Digital Fault Recorder Market Outlook:

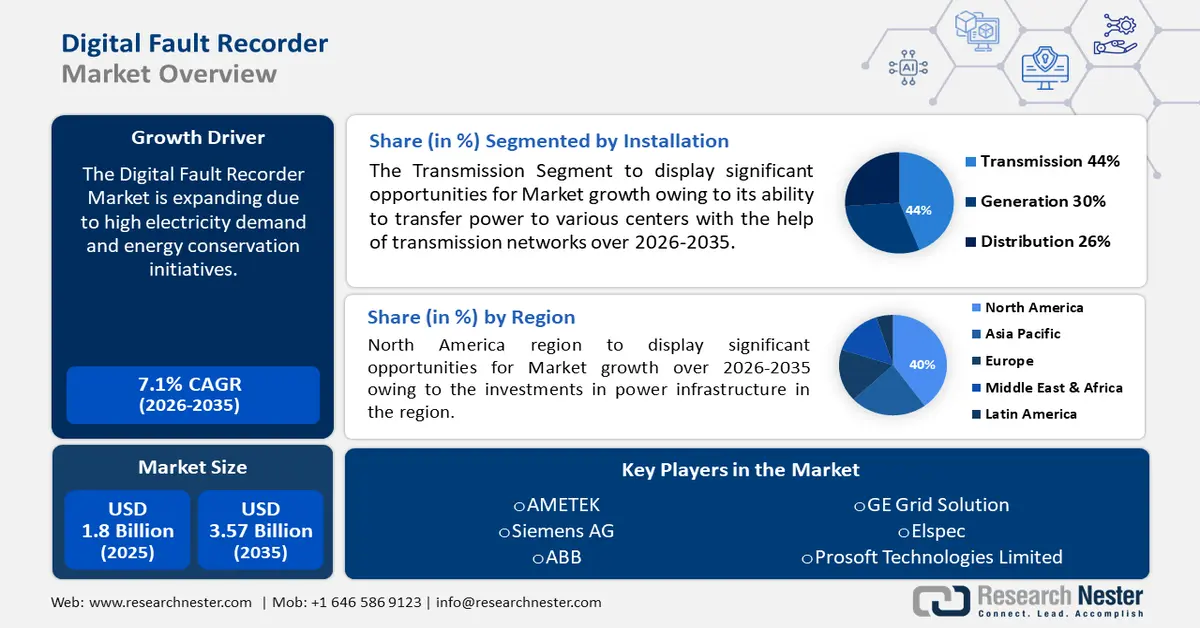

Digital Fault Recorder Market size was valued at USD 1.8 billion in 2025 and is likely to cross USD 3.57 billion by 2035, expanding at more than 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of digital fault recorder is assessed at USD 1.92 billion.

The increasing investments in the power infrastructure, government initiatives in energy conservation, and high electricity demand are the growth drivers for the market. According to the Energy Administration, the Ministry of Economic Affairs launched a program in Feb 2023, named the ‘New Energy Saving Campaign Program’ which is estimated to save 5 billion kWh to decrease the demand for electricity from 2017-2020.

Key Digital Fault Recorder Market Insights Summary:

Regional Highlights:

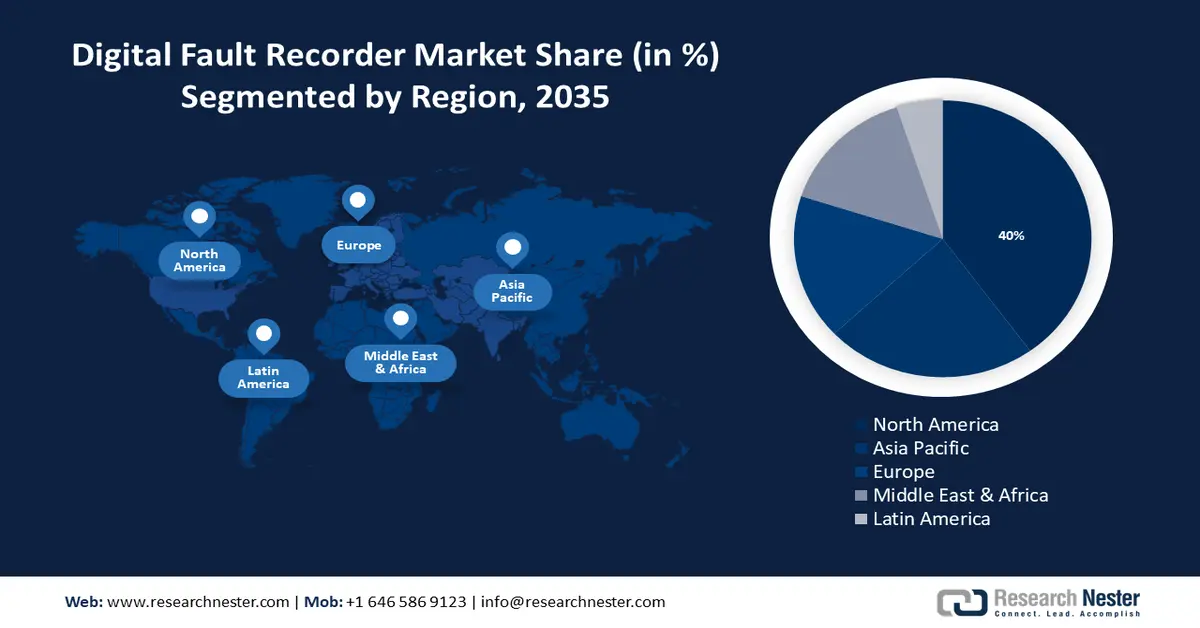

- North America digital fault recorder market will secure over 40% share by 2035, driven by investments in power infrastructure and the expansion of smart grids.

Segment Insights:

- The transmission segment in the digital fault recorder market is projected to hold a 44% share by 2035, driven by the power being transferred to various centers with the help of transmission networks.

- The automated (station) segment in the digital fault recorder market is projected to see significant growth till 2035, fueled by the ability to remotely monitor and control power distribution systems.

Key Growth Trends:

- Demand for reliable power supply

- Demand for digital substations

Major Challenges:

- Expensive grid manufacturing

- Presence of advanced technologies

Key Players: Siemens AG, General Electric Company, ABB Ltd., Schneider Electric SE, Elspec Ltd., AMETEK, Inc., Qualitrol Company LLC, Kocos Messtechnik AG, Megger Group Limited, ERLPhase Power Technologies Ltd.

Global Digital Fault Recorder Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.8 billion

- 2026 Market Size: USD 1.92 billion

- Projected Market Size: USD 3.57 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Singapore

Last updated on : 17 September, 2025

Digital Fault Recorder Market Growth Drivers and Challenges:

Growth Drivers

- Demand for reliable power supply - Nowadays, households and industries demand power supply on a large scale which requires the installment of strong power grid systems. As per the International Energy Agency, the electricity demand is expected to grow at a pace of 6.5% from 2024-2026. Additionally, here comes the need for monitoring these grid systems and ensuring proper functioning these actions are very well performed by digital fault recorders since these help in detecting faults, recording data, and ensuring the reliability of the power supply in the electric systems.

Moreover, various factors affect reliability such as the addition of more components in the system causing more malfunctioning, mere changes leading to component failure, and fluctuations in voltage. Therefore, the selection of smart devices that are compatible and can reduce common failures is a must.

- Demand for digital substations - A digital substation is more advanced than an electrical one and has a crucial role in the transmission and distribution of electricity. Many old grid infrastructures are unable to beat the strength of modern power demands. A digital substation is a modernized part of a substation’s secondary system that does not constitute analog secondary circuits between the transformers and protective relays. Such as Substation Automation is reliable and enhances the old infrastructures. Therefore, demand for DFR is rising in the market since it provides secure and reliable data by efficiently converting analog and binary data into digital data and, requires low maintenance cost.

- Investments in power grid infrastructure - The aging grid infrastructure needs gradation with smart devices like DFR which will seamlessly integrate with existing systems along with increasing reliability on grid infrastructure. Further, power grids not only support economic growth but also give rise to new energy demands.

Moreover, the largest direct investment made for power grid infrastructure is performed by the US. In October 2023, Joe Biden announced grants of USD 4 Billion for 58 projects along 44 states to expand transmission of electricity and secure power grids from natural or expected problems.

Challenges

- Expensive grid manufacturing - Although meeting the demand for power supply is crucial, it should also be noted that grid infrastructure requires high investment which could be challenging for various economies. Therefore, affecting the sale of digital fault recorders.

- Presence of advanced technologies - Many regions consist of cutting-edge competing technologies, for instance, nuclear energy and fossil fuels, reducing the adoption rate of DFR.

Digital Fault Recorder Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 1.8 billion |

|

Forecast Year Market Size (2035) |

USD 3.57 billion |

|

Regional Scope |

|

Digital Fault Recorder Market Segmentation:

Installation Segment Analysis

Transmission segment is likely to hold more than 44% digital fault recorder market share by 2035. The segment growth is attributed to the power being transferred to various centers with the help of transmission networks. The rise in the demand for DFR is related to the increase in transmission infrastructure to attain a reliable power supply coupled with seamless necessary data. China is the first country to create 1 million volt transmission lines, plans to partner with other countries to manufacture powerful grid infrastructures and attain a global interconnected electric grid by 2070.

Station Segment Analysis

By 2035, automated segment is projected to hold more than 25% digital fault recorder market share. The automated segment is poised to hold a significant share of 25% in the year 2035. This segment helps remotely monitor and control power distribution systems even the large power transmission systems. Additionally, automated systems assist in the transformation of standard substations by improvising old infrastructures.

Voltage Segment Analysis

The 66kV-220kV segment in digital fault recorder market is anticipated to hold the revenue owing to its usage in transmitting power over long distances since high-voltage transmission lines are required for covering large distances. USD 20 million has been allocated for investment in the transmission and distribution system for 2020-2023 as per NEMA on a global level.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Installation |

|

|

Station |

|

|

Voltage |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Digital Fault Recorder Market Regional Analysis:

North America Market Insights

North American in digital fault recorder market is anticipated to account for more than 40% revenue share by the end of 2035. The growth of the region is attributed to the investments in power infrastructure, excessive energy resources, high electricity consumption, and the expansion of smart grids. There are many distributed energy resources, for instance, rooftop solar panels, wind generating units, and, e-vehicle batteries which are growing day by day and require a powerful monitoring system.

In the United States, a high percentage of electricity comes from renewable resources and the electricity consumption rate is also high therefore, they constantly put efforts into reducing carbon emissions. As per EIA, electric appliances in an average household in the US consume 52% of electricity.

Due to the growing demand for power supply and the expansion of smart grids, the government in Canada is focused on investing more in grid infrastructures and transmission networks. In Canada, around USD 100 million is expected to be invested for the effective utilization of existing electrical assets and to reduce greenhouse gas emissions.

Asia Pacific Market Insights

Asia Pacific digital fault recorder market is expected to observe over 8.5% growth between 2024 and 2035. The region is experiencing growth due to the investment in power grid infrastructure, demand for renewable resources, and increased awareness of sustainability. The Union Minister of India disclosed that over USD 130 Billion has been administered to the generation, transmission, and distribution sector along with it nearly half of the stated amount is invested in the innovation of the renewable energy sector.

Carbon neutrality is again a crucial factor in helping the market grow in Japan. India and Japan's clean energy partnership aims to achieve sustainable goals such as economic growth and climate change. Moreover, both countries are planning to reach net zero and therefore investing in innovative technologies that will help in reducing carbon emissions, which will help the market grow.

Additionally, this partnership will cover many areas such as wind energy, carbon capture & recycling, etc. Along with India and Japan, South Korea is all set to become carbon neutral by 2050, as per a study South Korea will attain one-third of its power generation from renewable resources.

Digital Fault Recorder Market Players:

- AMETEK

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GE Grid Solution

- KVAR Technologies Pvt Ltd.

- Sonal Instruments India Pvt Limited

- Siemens AG

- KoCos Messtechnik AG

- Ducati Energia SpA

- Prosoft Technologies Ltd.

- ABB

- Elspec Ltd.

The market for digital fault recorder is dominated by key market players who are gaining traction in the market due to the high demand for electricity and excessive usage of energy-efficient products.

Recent Developments

- Prolec GE a joint venture of GE Grid Solutions and Xignux announced in December 2023 that it will invest a whooping USD 85 million to double its single-phase pad mount transformer to meet the demand for North America.

- GE Vernova and Germany’s one of the leading high voltage grid operators Tennet T signed an agreement in which GE Vernove will expand its business line in Germany by supplying transformers and shunt reactors to Tenne T.

- Report ID: 6158

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Digital Fault Recorder Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.