Digital Fabrication Inkjet Inks Market Outlook:

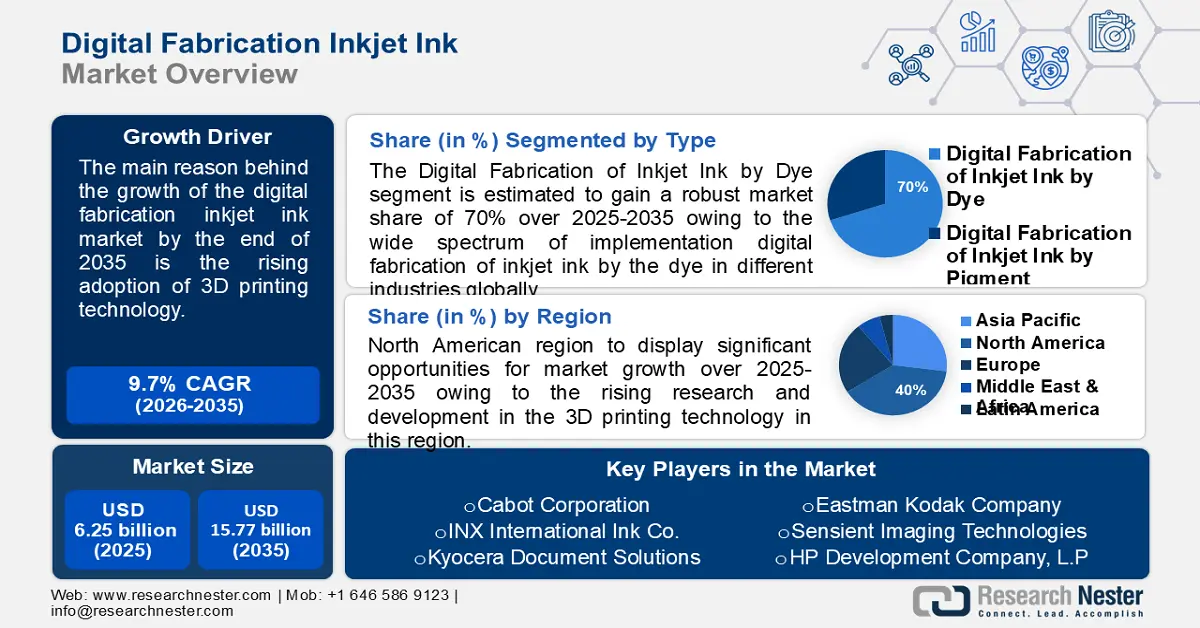

Digital Fabrication Inkjet Inks Market size was valued at USD 6.25 billion in 2025 and is set to exceed USD 15.77 billion by 2035, expanding at over 9.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of digital fabrication inkjet inks is estimated at USD 6.8 billion.

The reason behind the growth is the rising adoption of 3D printing technology. According to International Economics released in the year 2021, globally, a lot of applications have been started to make use of 3D printing technology. A few uses for 3D printing technology are in the medical field, where it may aid in the creation of customized medical equipment.

Key Digital Fabrication Inkjet Inks Market Insights Summary:

Regional Highlights:

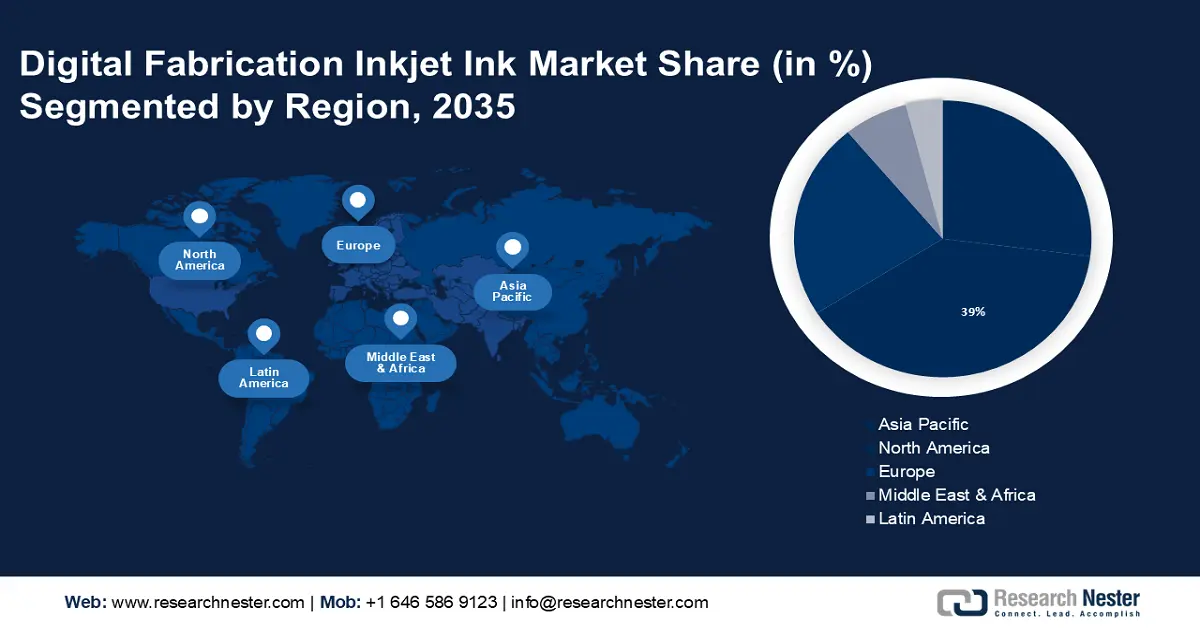

- Asia Pacific digital fabrication inkjet inks market will hold more than 39% share by 2035, driven by rising research and development in 3D printing technology.

Segment Insights:

- The digital fabrication of inkjet ink by dye segment in the digital fabrication inkjet inks market is anticipated to achieve substantial growth till 2035, driven by technological advancements enhancing print quality, speed, and efficiency.

- The packaging segment in the digital fabrication inkjet inks market is projected to experience significant growth till 2035, fueled by rapid growth in the packaging industry and increasing online purchases requiring secure shipment.

Key Growth Trends:

- Increasing and quick expansion of the packaging industry

- Rising demand for personalization in business

Major Challenges:

- High cost of Digital Fabrication Inkjet Inks

- Lack of variety in color gamut in inks

Key Players: Cabot Corporation, INX International Ink Co., Kyocera Document Solutions, Eastman Kodak Company, Sensient Imaging Technologies, HP Development Company, L.P, Seiko Epson Corporation, Van Son Ink Corporation, InkJet, Inc., Sensient Technologies Corporation, SCREEN Graphic Solutions Co., Ltd., Hitachi, Ltd., Fujifilm Sericol International, Nippon Kayaku Co., Ltd..

Global Digital Fabrication Inkjet Inks Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.25 billion

- 2026 Market Size: USD 6.8 billion

- Projected Market Size: USD 15.77 billion by 2035

- Growth Forecasts: 9.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (39% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Japan, Germany, China, South Korea

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 17 September, 2025

Digital Fabrication Inkjet Inks Market Growth Drivers and Challenges:

Growth Drivers

- Increasing and quick expansion of the packaging industry - The contemporary era's quick rate of change is reinforced by the sharp growth in worldwide regulation of packaging waste, the dramatic transition to online shopping, and the rising worries of consumers about sustainability. Future-proofing their business models and digital fabrication inkjet inks market strategies is imperative for next-generation industry winners, who must be able to guide CEOs through this unprecedented transformation.

According to estimates made by the National Library of Medicine (October 2024), the rise in global population growth would necessitate a 50% increase in food supply by 2050. The need for food packaging and flexible industrial packaging materials increases along with the demand for food. Packaging materials must be specifically designed to meet the increasing needs of producers, customers, and regulatory bodies while maintaining food quality. - The growing market for printing technologies - Digital printing reduces costs and turnaround times because there is no need to replace the printing plate. Unlike conventional ink, which penetrates the substrate, most methods employ toner or ink to create a thin coating that may be further bound to the substrate by a fuser fluid that uses UV or thermal curing (ink or toner).

According to a Stanford University Study made in 2021, AI is being used by more people these days to do a lot of things, along with dictating messages to their phones, improving their backdrops during conference calls, and providing recommendations for news, entertainment, or shopping. - Rising demand for personalization in business - Personalization has expanded from addressing a client by name to include recommendations and content customization based on wide consumer categories or interests.

Through the use of technology and data, hyper-customization raises the bar on personalization by enabling highly tailored interactions at each stage of the customer experience.

Challenges

- High cost of Digital Fabrication Inkjet Inks - The higher cost of digital fabrication inkjet inks can impede the market during the projected period. Several basic ingredients, including UV resins, pigments, and additives, are hitting higher costs because of the recent epidemic which as a result increases the cost of inkjet inks.

- Lack of variety in color gamut in inks - In order to replicate color on printing equipment, black, cyan, magenta, and yellow inks are utilized. The printer's color gamut is provided by the hue, saturation, and brightness of these inks. Because red, green, and blue (RGB) monitors have a wider color range than most printers, printed images frequently lack the vibrancy of computer screens. This can further impede the digital fabrication inkjet inks market expansion by the end of 2035.

Digital Fabrication Inkjet Inks Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.7% |

|

Base Year Market Size (2025) |

USD 6.25 billion |

|

Forecast Year Market Size (2035) |

USD 15.77 billion |

|

Regional Scope |

|

Digital Fabrication Inkjet Inks Market Segmentation:

Type Segment Analysis

Digital fabrication of inkjet ink by dye segment is poised to dominate around 70% digital fabrication inkjet inks market share by the end of 2035. The wide spectrum of implementation digital fabrication of inkjet ink by the dye in different industries globally will help this segment to have a massive revenue share by the end of 2035.

According to the Digital Textile Printing journal released in 2023, the succeeding wave of expansion in the printing sector is propelled by new developments and the growing popularity of digital technology solutions that improve print quality, speed, and efficiency.

Material Segment Analysis

By the end of 2035, plastics segment is estimated to capture around 45% digital fabrication inkjet inks market share and will increase massively. The rising use of plastic materials globally and the increasing use of inkjet inks in the printing of plastic materials will highly drive market expansion.

According to the Organization for Economic Cooperation and Development (OECD) -Library published in 2019, based on the Baseline scenario, economic development would be the primary driver of the predicted treble increase in worldwide plastics consumption between 2019 and 2060, from 460 million tonnes (Mt) to 321 Mt.

End-User Segment Analysis

In digital fabrication inkjet inks market, packaging segment is poised to account for more than 46% revenue share by the end of 2035. The growth of this segment will be noticed due to the quick expansion of the packaging industry and the rising use of inkjet inks in this industry.

In fact, more and more purchases are being made online by customers. As per a survey done by Research Nester in 2023, the demand for packaging ingredients particularly corrugated board designs will be hiked by 2028. This huge demand for packaging boards along with inkjet inks will be noticed because of the safer shipment of the products through more intricate distribution routes.

Our in-depth analysis of the global digital fabrication inkjet inks market includes the following segments:

|

Type |

|

|

Material |

|

|

Application |

|

|

Ink Type |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Digital Fabrication Inkjet Inks Market Regional Analysis:

North American Market Insights

Asia Pacific industry is estimated to dominate majority revenue share of 39% by 2035. Moreover, the digital fabrication inkjet ink industry will increase immensely from 2023 to 2035 and will reach around USD 1.8 billion.

This growth will be noticed mainly due to the rising research and development in 3D printing technology. As per the National Library of Medicine published in June 2023, the uses of 3D printing technology have increased exponentially in recent times due to the promise of new materials in North America. In fact, the U.S. 3D printing is expanding enormously.

The digital fabrication inkjet inks market has expanded in the U.S. as a result of an increasing inclination towards customizable gifts in this country. According to the November 2023 Survey, around 80% of buyers in the U.S. think that presents with personalization are more considerate than those without and these customized gifts require digital fabrication inkjet inks.

The Canadian digital fabrication inkjet ink sector will grow mainly due to the rising demand for flexible and high-quality printing solutions. For instance, Vera Inkjet, a Montreal, Canada-based digital inkjet printing inks and dispersions company launched its new line of inks specially curated for the R2R textile industry in the year 2023.

APAC Market Insights

The Asia Pacific region will encounter massive growth in the sector of the digital fabrication inkjet inks market during the anticipated period.

The powerful economic expansion in the countries of Asia Pacific such as South Korea, China, etc. will drive the market expansion of the digital fabrication inkjet inks. According to the World Bank (2023), excluding China, the growth rate in developing East Asia and the Pacific increased to 4.6 % this year from 4.4 % in 2023.

Digital fabrication inkjet inks are especially in actual demand in China, driven by the rising demand for digital printing. In the past 10 years i.e. 2014–2024, the average print run of published books has become 18,000; 3,000 volumes in China.

In Japan, digital fabrication inkjet inks market will encounter massive growth because of the presence of the important key players in this region. In order to illustrate, FujiFilm Sericol International, a Japan-based company has displayed its different technologies ranging from analog to digital; toner to inkjet; and printheads, inks, and software in March 2024.

South Korea’s huge expansion in the textile industry will help to grow the digital fabrication inkjet ink sector in this country. In South Korea, the textile sector was essential to the early industrialization of the nation. As of right now, growth has been consistent, and in 2021, exports reached USD 14.32 billion.

Digital Fabrication Inkjet Inks Market Players:

- Cabot Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- INX International Ink Co.

- Kyocera Document Solutions

- Eastman Kodak Company

- Sensient Imaging Technologies

- HP Development Company, L.P

- Seiko Epson Corporation

- Van Son Ink Corporation

- InkJet, Inc.

The abundance of regional and local merchants is what defines the digital fabrication inkjet inks market. Every competitor in the industry is vying for the largest possible market share, making it a very competitive environment. The need for digital ink is rising globally, which is driving up sales of digital fabrication inkjet inks. Some major participants in the industry are:

Recent Developments

- Eastman Kodak Company announced on June 6, 2024, that it will be selling five KODAK PROSPER ULTRA 520 Presses to an existing offset client for three years at Drupa 2024. Utilizing KODAK ULTRASTREAM Inkjet Technology and KODACHROME Inks to their fullest potential, the PROSPER ULTRA 520 Press produces exceptional offset-quality prints at up to 152 mpm (500 fpm).

- Kyocera Document Solutions proudly presented its ambitious vision for inkjet commercial printing on May 30, 2024. This included the introduction of the new TASKalfa Pro 55000c, the FOREARTH textile printer, and the Belharra Kyocera Nixka inkjet photo printer, which offered a glimpse of what's to come.

- Report ID: 6221

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.