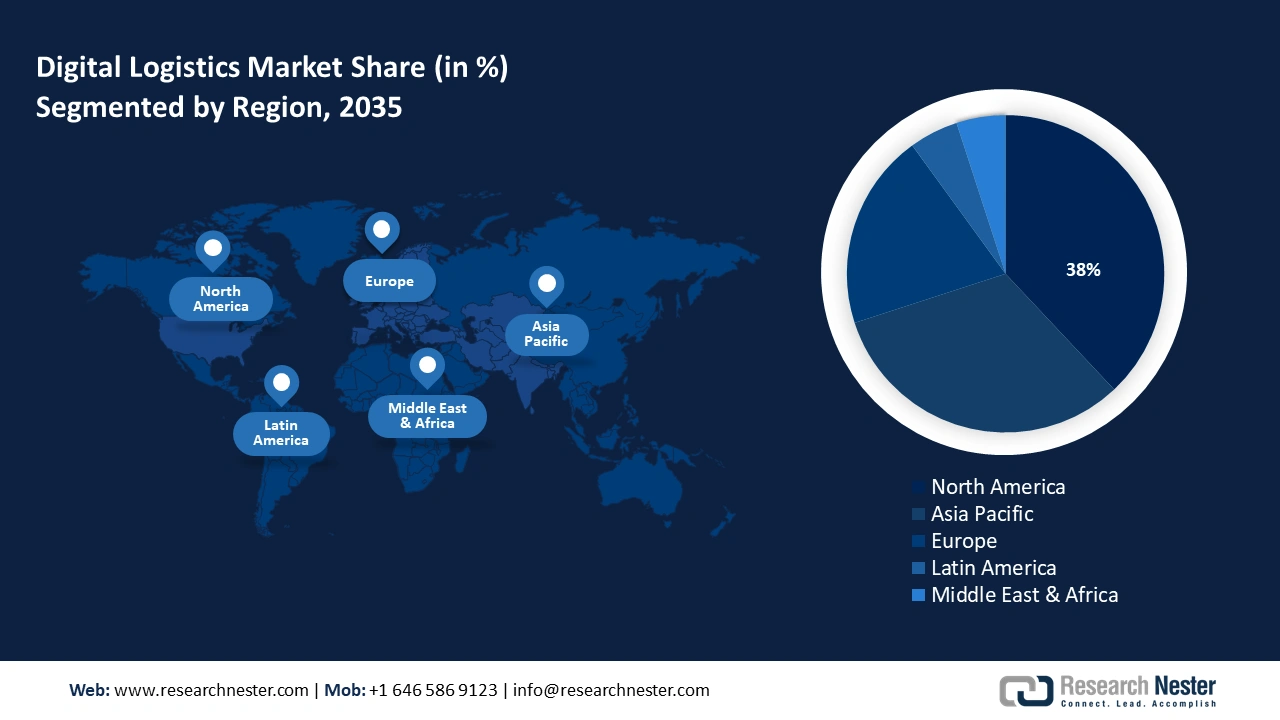

Digital Logistics Market - Regional Analysis

North America Market Insights

The North America digital logistics market is slated to hold a 38% revenue share by the end of 2035 and maintain its position as a leading market. The regional market’s dominance is attributed to high adoption rates of advanced digital solutions. Additionally, North America’s market is characterized by the presence of industry leaders, impacting the overall growth curve. The regional market is also impacted by the advent of AI, IoT, and blockchain in logistics operations. The opportunities are expected to be rife due to initiatives such as the Smart City Challenge of the U.S. Department of Transportation. Among major companies, FedEx has inculcated AI to facilitate demand forecasting, whilst UPS utilizes IoT devices for real-time tracking.

The U.S. market growth is attributed to the proactive adoption of advanced digital solutions to curb impediments in the supply chains and logistics operations. A notable factor contributing to the growth is the adoption of humanoid robots in logistics operations. Prominent companies such as Agility Robotics have included robots for logistics and warehouse roles, in a bid to eradicate labor shortages in physically demanding jobs. In Canada, policy reports are making regulatory reforms to encourage the establishment of the digital infrastructure. The report published by the C.D. Howe Institute in 2024 on the National Supply Chain Action Plan for Canada emphasizes promoting the usage of advanced technology and automation across the supply chain.

APAC Market Insights

The APAC digital logistics market is estimated to register the fastest growth throughout the forecast period at a CAGR of 13.6%. Countries such as China, India, and Japan have been at the forefront of growth in APAC. Major drivers of the regional market are the boom of e-commerce along with rapid urbanization. In terms of lucrative regional markets, China leads. The Made in China 2025 initiative emphasized the adoption of smart logistics technologies, whilst in India, the Digital India campaign has actively promoted the use of digital platforms across multiple sectors. Another lucrative market in APAC is Japan, where national digitalization efforts are slated to create opportunities for key players in the market. China is leading the market and offering lucrative opportunities with the rising e-commerce market in the country. According to the International Trade Administration, a country’s e-commerce market reached USD 2.2 trillion. Furthermore, a major USD 5 billion China-UAE partnership announced in 2025 anchors AI, cloud, and logistics initiatives, accelerating the sophistication of supply chains.

The India digital logistics market is poised to expand its revenue share throughout the forecast period. Additionally, the government has implemented exemplary schemes to develop connectivity across the country, propelling the overall logistics operation. With the service economy and e-commerce sector thriving in the country, digital logistics solutions are projected to experience greater demand. Moreover, in September 2022, the National Logistics Policy was launched to transform the country’s logistics. A Unified Logistics Interface Platform is designed to include 30 existing logistics systems, and as of August 2025, the platform has facilitated over 160 crore digital transactions, bolstered transparency, and streamlined logistics operations.

Europe Market Insights

The market in Europe is propelled by the swift integration of technological advancements and widespread e-commerce expansion. According to the World Bank’s Logistics Performance Index (LPI) Indicator in 2022, the region has a high Logistics Performance Index (LPI) infrastructure score of 3.6. This score highlights the region's impeccable and resilient trade and transport-associated infrastructure, including ports, roads, and information technology systems. In the UK, the market growth is propelled by significant infrastructure investments. For instance, DHL has invested USD 290 million in February 2025, in novel e-commerce in the near by vicinity of Coventry Airport. The new state-of-the-art e-commerce hub is projected to create more than 600 jobs for the local community.

Germany is favored with its central position and resilient road and rail infrastructure. According to data published by the government in 2022, inland waterways carried goods of worth 182 million tonnes while volume of goods loaded through German sea ports reached 279.1 million tonnes. By utilizing digital logistics tools, various companies are trying to manage capacity, and remain equipped to adapt to altered transport patterns, and enhance overall supply chain efficiency, reinforcing Germany’s position as a leading logistics hub in Europe.