Dietary Supplements Market Outlook:

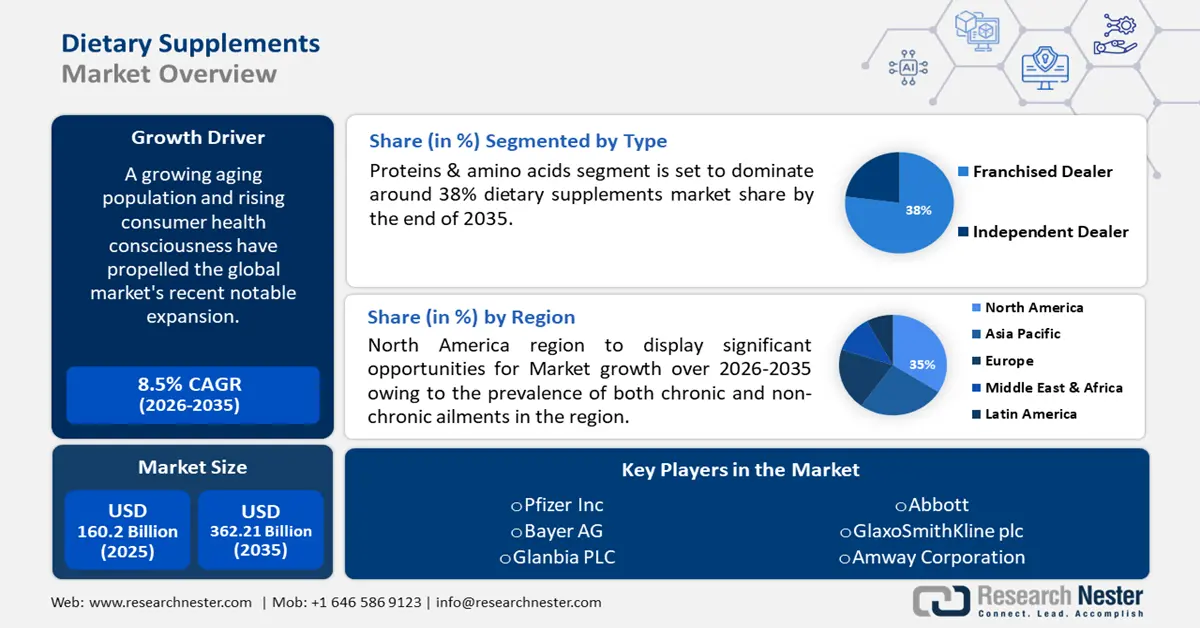

Dietary Supplements Market size was valued at USD 160.2 billion in 2025 and is expected to reach USD 362.21 billion by 2035, expanding at around 8.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of dietary supplements is evaluated at USD 172.46 billion.

A growing aging population and rising consumer health consciousness have propelled the global market's recent notable expansion. According to World Health Organization; the percentage of people over 60 in the world will almost treble from 12% to 22% between 2015 and 2050.

Key Dietary Supplements Market Insights Summary:

Regional Highlights:

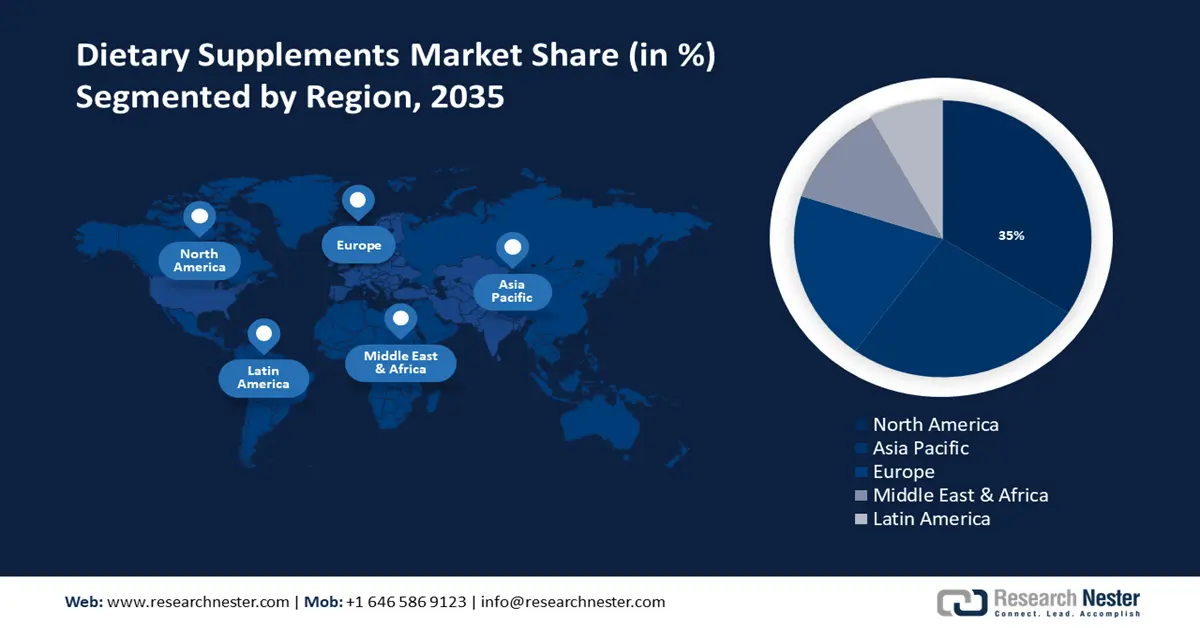

- North America dietary supplements market will hold more than 35% share by 2035, driven by the high prevalence of chronic and non-chronic ailments, along with growing consumer awareness about dietary supplements.

- Asia Pacific market will exhibit the fastest growth from 2026 to 2035, driven by rising disposable incomes, population growth, and greater awareness of health supplements.

Segment Insights:

- The proteins & amino acids segment in the dietary supplements market is projected to hold a 38% share by 2035, fueled by rising demand due to vitamin deficiencies and health-conscious consumers.

Key Growth Trends:

- Sports and bodybuilding are becoming more and more popular, which helps the business expand

- Technological advancements in microencapsulation and nanoencapsulation

Major Challenges:

- Exorbitant production expenses for organic raw resources

- Lack of belief in their benefits to health

Key Players: Pfizer Inc, Bayer AG, Glanbia PLC, Abbott, Archer Daniels Midland Company, Herbalife International of America, Inc., GlaxoSmithKline plc, Himalaya Global Holdings Ltd., Amway Corporation.

Global Dietary Supplements Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 160.2 billion

- 2026 Market Size: USD 172.46 billion

- Projected Market Size: USD 362.21 billion by 2035

- Growth Forecasts: 8.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

Dietary Supplements Market Growth Drivers and Challenges:

Growth Drivers

- Sports and bodybuilding are becoming more and more popular, which helps the business expand - One of the main drivers of the dietary supplements market is the increasing focus on eating a healthy diet. Due to the rise in lifestyle-related illnesses and the aging of the population, people are becoming more conscious of health products like food supplements.

The Centers for Disease Control and Prevention (CDC) estimate that between one and two million people have received a coronary heart failure diagnosis. These days, people take better care of their health by eating healthier meals and are more aware of it. Moreover, dietary supplement production is always changing and inventing. - Technological advancements in microencapsulation and nanoencapsulation - The development of nanoencapsulation and microencapsulation technologies is expected to be beneficial to the dietary supplements market worldwide. To meet the growing demand for products with scientific backing, major producers are concentrating on incorporating unique ingredients into their offerings. Their goals include supporting the health of the liver, bones, fetus, and brain.

Businesses are positioned to guarantee an adequate intake of vitamins and minerals in a person's diet through the use of microencapsulation technology. The goal is to fortify basic foods in poor nations where a low number of people can afford the expensive supplements.

Well-known businesses, such as BASF, employ a process called microencapsulation to add vitamins D and A to flour and sugar. At its Danish headquarters, BASF works to improve the qualities of vitamin powders. It demonstrates the strong demand from the pharmaceutical and enriched staple food industries. - Rise of health and wellness supplements targeting women - With women's health concerns at the center of the market, dietary supplement demand is predicted to increase dramatically over the projection period. It is anticipated that demand would increase for health and wellness supplements designed to support the diverse needs of women at various phases of their life.

Major companies frequently introduce women-focused health products to assist menstruation cycles, maternal health, and the menopause. They offer a variety of supplements that are filled with vital components, such as iron and calcium, to assist lessen discomfort and agony.

Novel products containing protein, green tea extract, collagen, mushroom extract, vitamin E, and royal jelly are being introduced by a few new and established businesses. These are thought to assist in reducing inflammation, promoting mood, and enhancing sleep

For example, in December 2023, O Positiv, a well-known supplement brand, increased its reach by launching its goods on Target.com and in over 250 Target locations nationwide. The company introduced FLO PMS Capsules & Gummies, MENO Menopause Capsules & Gummies, and URO Vaginal Probiotic Capsules.

Challenges

- Exorbitant production expenses for organic raw resources - The price of a supplement might vary significantly depending on the component's source and season. Synthetic substances are less expensive to produce and don't need to have the natural sources of their functional principles managed. But synthetic raw materials' quality is incomparable to that of natural raw materials.

The bioavailability of dietary supplements and the seasonality of their raw ingredients are additional factors that could impact their final cost. The majority of natural ingredients are not always easily obtainable or their prices may increase during particular months, which affects the cost of manufacturing a supplement. - Lack of belief in their benefits to health - Products made from natural sources called nutraceuticals that are said to provide health benefits have become more widely accessible over the last 20 years. Nutraceuticals are dietary supplements that also help the prophylaxis and/or treatment of illnesses and other conditions, in contrast to dietary supplements that only increase the basic nutritional content of the diet.

Owing to safety and efficacy concerns, these products may impede demand because the nutraceutical industry lacks well-established oversight and regulation.

Dietary Supplements Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 160.2 billion |

|

Forecast Year Market Size (2035) |

USD 362.21 billion |

|

Regional Scope |

|

Dietary Supplements Market Segmentation:

Type Segment Analysis

Proteins & amino acids segment is set to dominate around 38% dietary supplements market share by the end of 2035. Many countries are experiencing an increase in vitamin deficiencies, thus people are turning to vitamin supplements to make up for this. As per the data provided by WHO, it is believed that over 2 billion individuals worldwide suffer from deficiencies in important vitamins and minerals, specifically iron, zinc, iodine, and vitamin A.

The demand for minerals is increasing because deficiency in these elements can cause serious health problems in both adults and expectant mothers. In the next years, there will likely be a rise in bodybuilding and weight loss activities, which will drive up demand for protein supplements. The for herbal dietary supplements market has shown substantial value sales growth, with botanicals coming in second.

Growing consumer awareness of the health benefits of eating plant-based foods and a rise in health-conscious consumers are the main factors driving the market for herbal supplements. Some of the main herbal dietary supplements that have become increasingly well-known recently are cranberries, horehound, yohimbe, black cohosh, senna, cinnamon, and flaxseed.

Form Segment Analysis

Softgels segment in the dietary supplements market is set to showcase lucrative growth rate through 2035. The segment growth can be credited to compared to pills and hard capsules, soft gels offer a number of benefits and appealing characteristics. Because soft gelatin capsules are easy to swallow and quickly dissolve, it is estimated that they will greatly accelerate the rate at which active ingredients are absorbed. Furthermore, it is estimated that these capsules are customized for specific uses. Another benefit of soft gels is their extraordinary versatility. A vast range of shell colors, shapes, and sizes are available to help products stand out in the marketplace.

The cost-effectiveness and simple packaging of soft gel supplements are other factors contributing to their rising popularity. Their benefit is that they have exactly specified dosages, which liquid or other forms do not have. Because of this distinction, soft gel supplements are now more widely used than liquid ones. For instance, the US-based multinational company Catalent Inc. announced the release of Optigel DR softgel capsules in October 2020. Pectin is used in the formation of the medications, which are made with OptiGel DR technology.

Our in-depth analysis of the dietary supplements market includes the following segments:

|

Type |

|

|

Form |

|

|

Health Applications |

|

|

Distribution Channels

|

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dietary Supplements Market Regional Analysis:

North America Market Insights

North America industry is predicted to dominate majority revenue share of 35% by 2035, influenced by prevalence of both chronic and non-chronic ailments in the region. The dietary supplements market growth in the region is also expected on account of the prevalence of both chronic and non-chronic ailments, growing consumer knowledge of dietary supplement use, and an increase in large corporations' R&D expenditures. As per the statistics of CDC; in the US, 6 out of 10 adults suffer from a chronic illness. In the US, 4 out of 10 adults have two or more. As a result of consumers' incresasing reliance on low-calorie and high-nutrient products, it is anticipated to expand gradually over the projection period.

In United States, the trend toward holistic wellness embraces a return to traditional, natural medicines like botanical supplements, which are marketed as a no-risk option with very little chance of adverse health effects. According to the study, around one in three American consumers are interested in using botanicals to improve their mood and mental health, and roughly 43% of consumers believe that botanical substances are useful.

APAC Market Insights

APAC region in dietary supplements market is predicted to witness fastest growth rate till 2035. The country's dietary supplements market is being driven by rising disposable incomes, population growth, and greater knowledge of health supplements. Approximately 4.3 billion people, or 60% of the world's population, live in the Asia and Pacific region, which is home to the most populous nations on Earth.

China is expected to be primarily influenced by online retail platforms, rising consumer awareness, and government regulations. With over half of all e-commerce transactions occurring there, China is the world's largest e-commerce market.

Japan has grown recently as a result of these developing nations' significant aging populations. Japan currently has more than one in ten citizens who are 80 years of age or older, and the nation routinely has the oldest population in the world.

In Korea, the market for sports nutrition supplements is expanding. Many individuals have started participating in sports because popular activities like football, badminton, and skating are prevalent in Korea. Supplements for sports nutrition are being taken to increase practice. According to a 2021 survey, baseball came in second place with 18.8% of respondents, while football was cited as their favorite sport by a majority of South Korean sports fans 25%.

Dietary Supplements Market Players:

- Smart Protein Ltd

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Pfizer Inc

- Bayer AG

- Glanbia PLC

- Abbott

- Archer Daniels Midland Company

- Herbalife International of America, Inc.

- GlaxoSmithKline plc

- Himalaya Global Holdings Ltd.

- Amway Corporation

Leading companies in the dietary supplements Market worldwide include Pfizer, Glanbia Nutritionals, Abbott, Bayer AG, and Amway. Major international players also have an advantage due to their wide geographic reach and strong consumer brand awareness. The main competitors concentrate on developing novel products, providing a variety of tastes and entertaining forms such as chewables and gummies.

Recent Developments

- Abbott introduced a novel Ensure mix including HMB. The new Ensure is a science-based nutritional supplement that helps build stronger muscles and bones by including 32 key elements like protein, calcium, and vitamin D. Hydroxy-methyl butyrate, or HMB, is a novel element in it that helps prevent muscle loss and boosts the body's strength and power.

- Smart Protein, 142 Tesco locations nationally as well as the internet will carry an entirely new line of high-end active and wellness nutritional supplements. As a component of The Original Fit Factory's wellness ecosystem, which offers a range of products and services to enhance the wellness journey, the science-backed, nutritionist-formulated range has been designed to make nutrition simple and approachable for all. This is in response to an increasingly confusing market, where consumers feel uninformed and unable to make decisions that will improve their wellbeing.

- Report ID: 6075

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dietary Supplements Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.