Digital Isolator Market Outlook:

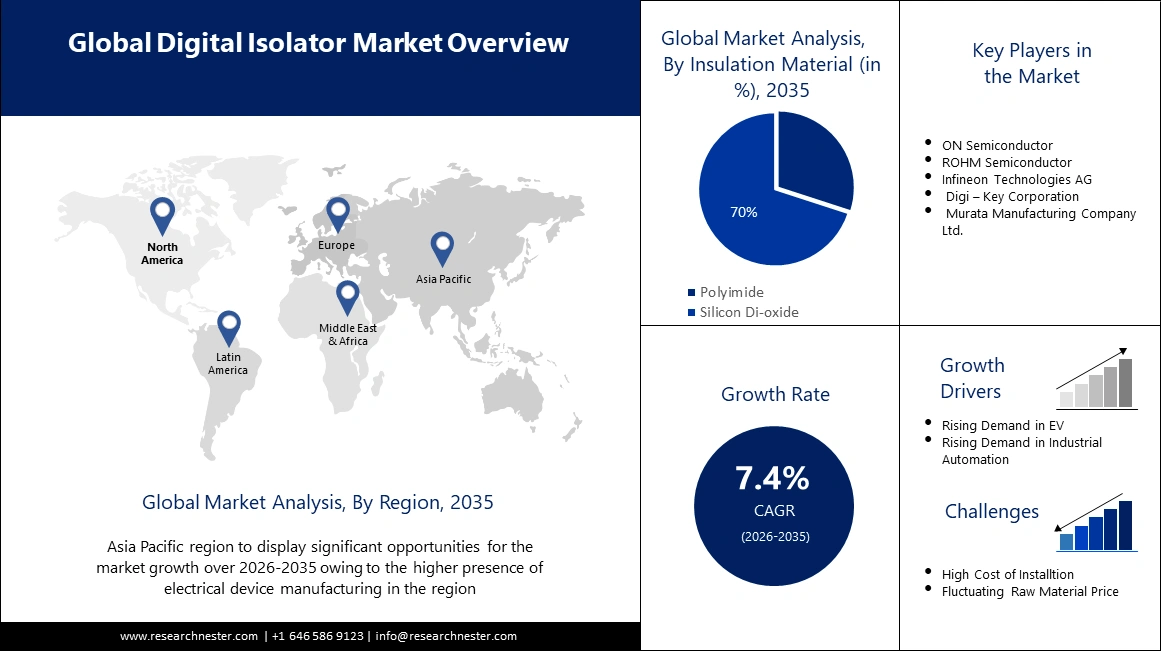

Digital Isolator Market size was over USD 2.33 billion in 2025 and is projected to reach USD 4.76 billion by 2035, witnessing around 7.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of digital isolator is evaluated at USD 2.49 billion.

To isolate machines from electricity and disrupt current flow patterns, there is an increasing trend of integrating digital isolation devices into a wide variety of equipment. This is often done to address the challenge confronted by conclusion clients and producers where they see to run their offices and gear at low-cost controls, and decrease machine downtime, among others. Digital isolators provide signal isolation and shift levels to see the correct operation of different circuits, in high-voltage equipment. They're also designed to prevent electric shocks for users. The growth of the market in terms of revenue is being driven by this. Digikey announced in 2020 the launch of its industrial communication networks, which are protected by the integration of digital isolators. Digital isolation, based on chip-scale transformers, has been made possible by RS4220/RS485 transceivers that integrate an isolated DCDC regulator and a three-channel signal isolator on a single chip.

Digital isolators offer a wide range of advantages, including benefits in terms of size, speed reduced energy consumption, reliability, and ease of integration into the module as compared to optocouplers. In the past, it has been difficult for designers to choose a suitable isolation barrier system used in medical modules or industry applications due to limited options.

Key Digital Isolator Market Insights Summary:

Regional Highlights:

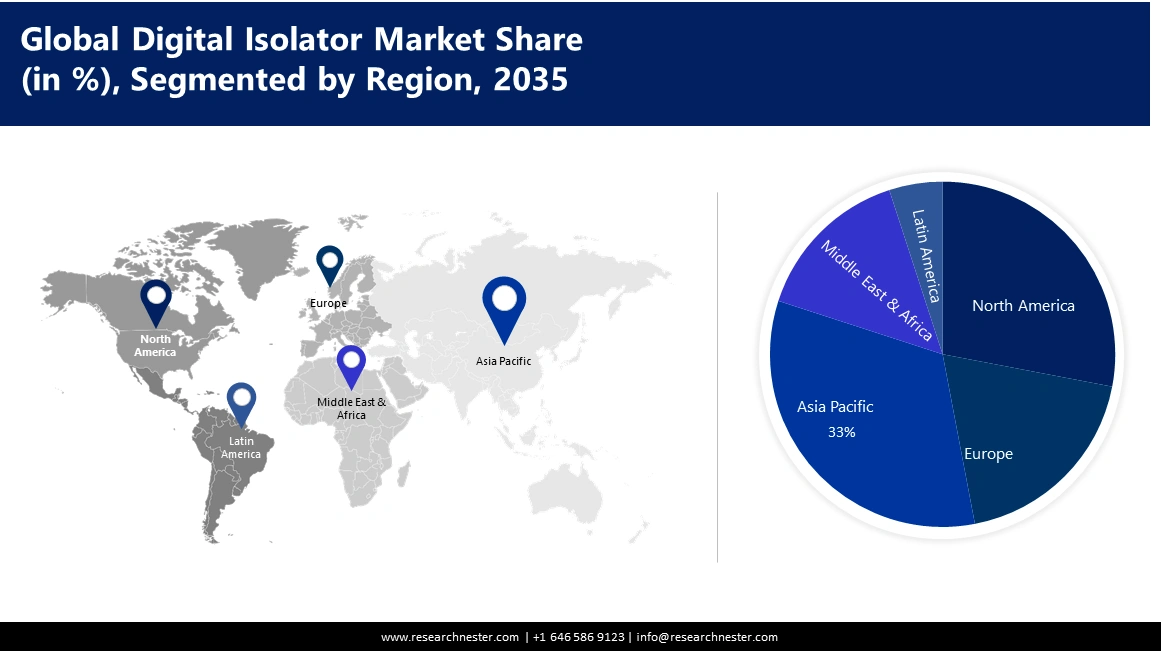

- Asia Pacific digital isolator market will hold more than 33% share, driven by the presence of many major electrical device manufacturers, forecast period 2026–2035.

- North America market will command a 30% share, fueled by increasing EV sales and aggressive promotion by vehicle manufacturers, forecast period 2026–2035.

Segment Insights:

- The silicon dioxide segment in the digital isolator market is projected to achieve a 70% share by 2035, fueled by high adoption among key players for insulation.

- The automotive segment in the digital isolator market is projected to experience significant growth through 2035, driven by rising electric vehicle adoption requiring digital isolators for power systems.

Key Growth Trends:

- Demand for Noise-Free Electronics and Electric Circuits

- Growing Adoption of Industrial Robots and Consumer Electronics

Major Challenges:

- High Manufacturing Costs and Fluctuating Prices of Raw Materials

Key Players: ON Semiconductor, ROHM Semiconductor, Infineon Technologies AG, Digi–Key Corporation, Murata Manufacturing Company Ltd.

Global Digital Isolator Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.33 billion

- 2026 Market Size: USD 2.49 billion

- Projected Market Size: USD 4.76 billion by 2035

- Growth Forecasts: 7.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, South Korea, Thailand, Mexico

Last updated on : 16 September, 2025

Digital Isolator Market Growth Drivers and Challenges:

Growth Drivers

-

Demand for Noise-Free Electronics and Electric Circuits - The request for noise-free electronic and electrical circuits has expanded drastically. Ground circles are one of the foremost common sources of undesirable clamor in electrical and electric circuits, which can cause them to glitch. When two associated terminals of a circuit have contrasting ground possibilities, a ground circle is generated. The current stream within the interconnection is a result of this potential distinction, coming about in balanced mistakes. Ground circles are broken with advanced isolators, which guarantee that all circuits have the same ground potential. They hinder the galvanic way between diverse ground possibilities permitting analog signals to pass through circles. Electrical commotion initiated by AC coherence is moreover disposed of by these gadgets. Aside from causing circuit harm, undesired conducted clamor caused by an alter in ground potential can cause an electric stun to clients.

-

Growing Adoption of Industrial Robots and Consumer Electronics - A major trend in the market is a growing acceptance of Industrial Automation within the manufacturing sector. As a result of the ground loop in industrial automation components, this isolator eliminates errors. It's capable of low latency, noise reduction, and high data transfer speeds. Through mergers and acquisitions strategies, several major players have increased their production capacity by setting up innovative isolators. For example, in July 2021, Skyworks Solutions Inc. acquired Silicon Laboratories's infrastructure and automotive business for a valuation of around USD 2.7 billion. The customer base of the semiconductor industry has been diversified by this acquisition.

Challenges

-

High Manufacturing Costs and Fluctuating Prices of Raw Materials - The growth of the digital isolator market is hindered by increasing production costs for isolation products as well as changes in resource pricing. The global market is dominated by several small and medium-sized players, with the largest market shares acquired by the leading players. In addition, according to the industrial requirement, the price of the raw materials needed for the production of these isolation products varies. The growth of the world market is hindered by these factors.

-

The inability of Digital Isolators to Transmit Low-Frequency Signals Without Modulators is Expected to Hamper the Market Expansion in the Projected Period

-

The High Cost of Integrating Digital Isolators Compared to Traditional Opt couplers is Predicted to Pose Limitations on Market Growth in the Future

Digital Isolator Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.4% |

|

Base Year Market Size (2025) |

USD 2.33 billion |

|

Forecast Year Market Size (2035) |

USD 4.76 billion |

|

Regional Scope |

|

Digital Isolator Market Segmentation:

Insulation Material Segment Analysis

In terms of insulation material, the silicon dioxide segment in the digital isolator market is set to hold the largest revenue share of 70% during the period between 2026-2035. The high adoption of silicon dioxide as an insulation material by several leading market players is the reason for the segment's revenue. In July 2022, Texas Instruments' Digital Isolator Design Guide mentioned that the company uses silicon dioxide-built, high-voltage capacitors to function as an isolation component. In addition, they noted in the Design Handbook that there are two other architectures for their and TX RX circuits which include OnOff Keying Edge as well as Based onOn.

Vertical Segment Analysis

Based on industry vertical, the automotive segment in the digital isolator market is set to grow significantly by the end of 2035. It is estimated that the automotive segment in the Digital Signal Isolator Market, divided into end-use sectors, will be significantly growing. The digital isolators are also used in electrical motor vehicles and include Capacitive Couplings. Electric motor power pure electric vehicles, hybrid electric vehicles, and plug-in hybrid electric vehicles. The high growth rate of digital isolators in the automotive industry over the forecast period is driven by the introduction of electric vehicles.

Our in-depth analysis of the global market includes the following segments:

|

Data Rate |

|

|

Channel |

|

|

Industry Vertical |

|

|

Insulation Material |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Digital Isolator Market Regional Analysis:

APAC Market Insights

The digital isolator market in the Asia Pacific is set to hold the largest revenue share of 33% by the end of 2035. The digital isolation market in Asia Pacific is expected to grow at the fastest rate during the forecast period, given the presence of a large number of major electrical device and equipment manufacturers in the region. In addition, digital isolators are commonly used for gate drivers and analog to digital converters in the Asia Pacific region. One of the most technologically advanced countries in the Asia Pacific region is China. This is a major contribution to the growth of the market in the Asia Pacific region.

North American Market Insights

The digital isolator market in the North American is set to hold a significant share by the end of 2035. The increase in EV sales in the region is largely due to aggressive efforts by vehicle manufacturers to promote their adoption. In the United States, more than 0.8 million electric vehicles were sold in 2022, and Tesla accounted for over 60% of all sales. Currently, about 1% of the 250 million cars, LCVs, and SUVs in the country are electric, and it is expected that by 2030, their share in the total number of cars will increase to 30% and further to 40% by 2035.

Digital Isolator Market Players:

- Advantech Co. Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- NXP Semiconductors NV

- Texas Instruments Analog Devices

- Broadcom Ltd.

- ST Microelectronics NV

- ON Semiconductor

- ROHM Semiconductor

- Infineon Technologies AG

- Digi – Key Corporation

- Murata Manufacturing Company Ltd.

Recent Developments

- In 2022, Texas Instruments announced the launch of a new, low noise, low emissions, quad, 4/0 channel, reinforced digital isolator integrated with integrated power. The company will be able to expand its product portfolio in the digital isolator by launching this product. Therefore, it will gain a competitive advantage over its competitors.

- Texas Instruments launched a new Ultra Low Power, Four Channel Digital Isolator at the beginning of 2022 with a multichannel digital isolator that can be used to isolate CMOS or LVCMOS digital I/Os. It is expected that this product launch will give the company a competitive advantage over other players in the market.

- Report ID: 5646

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Digital Isolator Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.