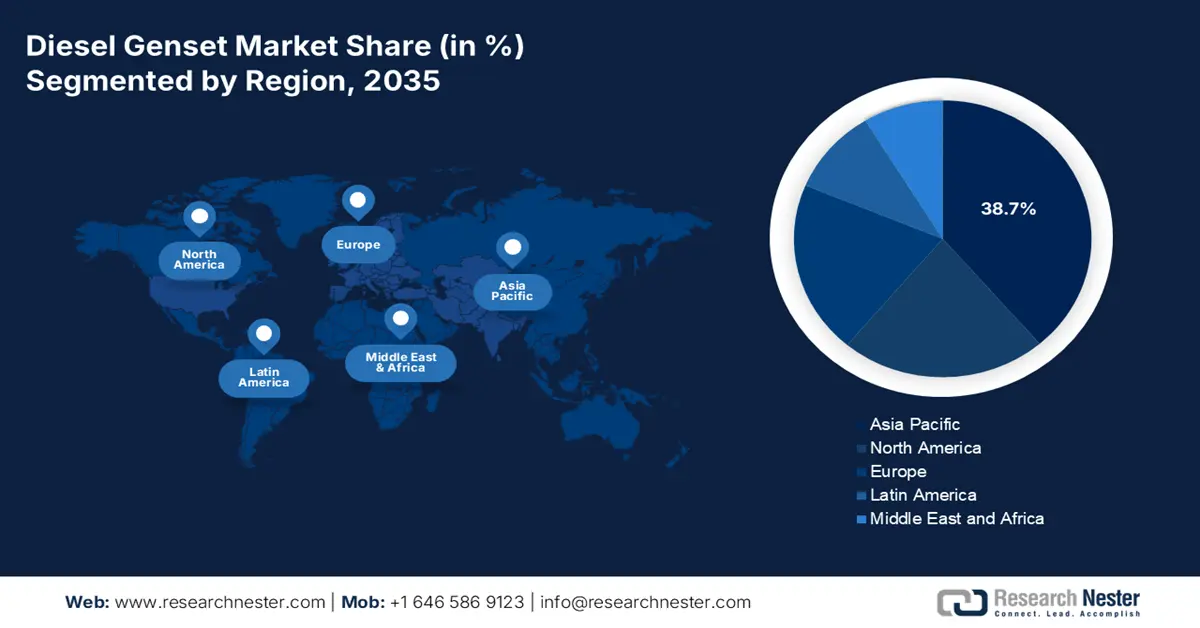

Diesel Genset Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the diesel genset market is anticipated to garner the highest share of 38.7% by the end of 2035. The market’s upliftment in the region is highly attributed to coal-reliant power systems and strong industrial activity in India and China, ensuring the sustained demand for high-reliability standby power. For instance, according to an article published by the IEA Organization in 2024, China grew by 1% in coal demand within the region and reached 4.9 billion tons. Likewise, India also demonstrated a demand growth of more than 5% to 1.3 billion tons. Besides, as per the 2023 MITI Government data report, the chemical sector in Southeast Asia was worth USD 238 billion as of 2022, which is predicted to grow, amounting to USD 448 billion by the end of 2030. Therefore, with all these developments, the market in the overall region is gradually growing.

China in the diesel genset market is growing significantly, owing to the upscaling of heavy industry, refining, and chemicals, along with the manufacturing industry, necessitating strict power quality as well as resilience, especially for ongoing processes with environmental and safety controls. As per an article published by the National Bureau of Statistics of China in December 2025, there has been an acceleration in coal production within the country, increasing to 440 million tons by industrial enterprises. This denoted a rise by 4.2% year-over-year (YoY), along with 2.4% points and resulting in an average daily output of 14.1 million tons. Besides, coal import accounts for 52.3 million tons, displaying an increase by 10.9% YoY. Besides, as of 2024, 4.7 billion tons of coal have been produced by industrial enterprises, leading to a 3% YoY, thereby catering to the market’s upliftment.

India in the diesel genset market is also growing due to a coal-based power mix, an increase in industrial expansion, which has intensified the demand for dependable backup across logistics, metal processing, pharmaceuticals, and chemicals. As stated in an article published by the IBEF Organization in August 2025, the manufacturing industry contributes almost 16% to 17% of the gross domestic product (GDP) and employs more than 27 million workers. Additionally, the presence of governmental strategies, such as Make in India, along with production-linked incentive (PLI) schemes, the country has targeted manufacturing, further accounting for 25% of GDP in the near future. Besides, the country also has the potential to cater to 10% of the world’s wind energy requirement by the end of 2030 through its increased capacity in wind, which in turn, is positively impacting the diesel genset market.

Europe Market Insights

Europe in the diesel genset market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is significantly driven by the demand for high-reliability backup across commercial, healthcare, data center, and industrial sites. According to an article published by the Cefic Organization in 2024, 74% capacity utilization is considered the norm in the European-27 chemical industry. In addition, this particular chemical sector operates at 9.5% below pre-crisis capacity, along with its output also remaining 10% below. Besides, the overall chemical production growth accounted for 2.4% as of 2024, with Poland demonstrating 7.0% growth, 8.3% in Belgium, 1.9% in France, 3.0% in Germany, and 3.3% in Spain. Therefore, with such growth in the overall region, there is a huge growth opportunity for the market.

Germany in the diesel genset market is gaining increased traction, owing to the presence of a massive industrial base, including logistics, automotive, machinery, and chemicals for operating high-value and continuous processes that need strict resilience and power-quality measures. Besides, as per an article published by Clean Energy Wire Organization in December 2025, renewable energy sources cover almost 56% of the country’s gross electricity consumption as of 2025. Additionally, the renewables share grew by 0.7% points in comparison to previous years, owing to a surge in the installed solar power capacity. Moreover, onshore turbines with a 5.2 GW capacity have been added to the electricity grid, marking an increase from 3.3 GW in the previous year. Therefore, with all these renewable energy source capacities, the market is continuously gaining increased importance and expansion in the overall nation.

Spain in the diesel genset market is also developing due to urban development, logistics centers, and tourism-based infrastructure that fuels the standby need for data connectivity, retail, hospitals, and hotel sites. As per an article published by the UN-Habitat in 2025, 80.8% of the population dwells in urban locations, accounting for 37.5 million people, and this is gradually increasing by 0.2% every year. Besides, of the 8,125 Spanish municipalities, 6 cities comprise over 500,000 inhabitants, while 4,955 have less than 1,000. In addition, 25% of the urban population resides in big cities, while rural areas readily occupy more than 2/3 of the territory. Moreover, the domestic housing stock comprises 25.2 million dwellings, with 22.9% of the population under rental arrangements. Therefore, with an upsurge in urbanization, there is a huge growth opportunity for the market in the country.

North America Market Insights

North America's diesel genset market is projected to witness suitable growth by the end of the stipulated timeline. The market’s growth in the region is highly driven by resilience and generous investments across healthcare, data centers, chemicals, and manufacturing, along with tight power quality specifications and industrial reliability demands. According to an article published by the EIA Government in December 2025, the regular gasoline prices in the U.S. range between USD 2,98 per gallon, USD 2,94 per gallon, and USD 2.8 per gallon throughout the month. Besides, on-highway diesel fuel prices have been ranging from USD 3.7 per gallon, USD 3.6 per gallon, and USD 3.60 per gallon within the same month. Moreover, based on crude oil, refining, distribution and marketing, as well as taxes, the regular gasoline and diesel prices vary, which is positively creating an optimistic outlook for the market’s growth in the region.

Differentiation Between Regular Gasoline and Diesel (2025)

|

Components |

Regulator Gasoline |

Diesel |

|

Crude Oil |

49% |

41% |

|

Refining |

14% |

23% |

|

Distribution and Marketing |

21% |

20% |

|

Taxes |

17% |

16% |

Source: EIA Government

The diesel genset market in the U.S. is gaining increased exposure, owing to the presence of quality, environmental, and safety standards, along with chemical refineries and plants continuously operating high-hazard processes that need dependable backup power. As per a data report published by the AFPM Organization in July 2024, activities in the country’s petroleum refineries generously contributed USD 688 billion of gross domestic product (GDP) or economic output. These activities effectively support almost 3 million employment offers USD 284 billion in labor income. Therefore, this particular activity generated USD 162 billion in local tax, state, and federal revenues. Thereby, based on all these activities and outputs, there is a huge growth opportunity for the market to gain increased exposure in the overall country.

Petroleum Refineries Economic Impacts in the U.S. (2022)

|

Components |

GDP |

Labor Income |

Employment |

|

Direct |

USD 169.4 billion |

USD 21.5 billion |

USD 645,000 |

|

Indirect |

USD 359.9 billion |

USD 175.0 billion |

1,551,000 |

|

Induced |

USD 158.7 billion |

USD 87.8 billion |

1,351,900 |

|

Overall |

USD 688.0 billion |

USD 284.3 billion |

2,967,400 |

Source: AFPM Organization

The diesel genset market in Canada is also growing due to expansion in the resource and industrial sector, infrastructure and construction growth, remote area power reliability, emission standards, government regulations, along with data center and commercial growth. According to an article published by the IGF Mining Organization in November 2023, the Government of Canada initiated an allocation of CAD 5.4 million for more than 4 years. The ultimate objective is to provide support to the Secretariat of the Intergovernmental Forum on Mining, Minerals, Metals and Sustainable Development. Besides, as stated in a data report published by the Environmental Defense in April 2025, the country’s government also offered nearly USD 29.6 billion to provide financial support to petrochemical and fossil fuel organizations. This fund comprises USD 21 billion for the TransMountain expansion pipeline, and USD 7.5 billion as public financing, thus creating an optimistic outlook for the market’s growth.