Digital Comparators Market Outlook:

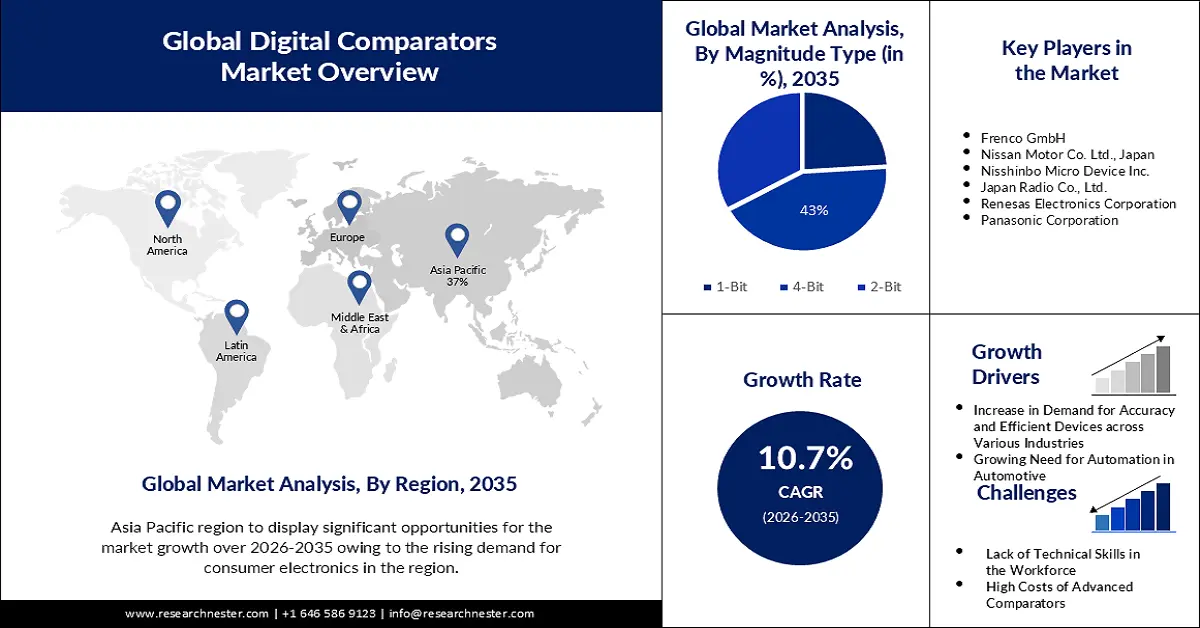

Digital Comparators Market size was valued at USD 20.66 billion in 2025 and is likely to cross USD 57.1 billion by 2035, registering more than 10.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of digital comparators is assessed at USD 22.65 billion.

Digital comparators have enormous potential and are predicted to be employed in a variety of scenarios over the years to come.

Hence, it also has gained huge importance in orthopedic devices since it leads to accurate inspection. Therefore, with the growing number of orthopedic surgeries in numerous nations the market demand is estimated to surge. In the case of India, over 5,675,560 orthopedic surgeries were performed in the year 2022.

Moreover, the advancement of technology is also rising which is further influencing the development of high-speed and high-resolution devices. This is estimated to increase the need to improve the efficiency and performance of digital comparators. As a result, key players are investing significantly in producing innovative digital comparators.

Key Digital Comparators Market Insights Summary:

Regional Insights:

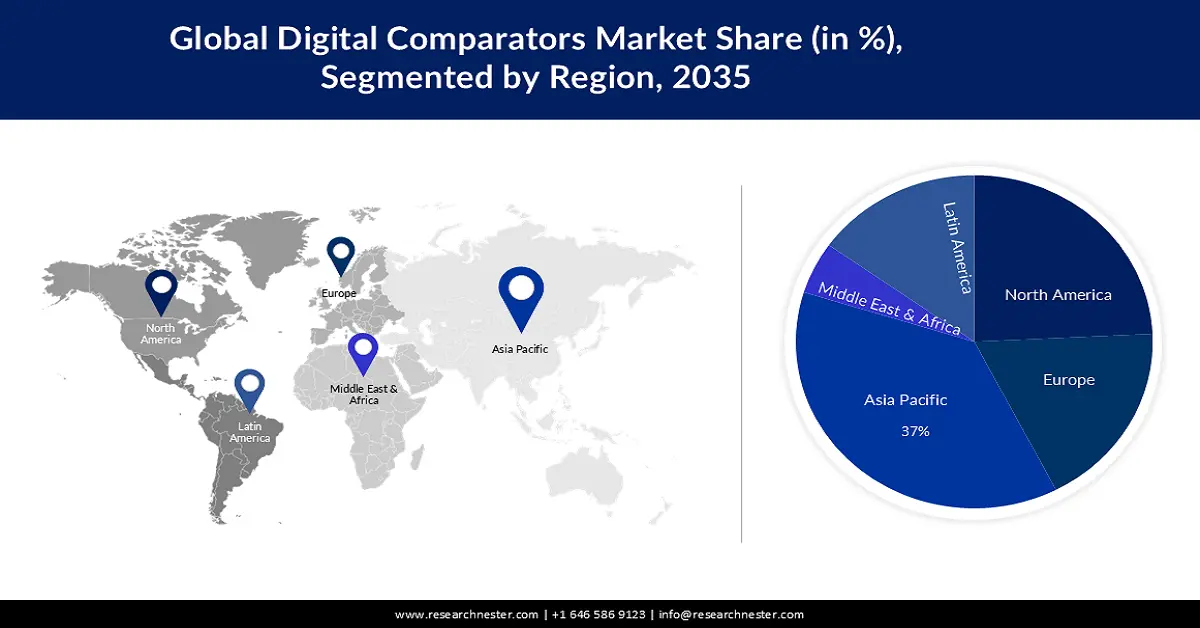

- By 2035, the Asia Pacific region in the digital comparators market is projected to command a 37% revenue share, bolstered by escalating consumption of smartphones, tablets, and other electronic devices.

- North America is anticipated to secure nearly 24% revenue share by 2035, supported by growing adoption of autonomous driving technologies and rising disposable incomes.

Segment Insights:

- The 4-bit segment in the digital comparators market is expected to capture about 43% share by 2035, underpinned by the expanding requirement for high-precision binary processing.

- The manufacturing segment is forecast to exceed a 36% revenue share by 2035, sustained by increasing utilization of digital comparators in automated quality control and inspection activities.

Key Growth Trends:

- Increase in demand for accuracy and efficient devices across various industries

- Growing need for automation in automotive industry

Major Challenges:

- Lack of technical skills in the workforce

- High costs of advanced comparators.

Key Players: STMicroelectronics, Mahr Inc, MetLogix. Inc., Volvo Trucks, Frenco GmbH, Nissan Motor Co. Ltd., Japan, Nisshinbo Micro Device Inc., Japan Radio Co., Ltd., Renesas Electronics Corporation, Panasonic Corporation.

Global Digital Comparators Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 20.66 billion

- 2026 Market Size: USD 22.65 billion

- Projected Market Size: USD 57.1 billion by 2035

- Growth Forecasts: 10.7%

Key Regional Dynamics:

- Largest Region: Asia Pacific (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: – United States, China, Germany, Japan, South Korea

- Emerging Countries: – India, Vietnam, Indonesia, Mexico, Brazil

Last updated on : 26 November, 2025

Digital Comparators Market - Growth Drivers and Challenges

Growth Drivers

- Increase in demand for accuracy and efficient devices across various industries - For improved operational performance, there is a growing need for accurate and effective equipment in a variety of industrial verticals, including manufacturing. When manufacturing faults are detected in the early stage, they can be corrected before continuing to the next step to improve the product's lifetime. Hence, this is made possible by the use of optical comparators.

The use of optical comparators has several benefits, including being lightweight, having fewer moving parts, exhibiting accuracy, eliminating parallax errors, and providing high magnification. These benefits have led to an increase in demand for digital comparators in the market over the forecast period. - Growing need for automation in automotive industry - The demand for automotive is expanding across the world. Globally, sales of cars increased to over 74 million units in 2023, up from close to 66 million units in 2022. Furthermore, the demand for automation in automobiles is also surging, such as artificial intelligence (AI) and machine learning technologies are growing in the automotive sector.

- Increasing demand for high-speed data processing - With the rapid advancement of digital technology, there is a growing need for high-speed data processing capabilities. Digital comparators offer fast and accurate comparisons of digital signals, meeting the requirements of industries relying on real-time data analysis and decision-making. Moreover, the growing use of digital comparators in the telecommunications industry is also projected to propel the digital comparators market expansion over the years to come.

Challenges

- Lack of technical skills in the workforce - In the IC industry, there is a growing need for engineers and other technical professionals, but businesses are having difficulty filling the positions with qualified candidates. In hot new areas like AI and 5G, where competition for skilled individuals is high, the issue is even worse. The trend toward automation and new technologies is making the shortages worse. For instance, machine learning necessitates new abilities, yet there aren't many specialists in this field. Therefore, this factor may negatively impact the growth of the market.

- High costs of advanced comparators.

- Complexity of integration with existing processes may hinder market growth.

Digital Comparators Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10.7% |

|

Base Year Market Size (2025) |

USD 20.66 billion |

|

Forecast Year Market Size (2035) |

USD 57.1 billion |

|

Regional Scope |

|

Digital Comparators Market Segmentation:

Magnitude Type Segment Analysis

In digital comparators market, 4-bit segment is likely to account for around 43% share by 2035. The digital sector is experiencing a surge in demand for 4-bit magnitude comparators. In addition, there's an increasing need for comparisons and measures with more accuracy and precision. Demand for digital systems that can process larger binary numbers and yield more accurate answers is rising as technology develops.

Also, the growing usage of digital technology in sectors like consumer electronics, automobiles, and telecommunications is accelerating the growth of the segment. As per a report, the spending on digital transformation (DX) accounted for USD 1.6 trillion by 2022. These sectors frequently need intricate digital circuits for arithmetic operations, logic control, and data sorting, which depend on 4-bit magnitude digital comparator circuits. As a result, 4-bit comparators are crucial for enabling more sophisticated functionality and enhancing digital circuit performance as a whole. Therefore, these factors are propelling the growth of the 4-bit magnitude segment.

Vertical Segment Analysis

In digital comparators market, manufacturing segment is predicted to hold more than 36% revenue share by 2035. In the manufacturing industry, these comparators are commonly used in quality control and inspection processes. For instance, in automated assembly lines, digital comparators can be used to predetermined specifications, ensuring that they meet the required standards.

Digital comparators are additionally utilized for precise measurements and alignment in machining operations. Furthermore, increasing demand for automation and digitization in the manufacturing industry is also driving the growth of the segment. For instance, in 2021, 50% of all manufacturing activity was done by robots worldwide. Also, the growing complexity of manufacturing processes contributes to the demand for digital comparators in the manufacturing industry.

Our in-depth analysis of the global market includes the following segments:

|

Magnitude Type |

|

|

Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Digital Comparators Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is expected to account for largest revenue share of 37% by 2035, The market is expanding due to the rising demand for consumer electronics in the countries such as China, and India. The demand for smartphones, tablets, and other electronic gadgets is higher in the region due to its big consumer base and expanding middle class.

The smartphone adoption rate in 2022 in the region of Asia-Pacific region totaled over 75 percent, marking a rise from over 63 percent in 2019. In addition, the region is rapidly developing its infrastructure and becoming more industrialized, which increases the need for digital comparators.

Moreover, various initiatives including smart cities initiatives have been carried out for the government which has been aimed towards encouraging the adoption of digital technology hence driving the demand for digital comparators.

North American Market Insights

By 2035, North American region in digital comparators market is set to account for around 24% revenue share. The demand for digital comparators in the region is further fuelled by the emerging trends of autonomous driving, and surging disposable income

Furthermore, the investment in the military sector by the government is surging to enhance the production of amenities which might further encourage demand for digital comparators. Moreover, along with the military, the healthcare sector is also predicted to experience investment growth.

Digital Comparators Market Players:

- STMicroelectronics

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Mahr Inc

- MetLogix. Inc.

- Volvo Trucks

- Frenco GmbH

- Broadcom Ltd

- Linear Technology, Inc.

- Maxim Integrated

- Analog Devices, Inc.

- FACOM

Recent Developments

- Mahr Inc., a top supplier of dimensional metrology solutions, unveiled the Millimess 2000 W(i) and 2001 W(i), a new generation of electronic digital comparators. The new digital comparators combine optimum precision with a practical and dependable operation. Measurements, whether static or dynamic, are more accurate than ever due to additional probe linearization and a special inductive measuring technology.

- Metlogix informed the widely used M3 Digital Comparator now has improved usability and flexibility. Part overlays can be created fast and precisely with the addition of new overlay construction tools and support for DXF import and editing, usually eliminating the need for complex CAD editing software. Additionally, DXF overlay chart manipulation has been enhanced.

- Report ID: 5493

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Digital Comparators Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.