Digital Business Card Market Outlook:

Digital Business Card Market size was over USD 215.13 million in 2025 and is poised to exceed USD 680.19 million by 2035, witnessing over 12.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of digital business card is evaluated at USD 238.75 million.

Mass-scale paper production is a primary factor contributing to carbon outrush in the global ecological system. The Environmental Paper Network estimates that worldwide paper use has surged by 400% over the last 40 years and an average U.S. citizen uses around 700 pounds of paper each year, which is the globally highest paper usage per capita. The U.S. paper usage reached 208 million tons in the last 20 years, a growth of 126% from 92 million tons. Despite accounting for a mere 5% of the world population, the U.S. uses 30% of the overall paper supply.

Paper usage poses a fundamental impact on the environment and public health. The paper and pulp sector is the fifth largest energy consumer, amounting a 4% of the total energy consumed, and paper’s share in municipal solid waste by weight is a staggering 35%. The paper pulp sector, which comprises the production of business cards consumes 33-40% of industrial traded wood and 13-15% of total wood consumed, further contributing to rampant deforestation. The European Journal of Sustainable Development Research 2023 report also predicts that global paper consumption is set to surge to 470 million metric tons by the end of 2032.

Global corporations are striving to decarbonize operations by shifting to paperless workplace initiatives as a part of Corporate Social Responsibility (CSR). It is a critical trait in aiding the adoption of the digital business card market. According to industry surveys by Popl and HiHello, around 25–30% of professionals now prefer digital business cards over paper ones, citing ease of sharing and storage. Adoption is particularly strong in tech companies, where over 50% have shifted to digital cards, while uptake in conventional industries such as manufacturing remains below 20%. Moreover, Statista data shows that traditional business card printing volumes dropped by nearly 65–70% during the COVID-19 pandemic.

Key Digital Business Card Market Insights Summary:

Regional Highlights:

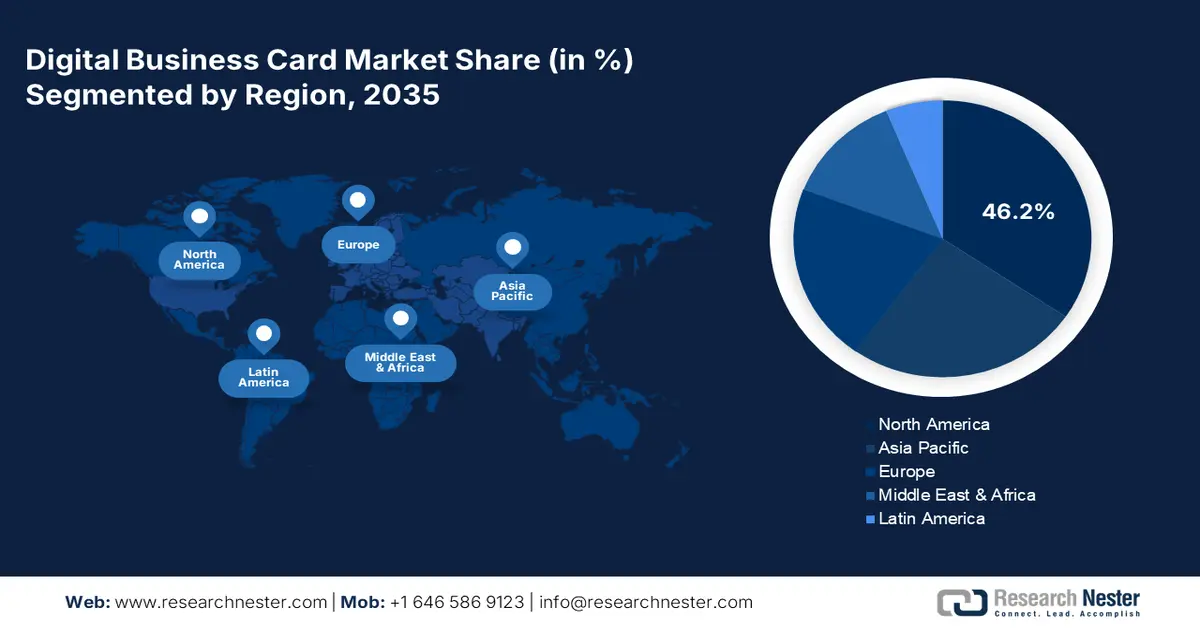

- North America dominates the digital business card market with a 46.2% share, driven by digitalization, tech-savvy consumers, and sustainable practices, supporting strong growth prospects through 2035.

- Asia Pacific's digital business card market is forecasted to achieve a healthy CAGR through 2026–2035, driven by startup innovation, digital shift, and government initiatives.

Segment Insights:

- The Android platform segment is expected to capture a significant 51.30% share by 2035, fueled by a large global Android user base and cost-effective, advanced technologies.

Key Growth Trends:

- High use of smartphones

- Integration of NFC, QR, and AR

Major Challenges:

- Lack of awareness and high costs

- Data privacy & security concerns

- Key Players: Haystack, Inigo, Switchit, Adobe, Inc., Camcard, and HiHello Inc.

Global Digital Business Card Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 215.13 million

- 2026 Market Size: USD 238.75 million

- Projected Market Size: USD 680.19 million by 2035

- Growth Forecasts: 12.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46.2% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 14 August, 2025

Digital Business Card Market Growth Drivers and Challenges:

Growth Drivers

- High use of smartphones: Smartphones are widely used by individuals as they have become a vital component in performing multiple tasks such as calling, messaging, and multimedia sharing in minutes. The continuous advancements in smartphones and the applications installed in them are contributing to the increasing use of digital business cards. Smartphones with advanced software applications such as Apple Wallet and Google Wallet make contact sharing easy and secure.

- Integration of NFC, QR, and AR: Near-field communication (NFC) chips, quick response (QR) codes, and augmented reality are some of the latest technological advancements in digital business cards. The NFC and QR code technologies directly connect with the individual’s business portfolio. These advanced technologies are effectively bridging the gap between traditional cards and modern networking.

Another aspect of these technologies is that they aid in aligning with sustainability practices. Augmented reality (AR) is one of the latest digital business card market trends, one can scan these electronic business cards using AR-enabled devices or scanning applications available on smartphones. AR-based digital business cards offer a personalized experience, further increasing brand visibility and data optimization. The continuous advancements in AR technology are anticipated to offer a bright future for digital business cards.

Challenges

- Lack of awareness and high costs: The lack of awareness in developing and underdeveloped regions is hampering the digital business card market growth to some extent. People and businesses in these regions are not aware of these latest technologies and also as they resist change creates challenges for digital business card producers. The high cost associated with digital business card technologies also limits their adoption rates among these regions. The older generation or companies with limited budgets are deterred from investing in such advanced contact-sharing solutions, hampering the digital business card market growth.

- Data privacy & security concerns: Data privacy concerns are also one of the significant challenges for digital business card adoption. These cards hold numerous professional as well as some personal information of the users, and if they are accessed by any third party or cybercriminal, a data privacy and security breach takes place. Thus, these concerns are expected to limit the sales of digital business cards.

Digital Business Card Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.2% |

|

Base Year Market Size (2025) |

USD 215.13 million |

|

Forecast Year Market Size (2035) |

USD 680.19 million |

|

Regional Scope |

|

Digital Business Card Market Segmentation:

Platform (iOS, Android, Web)

Android segment is projected to hold more than 51.3% digital business card market share by 2035. The high Android user base across the world is primarily contributing to the segmental growth. According to Google’s announcement at I/O 2021, Android surpassed 3 billion active devices, and recent estimates from Statista and IDC suggest the number has grown to over 3.5 billion users globally, with continued growth expected in the coming years. Android devices including smartphones are cost-effective and widely used by the public at large and consist of advanced and convenient technologies such as Bluetooth, NFC, and QR codes that aid in quick and efficient exchange of contacts.

Android platforms easily and seamlessly integrate with several other tools such as contact management applications, calendars, and email systems with minimal costs and efforts, which aids users in remaining updated and organized to share their professional information with others. Thus, easy compatibility, cost-effectiveness, and the presence of a high user base are collectively fueling Android-based digital business card adoption.

Type (Individual User, Business User, Enterprise User)

The enterprise user segment is anticipated to hold a dominating share of the global digital business card market through 2035. The scalability, easy integration of other tools, and cost-effectiveness are some of the factors driving the adoption of digital business cards for enterprise use. These advanced cards seamlessly integrate with systems such as customer relationship management (CRM) solutions, which efficiently track interactions, and follow-ups, and maintain comprehensive contact databases, driving demand among enterprises. Digital business cards are cost-effective to develop compared to conventional counterparts. The reduction of paper waste also makes them eco-friendly, aiding enterprises to align with sustainability trends.

Our in-depth analysis of the global digital business card market includes the following segments:

|

Type |

|

|

Platform |

|

|

Pricing |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Digital Business Card Market Regional Analysis:

North America Market Forecast

North America digital business card market is expected to account for revenue share of more than 46.2% by the end of 2035. The strong presence of tech-savvy consumers, the swift digitalization of companies, and the existence of industry giants are contributing to the increasing sales of digital business cards. The strict environmental regulations and increasing adoption of sustainable practices are fueling the adoption of digital business cards.

In the U.S., businesses and professionals have started adopting contactless solutions including digital business cards as a result of post COVID-19 pandemic. Digital business cards eliminate the need for physical interaction and are a more secure and efficient way to exchange contact information. The advanced networking culture in the U.S. is also augmenting the demand for digital business cards for both individual and enterprise use.

In Canada, government initiatives such as the Digital Ambition to promote sustainable and tech-driven business practices are driving the use of digital business cards. As many companies both corporate and manufacturing prioritize sustainable practices the use of digital business cards is anticipated to accelerate.

Asia Pacific Market Statistics

The Asia Pacific digital business card market is estimated to offer lucrative opportunities for digital business card producers in the coming years due to the rising digital shift across various industries. The digital transformation positively influences the adoption of digital business cards in the region. The key market players' expansion in the region is also projected to drive innovations leading to the production of modern contact solutions.

The digital business card market is foreseen to increase at a healthy CAGR in Australia during the projected period. The increasing emergence of new companies in the market is highlighting the popularity of digital business cards. For instance, founded in 2018, Blinq Technologies is offering efficient and advanced digital business cards in the country. In May 2022, Blinq Technologies received an investment of around USD 3 million (AUS 5 million dollars) from Blackbird and Square Peg Capital to develop simple and effective contact-sharing solutions. The company integrated advanced technologies such as QR codes, NFC chips, and email signatures to enhance its digital business card solutions.

In India, the digital transformation trend coupled with supportive government initiatives is generating high-earning opportunities for digital business card producers. The government is investing heavily in infrastructure development initiatives such as the Smart Cities Mission and Housing for All, and the Digital India aim is estimated to drive the demand for digital business cards in the coming years.

Key Digital Business Card Market Players:

- Haystack

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Inigo

- Switchit

- Adobe, Inc.

- Camcard

- HiHello Inc.

- L-Card

- Techno Infonet

- Popl

- SnapDat

- TM Networks, Inc.

- Lulu System, Inc.

- VistinKard

- Spreadly GmbH

- Blinq Technologies

- Itzme

- Tapt

- Uniqode Phygital, Inc.

- Mobilo

- Eylet.com

The digital business card market is quite competitive with the presence of existing industry giants and the emergence of new companies. The key market players for forming strategic partnerships with other players to increase their market reach. They are also adopting mergers & acquisitions strategies to boost their product offerings with minimum investment. Region expansion tactics are further aiding them to tap into high-potential markets to multiply their revenue shares. Whereas start-ups are investing heavily in research and development activities to introduce innovative solutions and to stand out from the crowd. They also employ finding tactics to accelerate their production cycles.

Some of the key players include in digital business card market :

Recent Developments

- In October 2023, Eylet.com a digital business card company announced that it started its first subscription-free service to all. Through this service, customers can generate 100% free and QR-code-based digital business cards.

- In January 2023, Uniqode Phygital, Inc. announced that it raised USD 25 million through Series A funding led by Telescope Partners and Accel. With this funding, the company aims to accelerate its QR code platform production to enhance customer’s experience with advanced digital solutions.

- Report ID: 6782

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Digital Business Card Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.