Digital Integrated Circuit Market Outlook:

Digital Integrated Circuit Market size was over USD 599.37 billion in 2025 and is poised to exceed USD 1.19 trillion by 2035, growing at over 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of digital integrated circuit is estimated at USD 637.67 billion.

The primary growth driver of the digital integrated circuit (IC) market is the increasing demand for consumer electronics. The proliferation of smartphones, tablets, smartwatches, and other portable devices is a major driver of the digital IC market. The creation of miniatures of electronics and advancements in microprocessors and memory are boosting digital IC adoption. As of 2024 mobile phones are the most popular electronic devices globally. Almost 97.7% of people worldwide own a mobile phone and among these smartphones are the most widely used.

Smartphones are the most profitable product in the consumer electronics sector, with nearly 1.2 billion units sold worldwide. Samsung Electronics provides high-performance smart card solutions for uses like mobile phones, cards, mobile phones, electronic passports, transportation cards, banking cards, and e-commerce applications. Their smart card ICs also offer extra security for industries such as finance, telecommunication, and public services.

Additionally, partnerships in the digital IC market help overcome technological challenges, reduce costs, and position companies to meet the growing demand for advanced electronic systems. Qualcomm Technologies, Inc. has agreed with Apple Inc. to supply Snapdragon 5G Modem‑RF Systems for launching smartphones in 2024, 2025, and 2026. This mutual agreement supports Qualcomm’s initiative of sustained leadership across 5G technologies and products.

Key Digital Integrated Circuit Market Insights Summary:

Regional Highlights:

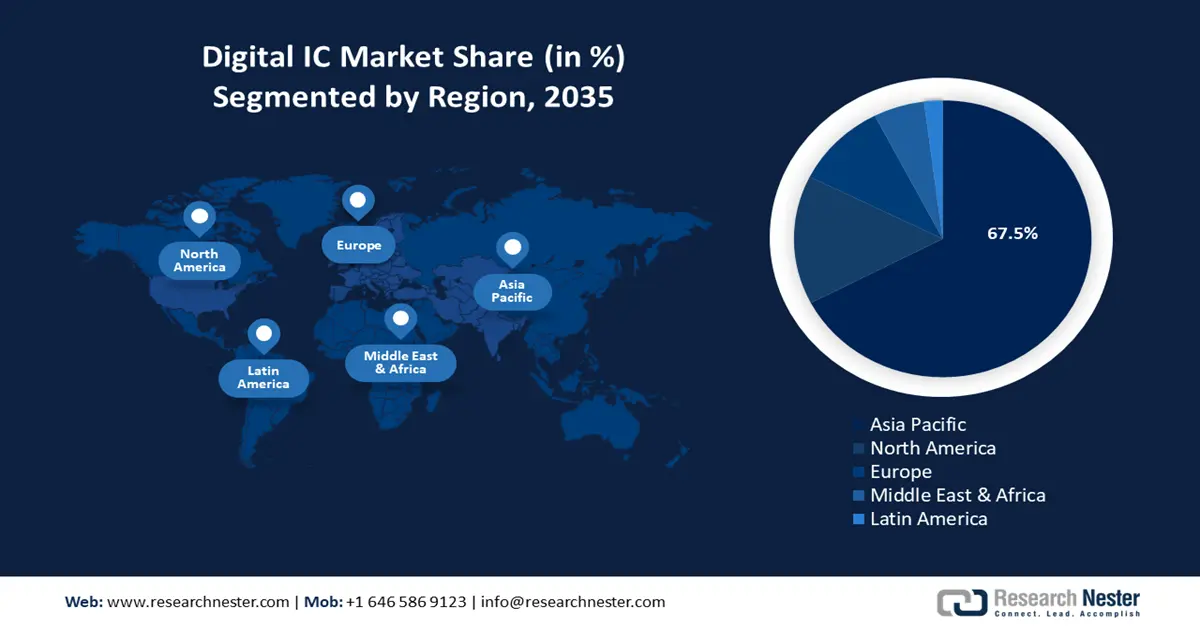

- Asia Pacific digital integrated circuit (IC) market will account for 67.50% share by 2035, attributed to rapid 5G network expansion, IoT adoption, and increasing demand for consumer electronics and automobile technology.

Segment Insights:

- The logic ics segment in the digital integrated circuit market is expected to secure a 43.40% share by 2035, driven by rising demand for smaller, energy-efficient semiconductor devices across consumer electronics and automotive sectors.

Key Growth Trends:

- Technological advancements in the automobile industry

- Emergence of the Internet of Things (IoT)

Major Challenges:

- Lack of skilled professionals

- Technological complexities

Key Players: Lattice Semiconductor Corporation, Taiwan Semiconductor Manufacturing Company, Samsung Corporation, Integrated Device Technology Inc., Texas Instruments Inc., Skyworks Solutions Inc., Semiconductor NV, Micross Components Inc., Toshiba Corporation.

Global Digital Integrated Circuit Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 599.37 billion

- 2026 Market Size: USD 637.67 billion

- Projected Market Size: USD 1.19 trillion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (67.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, South Korea, Japan, Taiwan

- Emerging Countries: China, Japan, South Korea, Taiwan, India

Last updated on : 18 September, 2025

Digital Integrated Circuit Market Growth Drivers and Challenges:

Growth Drivers

- Technological advancements in the automobile industry: The automotive industry has rapidly advanced with technologies like 3D mapping applications, electric vehicles, and automobile automation. This has led to an increased demand for advanced semiconductors such as sensors, memory chips, and types of ICs. The developments of passenger vehicles and the need for safety features are increasing the demand for automotive integrated circuits. The shift toward electric vehicles is another major trend, as these vehicles require semiconductors for managing batteries. For instance, with the development of EVs, the demand for power electronics is also rising, positively impacting the digital integrated circuit (IC) market.

Semiconductors are also used in car touch screens and entertainment systems. As vehicles become more automated and sophisticated, ICs will be increasingly used in onboard systems. Nowadays, semiconductors power everything in vehicles from entertainment systems to battery management. Innovations are enabling demanding applications like AI-powered systems to run efficiently. - Emergence of the Internet of Things (IoT): The growth of technology has made AI more common in industries like automotive, healthcare, and consumer electronics. This has increased the need for specialized integrated circuits designed for tasks like machine learning. The growing use of IoT devices is a major factor in the demand for low-power, efficient ICs. Since IoT devices rely on batteries, they require ICs that use minimal power while working efficiently. Further, companies making IoT devices are teaming up with industry leaders to improve product quality and performance. For instance, in March 2024, Kudelski an IoT solutions provider partnered with Infineon, a semiconductor leader to create a secure, certified solution for smart home devices.

- Rapid development of 5G technology: 5G, the fifth-generation mobile network is designed to offer faster data speed, ultra-low delay, better reliability and network capacity, greater availability, and a seamless experience for more users. 5G can handle 100 times more traffic efficiently, making it essential for future communication needs. The spread of 5G networks worldwide is also driving growth in the digital IC market. ICs are crucial for managing the massive data flow and reducing delays in 5G systems. The expansion has created new opportunities in the semiconductor industry.

For instance, from 2019 to 2020, the global share of 5 G-enabled smartphones grew from just 1% to 20%. Global 5G connections also hit nearly 2 billion in Q1 2024, with 185 million new users. By 2028, this number could hit 7.7 billion. In North America, 5G adoption is currently at 32%, double the global average, with an 11% growth rate and 22 million new connections. This transition gives rise to the urgent need for next-generation ICs that are capable of supporting the demands of 5G infrastructure, fostering innovation and growth in the industry.

Challenges

- Lack of skilled professionals: The lack of skilled professionals in the digital integrated circuit market can make it very challenging for the manufacturers to enhance the ICs. The designing of various functions into a single integrated circuit is a complicated task. Thus, with the absence of skilled professionals, market growth can be hampered. Further, developing advanced ICs such as smaller nodes (5nm, 3nm), requires significant investment in research and development which can be a barrier for smaller companies.

- Technological complexities: Designing and manufacturing ICs has become increasingly complex due to the push for miniaturization, higher efficiency, and integration of multiple functionalities on a single chip. Chip designers face issues in creating programs that consist of low costs, low power consumption, and yield high performance, and optimal processing. These technological issues restrict the digital IC market's expansion. Furthermore, the production costs for semiconductor manufacturers tend to get high due to the professional and trained workforce required for higher accuracy and precision while making these ICs. These variables significantly affect the expansion of the digital IC market.

Digital Integrated Circuit Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 599.37 billion |

|

Forecast Year Market Size (2035) |

USD 1.19 trillion |

|

Regional Scope |

|

Digital Integrated Circuit Market Segmentation:

By Type Segment Analysis

Logic ICs segment is set to capture digital IC market share of around 43.4% by the end of 2035. Logic ICs handle digital input signals and are vital for industries like electronics, telecommunications, and automotive in the US. They are especially important for designing small, energy-efficient devices like smartphones, tablets, car systems, sensors, and other applications. The market shift into the EV and renewable energy sectors is a notable trend. Components like NAND Flash Memory ICs, microcontrollers, digital signal processors, and image signal processors are crucial for driving the digital integrated circuit market. Logic ICs have helped make electronic devices smaller and more integrated. Advances in semiconductor manufacturing allow more complex circuits to fit on a single chip, making devices more functional while reducing their size and power usage. This makes them suitable for portable devices, wireless technology, and space-saving applications. Components like display drivers, general-purpose logic, and touchscreen controllers have become more popular recently.

Additionally, as industries develop, there’s a growing demand for small and durable semiconductor devices. For example, modern smartphones need smaller circuit boards than older designs. The rise of IoT devices like wearables with unique shapes also relies on miniaturization. These trends are driving the demand for smaller IC components.

By End user Segment Analysis

Based on the end-use industry, the consumer electronics equipment segment in the digital IC market report is reported to have the highest share owing to the increase in miniaturization of devices, incorporation of IoT, and growing demand for high-performance devices. At present, customer preferences for more equipped, smaller, quicker, and more efficient electronic devices have increased which is driving the demand for digital integrated circuits. Additionally, advancements in technology and the increasing adoption of smart devices are fueling the growth of the digital IC market. The rising adoption of consumer electronic devices such as smartphones, smartwatches, and gaming products such as AR and VR are driving the growth of the market. Currently, there are over 7.2 billion smartphones worldwide which is predicted to increase in the upcoming years.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Raw Material |

|

|

Components |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Digital Integrated Circuit Market Regional Analysis:

APAC Market Insights

Asia Pacific digital IC market is predicted to dominate revenue share of around 67.5% by the end of 2035. The market growth is driven by advancements in automobile technology, increasing demand for consumer electronics, the emergence of IoT, rapid development of 5G networks, and many more. The region plays a very important role in shaping the future of connectivity. In 2024, China, South Korea, and Japan comprise more than 60% of global 5G connections, with China alone having the highest 5G users. The Asia-Pacific region is predicted to have more than 1.2 billion 5G connections by 2025 and over 1.4 billion connections by 2030, making it the fastest-growing region for 5G connectivity worldwide. It is estimated that 5G technology will approximately generate USD 133 billion in economic benefits in the Asia-Pacific region by 2030.

In addition, Japan and South Korea are also advancing towards utilizing the Internet of Things (IoT), with over 150 million IoT connections estimated by 2025. In China, the 5G network covers almost 90% of its villages. China alone has a network of 3.84 million 5G base stations, which is more than 60% of the global total percentage.

South Korea has also been one of the earliest countries to adopt a 5G network. The rapid growth of 5G has been a key driver for the development of the digital IC market in the Asia Pacific region. 5G network in South Korea has reached 40% of its total population by 2024.

North America Market Insights

The digital integrated circuit (IC) market of North America is poised to register significant revenue growth by 2035. The growth can be attributed to increasing autonomous cars, the rise in consumer electronics, growing demand for safety and efficiency.

A primary key driver for growth in the U.S. digital IC market is the widespread adoption of smartphones and tablets. This increase in demand has raised the demand for digital ICs in consumer electronics. Additionally, the combination of IoT (Internet of Things) in various sectors is another major trend, requiring advanced digital ICs for efficient data processing and Internet connectivity. In the U.S., the development of autonomous cars also drives the growth and integration of complex integrated circuits. According to a report, about 3,20,000 fully automated self-driving vehicles are predicted to be shipped by the end of this year. The number of self-driven vehicles will steadily rise and capture the digital integrated circuit market in the coming years.

Autonomous driving stands out as one of the most groundbreaking developments in the history of the automobile industry. Advances in artificial intelligence, sensor technology, and high-speed connectivity are bringing self-driving cars to the norm. These advancements in the automotive sector are increasing the demand for software-defined vehicles that can receive remote updates to introduce new functions and features, such as enhanced driver assistance, advanced safety features, and improved connectivity and infotainment options.

Digital Integrated Circuit Market Players:

- Lattice Semiconductor Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Taiwan Semiconductor Manufacturing Company

- Samsung Corporation

- Integrated Device Technology Inc.

- Texas Instruments Inc

- Skyworks Solutions Inc

- Semiconductor NV

- Micross Components Inc.

- Toshiba Corporation

- MediaTek Inc.

The major key players are driving growth through a combination of technological innovation, partnerships, and expanding product offerings. These players are particularly focusing on integrating features like IoT, AI, and ML for improved safety and operational efficiency in digital integrated circuits. Companies are focused on designing, manufacturing, and supplying ICs for various applications. The major players are listed below.

Recent Developments

- In June 2024, Samsung Electronics. Co., Ltd. introduced new chips for advanced 5G technology. These chips include improved components for better performance and energy efficiency, making Samsung’s next-generation 5G devices faster and more efficient.

- In October 2024, Qualcomm partnered with Google to use Snapdragon Digital Chassis and Google’s in-vehicle technologies to produce a standardized reference framework for the development of generative AI-enabled digital cockpits and software-defined vehicles (SDV). This collaboration focuses on using Gen AI to develop advanced digital dashboards and smart vehicle systems for automakers and tier-1 suppliers to create safe and digitally advanced experiences.

- Report ID: 6950

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Digital Integrated Circuit Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.