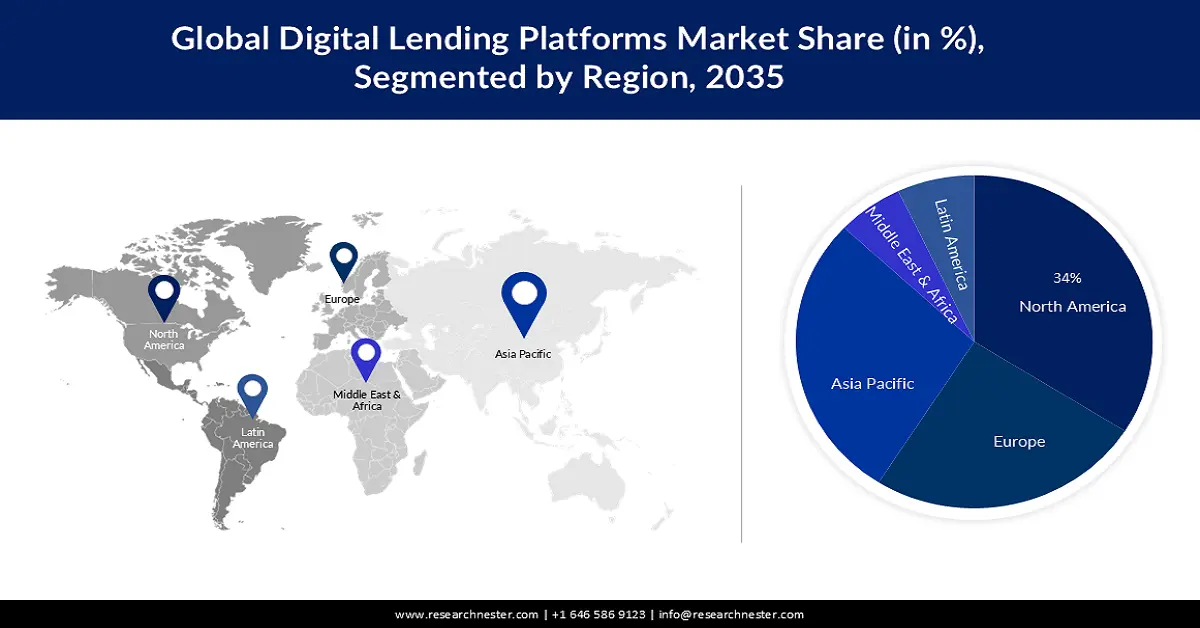

Digital Lending Platform Market Regional Analysis:

North American Market Insights

The digital lending platform market in the North American region is attributed to holding the largest revenue share of about 34% during the forecast period. The growth of the market in this region is due to the existence of significant digital lending providers throughout the nation. Additionally, the area has embraced cutting-edge technologies, which have led to a persistently strong demand for digital, end-to-end financial solutions in North America.

Financial institutions in the area are being especially prompted to digitize their services and improve the customer experience due to a sizable mobile workforce. To obtain a significant competitive advantage, financial institutions in the area are attempting to set themselves apart from their rivals by launching cutting-edge digital services. According to recent information, in total, 72% of the world’s largest tech companies are based in the United States.

APAC Market Insights

The digital lending platform market in the Asia-Pacific region is projected to hold a revenue share of about 28% during the projected period. Certain Asian nations have regulatory frameworks that are conducive to the advancement of innovation and digital financial services. For instance, a legislative framework known as The Singapore Variable Capital Company (VCC) was developed for digital lending platform operating in Singapore, which offers operational efficiencies, regulatory clarity, and flexibility.

Additionally, it has put into place the "Fintech Regulatory Sandbox," which enables fintech businesses, including online lending platform, to test their creative business concepts in a safe setting. Due to this, an atmosphere has been established that promotes the development and growth of digital lending platform, drawing in both domestic and foreign participants.