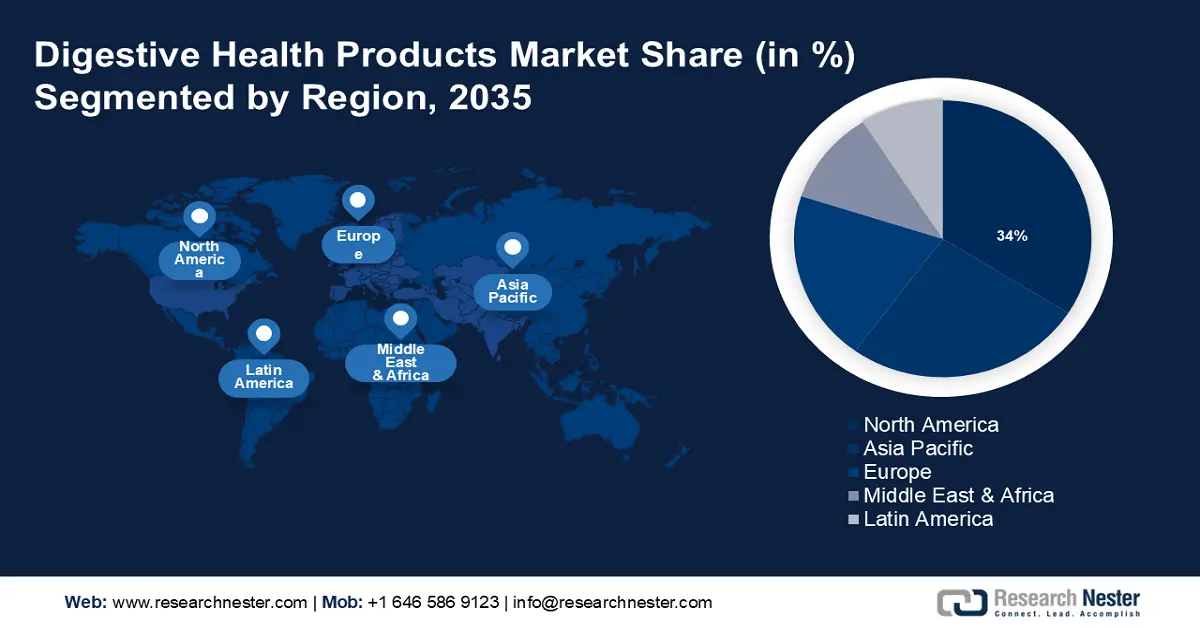

Digestive Health Products Market Regional Analysis:

North America Market Insights

North America industry is estimated to account for largest revenue share of 34% by 2035. The region's future growth will be aided by rising healthcare expenditures, evolving food regulations that impact product claims and labels, swift advancements in science and processing technologies, an aging population, and growing interest in achieving wellness through diet. In 2020, the number of senior Americans reached 55.8 million, or 16.8% of the total population of the US.

To obtain a competitive advantage, market participants in the United States are implementing a range of tactics, including partnerships and diversifying their product offerings. For instance, Kerry announced in November 2020 that it was purchasing Bio–K Plus, a Canadian company that makes probiotic drinks and supplements. Kerry's plan to enhance its capabilities and solidify its position as the industry leader in the probiotics sector aligned with this acquisition.

APAC Market Insights

APAC region in digestive health products market is set to register fastest growth through 2035. Rapid urbanization and rising affluence have led to a shift in consumer preferences toward processed and fast food, which has resulted in gastrointestinal problems such constipation, acid reflux, and irritable bowel syndrome treatment. Products that enhance digestive health and treat these issues are now in demand as a result. 12.0% was the combined prevalence of constipation.

Factor contributing to the Chinese market's expansion in the area is the rising incidence of digestive issues there. In China, 10.75% of all illnesses among patients hospitalized to public hospitals were digestive in nature.

The Japan's growing demand for digestive health goods. In Japan, Yakult Honsha Co., Ltd., for example, sells 9,540 probiotic drink bottles every day.

The proliferation of e-commerce platforms and online shops in Korea has facilitated consumers' access to a vast array of products sourced both domestically and internationally. Domestic internet sales increased from USD 168.5 billion in 2021 to USD 180.4 billion in 2022.