Digital Audio Workstation Market Outlook:

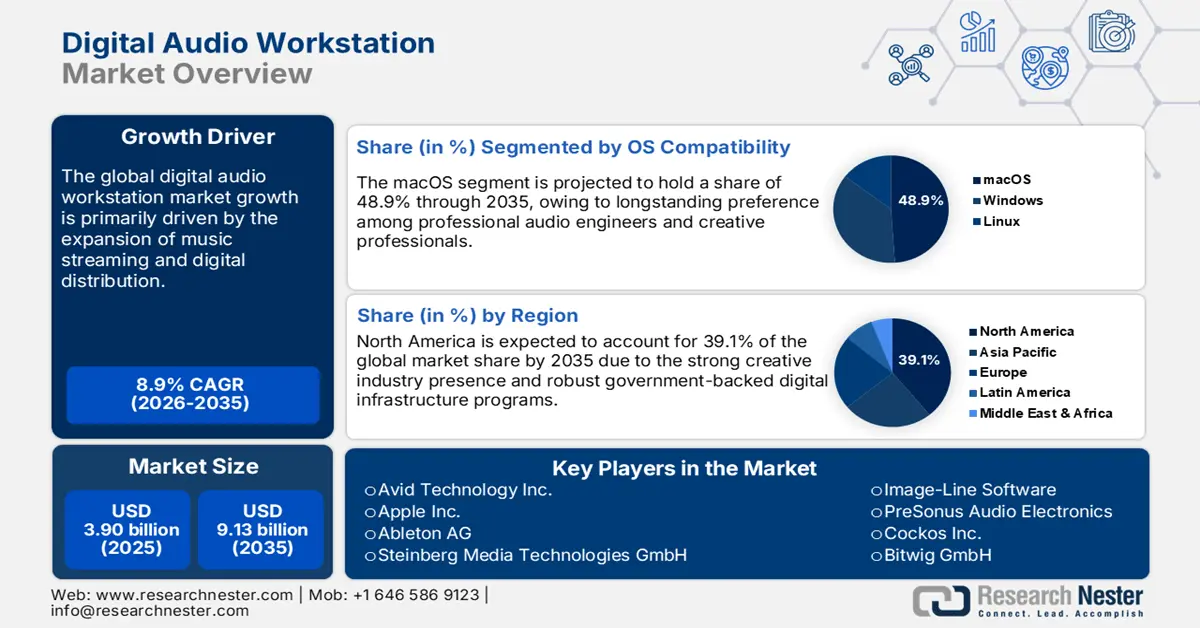

Digital Audio Workstation Market size was valued at USD 3.90 billion in 2025 and is projected to reach around USD 9.13 billion by the end of 2035, rising at a CAGR of 8.9% during the forecast period 2026-2035. In 2026, the industry size of digital audio workstation is estimated at USD 4.24 billion in size.

The manufacturing of digital audio workstations (DAWs) requires precision electronics, software engineering, and specialized audio hardware components. Audio interfaces, MIDI controllers, DSP chips, integrated circuits, etc., are pivotal elements required for the smooth production and commercialization of digital audio workstations. The specialized materials and components are mainly sourced from the U.S., Japan, and South Korea. The stable supply of raw materials and increasing adoption of musical tools and instruments represent hefty earning opportunities for digital audio workstation producers. Furthermore, the surging trend of cloud-based production of music and AI-enabled audio engineering is encouraging producers to invest in research and development.

Additionally, the research and development in the market is mainly focused on the amalgamation of advanced innovation of software innovation with the robust integration of hardware. Companies are investing a humongous budget in introducing AI to process natural-language guidance or simplify music creation. The surge in research is enhancing user interfaces and plugin compatibility to streamline the workflow. The innovations in edge and mobile computing are expanding the creative ecosystem.

Key Digital Audio Workstation Market Insights Summary:

Regional Insights:

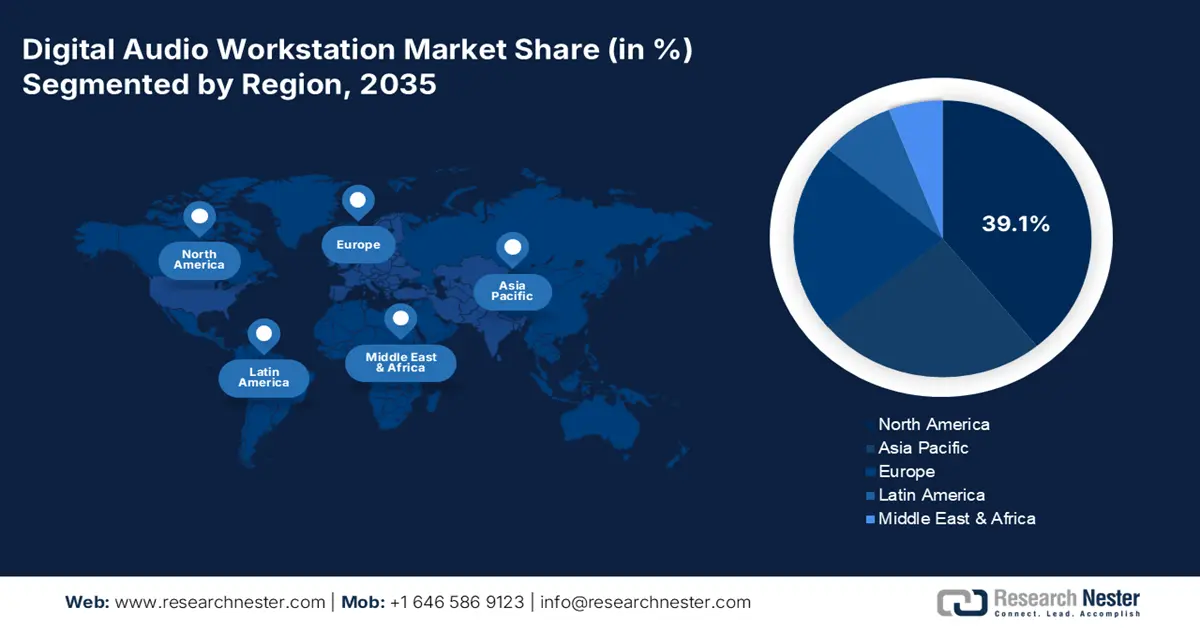

- By 2035, the North America Digital Audio Workstation Market is projected to secure a 39.1% share, supported by the expansion of digital infrastructure initiatives and education-driven technology integration.

- The Asia Pacific market is forecast to grow at a CAGR of 10.9% from 2026 to 2035, stimulated by rising investments in creative technologies and government-led digitization programs.

Segment Insights:

- The media & entertainment segment is set to account for 52.5% share by 2035 in the Digital Audio Workstation Market, bolstered by the widespread demand for high-quality audio in streaming, OTT, and immersive content.

- The macOS segment is anticipated to hold a 48.9% share by 2035, reinforced by strong professional preference for its stability, low latency, and expanding adoption in public institutions and education labs.

Key Growth Trends:

- Expansion of the music streaming and digital distribution

- Surge in adoption by educational institutions

Major Challenges:

- Limited digital infrastructure in emerging markets

- Pricing model inflexibility

Key Players: Avid Technology Inc., Apple Inc. (Logic Pro), Ableton AG, Steinberg Media Technologies GmbH (Yamaha), Image-Line Software, PreSonus Audio Electronics, Cockos Inc., Bitwig GmbH, Tracktion Software Corporation, Acoustica Inc., BandLab Technologies, Soundtrap (Spotify), Waveform Audio, Studio One Software Solutions, Sonicfoundry Asia.

Global Digital Audio Workstation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.90 billion

- 2026 Market Size: USD 4.24 billion

- Projected Market Size: USD 9.13 billion by 2035

- Growth Forecasts: 8.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: South Korea, India, Brazil, Australia, Singapore

Last updated on : 3 October, 2025

Digital Audio Workstation Market - Growth Drivers and Challenges

Growth Drivers

- Expansion of the music streaming and digital distribution: The steady rise in music streaming platforms is creating a high-earning space for digital audio workstation producers. Musicians as well as producers require smooth incorporation with platforms such as SoundCloud, and YouTube Music is projected to bolster the sales of digital audio workstations. Many companies are focused on introducing export plugins and built-in publishing tools to meet the evolving demands of end users. Moreover, the rise in local and vernacular content streaming in developing regions is further expected to boost the deployment of digital audio workstation technologies. For instance, according to data published by the World Economic Forum, global recorded music revenues reached USD 26 billion in 2022, which is further anticipated to bolster the market share.

- Surge in adoption by educational institutions: Governments all across the globe are more inclined towards incorporating creative education and spending a huge money on including DAW. Such funding programs are expected to expand the trade of digital audio workstations in the coming years. Many businesses are also focusing on the development of scalable and student-safe tools. Furthermore, the incorporation of music tech into STEAM education models is expected to push demand for low-cost, multi-user DAWs in South Korea and Japan. These factors are augmenting the market growth during the forecast period.

- Growth in gaming, film, and multimedia: The mushrooming demand for high-quality audio in films and video games has increased the reliance on digital audio workstations. There has been a burgeoning requirement for state-of-the-art production tools for sound design and executing voiceover integration, fostering the adoption of DAWs among media professionals. The data published by the Pew Research Center in April 2023 stated that in the U.S., 49% of adults have listened to at least one podcast in the last 12 months. DAW acts as the primary tool in the workflow and has features for multi-track editing and plugin support to render impeccable audio that the modern audience expects.

Challenges

- Limited digital infrastructure in emerging markets: Many regions in Sub-Saharan Africa, Southeast Asia, and Latin America still lack the broadband speeds or processing hardware needed to support cloud-based or real-time DAW functionalities. Small companies have low scope to expand due to the unavailability of advanced technologies and infrastructure. As a result, several companies scaled back B2B cloud offerings in Nigeria and Kenya and instead shifted to downloadable offline versions with reduced collaborative features.

- Pricing model inflexibility: Many digital audio workstation companies offer freemium or subscription-based pricing, but these often clash with the budgeting and procurement rules of government institutions, which potentially hinders their adoption rates. For example, in India, state schools are prohibited from adopting monthly subscriptions to digital audio workstations due to strict procurement policies.

Digital Audio Workstation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.9% |

|

Base Year Market Size (2025) |

USD 3.90 billion |

|

Forecast Year Market Size (2035) |

USD 9.13 billion |

|

Regional Scope |

|

Digital Audio Workstation Market Segmentation:

End-user Segment Analysis

The media & entertainment segment is poised to account for 52.5% of the digital audio workstation market share throughout the forecast period. The increasing popularity of short-form and streaming content is amplifying the sales of digital audio workstations. The rise in virtual concerts across the world is also projected to fuel the adoption of digital audio workstation technologies. The widespread adoption of the over-the-top platforms has further increased the requirement for high-quality sound effects and background scoring. Moreover, the widespread adoption of immersive technologies such as AR and VR is fostering the need for spatial audio production, propelling developers to include ambisonic audio features.

OS Compatibility Segment Analysis

The macOS segment in the market is predicted to garner a 48.9% share of market share by 2035. The growth of the sub-segment can be attributed to the high preference among professional audio engineers due to its attributes, such as stability, low latency, and robust audio drivers. Government-backed institutions and public broadcasters, especially in Europe and Japan, prefer macOS-based systems. The rising use of macOS in both public and private sectors is likely to double the revenues of key players in the years ahead. Various educational institutions are providing courses for music production and establishing labs incorporating macOS setups. These factors are reinforcing the dominance of the OS compatibility sub-segment in the market.

Deployment Type Segment Analysis

The cloud-based DAW segment is anticipated to garner a significant share owing to rising investment in broadband and digital infrastructure. There has been an exponential growth in data traffic in recent years, which is encouraging vendors to shift towards collaboration and cloud sync features. Other than this, the proliferation of 5G technologies is further lowering the latency by enabling real-time monitoring. Government-led programs are also expanding access by broadening the market research for cloud DAWs. These factors are augmenting the segment growth during the forecasted period.

Our in-depth analysis of the global digital audio workstation market includes the following segments:

|

Segments |

Subsegments |

|

OS Compatibility |

|

|

Type |

|

|

Product |

|

|

Application |

|

|

End user |

|

|

Deployment |

|

|

Revenue model |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Digital Audio Workstation Market - Regional Analysis

North America Market Insights

The North America digital audio workstation market is anticipated to hold 39.1% of the revenue share through 2035. The strong creative industry presence and robust government-backed digital infrastructure programs are opening lucrative doors for digital audio workstation producers. Federal education funding under Perkins V and Canada's Universal Broadband Fund support DAW integration in K-12 and post-secondary learning environments. There has been a surge in government initiatives in Canada to narrow down the digital disparities, which is further expanding accessibility to the DAWs for a large portion of the population.

The government-funded ICT programs are expected to boost the sales of digital audio workstations in the U.S. Digital audio workstations’ integration into media production and education institutions is gaining traction in the country. The federal investments in broadband access and creative industry tech are expected to increase the production of digital audio workstations. Additionally, in FY2025, the U.S. Department of Education included a proposal of USD 1.5 billion of funding for Career and Technical Education (CTE) State Grants, which increased the DAW platform licensing.

Europe Market Insights

Europe is estimated to account for 27.5% of the digital audio workstation market share by 2034. The education, public broadcasting, and creative industries are set to significantly contribute to the sales of digital audio workstations. The strong EU-level funding and favorable ICT policies are supporting the increasing adoption of DAWs. France, Germany, and the U.K. are the most lucrative marketplaces for digital audio workstation manufacturers. Public funding from programs is further propelling the deployment of DAWs in multimedia production and music technology across schools, studios, and startups. The market in the UK is flourishing mainly due to a surge in streaming and music exports. According to data published by the Government of the UK, consumers have widely adopted music streaming. In the UK in 2021, there were 39 million monthly active users of music streaming services, and there were over 138 billion streams.

The sales of digital audio workstations in Germany are estimated to be driven by the structured digital investment and the integration of DAWs in national education. A strong audio technology manufacturing base is also boosting the sales of digital audio workstations. The strategic public-private investments are likely to amplify the trade of digital audio workstations in the coming years. According to the International Confederation of Societies of Authors and Composers, 45% of the population in the country uses music streaming, further propelling the market growth.

APAC Market Insights

The Asia Pacific digital audio workstation market is poised to increase at a CAGR of 10.9% from 2026 to 203. The growth of the market can be attributed to the significant investments in creative technologies and government-led digitization programs. The constant surge in digital skill development programs across prominent economies such as Japan, China, and India is also augmenting the demand for digital audio workstations. Moreover, the public support for cloud-native software, music tech education, and digital media infrastructure is projected to double the revenues of digital audio workstation producers.

The digital audio workstation market growth in China can be attributed primarily to the extraordinarily flourishing digital music industry and burgeoning adoption of cloud-based workstations. Also, there has been a surge in independent creators and a proliferation of home studios. Educational institutions in China are increasingly incorporating DAWs into their curricula, supported by government funding and initiatives. Cumulatively, these growth-catalyzing factors are positioning the country as a hub for the global market.

The market in India is witnessing staggering growth, driven by the mushrooming number of independent artists and content creators in the country. Educational content (online courses, YouTube tutorials) and collaborative remote workflows have accelerated skills adoption, while industry and government moves to streamline licensing and rights management are improving the commercial ecosystem for Indian creators. Together, these factors—larger domestic audiences, better revenue channels, cheaper tools, easier learning, and stronger institutional support—are fueling DAW adoption and market growth across India.

Key Digital Audio Workstation Market Players:

- Avid Technology Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Apple Inc. (Logic Pro)

- Ableton AG

- Steinberg Media Technologies GmbH (Yamaha)

- Image-Line Software

- PreSonus Audio Electronics

- Cockos Inc.

- Bitwig GmbH

- Tracktion Software Corporation

- Acoustica Inc.

- BandLab Technologies

- Soundtrap (Spotify)

- Waveform Audio

- Studio One Software Solutions

- Sonicfoundry Asia

- Avid Technology Inc.

- Apple Inc. (Logic Pro)

- Ableton AG

- Steinberg Media Technologies GmbH (Yamaha)

- Image-Line Software

The digital audio workstation market is characterized by the presence of gigantic companies and the increasing emergence of new players. Robust institutional contracts and software integration in creative industries are creating a profitable environment for digital audio workstation manufacturers. Technological innovations and hefty investments in R&D are likely to double the revenues of key players in the years ahead. Strategic collaborations and partnerships with other players and raw material suppliers are also aiding companies to boost their position in global landscape.

Here is a list of key players operating in the digital audio workstation market:

Recent Developments

- In August 2025, Apple's Logic Pro 11.1 update introduces several notable features designed to enhance music production workflows. This high-quality reverb processor features two reverb models: the original Quantec QRS and the updated YardStick.

- In September 2025, Ableton has launched the public beta of Live 12.3, introducing a suite of powerful features designed to enhance music production workflows. This update brings significant improvements to stem separation, device comparison, modulation effects, and hardware integration.

- Report ID: 4967

- Published Date: Oct 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Digital Audio Workstation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.