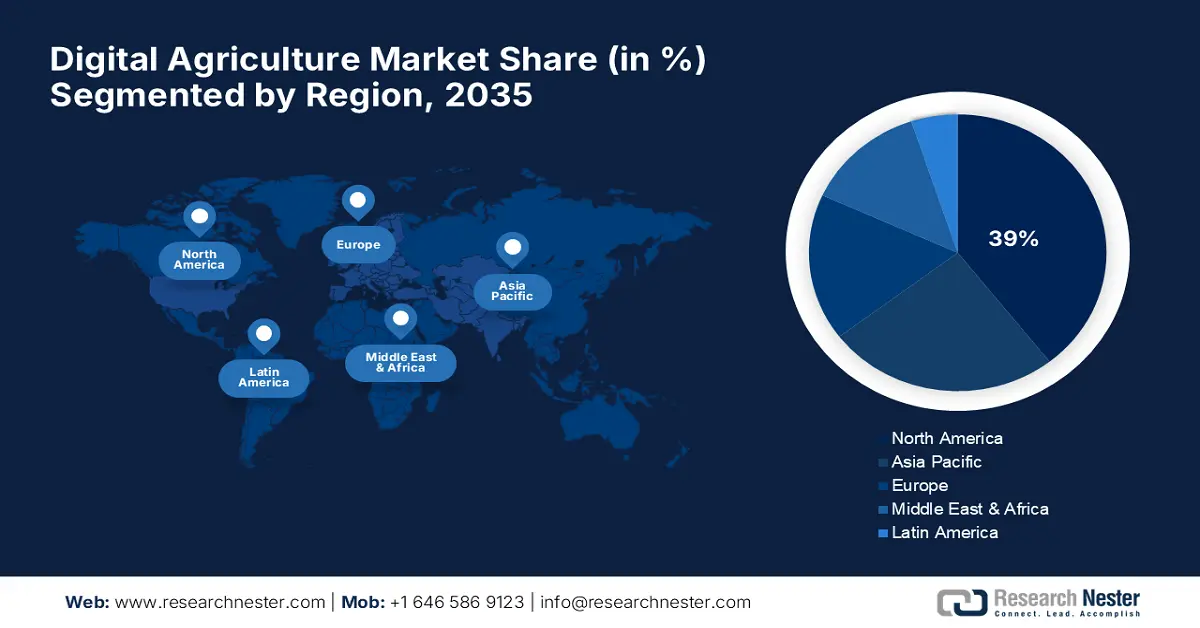

Digital Agriculture Market - Regional Analysis

North America Market Insights

North America is expected to maintain a 39% digital agriculture market share throughout the forecast period, positioning the region as a global leader in digital agriculture adoption. The region is supported by advanced technology infrastructure, substantial government spending, and widespread adoption of precision farming solutions among farmers. Sophisticated data analytics platforms, pervasive IoT sensor networks, and AI applications enable holistic farm management across a wide range of agricultural operations. Effective regulatory systems promote innovation while ensuring food safety and environmental protection along the agricultural value chain. Interactions among technology firms, agricultural associations, and government institutions propel ongoing market evolution and technological innovation.

The U.S. digital agriculture market is leading in digital agriculture development through overall government backing and widespread technology deployment in key agricultural areas. Federal partners team with private sector collaborators to create innovative farming solutions that increase productivity and sustainability results. In February 2023, the USDA released detailed documentation of U.S. farm sector adoption patterns for digital agriculture technology. The report indicates the widespread adoption of yield maps, soil maps, and variable-rate technologies on corn and soybean land. Automated guidance systems have been implemented on more than 50% of acres for large crops, including corn, cotton, rice, sorghum, soybeans, and winter wheat. Key driving factors for adoption include pricing considerations, soil variability, USDA program effects, and labor-saving advantages.

Canada digital agriculture market exhibit continuous growth, underpinned by government initiatives that promote innovation and sustainability in the agricultural industry. Agriculture and Agri-Food Canada's Agricultural Climate Solutions program provides $4 billion over 10 years for the promotion of clean technologies and farm practices. The program funds projects such as Living Labs and the On-Farm Climate Action program, facilitating co-innovation and real-world implementation of precision agriculture technologies. This program aligns with national efforts to mitigate the effects of climate change and enhance agricultural productivity through the deployment of high-tech technologies. Farmers benefit from improved advisory services, as well as sophisticated machinery equipped with AI and IoT, to optimize resource utilization. Synergy between governments, academia, and the industry supports the sustainable growth of digital agriculture in Canada.

Europe Market Insights

Europe digital agriculture market is set to experience substantial growth from 2026 to 2035, driven by European Union policies promoting precision agriculture and sustainable farming technologies. The region focuses on investment in research and development through public-private partnerships to develop innovative agricultural technology and implement it at a high level. Stringent regulatory structures facilitate the uptake of technology while preserving environmental conservation and food safety levels in member countries. Digital literacy initiatives and dedicated funding for smart agriculture efforts hasten the uptake of technology among European farmers. Cross-border knowledge exchange programs and collaborative research initiatives enhance the development of comprehensive agricultural technology solutions.

The digital agriculture market in the UK receives significant government support through innovation challenges and technology accelerator programs, which enhance farm productivity. Strategic investments channel funds into AI-powered advisory platforms, data convergence services, and precision agriculture research programs through collaborations between academia and industry. In 2025, the UK government heavily increased its support for agricultural innovation through the £90 million Transforming Food Production Challenge, channeling more than £22.4 million into smart farming initiatives through the Farming Innovation Programme. DEFRA and UK Research & Innovation have partnered to boost agricultural innovation with funds dedicated to businesses that improve environmental sustainability. Government efforts cover technology adoption grants, research grant funding to agricultural institutions, and digital skills development training programs.

Germany is emphasizing digital farm development through a concerted national policy that involves experimental research support alongside commercial technology implementation. Agri-research institutes collaborate closely with technology producers to develop sophisticated sensor networks, robot-based systems, and artificial intelligence-driven farm management platforms. Between 2019 and 2023, the German Federal Ministry of Food and Agriculture (BMEL) initiated the Digital Experimental Fields project to facilitate digitization within German agriculture through 14 research projects. Germany promotes farm digitalization through various R&D funding initiatives, offering a maximum of 70% of the costs. The BMEL's Investment and Future Program in Agriculture has a budget of EUR 816 million. The federal government's Energy Efficiency Program invites agribusiness firms that invest in farm digitalization and AI applications, satisfying energy-efficiency criteria.

APAC Market Insights

Asia Pacific digital agriculture market is projected to achieve a CAGR of 10% during the forecast period, fueled by fast technology uptake and government initiatives in emerging economies. Governments in the region are introducing comprehensive digital agriculture policies, while innovation in the private sector further propels technology development and adoption in various farming systems. Improved rural connectivity and digital infrastructure upgrades further facilitate greater access to precision agriculture technology and data-driven farming solutions.

China's growth in digital agriculture market is driven by multidimensional government programs that facilitate AI integration, big data analysis, and the deployment of precision farming technology. Technology standardization is fostered by national programs while promoting innovation through the private sector and international cooperation in the development of agricultural technology. In October 2024, China's Ministry of Agriculture and Rural Affairs released the Smart Agriculture Action Plan 2024-2028, which elaborates on the previous Rural and Agricultural Digitalization Development Plan 2019-2025 to drive strategic smart agriculture actions forward. Three key objectives are outlined in the action plan, which are strengthening public service capabilities, expanding applications in critical fields, and achieving tangible results through leadership examples.

India's digitalization of agriculture is gaining speed through the government-approved Digital Agriculture Mission, which is backed by considerable financial resources and an all-encompassing plan of action. The scheme equips millions of farmers with data-driven advisory services, decision-making support driven by AI, and remote sensing across agricultural activities. In December 2023, Mitsubishi Electric India commissioned a new Rs. 2,200 million manufacturing facility for advanced factory automation systems in the Talegaon Industrial area of Maharashtra. The 40,000 sq.m manufacturing facility supports Mitsubishi Electric's strategy to bolster its Indian business and cater to increased global demand for automation solutions. The factory automation systems cater to various industries, including automotive, food & beverages, pharmaceuticals, and agricultural mechanization, in India.