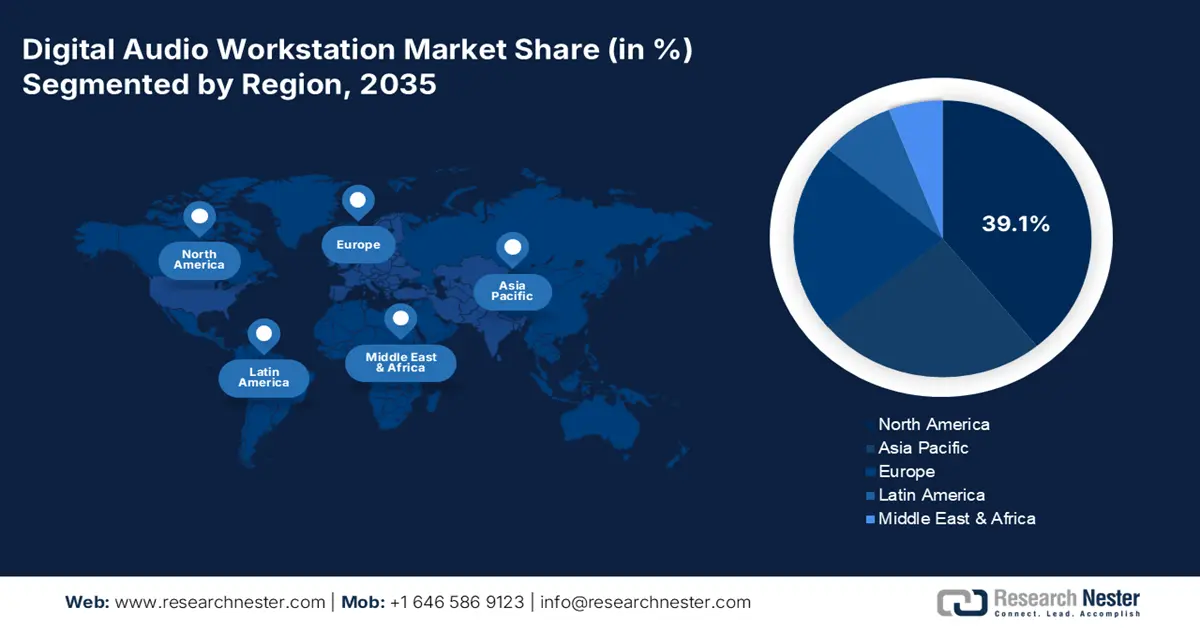

Digital Audio Workstation Market - Regional Analysis

North America Market Insights

The North America digital audio workstation market is anticipated to hold 39.1% of the revenue share through 2035. The strong creative industry presence and robust government-backed digital infrastructure programs are opening lucrative doors for digital audio workstation producers. Federal education funding under Perkins V and Canada's Universal Broadband Fund support DAW integration in K-12 and post-secondary learning environments. There has been a surge in government initiatives in Canada to narrow down the digital disparities, which is further expanding accessibility to the DAWs for a large portion of the population.

The government-funded ICT programs are expected to boost the sales of digital audio workstations in the U.S. Digital audio workstations’ integration into media production and education institutions is gaining traction in the country. The federal investments in broadband access and creative industry tech are expected to increase the production of digital audio workstations. Additionally, in FY2025, the U.S. Department of Education included a proposal of USD 1.5 billion of funding for Career and Technical Education (CTE) State Grants, which increased the DAW platform licensing.

Europe Market Insights

Europe is estimated to account for 27.5% of the digital audio workstation market share by 2034. The education, public broadcasting, and creative industries are set to significantly contribute to the sales of digital audio workstations. The strong EU-level funding and favorable ICT policies are supporting the increasing adoption of DAWs. France, Germany, and the U.K. are the most lucrative marketplaces for digital audio workstation manufacturers. Public funding from programs is further propelling the deployment of DAWs in multimedia production and music technology across schools, studios, and startups. The market in the UK is flourishing mainly due to a surge in streaming and music exports. According to data published by the Government of the UK, consumers have widely adopted music streaming. In the UK in 2021, there were 39 million monthly active users of music streaming services, and there were over 138 billion streams.

The sales of digital audio workstations in Germany are estimated to be driven by the structured digital investment and the integration of DAWs in national education. A strong audio technology manufacturing base is also boosting the sales of digital audio workstations. The strategic public-private investments are likely to amplify the trade of digital audio workstations in the coming years. According to the International Confederation of Societies of Authors and Composers, 45% of the population in the country uses music streaming, further propelling the market growth.

APAC Market Insights

The Asia Pacific digital audio workstation market is poised to increase at a CAGR of 10.9% from 2026 to 203. The growth of the market can be attributed to the significant investments in creative technologies and government-led digitization programs. The constant surge in digital skill development programs across prominent economies such as Japan, China, and India is also augmenting the demand for digital audio workstations. Moreover, the public support for cloud-native software, music tech education, and digital media infrastructure is projected to double the revenues of digital audio workstation producers.

The digital audio workstation market growth in China can be attributed primarily to the extraordinarily flourishing digital music industry and burgeoning adoption of cloud-based workstations. Also, there has been a surge in independent creators and a proliferation of home studios. Educational institutions in China are increasingly incorporating DAWs into their curricula, supported by government funding and initiatives. Cumulatively, these growth-catalyzing factors are positioning the country as a hub for the global market.

The market in India is witnessing staggering growth, driven by the mushrooming number of independent artists and content creators in the country. Educational content (online courses, YouTube tutorials) and collaborative remote workflows have accelerated skills adoption, while industry and government moves to streamline licensing and rights management are improving the commercial ecosystem for Indian creators. Together, these factors—larger domestic audiences, better revenue channels, cheaper tools, easier learning, and stronger institutional support—are fueling DAW adoption and market growth across India.