Digital Lending Platform Market Outlook:

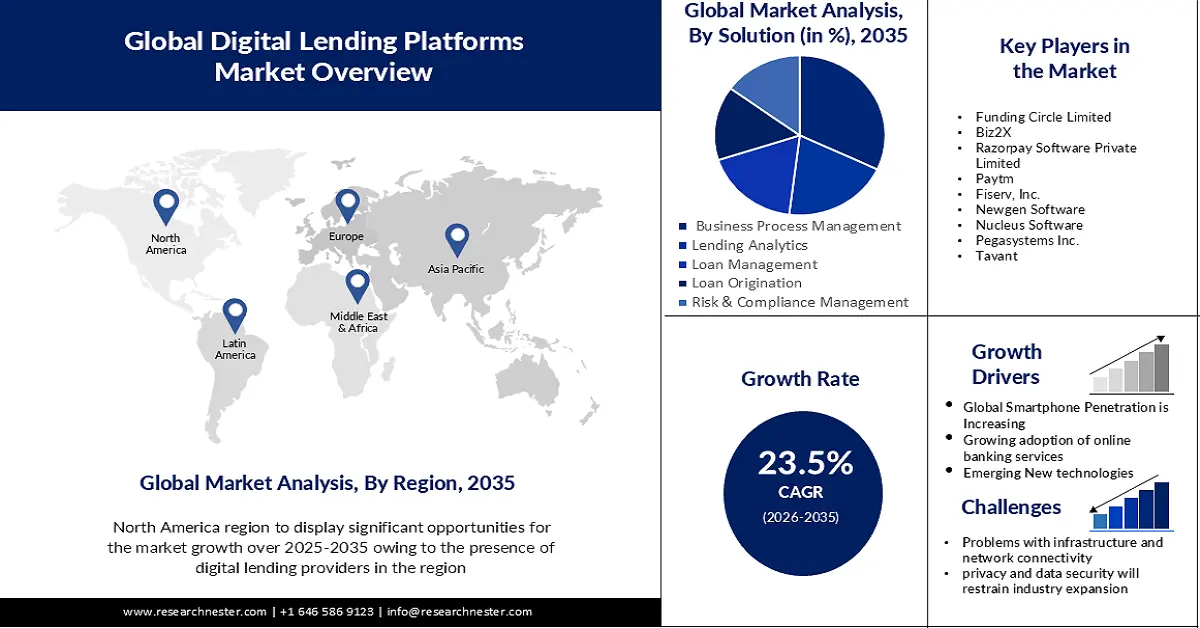

Digital Lending Platform Market size was over USD 23.28 billion in 2025 and is poised to exceed USD 192.16 billion by 2035, growing at over 23.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of digital lending platform is estimated at USD 28.2 billion.

The ongoing advancement of cutting-edge technologies like cloud computing, network analytics, and the Internet of Things is significantly propelling the market for digital lending platform. Since 2018, the amount spent on IoT globally has increased annually by at least USD 40 billion. Furthermore, spending reached USD 1.1 trillion in 2023, maintaining the higher annual growth rate.

In addition, it is anticipated that blockchain technology will become more significant among digital loan providers because of its capacity to move documents quickly and with great integrity. Regulators, auditors, and other lending process participants may quickly follow transactions and verify identities thanks to blockchain technology. For example, Figure Lending LLC and Apollo closed a deal in March 2022 that involved ownership transfers and blockchain-based digital mortgage loans.

It is anticipated that the mortgage sector will become more transparent and efficient as a result of this safe and efficient mortgage loan registry.